China Halts U.S. LNG Imports Amid Tariff War

China has ceased importing liquefied natural gas from the United States since early February, as the ongoing tariff war impacts energy trade.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

On April 20, the Chilean government announced its new lithium strategy,[1] which plans to give control of the country’s lithium industry to the state. While Chile’s decision is fueling much debate and commentary, this article explains why Chile’s lithium production is particularly important and lays out some of the key questions and challenges facing policy makers as the country launches its new strategy. For a nation rich in the lithium reserves desperately needed to support the pace of the energy transition, it is critical that Chile adopt strategies that help meet global demand, maximize the benefits for its people, and protect the environment.

The world needs lithium—a lot of it—for batteries in electric vehicles (EVs) and electricity storage. Lithium supply would need to grow sevenfold by 2030—which translates to opening 50 new lithium mines[2]—to maintain global warming below 1.5°C.[3] To limit global warming to 2°C, lithium output would need to grow 40-fold by 2040.[4] These growth rates will require billions of dollars of investment.

The world is not on track to meet this lithium demand, with an expected deficit of 12.5 percent by 2030.[5] Supply deficits mean higher lithium prices, which in turn will be reflected in higher battery costs, slowing down EV adoption. Any setback to Chile’s lithium supply would add to that supply deficit and to costs.

Alternative technologies, such as sodium-ion batteries, are in the early stages of development and will probably remain a backup to lithium-ion batteries.[6] Lithium has characteristics that make it technically superior: it is lighter, safer, and has a higher energy density.

Chile is in pole position to supply lithium to the global market. It owns 36 percent of economically recoverable lithium reserves[7] and accounts for about 26 percent of global production.[8] The other large producer is Australia, which owns 24 percent of lithium reserves and produces 47 percent of global lithium.[9]

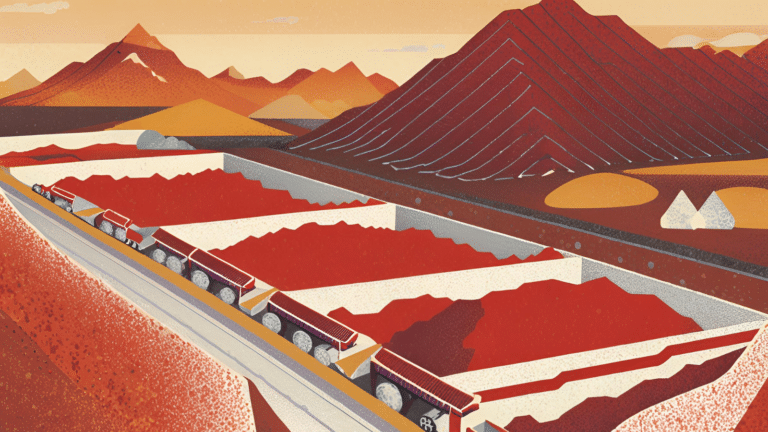

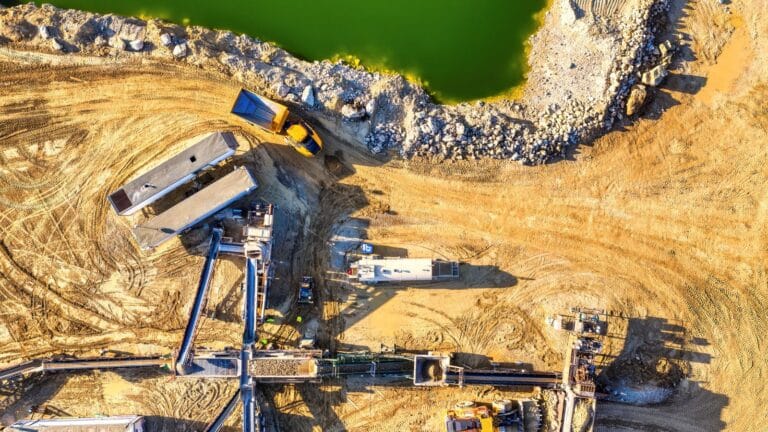

Where the lithium comes from and what it is processed into matters a great deal. Australia produces lithium from hard rock mining, whereas Chile produces lithium from brine deposits, which are underground lakes of saline groundwater located under salt flats.

Brine operations have longer lead times than hard rock mining. The time between the investment decision and the first production is around seven years for brine operations in Latin America, compared to four years for hard rock lithium in Australia.[10] But producing lithium from brines has a much lower greenhouse gas emissions intensity than lithium produced from hard rock mining.[11]

Brine operation in Atacama. Photograph via Wikimedia Commons.

Australia’s lithium is more easily processed into lithium hydroxide, used in high-end batteries that include nickel, manganese, and cobalt (so-called NMC batteries). Lithium from brines is more easily processed into lithium carbonate, which is more easily used in another type of battery that includes iron phosphate (so-called LFP batteries).

There are only about 8 operations in the world using lithium brines.[12] Chile is by far the most important producer, holding 61 percent of global lithium carbonate in 2021.[13] So, while Chile’s role is important in the lithium market, it is even more important in the lithium carbonate market.

While the LFP batteries that use lithium carbonate are less energy dense, they are considered cheaper and safer, and can run more cycles than NMC batteries that use lithium hydroxide.

As a result, LFP batteries are considered essential to the democratization of electric vehicles for middle and lower-middle-income households, the addition of battery storage more quickly to the grid, and the reduction of reliance on problematic minerals such as nickel (short supply) and cobalt (human rights issues).

The share of LFP batteries in total lithium-ion batteries grew from 20 percent in 2020 to a projected 40 percent in 2023.[14]

With Chinese LFP patents expiring at the end of 2022, global car makers are set to move on two tracks: high-nickel NMC batteries for the high-end market, such as more luxurious electric SUVs, and LFP batteries for regular car sizes. A few notable examples include Ford’s Michigan plans for an LFP plant with the Chinese battery conglomerate CATL,[15] Stellantis’ plans to use LFP cathodes in their European manufacturing,[16] and Tesla’s unconfirmed plan to build LFP plants using CATL’s LFP technology.[17]

How to best leverage the expected demand increase is the question before Chile’s policy makers. The country’s lithium production is concentrated in just two companies, SQM and Albemarle, in only one salt flat region: Atacama. The challenge is to expand production both in Atacama and in other areas (the country has preliminarily identified 18 salt flats where lithium could be produced), and to attract more players to deploy investment and technology to increase production in a sustainable way.

There remain unanswered questions about what role the state would play in this growing industry. An important consideration is how to improve environmental standards; for example, will the state impose technological choices on private companies or regulate to achieve desired outcomes? Another critical set of questions revolve around how Chile can maximize the economic rents—or revenues in excess of cost of production—captured by the state and local communities. Could state control without investment make the risk-return balance unattractive for the private sector, discouraging its involvement? Just as important are measures to help Chile create an ecosystem in which more value is added to its lithium industry, specifically technology transfer and worker training in areas like LFP cathode manufacturing.

In 2015, the size of the lithium market was forecast at just $8–10 billion by 2020. But in 2022, the market was worth $48 billion with strong margins expected over at least the next decade.[18] That gives leverage to the Chilean government in its partnerships with private sector companies that possess technical expertise and financial resources to expand sustainable production. The development of a sound and predictable policy framework—that attracts private investors while advancing environmental, benefit-sharing, and value addition objectives—could make all the difference as Chile pursues its economic development and sustainability goals while satisfying global demand growth for lithium to drive the clean energy transition.

[1] “Estrategia Nacional del Litio,” https://www.gob.cl/litioporchile/.

[2] International Energy Agency, “The Role of Critical Minerals in Sustainable Energy Transitions,” May 2021, https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

[3] International Energy Agency, “Critical Minerals Policy Tracker,” November 2022, https://www.iea.org/reports/critical-minerals-policy-tracker.

[4] International Energy Agency, “The Role of Critical Minerals in Sustainable Energy Transitions,” May 2021, https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

[5] Benchmark Minerals Intelligence, “Albemarle’s Turbo-Charged Demand Data Showcases Lithium’s Growing Supply Problem,” January 26, 2023, https://source.benchmarkminerals.com/article/opinion-albemarles-turbo-charged-demand-data-showcases-lithiums-growing-supply-problem.

[6] Benchmark Minerals Intelligence, “We Believe Africa Will Be the Next Good Opportunity for Lithium,” April 4, 2023, https://source.benchmarkminerals.com/article/we-believe-africa-will-be-the-next-good-opportunity-for-lithium-qa-with-wang-xiaoshen-of-ganfeng-lithium.

[7] US Geological Survey, Mineral Commodity Summaries, “Lithium,” January 2023, https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-lithium.pdf.

[8] Alejandra Bernal, Joerg Husar, and Johan Bracht, “Latin America’s Opportunity in Critical Minerals for the Clean Energy Transition,” International Energy Agency, April 7, 2023, https://www.iea.org/commentaries/latin-america-s-opportunity-in-critical-minerals-for-the-clean-energy-transition.

[9] US Geological Survey, Mineral Commodity Summaries, “Lithium,” January 2023, https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-lithium.pdf.

[10] International Energy Agency, “The Role of Critical Minerals in Sustainable Energy Transitions,” May 2021, https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

[11] Benchmark Minerals Intelligence, “Hard Rock Lithium vs. Brine—How Do Their Carbon Curves Compare?,” March 3, 2023, https://source.benchmarkminerals.com/article/hard-rock-vs-brine-how-do-their-carbon-curves-compare.

[12] US Geological Survey, Mineral Commodity Summaries, “Lithium,” January 2023, https://pubs.usgs.gov/periodicals/mcs2023/mcs2023-lithium.pdf.

[13] Observatory of Economic Complexity, “Lithium Carbonates,” 2023, https://oec.world/en/profile/hs/lithium-carbonates#exporters-importers.

[14] Ahmed Mehdi and Tom Moerenhout (2023, forthcoming) using data from Benchmark Minerals Intelligence.

[15] Ford, “Ford Taps Michigan for New LFP Battery Plant,” February 13, 2023, https://media.ford.com/content/fordmedia/fna/us/en/news/2023/02/13/ford-taps-michigan-for-new-lfp-battery-plant–new-battery-chemis.html.

[16] Nick Gibbs, “Stellantis Will Use Cheaper LFP Batteries for EVs in Europe,” Automotive News Europe, February 24, 2023, https://europe.autonews.com/automakers/stellantis-will-cut-costs-europe-lfp-batteries.

[17] Dan Mihalascu, “Tesla Said to Plan US Battery Cell Factory Using CATL’s LFP Tech,” Inside EVs, March 31, 2023, https://insideevs.com/news/660046/tesla-said-plan-us-battery-cell-plant-using-catl-lfp-tech/.

[18] Ricardo Morales, “What Most Major Mining Houses Have Hot Wrong About Lithium,” Benchmark Minerals Intelligence, April 25, 2023, https://source.benchmarkminerals.com/article/opinion-what-most-major-mining-houses-have-got-wrong-about-lithium.

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

President Donald Trump has made energy a clear focus for his second term in the White House. Having campaigned on an “America First” platform that highlighted domestic fossil-fuel growth, the reversal of climate policies and clean energy incentives advanced by the Biden administration, and substantial tariffs on key US trading partners, he declared an “energy emergency” on his first day in office.

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

This commentary addresses the importance of Indonesian nickel supply to US climate goals, and why a US-Indonesia critical minerals agreement could be beneficial for both countries.

The mining sector continues to face headwinds in attracting the necessary investments to meet the growing demand for critical minerals in clean energy technologies.