This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

Estimating Interregional Transmission Expansion Under the BIG WIRES Act

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Recent congressional legislation has the potential to accelerate the construction of new electricity transmission projects that cross existing electric grid boundaries. These interregional transmission projects provide a host of benefits, but building them has proven to be exceptionally difficult. In this article, we, the authors, estimate how much new transmission capability would be required, and where, by the BIG WIRES Act[1]—arguably the most ambitious expansion of the US transmission grid in a generation. Our analysis helps to provide clarity about how close the bill might come to realizing its intended benefits.

Over one-third of all fuels consumed[2] in the United States are used to make electricity, but the electricity sector struggles to move that massive amount of energy from where it is produced to where it’s needed. In its recent National Transmission Needs Study,[3] the US Department of Energy’s Grid Deployment Office (GDO) found that expanding the links between fractured electric grids could achieve a policy win trifecta:

- Increased grid reliability, particularly in the face of increasingly extreme weather

- Reduced energy prices for consumers

- A faster clean energy transition

Despite these benefits, regulators have struggled to incentivize grid operators to collaborate on projects that move electricity across existing electric grid boundaries. Indeed, the GDO recently reported that the pace of interregional transmission construction has slowed to a crawl; from 2011 to 2020, the current planning system managed to energize an average of only 72 circuit-miles of new lines per year.[4] The BIG WIRES Act, however, sets minimum transfer requirements between regions and mandates that utilities work together to make those connections a reality. Minimum transfer requirements ensure that regions can import and export from other regions a certain percentage of their peak hourly electricity demand—that is, the highest amount of electricity used by customers in a single hour over the course of a year.

What Is the BIG WIRES Act?

In September 2023, Senator John Hickenlooper (D-CO) and Representative Scott Peters (D-CA) reintroduced the Building Integrated Grids with Inter-Regional Energy Supply Act, or the BIG WIRES Act, in both houses of Congress. As with an earlier version of the bill, announced in May, the legislation authorizes and directs the Federal Energy Regulatory Commission (FERC) to establish minimum requirements for interregional electricity transfer capabilities within the continental United States.

Stronger transmission linkages could not be more timely for the electricity sector, which is facing mounting pressure from new challenges and opportunities:

- Decarbonization targets set by governments and private firms

- The growing deployment of renewable electricity resources,[5] which are variable in both time and space

- Extreme weather events[6] that can disable power across wide geographic areas

- Unprecedented rise in demand as consumers electrify energy services, such as heat and transportation

- A focus on ensuring that the deployment of new infrastructure does not repeat the past mistakes of disproportionately impacting marginalized communities

Last year, Congress called for the North American Electric Reliability Corporation (NERC) to conduct an Interregional Transfer Capability Study (ITCS)[7] in the Fiscal Responsibility Act of 2023.[8] The ITCS “will analyze the amount of power that can be moved or transferred reliably from one area to another area of the interconnected transmission systems” and recommend where further additions would realize the most benefits. Yet these far-ranging and comprehensive recommendations are not due to be filed with FERC until December 2, 2024. With the BIG WIRES Act, Congress can push for stronger action sooner.

The Act Signals Its Ambition with a Simple Rule

The BIG WIRES Act sets out an ambitious timeline for connecting the country. FERC must determine the minimum transfer requirements within 18 months of the bill’s passage. Regions would then have two years to jointly submit a plan for building the infrastructure that would satisfy those minimum transfer requirements, and update those plans every five years. More critically, these joint filings would have to incorporate a deadline for the construction of new transmission lines by the end of 2035, including which entity or entities would build the facilities and how costs would be allocated on an interregional basis. The BIG WIRES Act process addresses several of the issues bedeviling today’s transmission planning processes: the lack of a “venue” for regions to engage in planning, uncertainty on how costs would be allocated, and designating who builds the infrastructure.

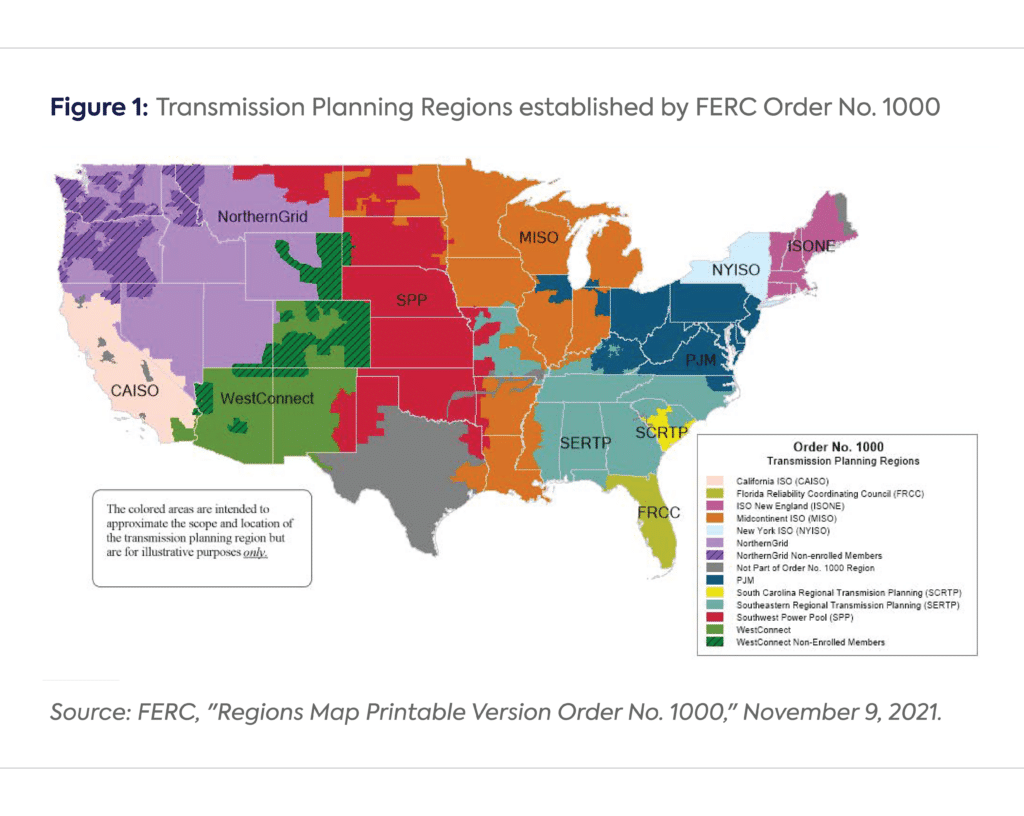

Complicating long-distance transmission is the fact that the electricity grid in the United States is actually a mosaic of regional grids.[9] Some of these regional grids are jointly planned and operated by regional transmission organizations (RTOs) or independent system operators (ISOs), but most US transmission runs on weaker ties. The BIG WIRES Act directs FERC to divide the country into “Regional Planning Areas” and indirectly suggests[10]that the borders of these areas follow those outlined in FERC Order No. 1000 (Figure 1).[11]

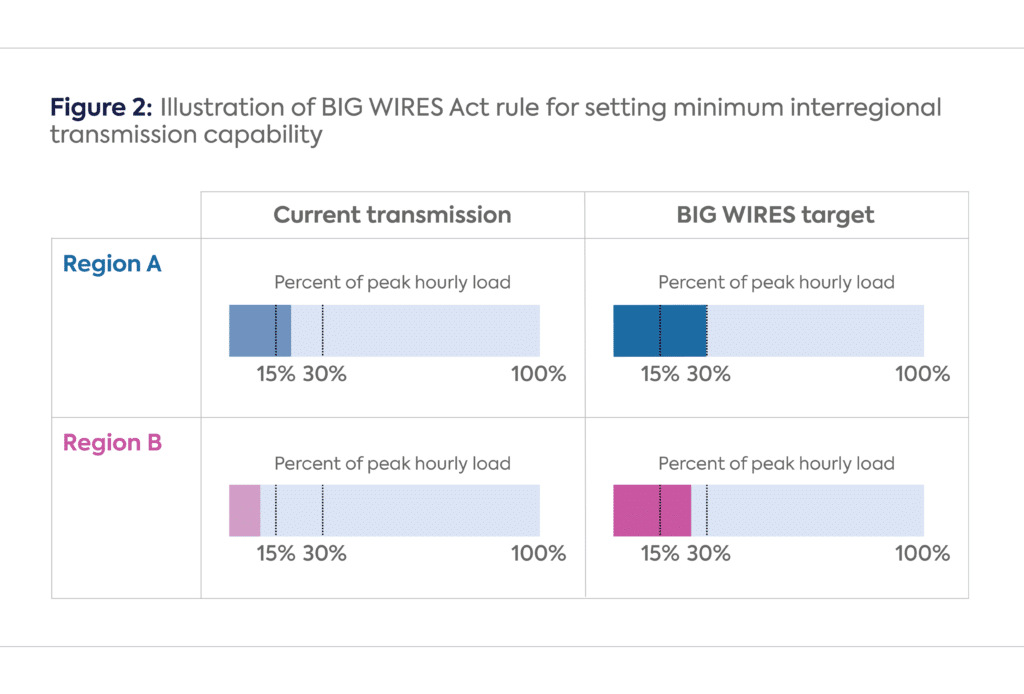

The BIG WIRES Act sets out a simple rule for establishing minimum capability requirements. First, FERC must determine the peak hourly load within each region based on data collected by the Energy Information Administration (EIA) over the previous five years. Second, FERC can determine the maximum existing transfer capability required for each region by looking at EIA data on hourly interregional transmission of electricity over that same period. Third, once these two quantities are known for each region, FERC would require the region’s utilities to meet the smaller of the following two options as the minimum requirement:

30% of peak load OR Peak transmission + 15% of peak load

In the illustration below (Figure 2), Region A and Region B have the capability of transmitting 20% and 10%, respectively, of their peak hourly load. Under the BIG WIRES Act, FERC would set Region A’s minimum requirement at 30% (an additional 10%) and Region B’s at 25% of its peak hourly load (an additional 15%). Region A, which already has sufficient interregional transmission capability, would face a smaller proportional burden for building out additional infrastructure than Region B. FERC would also be empowered to exceed the minimum transfer capability if it finds that there are “net benefits” associated with transfer capability that exceeds the minimum amount.[12]

Estimating the Required Infrastructure Build-Out

The targets set by the BIG WIRES Act sound impressive, but the real question is what they mean in terms of new steel in the ground and wires in the air. To quantify how much additional transmission capability would be required and where, we ran the following analysis based on the bill’s language.

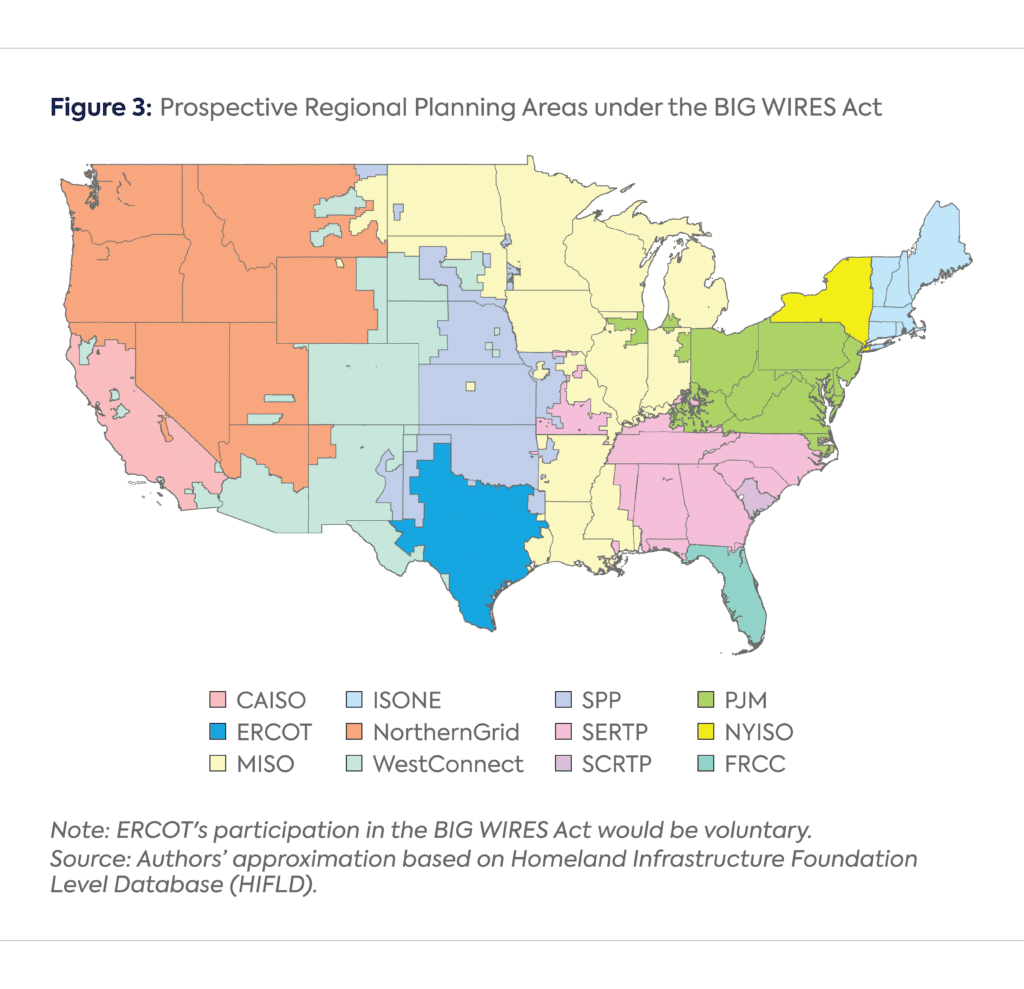

First, we aggregated the balancing authorities[13]—the smaller grids within the continental United States that report generation, demand, and transmission data to the EIA—into Regional Planning Areas that align as closely as possible to the FERC Order 1000 regions. The BIG WIRES Act allows the Electric Reliability Council of Texas (ERCOT) to voluntarily opt into the minimum transfer requirements and includes a jurisdictional savings clause (§3(e)(2)); we created a separate regional planning area for ERCOT to provide as complete an analysis as possible. This aggregation resulted in 12 regions (Figure 3).[14]

Second, we aggregated data from EIA Form 930[15] on balancing authorities to the regional planning areas shown above. These data detail electricity loads and transmission (both exports and imports) at the hourly level. We use the five years of the most recent data (2019–2023) as per the terms of the act.[16]

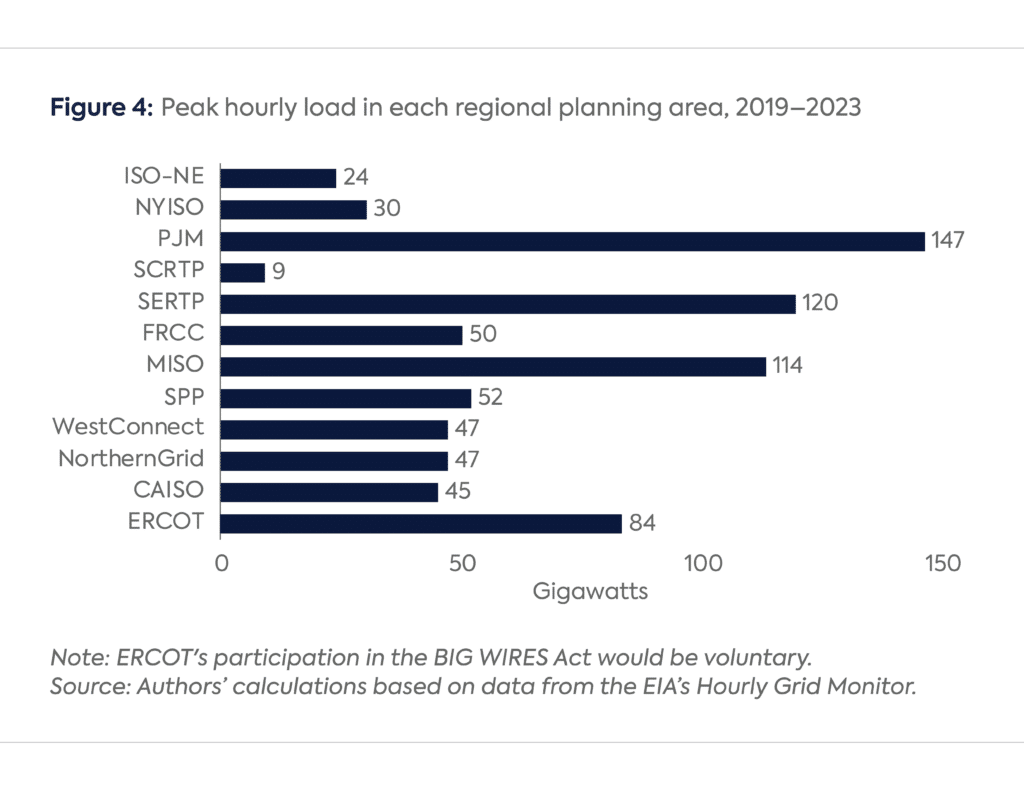

When it comes to peak hourly load (Figure 4), the Mid-Atlantic Region grid operator PJM Interconnection (PJM) leads the country by far, with 147 gigawatts (GW), followed by the Southeastern Regional Transmission Planning region (SERTP) with 120 GW, the Mid-Continent System Operator (MISO) with 114 GW, and ERCOT with 84 GW.

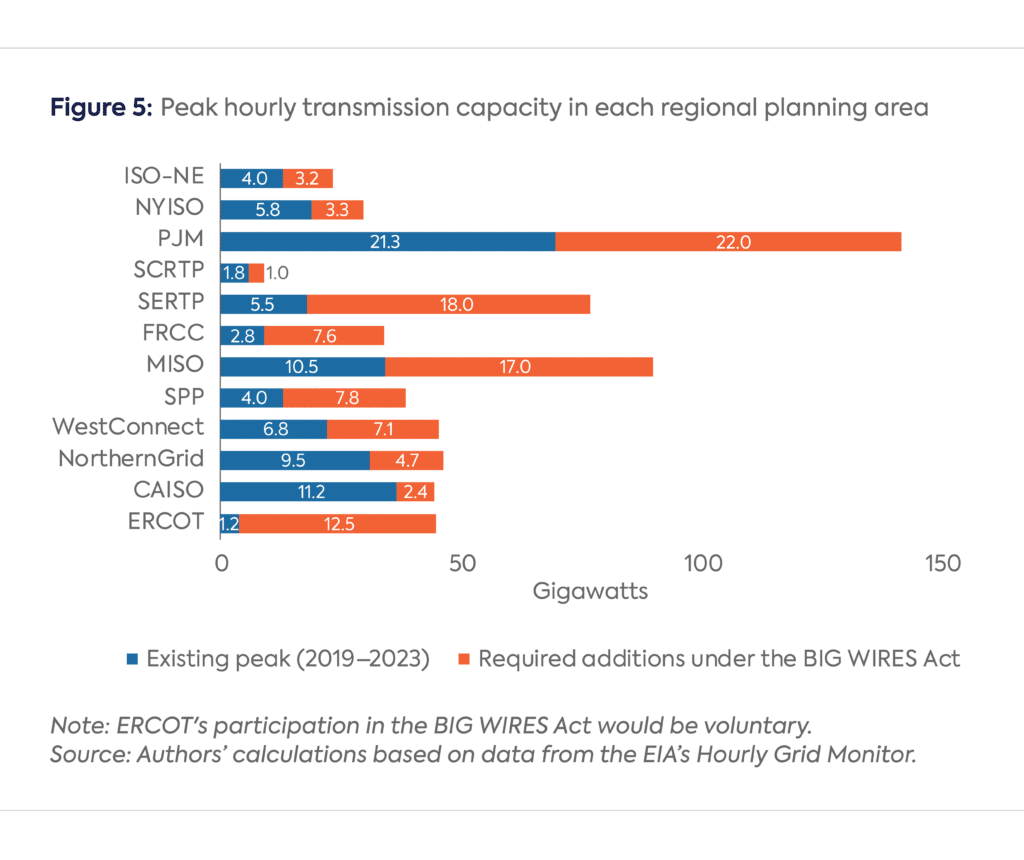

Third, we applied the BIG WIRES Act’s rule for determining the required minimum transmission capability for each region: either 30% of the peak hourly load or the existing peak transmission plus 15% of the peak hourly load, whichever is smaller. The three largest regions under FERC’s jurisdiction—PJM, SERTP, and MISO—would require the most new transmission capability (Figure 5). ERCOT is currently capable of transmitting only 1.4%, or 1.2 GW out of a peak hourly load of 84 GW, and would have to join with the other regions if it elects to opt in.[17] The California Independent System Operator (CAISO), with 11.2 GW of current transmission capability, or 25% of its peak hourly load, would require only 2.4 GW of new transmission to meet its potential obligations.

America Needs a Much Bigger Grid

If the BIG WIRES Act meets its targets, transmission capability in the continental United States will more than double, growing from 84.4 GW to 191 GW in less than a decade.[18] While these numbers are large, they are not outside the bounds of what others have found.[19] Our estimate of the growth in transmission capability required by the BIG WIRES Act, if enacted this year, would require an expansion rate of 7.7% per year—more than thrice the historic rate observed between 1978 and 2020 by Princeton University’s Zero Lab. Moreover, the interregional focus of the BIG WIRES Act deviates from the recent focus on smaller, more local transmission projects. Instead, it requires transmission expansion at the vulnerable “seams” between the US regional grids, with the potential to reduce costs and substantially improve system reliability.[20] If passed, the BIG WIRES Act could set in motion an expansion in transmission capability unprecedented in speed and scope, a crucial factor for a more integrated, cleaner, and cost-effective national grid. Further work will allow us to quantify the optimal size of transmission ties between regions and determine the potential cost savings to customers.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] Building Integrated Grids With Inter-Regional Energy Supply Act, H.R. 5551, 118th Cong. (2023). https://www.congress.gov/bill/118th-congress/house-bill/5551/text.

[2] Lawrence Livermore National Laboratory, “Estimated U.S. Energy Consumption in 2022,” 2023, https://flowcharts.llnl.gov/sites/flowcharts/files/2023-10/US%20Energy%202022.png.

[3] US Department of Energy, National Transmission Needs Study, October 30, 2023, https://www.energy.gov/gdo/national-transmission-needs-study.

[4] US Department of Energy, Grid Deployment Office, Guidance on Implementing Section 216(a) of the Federal Power Act to Designate National Interest Electric Transmission Corridors, p. 26, December 19, 2023.

[5] Brad Plumer, “U.S. Solar Goal Stalled by Wait On Creaky Grid,” New York Times, February 23, 2023, https://www.nytimes.com/2023/02/23/climate/renewable-energy-us-electrical-grid.html.

[6] Michael Goggin, Transmission Makes the Power System Resilient to Extreme Weather (Washington, DC: Grid Strategies LLC, July 2021), https://cleanenergygrid.org/portfolio/transmission-makes-the-power-system-resilient-to-extreme-weather/.

[7] North American Electric Reliability Corporation, “Interregional Transfer Capability Study (ITCS),” https://www.nerc.com/pa/RAPA/Pages/ITCS.aspx.

[8] SeeSection 322 of the Fiscal Responsibility Act, https://www.congress.gov/118/plaws/publ5/PLAW-118publ5.pdf.

[9] Nadja Popovich and Brad Plumer, “Why the U.S. Electric Grid Isn’t Ready for the Energy Transition,” New York Times, June 12, 2023, https://www.nytimes.com/interactive/2023/06/12/climate/us-electric-grid-energy-transition.html.

[10] See definition of “interregional transmission planning region” under §3(a) of the BIG WIRES Act.

[11] FERC, “Regions Map Printable Version Order No. 1000,” November 9, 2021, https://www.ferc.gov/media/regions-map-printable-version-order-no-1000.

[12] While the statute does not explicitly lay out the criteria for determining “net benefits,” presumably FERC would require regions to calculate the benefits of increased transfer capability—including production cost savings, reliability benefits, resource adequacy savings and similar factors—and then compare those benefits against the costs of further transmission expansion. These calculations are outside the scope of our current analysis, and our estimates represent a plausible minimum amount of required transfer capability under the BIG WIRES Act.

[13] US Department of Energy, Office of Cybersecurity, Energy Security, and Emergency Response, How it Works: The Role of a Balancing Authority, 2022, https://www.energy.gov/sites/default/files/2023-08/Balancing%20Authority%20Backgrounder_2022-Formatted_041723_508.pdf.

[14] Boundaries of balancing authorities came from the Homeland Infrastructure Foundation Level Database (HIFLD), December 2022, https://hifld-geoplatform.opendata.arcgis.com/datasets/geoplatform::control-areas/about.

[15] US Energy Information Administration, “Hourly Electric Grid Monitor,” https://www.eia.gov/electricity/gridmonitor/about.

[16] The act allows FERC to inspect and revise these data for errors, including explicitly using the 99.9th-percentile of the values to exclude outliers, and we did so here.

[17] The abnormally low number for ERCOT stems from ERCOT’s historical isolation from the national electric grid to maintain independent from FERC’s regulatory authority.

[18] Our inclusion of ERCOT in this analysis results in 12.5 GW of additional required capability, or about 12% of the total 106.6 GW of additional required capability. Even without ERCOT, the BIG WIRES Act would result in substantial grid expansion.

[19] The DOE’s National Transmission Needs Study, which considers several scenarios of how the electricity system could develop over the same time period, finds that high growth in clean energy could necessitate a doubling or even quintupling of interregional transfer capacity. Princeton University’s Zero Lab estimated that fulfilling the emissions reduction potential of the Inflation Reduction Act would require expanding the grid by an average of ~2.3% per year.

[20] Transmission seams are “the interface between two wholesale electricity control areas, systems, and markets” and can “prevent the economic transfer of capacity and energy between neighboring wholesale electricity markets or between control areas.” Rishi Garg, Electric Transmission Seams: A Primer Whitepaper, National Regulatory Research Institute (2015).

More on Energy Explained Energy Explained

How DOE’s Announcement on Data Centers Could Impact the Grid

The US Secretary of Energy Chris Wright has directed the Federal Energy Regulatory Commission to make a rule that would help rapidly move electricity onto the US grid in large amounts.

Q&A: How the US Is Using Equity Stakes to Support Domestic Critical Minerals Development

The Trump administration is increasingly using equity investments as a tool of industrial policy to support domestic critical minerals supply chains.

Six Key Issues That Defined Climate Week 2025

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

The Social Cost of Carbon Is Gone — and That May Be Good News for Future US Climate Policy

President Trump has ended the federal government’s use of the "social cost of carbon" (SCC), an official estimate of the harms caused by carbon dioxide emissions.

Relevant

Publications

The Role of PHEVs in Transport Electrification

As the US and Europe navigate a difficult and uneven shift toward full battery electric vehicles (BEVs), the US and EU auto markets are under heavy pressure.

Climate Ambition and Electricity Affordability: Lessons from Connecticut

The Potential Contribution of Enhanced Geothermal Systems to Future Power Supply: Roundtable Summary