Guest

Bob McNally and Dr. Karen Young

Even as prices decline, the tight oil market is once again raising economic and political worries in Washington.

In July, President Biden traveled to the Middle East to meet with several Arab leaders – including Saudi Arabia’s King and Crown Prince Mohammed bin Salman. Expanding oil supply was high on the list of the administration’s diplomatic objectives.

Saudi Arabia says it has limited ability to add extra oil to the market, and it’s not clear whether OPEC+ countries agree on a path forward for oil output. All of this comes at a time of enormous uncertainty in the global outlook for oil, due to fears of a recession and concerns over Russian supply.

Now all eyes are on OPEC+ in early August. Will Biden’s overtures have any consequential impact on production?

This week, host Jason Bordoff sits down with Dr. Karen Young and Bob McNally to discuss what’s next for oil markets.

Dr. Young is the newest Senior Research Scholar at the Columbia University Center on Global Energy Policy. She was a Senior Fellow and Founding Director of the Program on Economics and Energy at the Middle East Institute.

Bob McNally is a Non-Resident Fellow at the Center on Global Energy Policy. He’s the author of Crude Volatility: The History and the Future of Boom-Bust Oil Prices, published by Columbia University Press. In his full-time capacity he is the founder and President of Rapidan Energy Group, an independent energy consulting and market advisory firm based in the Washington DC area.

In the wake of Biden’s controversial trip to the Middle East, Jason spoke with Karen and Bob about what it tells us about the state of the global oil market in the months ahead.

More Episodes

Transforming America’s Power System

This week host Jason Bordoff talks with Cheryl LaFleur and David Hill about the incoming Trump administration, its impact on FERC, and the status of permitting reform measures.

COP29: A Veteran’s Account of the UN Process

The international climate negotiation process stands at a critical juncture. At the recent COP29 summit in Azerbaijan, nations struggled to find common ground on financial support and carbon...

The Cybersecurity Stakes of the Energy Transition

The energy transition is transforming how we power our world – clean energy systems are becoming more interconnected, automated, and reliant on digital infrastructure. But with this transformation...

Minimizing Damage as Mining for Critical Minerals Ramps Up

The clean energy transition has a dirty underside. To move away from fossil fuels and toward solar, wind, batteries, and other alternative sources of energy, we have to intensify mining operations for critical minerals like lithium, copper, and cobalt.

Relevant

Publications

How the New Geopolitics of Energy Informs the Current Oil Price-Risk Relationship in the Middle East

The traditional correlation between Middle East conflict risk and accelerating oil prices is now broken.

Opinion: Financial engineering will not suffice for Africa’s climate needs

Also in today’s newsletter, why private capital will not suffice for Africa’s climate needs

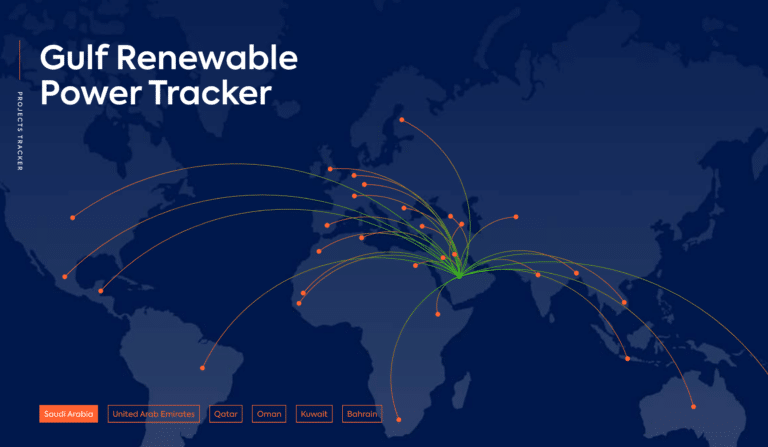

Gulf Renewable Power Tracker

The Gulf Renewable Power Tracker is an interactive and visual database of Gulf state-owned and state-related renewable power investments and developments on a global scale.

Saudi Arabia’s Renewable Energy Initiatives and Their Geopolitical Implications

Saudi Arabia is experiencing a significant economic transformation under its Vision 2030 plan to reduce the country’s dependence on oil revenues by diversifying its economy. The Saudi government’s...