China moves to supercharge green hydrogen as US pulls back

The country's new policy is likely to boost the production of green hydrogen, which the country aims to use to decarbonize airplanes, ships, and heavy…

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

The winter energy crisis, which everyone feared would lead to blackouts, gas rationing, and consumers shivering in poorly heated apartments, did not materialize in Europe. Far from Brussels, in Central Asia, however, widespread power cuts and crippling gas shortages became an all-too-painful reality for households and businesses. Uzbekistan and Kazakhstan were especially hard hit as a sustained cold snap led to power shortages, gas rationing, and disruptions in residential heating from December 2022 to February 2023.[1] The crisis was further exacerbated by export cuts from Turkmenistan to Uzbekistan in January due to “technical issues, which also affected Turkmen gas deliveries to China.”[2]

While this cold spell was severe, midwinter energy supply disruptions are not unprecedented in the region.[3] The inability to meet winter peak demand in Uzbekistan and Kazakhstan is noteworthy because both countries are significant gas producers and net exporters of natural gas. Together, they supplied approximately 11 billion cubic meters (Bcm) of natural gas to China in 2021, accounting for a fifth of China’s pipeline gas imports that year.[4]

This post analyzes homegrown and structural problems with the natural gas balances of Uzbekistan and Kazakhstan and discusses the global implications of this Central Asian energy crisis. For now, Europe has averted crisis thanks to a combination of factors: an unseasonably warm winter, abundant liquefied natural gas (LNG) availability due to lackluster demand in China, price-driven demand curtailments in industry, and well-timed policy action coordinated by the European Commission.[5] But in today’s deeply interconnected global gas market, a shortfall in the heart of Eurasia could still squeeze supply—and push prices higher—for far-off consumers too, including in Europe.

Kazakhstan—despite its vast natural gas reserves—has struggled to maintain a healthy natural gas surplus as the country’s gas processing capacity lagged far behind rapidly growing domestic demand.[6] Uzbekistan’s gas production, on the other hand, is entering a phase of terminal decline, with a reserve life of less than 18 years and no prospect of significant new discoveries.[7] Meanwhile, the government anticipates domestic consumption to increase by 40 percent between 2020 and 2030,[8] thanks in part to the development of heavily gas-intensive industries, including a recently commissioned gas-to-liquids plant, and a compressed natural-gas-based transport infrastructure. Both countries have rapidly growing populations, decrepit gas and power infrastructure (including highly inefficient district heating networks), an aging and poorly insulated building stock, poor overall energy efficiency, low and subsidized energy prices, chronic underinvestment, and stalled market reforms. All of these have further exacerbated the gas supply challenge.

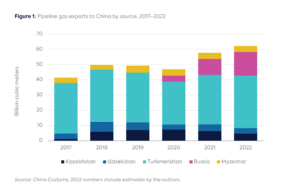

As a result of tightening gas balances, both Kazakhstan and Uzbekistan struggled to meet export commitments to China in 2022. Currently, each country is under contract to deliver 10 Bcm of pipeline gas annually to China, and though neither came close to delivering the full contracted volume at any point, the two countries together managed to provide a stable supply of 11 to 12 Bcm each year to China between 2018 and 2021 (Figure 1). This volume fell to just over 8 Bcm in 2022, with Kazakhstan’s deliveries dropping by more than a quarter to 4.6 Bcm[9] and Uzbekistan’s shrinking by 17 percent to an estimated 3.7 Bcm.

Further declines are very likely in 2023, with the distinct near-term possibility of dropping to zero—if not in 2023, then within the next three years. Both countries suspended natural gas exports to China this winter to cope with domestic shortages.[10] In February 2023, Kazakhstan’s government indicated that no gas exports to China should be expected in the coming fall-winter period.[11] Moreover, the current 10 Bcm contract with China is set to expire at the end of 2023, after which the continuation of exports is far from assured. In 2020, Uzbekistan’s government set an end date of 2025 for the country’s natural gas exports to China,[12] but given its rapidly disappearing gas surplus it is doubtful if Uzbekistan can sustain meaningful levels of exports that long.

In November 2022, Russia proposed a “tripartite gas union” with Kazakhstan and Uzbekistan to facilitate Russian gas shipments to the two Central Asian economies as well as to third-party buyers, including China.[13] For Russia, this arrangement could provide an alternative outlet to the country’s disappearing European customer base and boost its influence in Central Asia. Earlier reports indicated that Gazprom’s initial proposal included the takeover of gas transmission networks in both Uzbekistan and Kazakhstan in exchange for the right to re-export Russian gas to China, in addition to securing gas for the local market.[14] Kazakhstan and Uzbekistan first reacted dismissively to the proposal.[15] However, after this winter’s energy crisis—and Russia’s concession to drop demands for the transfer of gas pipeline ownership rights—Kazakhstan and Uzbekistan appear to be open to joining the gas union with Russia in principle.

In January 2023, both countries signed roadmaps on cooperation in the gas industry with Gazprom and agreed to study the technical possibilities of supplying Russian gas to the region and beyond.[16] The latest plans call for the supply of up to 10 Bcm of Russian gas annually—of which 4 to 6 Bcm could go to China—with deliveries starting by the end of 2023.[17] However, given uncertainties around the transit routes and the lack of agreement on pricing terms for the moment, this timeline appears ambitious at best. The preferred transit route is still in question as of April 2023: a reversal of the existing Central Asia-Center (50 Bcm) and Bukhara-Ural (8 Bcm) pipelines requires extensive maintenance and upgrades,[18] and an entirely new transit route proposed by Kazakhstan requires years of planning and construction.[19]

While various forecasts anticipate flat or increasing Chinese imports of pipeline gas from Central Asia in 2023,[20] they may be overly optimistic given the limited upside to increasing shipments from Turkmenistan and the high likelihood of further declines from Kazakhstan and Uzbekistan. Any shortfalls in China’s gas imports from Central Asia would have to be backfilled from the global LNG market, which would in turn reduce the availability of LNG for Europe.

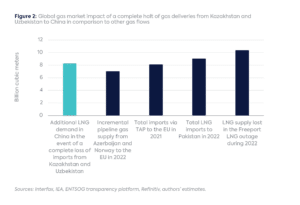

The volumes at stake are not insignificant (Figure 2). If all pipeline exports from Kazakhstan and Uzbekistan were to cease, the incremental call on LNG by China—and the corresponding gap faced by Europe—would be more than 8 Bcm. For comparison, this is more than the incremental amount of pipeline gas EU member states were able to mobilize from Norway and Azerbaijan combined during 2022 (7 Bcm) and roughly equivalent to the total volume of gas EU countries received via the Trans Adriatic Pipeline (TAP) system during its first full year of operation in 2021 (8 Bcm). If Kazakh and Uzbek supplies had to be replaced entirely with LNG in China, the corresponding tightening of the global LNG market would be similar to adding another Pakistan (9 Bcm) to global LNG demand, or removing a volume of supply comparable to the setback from the outage at Freeport LNG during 2022 (10 Bcm).

While a gradual erosion of pipe gas flows from Uzbekistan and Kazakhstan is more likely than an abrupt end—and Russia could eventually come to save the day—an emerging supply-demand gap in Central Asia’s two struggling gas producers could nonetheless have ripple effects far beyond Asia.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] https://www.voanews.com/a/reporter-s-notebook-energy-crisis-exposes-deep-grievances-in-uzbekistan-/6976817.html; https://eurasianet.org/kazakhstan-again-struggling-with-power-outages; https://www.intellinews.com/big-freeze-that-was-feared-by-gas-hungry-europe-hits-central-asia-iran-267467/.

[2] https://www.gazeta.uz/ru/2023/01/14/gas/; https://eurasianet.org/turkmenistan-the-big-chill.

[3] A similar—though shorter—disruption occurred in January 2022, for example, when Kazakhstan, Uzbekistan, and Kyrgyzstan suffered widespread power outages and swathes of Uzbekistan was left without heating, gas, and water supply. See: https://www.reuters.com/world/asia-pacific/power-blackout-hits-kazakhstan-kyrgyzstan-uzbekistan-2022-01-25/.

[4] http://stats.customs.gov.cn/indexEn.

[5] https://www.iea.org/reports/background-note-on-the-natural-gas-supply-demand-balance-of-the-european-union-in-2023.

[6] https://www.energypolicy.columbia.edu/qa-the-geopolitics-behind-kazakhstans-turbulent-energy-sector/#_edn7.

[7] https://www.iea.org/reports/uzbekistan-2022.

[8] These calculations are based on total gas consumption of 46.1 Bcm in 2020, reported by the IEA, and expected consumption of 65 Bcm in 2030 projected by the government of Uzbekistan. See: https://www.iea.org/reports/uzbekistan-2022.

[9] https://interfax.com/newsroom/top-stories/86790/.

[10] Kazakhstan suspended exports from late December 2022 to early January 2023 and Uzbekistan is reported to have halted exports in December 2022. See: https://www.energypolicy.columbia.edu/qa-the-geopolitics-behind-kazakhstans-turbulent-energy-sector/#_edn24; https://www.upstreamonline.com/production/uzbekistan-halts-gas-exports-to-china-as-winter-demand-spikes/2-1-1372699.

[11] https://eurasianet.org/kazakhstan-officials-vow-no-repeat-to-gas-shortages-but-warn-exports-and-excess-use-must-stop.

[12] https://www.gazeta.uz/uz/2020/01/18/gaz-aa/.

[13] https://www.reuters.com/business/energy/russia-discussing-gas-union-with-kazakhstan-uzbekistan-deputy-pm-2022-11-29/.

[14] https://www.gazeta.uz/ru/2023/01/24/gas/.

[15] https://tengrinews.kz/kazakhstan_news/kazahstan-ne-dozvolyaet-ispolzovat-territoriyu-obhoda-484700/; https://www.reuters.com/article/uzbekistan-gas/uzbekistan-takes-cool-line-on-russian-gas-union-plan-idUKL1N32X172.

[16] https://tass.ru/ekonomika/16947931.

[17] https://podrobno.uz/cat/uzbekistan-i-rossiya-dialog-partnerov-/gazprom-uzhe-v-etom-godu-dogovoritsya-o-postavkakh-10-mlrd-kubometrov-gaza-v-uzbekistan-i-kazakhstan/.

[18] https://www.gazeta.uz/ru/2023/03/01/gas/.

[19] https://www.energyintel.com/00000186-9339-dfa1-aff7-bf7d60ce0000; https://www.kommersant.ru/doc/5798463.

[20] https://www.reuters.com/article/china-gas-outlook/china-lng-buyers-return-to-spot-market-but-coal-to-keep-demand-capped-idUSL4N35M2F9.

Economic, political, and fiscal realities have shifted energy policy priorities across the globe toward the goals of affordability and competitiveness.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

Gulf Cooperation Council (GCC) countries have not only the world's lowest costs for oil and gas production but also the lowest costs for electricity generated from renewable energy sources.

World leaders are meeting in New York this month at the request of the United Nations Secretary-General António Guterres to discuss the state of global ambition on climate change.

The global clean energy economy today looks starkly different than it did even 10 years ago. Not only have production and deployment of clean energy technologies expanded significantly, the geographic distribution of clean energy manufacturers, resellers, and end-users has shifted dramatically.

Throughout much of the modern era, limiting or disrupting the flow of energy was a highly effective tool of global power.

The report outlines five foundational choices if a stockpiling strategy is adopted, as bipartisan support suggests is possible.