This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

Commitments and Contradictions: Gulf and Middle East Decarbonization Strategies Ahead of COP28

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

The 28th edition of the United Nations Climate Change Conference (COP28) that opens in Dubai, United Arab Emirates (UAE), on November 30 has brought the usual flurry of diplomatic preparation—heightened this year by a surge in global temperatures and an outbreak of massive wildfires and extreme weather. It has also attracted intense praise for and criticism of the host nation, as well as a sharpening challenge to it and other leading Gulf and Middle East oil and gas exporters: How can they decarbonize their fossil-fuel-dependent domestic economies and reduce or reconfigure their hydrocarbon sales, which bring in the bulk of government revenues and export earnings?

Contradictory Pressures

The UAE’s circumstances are quite similar to those of its high-income neighbors in the Gulf Cooperation Council (GCC): Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia. Other than Qatar, they all have net-zero carbon targets (UAE and Oman in 2050; Bahrain, Kuwait, and Saudi Arabia in 2060). In contrast, other regional oil and gas producers, notably Iran, Iraq, Egypt (host of COP27 in 2022), Libya, and Algeria have much larger populations and lower income levels, and face political and economic instability.

Collectively, the region’s major oil exporters and members of the OPEC+ alliance face contradictory pressures. Each time OPEC+ cut back production as oil prices rose sharply in 2022, they were heavily criticized by the US administration,[1] while European politicians visited repeatedly[2] to seek increased gas supplies to replace those lost from Russia. Not just OPEC[3] but the International Energy Agency (IEA) has warned numerous times of “underinvestment”[4] in production capacity, although other analysts suggest that aggregate upstream investment is sufficient to meet medium-term projected demand.[5]

The UAE and Saudi Arabia have significant, credible plans to expand production capacity, as does Iraq, though with a tougher challenge to deliver. And although emissions from oil and gas exports fall within the remit of the importing country, not that of the producer, these plans are seen as a threat to the Paris Agreement’s goal—to hold the increase in global average temperature to “below 2°C and towards 1.5°C” above preindustrial levels—and an indication of these countries’ lack of climate commitment. In response, the Gulf oil exporters argue that[6]:

- Even “net-zero” scenarios, such as those of the IEA, include substantial, continuing amounts of oil and gas consumption to 2050.

- As low-cost, low-carbon, politically stable producers, it is understandable and optimal for the climate and consumers that they would increase their market share.[7]

- Natural field decline rates without reinvestment exceed projected rates of declines in demand, and, therefore, a lack of investment would result in high prices and economic damage, particularly in developing countries.[8]

At the same time, these oil and gas exporters—and particularly the four Gulf leaders Saudi Arabia, UAE, Qatar, and Oman—are seeking to play to their strengths in climate policy and diplomacy. On July 11, the UAE issued a third update to its second Nationally Determined Contribution (NDC),[9] the plan that all signatories to the Paris Agreement are meant to issue and revise at least once every five years. The new NDC describes how the UAE plans to decarbonize, indicating routes its regional peers might follow.

Decarbonization Strategies

The UAE has named Dr. Sultan Al Jaber as president-designate for COP28. He is the CEO of the Abu Dhabi National Oil Company (ADNOC), one of the world’s biggest oil companies, which has plans to make substantial increases in oil and gas production capacity. As such, his appointment has received heavy criticism from various quarters, including environmental groups and some US and European lawmakers.[10] However, in a combination of portfolios not unusual for a leading Gulf technocrat, he is also the founding CEO (2006) and current chairman of Masdar, Abu Dhabi’s clean energy vehicle; the UAE’s special envoy for climate change (since November 2020); and the minister of industry and advanced technology.

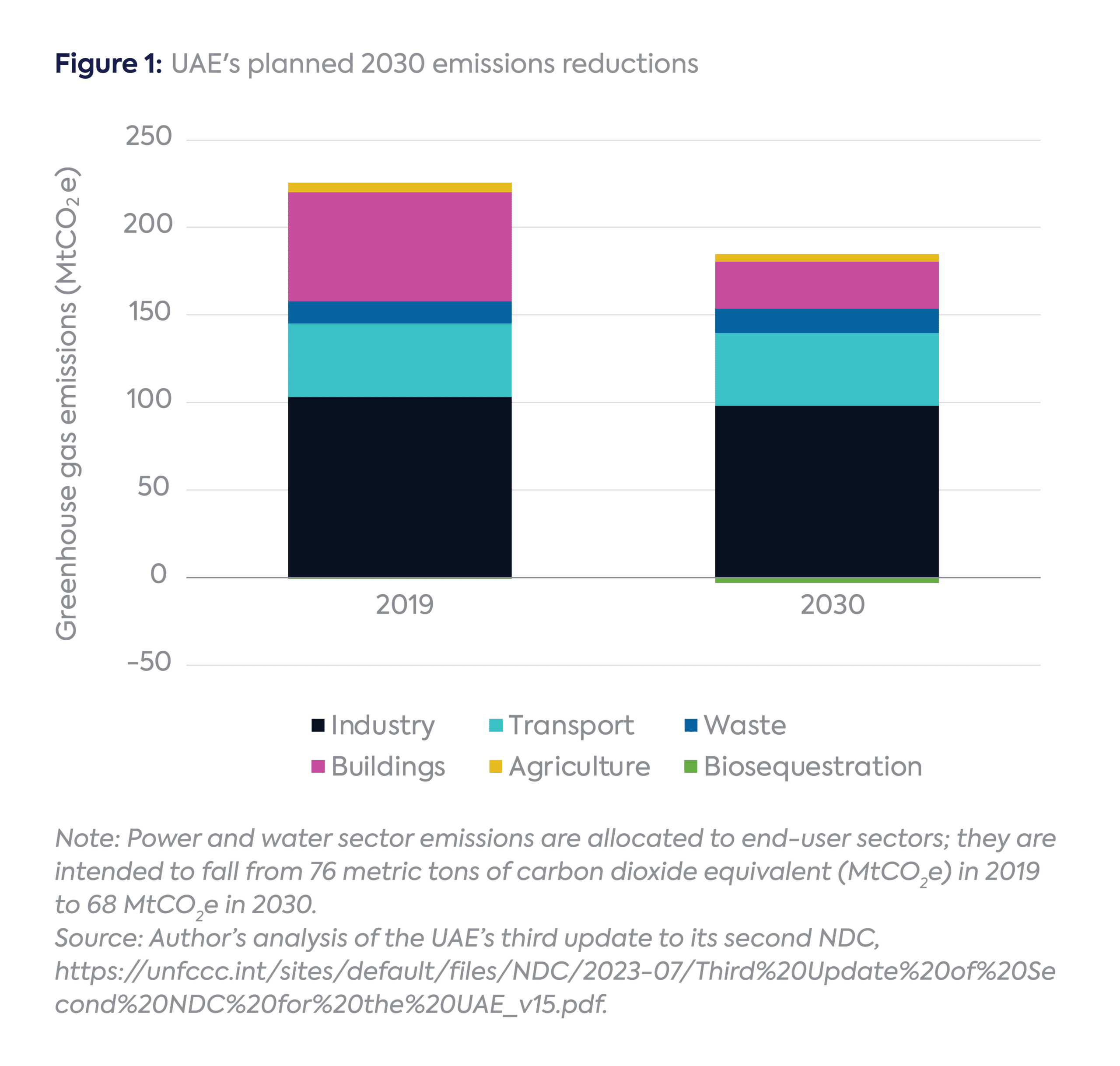

The UAE’s NDC intends that greenhouse gas (GHG) emissions will fall 40 percent on “business-as-usual” levels by 2030, or 19 percent on 2019 levels, reaching 182 million metric tons of carbon dioxide equivalent (MtCO2e), divided between the five key emitting sectors (Figure 1), and with electricity and water sector emissions allocated to end-user sectors. This is to be achieved by a broad range of measures including renewable and nuclear power, reverse osmosis desalination, improved efficiency, district cooling and demand-side management, carbon capture and storage (CCS), hydrogen use in industry, fugitive methane cutting, public transport and electric vehicles, innovative agricultural technologies, and others.

Notably, carbon contracts for difference (CCFDs), as used for example in the UK[11] and Germany,[12] will incentivize CCS and low-carbon hydrogen (“blue” and “green”) production, supplemented by government procurement for low-carbon steel and cement. There will also be biosequestration in mangroves and pilots of direct air capture of carbon dioxide. Although international aviation and shipping are not typically included in domestic targets in NDCs, as a major aviation and shipping hub, the UAE’s NDC also describes plans for sustainable aviation fuels (SAF) and green shipping corridors.

On July 31, ADNOC announced it would advance its net-zero carbon target to 2045 from 2050; reduce carbon intensity 25 percent by 2030; and target zero methane leaks by 2030 (from 0.07 percent leakage in 2022). It reported 24 MtCO2e of direct GHG emissions in 2022, having saved 4 Mt from imports of nuclear and renewable electricity, and 1 Mt from energy efficiency and flaring reduction.[13]

This is somewhat ahead of the pack of GCC national oil companies, but consistent with the general approach of attempting to improve the carbon footprint of oil and gas production[14] by methods such as cutting flaring and methane leakage, electrifying facilities and powering them with low-carbon electricity, and using CCS for operational emissions including the CO2 content of natural gas.[15] Saudi Aramco has a plan for a major carbon capture hub. GHG reductions come with some direct financial benefits, and may achieve premium pricing for their products, reduce costs of compliance with measures such as the European Union’s intended Carbon Border Adjustment Mechanism, and improve their position versus higher-carbon competitors.

While Aramco, Qatar Energy, ADNOC, and Kuwait Oil Company all have plans to boost oil and/or gas production capacity, they are also seeking to solidify their positions in future markets, via long-term contracts for LNG sales[16] and investment in petrochemical complexes and refineries, particularly in middle-income Asian countries such as China,[17] India, Malaysia, Indonesia, and Vietnam. LNG is a medium-term bet on replacing higher-carbon coal in Asia; long-lived petrochemicals, such as non-metallic materials,[18] can be a low-emitting use.

Saudi Arabia, the UAE, and Oman, in particular, are also seeking to be leaders in low-carbon hydrogen, mostly for export in the form of derivatives such as ammonia, methanol, and SAF, as well as for domestic use for low-carbon industrial materials, notably steel. However, the “rents” (surplus profits) from hydrogen are much smaller than from oil and gas. Even though in total market size hydrogen may be a valuable complement to oil and gas exports by 2050, in financial terms it would be far from a replacement.

Neighboring countries, such as Iran, Iraq, and Libya, do not have clearly articulated visions on emissions and struggle from lack of finance and political stability and direction, but they also seek to reduce flaring for more immediate financial and local environmental reasons.

International Climate Diplomacy

The Gulf oil exporters’ strategies stress the role of CCS, and prefer calls to phase out “unabated fossil fuels”[19] (i.e., without CCS) rather than all fossil fuels; position themselves as champions of energy access for lower-income countries; stress the need to increase climate finance to promised levels (implicitly criticizing Western countries); and forge strategic partnerships with particular countries or on particular issue. “I made the case for all parties to get behind a rapid scale up of renewable energy, while we comprehensively decarbonize the current energy system and build towards a system free of all unabated fossil fuels,” Dr. Al Jaber told the G20 gathering in Chennai, India, on July 28.[20]

The UAE and US concluded the Partnership for Accelerating Clean Energy in November 2022, aiming to catalyze $100 billion of investment.[21] In April 2021, the US Department of Energy led the establishment of the Net Zero Producers Forum, aiming to decarbonize oil and gas output, including the US, Canada, and Norway, with Qatar and Saudi Arabia; the UAE joined in May 2022.[22] The Global Methane Pledge was launched at COP26 in the UK in November 2021, aiming for a 30 percent global reduction in methane emissions by 2030; all the GCC countries, Iraq, and all of North Africa except Algeria are participants.

Notably, apart from some such forums and some foreign direct investment in renewables, the GCC states have cooperated little on climate strategies, investments, or infrastructure, preferring to chart their own paths. Masdar has been a prominent investor in international renewable and hydrogen projects, including in Europe and the US, and also, notably, in Central Asia and Africa. It has declared a target of 100 gigawatts (GW) of renewable capacity by 2030,[23] up from 20 GW last year, a level of ambition comparable to those of big European renewable players such as Iberdrola, Engie, and Enel.

Private UAE companies such as AMEA Power[24] are also active investors in African renewables, as is Acwa Power,[25] a prominent developer 50 percent owned by Saudi Arabia’s Public Investment Fund. Nebras Power, owned by the state entity Qatar Electricity and Water Company, holds solar, wind, and hydro assets across Brazil, Australia, Ukraine, the Netherlands, and the Middle East.[26]

With the GCC and other Middle East countries facing contradictory pressures, updates of their NDCs, national oil companies’ climate plans, and platforms at COP28 will be critical in demonstrating ambitious and realistic pathways to rapid decarbonization.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] https://www.cnbc.com/2022/10/12/biden-threatens-consequences-for-saudi-arabia-after-opec-cut.html

[2] https://www.bmwk.de/Redaktion/EN/Pressemitteilungen/2022/03/20220318-minister-habeck-visits-qatar-and-the-uae-focus-on-energy-security-matters.html, https://www.arabnews.com/node/2175671/business-economy, https://www.aa.com.tr/en/europe/french-foreign-minister-on-tour-of-gulf-to-secure-energy-supplies/2548541, https://www.middleeastmonitor.com/20230121-italy-pm-to-visit-algeria-to-guarantee-gas-compensate-france/

[3] https://www.energyintel.com/00000187-8e37-dc4f-a7e7-9fb7a32e0000

[4] https://www.ft.com/content/8aaf3910-7230-4ab4-b31c-242c40c10e4d

[5] https://www.woodmac.com/horizons/is-there-enough-upstream-investment/

[6] https://www.opec.org/opec_web/en/6704.htm

[7] https://www.opec.org/opec_web/en/press_room/5772.htm

[8] https://www.bnnbloomberg.ca/oil-demand-growth-to-slow-dramatically-as-peak-nears-iea-says-1.1932891

[9] https://unfccc.int/sites/default/files/NDC/2023-07/Third%20Update%20of%20Second%20NDC%20for%20the%20UAE_v15.pdf

[10] https://www.euronews.com/green/2023/05/24/us-and-eu-lawmakers-call-for-designated-head-of-cop28-talks-to-be-removed

[11] https://www.gov.uk/government/publications/contracts-for-difference/contract-for-difference

[12] https://www.iea.org/policies/17538-carbon-contracts-for-difference-ccfd-program-for-energy-intensive-industries

[13] https://www.thenationalnews.com/business/energy/2023/07/31/adnoc-aims-to-reach-net-zero-emissions-by-2045/

[14] https://www.osti.gov/pages/servlets/purl/1485127

[15] See, for example, the policy and approaches of Qatar Energy (https://www.iea.org/policies/14924-qatar-energys-sustainability-strategy), Saudi Aramco (https://www.aramco.com/en/sustainability/climate-change), ADNOC (https://www.adnoc.ae/en/ourstrategy/net-zero-by-2050), Petroleum Development Oman (https://pdo.co.om/hseforcontractors/Environment/Pages/GHGAirEmission.aspx), BAPCO of Bahrain (https://www.zawya.com/en/business/energy/bahrains-bapco-energies-launches-sustainability-linked-finance-framework-eubp8ruq), Kuwait Oil Company (https://www.bloomberg.com/news/articles/2022-11-08/kuwait-aims-to-reach-carbon-neutrality-in-oil-and-gas-by-2050), and Sonatrach of Algeria in partnership with ENI (https://www.eni.com/en-IT/media/press-release/2023/01/eni-sonatrach-sign-strategic-agreements-accelerate-emissions-reduction.html).

[16] https://www.energypolicy.columbia.edu/unpacking-the-recent-china-qatar-lng-deals/

[17] e.g., https://www.aramco.com/en/news-media/news/2023/aramco-completes-purchase-of-rongsheng-petrochemical-stake

[18] https://www.aramco.com/en/creating-value/technology-development/in-house-developed-technologies/nonmetallic-solutions

[19] https://fortune.com/2023/07/13/uae-oil-exec-al-jaber-cop28-need-attack-all-emissions/

[20] https://www.thenationalnews.com/climate/cop28/2023/07/28/cop28-chief-warns-climate-change-is-going-in-wrong-direction-and-urges-action/

[21] https://ae.usembassy.gov/fact-sheet-u-s-uae-partnership-to-accelerate-transition-to-clean-energy-pace/

[22] https://www.energy.gov/articles/united-arab-emirates-joins-sixth-member-net-zero-producers-forum

[23] https://masdar.ae/en/Masdar-Clean-Energy/Overview

[24] https://www.ameapower.com/projects/

More on Energy Explained Energy Explained

Q&A: Trump’s Executive Order on US Domestic Mineral Production

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

Energy and Climate Issues During the Trump Administration’s First 100 Days

President Donald Trump has made energy a clear focus for his second term in the White House. Having campaigned on an “America First” platform that highlighted domestic fossil-fuel growth, the reversal of climate policies and clean energy incentives advanced by the Biden administration, and substantial tariffs on key US trading partners, he declared an “energy emergency” on his first day in office.

US State Actions to Help Fossil Fuel Communities Navigate the Energy Transition

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

The US has a Hydrogen Demand Problem – Despite Generous Incentives

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

Relevant

Publications

The U.S. Should Not Politicize LNG Exports

Can U.S. gas exports throw a lifeline to Europe without raising prices at home?

More energy is more security

The incoming Trump administration should embrace a diverse energy mix, including renewables, for the sake of economic and national security.