Big banks predict catastrophic warming, with profit potential

Morgan Stanley, JPMorgan and an international banking group have quietly concluded that climate change will likely exceed the Paris Agreement's 2 degree

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Akos Losz, Kong Chyong & Ira Joseph • June 14, 2023

This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated.

An influx of high-priced liquefied natural gas (LNG) to Europe in 2022 alleviated the energy crisis that followed the Russian invasion of Ukraine and the progressive reduction of Russian pipeline gas supplies to the continent throughout the year. More than two-thirds of the European Union’s estimated 78 billion cubic meter (bcm) supply gap in 2022, caused by Russian curtailments, was filled with increased LNG imports, which rose 70 percent in 2022 compared to the previous year.[1] Europe’s increased reliance on LNG—and the continent’s rapid transformation from a market of last resort to a premium market for LNG—is not a one-time fix but a structural shift that is likely to remain a defining characteristic of the global gas market for several years.[2]

Most incremental LNG imports to Europe came in the form of spot market purchases or destination-flexible LNG volumes drawn away from other markets—primarily Asia. Yet the argument for signing new long-term LNG contracts to meet Europe’s increased LNG requirements more reliably and on more predictable pricing terms competes with counterarguments about long-term demand uncertainty amid EU decarbonization goals.[3]

The dilemma for European buyers is often presented as a choice between two extremes: committing to new long-term contracts—preferably with pre-final investment decision projects that would underwrite new LNG capacity but could only start delivering five to six years out—or continuing to rely on spot and flexible LNG volumes to replace Russian gas supply. The former is squarely inconsistent with the EU’s 2050 net zero target, while the latter raises the risk of falling short, especially if demand for LNG rebounds in Asia, where contract coverage is more widespread and buyers have first call on divertible LNG supplies.

But this dichotomy is in many ways false. European buyers have at least two large pools of available LNG supply that they can tap for short-term (up to five-year) or medium-term (five- to ten-year) contracts: expiring legacy contracts with existing LNG producers and unsold LNG volumes in the portfolios of major aggregators (also known as portfolio players) and trading houses. European buyers could also make a concerted push for commercial innovation and try to compel suppliers to offer new types of contracts, including seasonal and options contracts. This commentary discusses these four potential purchasing avenues to meet Europe’s variable current demand and to better suit the continent’s highly uncertain long-term LNG needs.

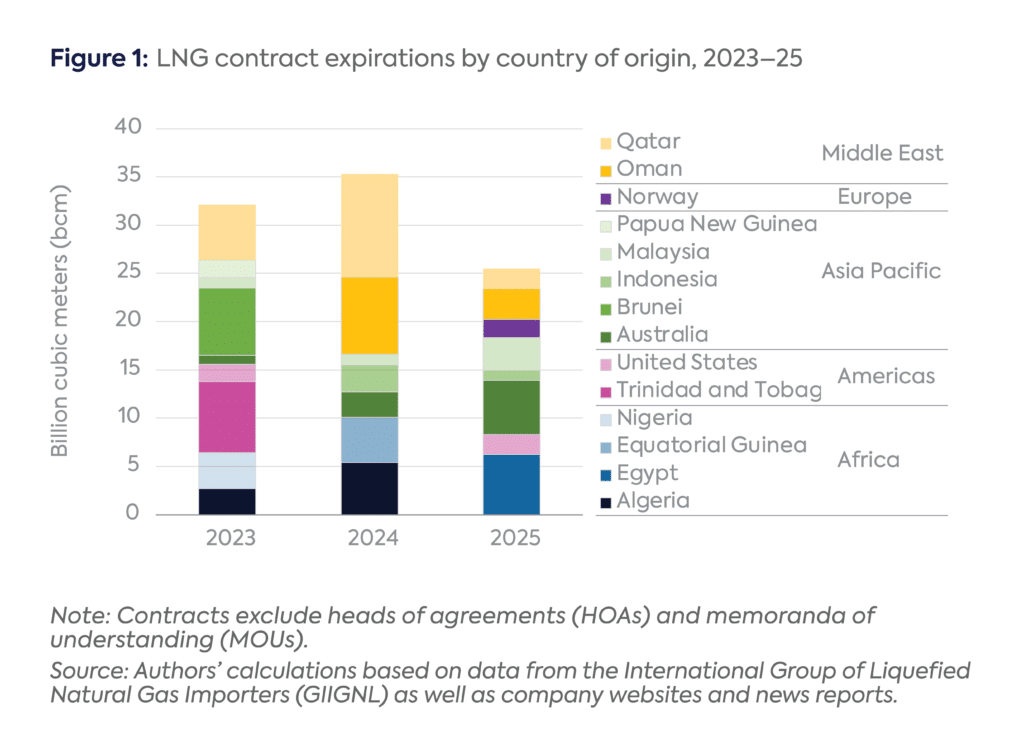

The LNG industry developed in waves over the past six decades. The existing production base of more than 500 bcm ensures that a substantial volume of LNG locked up in legacy contracts expires each year (by virtue of the size of the market and due to a big stack of old long-term and more recent short- and medium-term contracts that come up for expiration each year). Based on publicly available information on active LNG sales purchase agreements (SPAs), the authors estimate that contracts covering a combined 93 bcm of yearly LNG supply will expire in 2023, 2024, and 2025, with the highest amount (35 bcm) expiring in 2024 (Figure 1).[4] By comparison, the European Union imported a total volume of 128 bcm in 2022, according to Bloomberg data, and the incremental deliveries compared to 2021 levels totaled approximately 53 bcm.

More than 70 percent of the total contract volume terminating in the next three years originates in regions that are better suited to supply Europe than Asia (namely in Africa, Europe, the Middle East, and the Americas). Less than 30 percent is sourced from the Asia Pacific region, where higher transportation costs to Europe make it more challenging—though not impossible—to target European buyers. Only about 25 percent of these expiring contracts deliver mainly to European destinations and less than 15 percent to destinations within the EU.

The LNG projects behind these expiring SPAs have typically already amortized their investments and paid their debts.[5] In most cases, plant operators with no further debt obligations can recontract LNG for shorter durations and more flexible terms.[6] One potential limitation is that older legacy plants (e.g., in Algeria or Trinidad and Tobago) may have less LNG to sell than was included in the original SPAs due to reserve depletion and because gas production levels have declined to well below the LNG projects’ full output capacity. Still, the potential volumes available for Europe from the expiring contract stack are nonetheless significant.

LNG portfolio players (also known as aggregators) and trading houses emerged in the 2000s and 2010s, respectively, as intermediaries between producers and end users of LNG. Over the years, these entities have built up substantial contractual positions as primary buyers of LNG, far exceeding their sales commitments to end users and other secondary buyers.[7] This long contractual position (also referred to as “homeless LNG”)[8] enabled these players to leverage short-term market opportunities with available volumes to sell into the spot market.

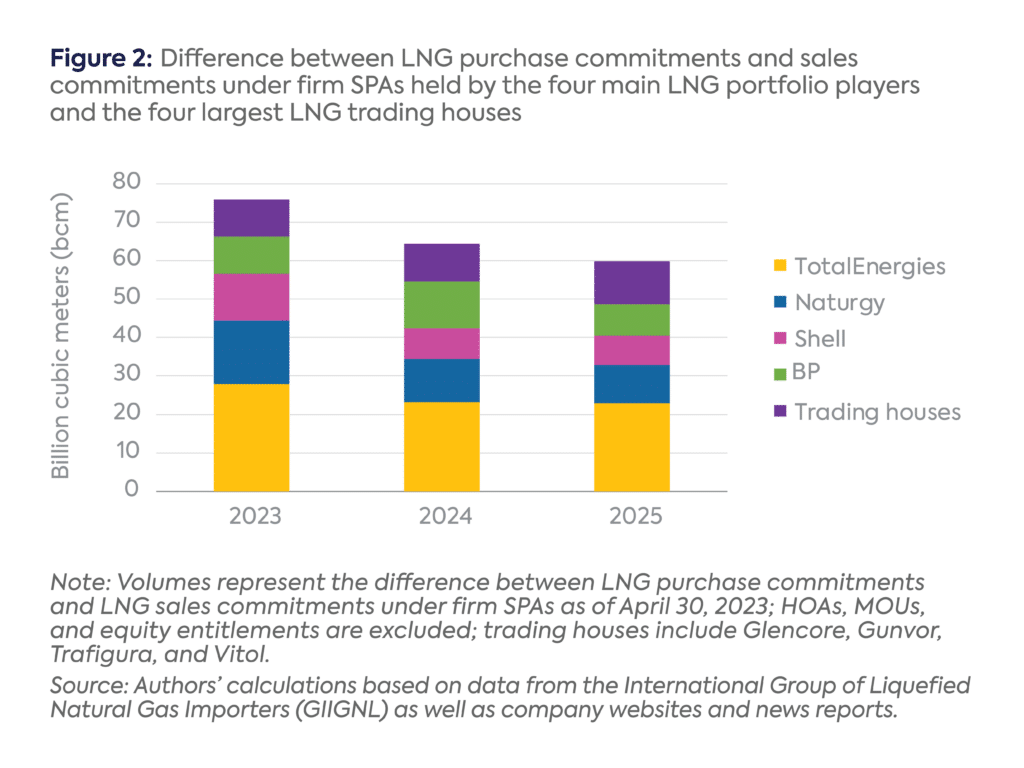

The four largest LNG aggregators (BP, Naturgy, Shell, and TotalEnergies), which by one classification[9] are the only companies qualifying as portfolio players, plus the four biggest trading houses active in the LNG market (Glencore, Gunvor, Trafigura, and Vitol) are overcontracted to the tune of 76 bcm as of 2023— with TotalEnergies holding the largest net long position by far (Figure 2). The corresponding volume is set to shrink to 60 bcm by 2025 (and to 36 bcm by 2030 if no new contracts are signed), but that amount would still offer Europe the ability to tap into a substantial pool of immediately available LNG.[10]

Aggregators and trading houses do resell a substantial portion of their contracted portfolio to end users, including on a short- and medium-term basis. The net long position in 2023 masks a total sales commitment of nearly 82 bcm (against a total purchase commitment of 158 bcm), and about 11 percent of the 2023 sales are under ten-year or shorter duration contracts.

Portfolio players and trading houses might be reluctant to give up the upside during a period of volatile prices and tight market conditions by signing additional short- and medium-term contracts with European buyers. But a wave of new LNG supply (expected to hit the market from 2025 onward),[11] the heightened risk of policy intervention if prices rise too sharply (in the form of price caps and windfall taxes), and even the possibility—however distant—of a partial return of Russian pipeline gas flows to Europe within this decade could compel intermediaries to resell greater volumes of their homeless LNG to European buyers on shorter, more flexible contracts.

The recent reconfiguration of global LNG trade and Europe’s emergence as a premium LNG market with a highly seasonal demand profile could inspire new ways of thinking about how LNG is contracted, especially given Europe’s decarbonization agenda and energy security concerns.

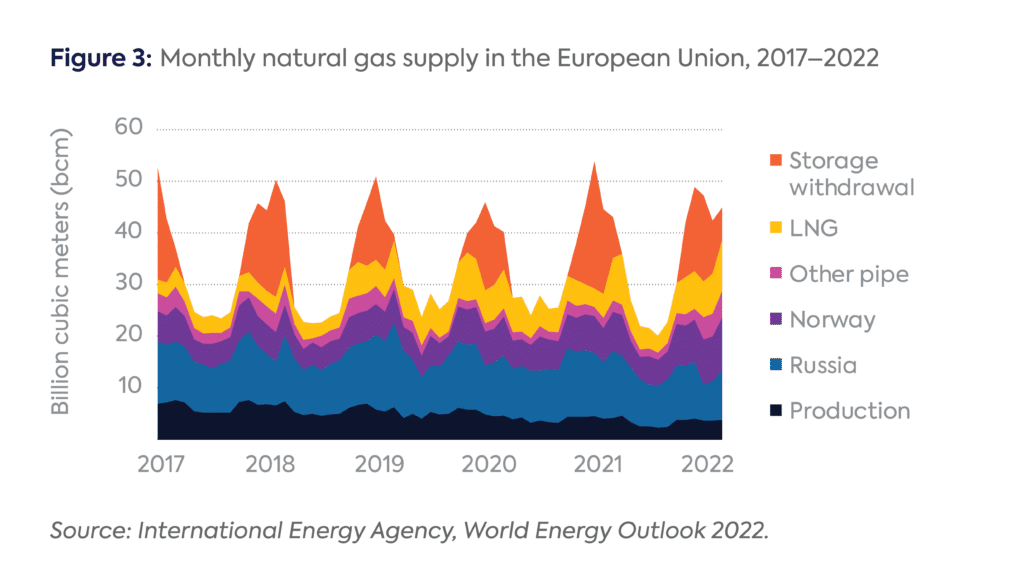

The European Union has sizeable underground gas storage capacity in excess of 100 bcm.[12] However, even with such a substantial storage buffer, the EU requires incremental imports in addition to storage withdrawals to meet demand during the peak winter months. Any period requiring supplemental imports to keep the system in balance is a period of heightened risk, as competitive forces kick in. Seasonal LNG contracts could allow Europe to mitigate supply risks and alleviate the burden on storage as the sole provider of flexibility during the most critical winter months (at least until heat pumps, energy efficiency, and other measures reduce the seasonal profile of gas consumption within the EU).

Given the uncertainties around European gas demand and Russian gas flows,[13] an options contract is another potential solution.[14] Such options contracts would give European importers the right to buy a predefined volume of LNG when needed in exchange for a premium paid to the seller of the options contract. An LNG options contract would follow the same logic as US LNG tolling agreements (which are, in effect, options contracts), but extend the use of such contracts to a much wider range of LNG supply sources beyond the US.

A seasonal LNG contract would cover up to six months between October and March, when gas demand in weather-sensitive markets can double or triple (Figure 3). These LNG contracts could be signed ahead of winter at a premium to the regional spot price benchmark (such as TTF) or indexed to the Brent oil benchmark using a so-called price slope.[15] In this case, the buyer would pay a 10–15 percent premium above the average of forward gas prices for the winter months prior to the heating season.[16] The premium to be paid on the seasonal LNG contract would largely depend on the summer-winter price spread at the time of signing the contract. The underlying price would be fixed at the time the contract was purchased to avoid the upside risk of a stronger winter spot market. Other variants could include fixing the underlying price at the peak winter price on the forward price curve (which indicates the present price of gas for future delivery) or charging a wider premium.

For buyers, paying a premium for seasonal supplies would be justified by both the security of supply the LNG contract provides and the convenience of not having to (i.e., take the contracted amount), store, and hold the gas at cost during the other half of the year. From the sellers’ perspective, having to market excess LNG to two sets of buyers (one for the winter and one for the rest of the year) might be an unattractive proposition, even in exchange for a premium. But the prospect of looser market conditions post-2025 due to a new wave of LNG supply and the possibility of a partial return of Russian volumes to Europe before the end of the decade could ultimately make seasonal contracts a win-win for buyers and sellers. Seasonal contracts would at least relieve sellers of 50 percent of their annual vulnerability to not being able to secure buyers and provide them a financial cushion for downside price risk during the injection season, when typically demand is much lower, price spreads are less favorable, and sellers are at risk of cargo cancellations.

In the second and third quarters, most incremental LNG lands in European storage in any case, because few other places require LNG for summer peaking or have the infrastructure to store it seasonally. The EU’s new gas storage regulation also requires member states to fill their storage sites to 90 percent of capacity ahead of the winter heating season.[17] Seasonal LNG contracts do not alter this reality, but they would allow sellers to hedge against weaker European gas prices ahead of the injection season.

An LNG options contract gives buyers the right to import a specified volume of LNG, if needed, at a specified price. It is a right to buy LNG, not an obligation. In exchange for this right, buyers pay an option premium (i.e., the price of the option) to the sellers of these contracts. The right to buy LNG with no obligation to import is especially valuable in the context of a highly uncertain gas supply-demand balance in Europe.

In September 2022, Greek utility DEPA signed with TotalEnergies what is likely the first LNG options contract between a European buyer and a major portfolio player. The deal required TotalEnergies to deliver two LNG cargoes per month to Greece between November 2022 and March 2023, but DEPA reserved the right to cancel any cargoes in exchange for a fee.[18]

US LNG tolling agreements are also options contracts. Typically, buyers commit to paying $2–3 per million British thermal units (MMBtu) over 15–25 years to underwrite the capital expenditure of an LNG export facility, which gives them access to US gas supply.[19] When the price differentials between the US and other regional markets justify LNG lifting, buyers exercise their option and sell the LNG to the highest price market. If the price differentials are too small or negative, less LNG is exported from the US.[20] The buyers pay the “tolling fee” (i.e., the option premium) but avoid the volume risk.

The expiration of LNG contracts (Figure 1) and excess LNG in supplier portfolios (Figure 2) present an opportunity for buyers and sellers to innovate in LNG contracting. LNG options contracts could be seen as helping both sellers and buyers cope with a highly uncertain global LNG market outlook in the years ahead.

There are several additional ways portfolio players could benefit from options contracts:

The pricing of the underlying gas commodity within these options contracts (which buyers pay for the fuel when the option is called) could be linked to the EU Agency for the Cooperation of Energy Regulators’ newly developed LNG price benchmark.[23] Using an index that is closely correlated with the Asian JKM spot LNG benchmark minus transportation costs would make LNG portfolio players indifferent between sending a cargo to Asia or Europe.[24] Alternatively, gas pricing within the options contracts can be a mix of spot and oil indexation that would suit portfolio players and European buyers alike.

For European buyers, these types of contracts could be beneficial for three reasons:

The Russian invasion of Ukraine and subsequent Russian gas supply cuts to Europe have structurally increased the European Union’s reliance on LNG imports in the medium term, but also accelerated the continent’s transition away from gas in the longer term. As European LNG buyers navigate an uncertain energy future, they have contracting options beyond long-term contracts and spot market purchases. Expiring legacy contracts and substantial LNG volumes held by portfolio players and trading houses present immediate opportunities for shorter, more flexible contracts. Additionally, exploring innovative contracting approaches such as seasonal LNG contracts and LNG options contracts can provide more tailored solutions to Europe’s variable and uncertain LNG requirements in the face of the continent’s long-term demand uncertainty and decarbonization goals.

[1] International Energy Agency, “Natural Gas Supply-Demand Balance of the European Union in 2023: How to Prepare for Winter 2023/24,” February 2023, p. 5, https://iea.blob.core.windows.net/assets/227fc286-a3a7-41ef-9843-1352a1b0c979/Naturalgassupply-demandbalanceoftheEuropeanUnionin2023.pdf.

[2] Shell, “LNG Outlook 2023,” p. 23, https://www.shell.com/energy-and-innovation/natural-gas/liquefied-natural-gas-lng/lng-outlook-2023/_jcr_content/root/main/section_599628081_co/promo_copy_copy/links/item0.stream/1676487838925/410880176bce66136fc24a70866f941295eb70e7/lng-outlook-2023.pdf.

[3] Anne-Sophie Corbeau, “Could Europe’s Supply Gap Herald a Golden Age of LNG?,” Center on Global Energy Policy, February 14, 2023, https://www.energypolicy.columbia.edu/could-europes-supply-gap-herald-a-golden-age-of-lng/.

[4] Original LNG contract volumes are listed in million metric tons per annum (mtpa). Mtpa is converted to billion cubic meters (bcm) using BP conversion factors (1 mtpa = 1.36 bcm); see: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-approximate-conversion-factors.pdf.

[5] “Shorter LNG Contract Terms May Lead to Future Supply Challenges,” Upstream Online, March 29, 2018, https://www.energypolicy.columbia.edu/shorter-lng-contract-terms-may-lead-to-future-supply-challenges/.

[6] International Energy Agency, “Gas Market Report, Q4-2022,” October 2022, p. 46, https://iea.blob.core.windows.net/assets/318af78e-37c8-425a-b09e-ff89816ffeca/GasMarketReportQ42022-CCBY4.0.pdf.

[7] Ibid., 44–45.

[8] Poten & Partners, “Where Will All the Homeless LNG Go?,” February 18, 2016, https://www.poten.com/wp-content/uploads/2016/02/Platts-15th-Annual-Majed-Limam-2016-FINAL.pdf.

[9] Richard Pratt, “Two Of Us—Portfolio Players Take On Critical Roles in Rapidly Commoditizing Global LNG Market,” RBN Energy Daily, February 1, 2023, https://rbnenergy.com/two-of-us-portfolio-players-take-on-critical-roles-in-rapidly-commoditizing-global-lng-market.

[10] It is important to note that these volumes include only the difference between LNG purchase and LNG sales commitments locked up in firm SPAs, and exclude equity entitlements held by these players as part owners of LNG terminals. The inclusion of equity entitlements would boost portfolio net length even further, make Shell (rather than TotalEnergies) appear the biggest among the portfolio players, and highlight an even greater opportunity set for European buyers. But quantifying such equity entitlements can be problematic, especially in the case of older legacy projects in which theoretical and actual volumes available as equity entitlement can differ substantially. In some cases, recontracting the net length held by aggregators and trading houses on a short- to medium-term basis to European buyers might be constrained by other factors, such as destination restrictions in the primary purchase contracts that form the basis of aggregator and trading house portfolios. However, we believe that such potential constraints might apply only in a minority of cases, while approximately three-quarters of the LNG bought by aggregators and traders is purchased on a free-on-board basis, which typically means no restrictions on destinations whatsoever.

[11] Abhiram Rajendran and Anne-Sophie Corbeau, “Opportunities and Risks in Expanding US Gas and LNG Capacity,” Center on Global Energy Policy, September 22, 2022, https://www.energypolicy.columbia.edu/publications/opportunities-and-risks-expanding-us-gas-and-lng-capacity/.

[12] Gas Infrastructure Europe, “Aggregated Gas Storage Inventory (AGSI),” accessed June 6, 2023, https://agsi.gie.eu/.

[13] Kong Chyong et al., “Future Options for Russian Gas Exports,” Center on Global Energy Policy, January 19, 2023, https://www.energypolicy.columbia.edu/publications/future-options-russian-gas-exports/.

[14] The reaction of Asian LNG buyers that lack seasonal underground storage capacity to options contracts with European counterparties merits further investigation beyond the scope of this commentary.

[15] Used in oil-linked LNG contracts, the slope of a price refers to the percentage of a crude oil indicator at which the LNG is priced. For example, an oil-linked contract sold at a slope of 12 percent relative to a $100 per barrel Brent crude oil price is $12/MMBtu.

[16] A forward curve is defined as “a snapshot representation of what a commodity is currently worth today based on a possible buy or sell in the future.” See: https://www.enverus.com/blog/what-is-a-forward-curve-a-beginners-guide-part-1/.

[17] Council of the EU, “Council Adopts Regulation on Gas Storage,” press release, June 27, 2022, https://www.consilium.europa.eu/en/press/press-releases/2022/06/27/council-adopts-regulation-gas-storage/.

[18] “Greek Utility Clinches Winter LNG Deal with TotalEnergies,” Reuters, September 29, 2022, https://www.reuters.com/business/energy/greek-utility-clinches-winter-lng-deal-with-totalenergies-2022-09-29/.

[19] Timera Energy, “Breaking Down US LNG Contract Value,” June 14, 2021, https://timera-energy.com/breaking-down-us-lng-contract-value/.

[20] In practice, exercising the optionality embedded in US tolling contracts—and actually canceling LNG cargoes—comes with time lags (due to the one- to two-month notification period for cargo cancellations) and may have a number of complicating factors, including upstream gas supply commitments, sunk costs on pipeline transportation and LNG shipping, and downstream gas supply obligations or limited trading ability on the part of some offtakers of US LNG, for example. International Energy Agency, “Global Gas Security Review 2020,” October 2020, p. 23, https://iea.blob.core.windows.net/assets/15a3ec72-1bf2-47a1-8b6c-e45e858cfcd8/Global_Gas_Security_Review_2020.pdf.

[21] Estimate based on Refinitiv.

[22] At the time of writing, the market capitalization of TotalEnergies was $154 billion, according to Google Finance; see: https://www.google.com/finance/quote/TTE:NYSE?sa=X&ved=2ahUKEwjp-_DsmOb-AhWnMlkFHVsHBuUQ3ecFegQIHhAa.

[23] ACER, “Price Assessments,” accessed June 6, 2023, https://aegis.acer.europa.eu/terminal/price_assessments.

[24] Most of the spot LNG indices for Europe (e.g., S&P DES NWE LNG) show convergence with the spot JKM index, and the price differentials between the two regional spot indices reflect net transport cost. Therefore, on a netback basis, moving an LNG cargo to Europe vs. to Asia would make a limited difference to the revenue of LNG suppliers that are pricing their sales against these well-developed LNG spot indices.

[25] Council of the EU, “Council Adopts Regulation on Gas Storage,” press release, June 27, 2022, https://www.consilium.europa.eu/en/press/press-releases/2022/06/27/council-adopts-regulation-gas-storage/.

Earlier this month, China convened its “two sessions”—the annual concurrent meetings of the National People’s Congress (NPC), China’s legislature, and the Chinese People’s Political Consultative Congress, a political...

Shortly after Donald Trump was elected president of the United States, European Commission President Ursula von der Leyen suggested the European Union could import more US liquefied natural gas...

Full report

Commentary by Akos Losz, Kong Chyong & Ira Joseph • June 14, 2023