Experts: What do Trump’s tariffs mean for global climate action?

The Trump administration has imposed tariffs on all imports from China, Mexico and Canada, as well as on steel, aluminium and cars from around the world

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

As of last month, 61 countries have published a national hydrogen strategy.[i] Continuing from the authors’ previous blog on what these strategies tell us about hydrogen trade, this blog is a comparative analysis of the various production pathways each nation is considering. It utilizes CGEP’s National Hydrogen Strategies and Roadmap Tracker, which gathers official documents published by governments.

Knowing what energy sources countries plan to use for hydrogen production is useful because it shows that production pathways envisaged are more varied than just electrolysis and steam-methane reforming with carbon capture, utilization, and storage (CCUS).

Dogmatic Versus “All-of-the-Above” Approaches

Each country’s specific conditions—geographical location, quality and quantity of natural resources, and current energy market—affect their hydrogen strategy. All strategies aim to develop renewable hydrogen, in line with studies showing that two-thirds of planned hydrogen production capacity by 2030 could come from renewable sources.[ii] But only 13 countries plan to rely solely on wind and solar, including potential exporters such as Chile, Oman, and South Africa as well as a few European countries. Meanwhile, a handful of countries—Brazil, Canada, Colombia, Indonesia, and the United States—have a more technology-neutral approach and plan to take advantage of the wealth and variety of their resources with six to seven options (see Table 1). Other strategies include between three and five options, such as other renewable sources, nuclear, by-product, natural, and low-carbon hydrogen.

Renewable Hydrogen

Every single national strategy mentions at least one form of renewable energy to produce electrolytic hydrogen. Wind and solar are the most widely mentioned—in 55 national strategies out of 61—with 42 countries using both sources, seven using only wind, and six only solar. Six countries refer to “renewable electricity” without more details, while Germany mentions renewable energy sources on top of offshore wind.

Meanwhile, hydro-electricity appears in 21 strategies, allowing for a more continuous use of electrolyzers. This includes Brazil and Canada, which already have around 60% of hydro in their electricity mix, as well as most Latin American countries, which also boast significant hydro potential. Norway and Romania are the only European countries that refer to hydro. Other countries planning to use hydro include Kazakhstan, Kenya, and Russia. Finally, using geothermal energy to power electrolyzers is envisaged by Colombia, Costa Rica, Ecuador, Indonesia, Kenya, and New Zealand.

Many countries planning to produce hydrogen using electrolysis are anticipating the impact on water resources.[iii] Water used for electrolysis should be deionized water. If produced from freshwater, this may result in a conflict between hydrogen production or other uses, such as agricultural or municipal. Countries experiencing water stress are often located in Africa, but Ecuador and Portugal are also paying attention to this. These countries often aim to use seawater desalination to supply the water, which may also solve the problem of water availability for the population. Morocco and Portugal believe that additional investment for desalination is insignificant compared to the total capital required for the hydrogen ecosystem. Portugal is also considering the use of water from wastewater treatment plants.

Low-Carbon Hydrogen

Despite some countries’ strong preference for renewable hydrogen, low-carbon hydrogen based on fossil fuels is actually mentioned by around half of the strategies. Most plan to use steam-methane reforming with CCUS; however, countries such as Austria, Canada, the Czech Republic, Germany, Mauritania, and Turkey also mention pyrolysis,[iv] albeit with some caveats regarding the technology readiness. Gas producers—Australia, Canada, Indonesia, Kazakhstan, Malaysia, Norway, Russia, and the UAE—have significant gas resources and carbon storage potential, and plan to continue using their gas resources in a hydrogen economy. However, low-carbon hydrogen is also mentioned in some EU countries’ plans, including Belgium, the Czech Republic, Hungary, the Netherlands, and Poland. Germany mentions its production in a limited way, while the UK confirms its interest. In plans, producers often argue that these could be a suitable short-term source to quick-start the market, mainly because of their lower costs—compared to current renewable hydrogen costs—and the ability to produce at scale and in sufficient quantities. While EU countries agree on low-carbon hydrogen’s potential to quick-start the market in their strategies, they often insist on its transitional aspect.

A handful of countries such as Australia, Colombia, Poland, and Russia are also exploring the possibility of coal gasification due to their existing coal reserves and production. However, none of the four largest coal producers—China, India, Indonesia, and the US—is considering coal-derived hydrogen.

Other Sources of Hydrogen

Of the 17 countries considering nuclear, almost all have operating nuclear power plants, except for Indonesia and Poland. Only a few are European, notably France, which has been a long proponent of this production method. Meanwhile, five countries also recognize by-product hydrogen (China, Canada, Finland, India, and South Korea) and three are investigating natural hydrogen (Brazil, France, and Morocco).

Although bio-hydrogen[v] is not getting as much media coverage as electrolytic hydrogen based on wind and solar, various biomass-based technologies (including gasification, pyrolysis, or biomethane reforming) are mentioned by 21 countries, while another two (Germany and the UAE) mention it as a limited source. India’s plan mentions that biomass has the potential to achieve scale and low costs while delivering a continuous hydrogen output.

Ambitions in Projected Hydrogen Production and Electrolyzer Capacity

All but 12 of the 61 countries include production targets for hydrogen quantity or electrolyzer capacity in their plans (see Table 2). Meanwhile, 44 countries indicate a 2030 target, highlighting the preference to give medium-term visibility to the industry. In contrast, there are fewer 2040 and 2050 targets (23 and 24, respectively). The highest 2030 production targets are found in the US and India, up to 10 million tons (Mt) each, while the US plans to be one of the largest producers by 2050 (50 Mt). Announced electrolyzer capacity targets amount to around 125 gigawatts (GW) by 2030; this number reaches almost 225 GW if one translates the renewable hydrogen production targets into electrolyzer capacity.[vi] Meanwhile, announced hydrogen production would reach around 41 Mt by 2030.

One can question the realism of these forecasts. Electrolyzer installed capacity was 1.1 GW as of October 2023.[vii] Electrolyzer manufacturing capacity was 32 GW in 2023, and expected to reach 50 GW in 2024 and 75 GW in 2025, which could support the expansion.[viii] But progress in terms of projects reaching final investment decision (FID) has been slow: only 7% of the 45 Mt of planned renewable and low-carbon hydrogen projects reported by the Hydrogen Council had taken FID as of October 2023.[ix] BNEF’s most recent analysis also pointed to these shortcomings, forecasting that supply would reach only 16.4 Mt by 2030.[x]

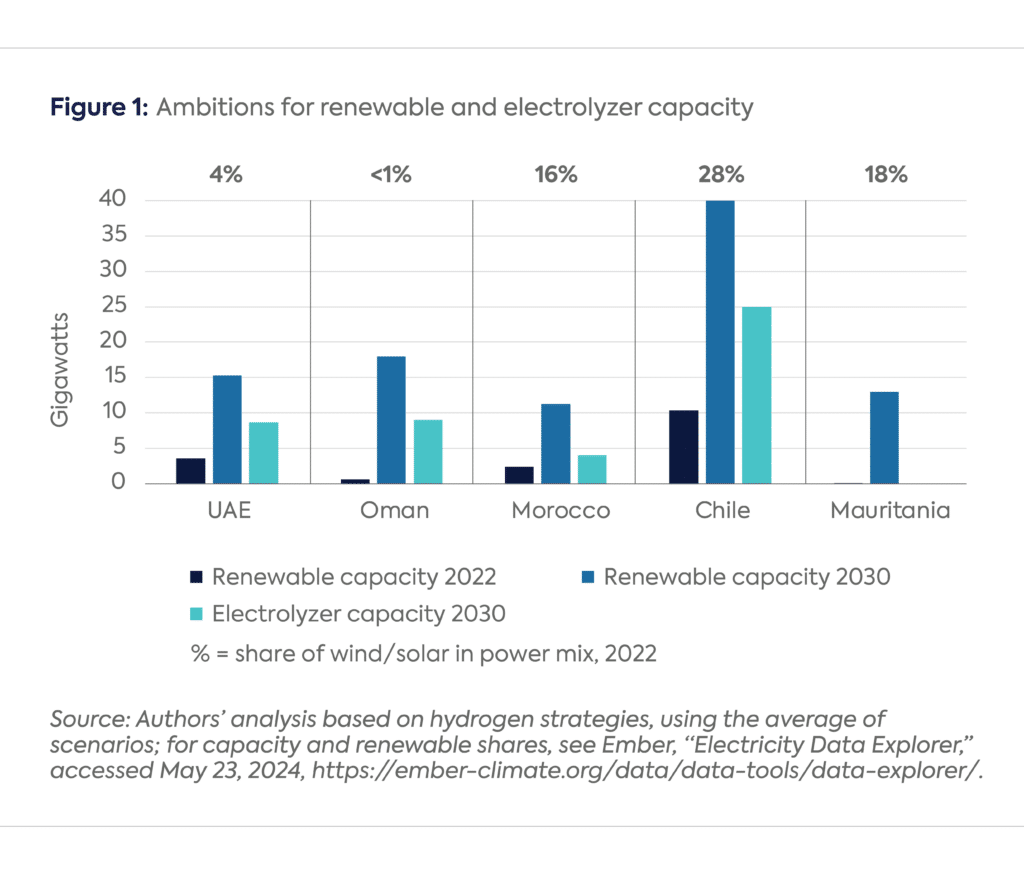

Additionally, it is uncertain whether sufficient renewable capacity could be developed in time without cannibalizing resources for the power sector. Countries have very different starting points when it comes to material renewable sources of electricity: only a handful of countries with hydrogen plans have renewable shares above 90%—Costa Rica, Norway, Paraguay, and Uruguay[xi]—with countries such as Brazil and New Zealand having shares above 80%. While many countries are counting on their significant renewable energy potential, it is often not yet tapped. And, as noted, their objectives will also have to take into account developing renewables to decarbonize their power mix. Figure 1 shows the ambitions of selected countries for 2030, highlighting the gap between existing and planned renewable capacity dedicated to hydrogen production. Similarly, low-carbon hydrogen relies on sufficient carbon capture and storage capacity to be developed in a timely manner.

[i] Anne-Sophie Corbeau and Rio Pramudita Kaswiyanto, “National Hydrogen Strategies and Roadmap Tracker,” Center on Global Energy Policy, Columbia University, May 2024, https://www.energypolicy.columbia.edu/publications/national-hydrogen-strategies-and-roadmap-tracker/. Three countries (Estonia, Kazakhstan, and Uzbekistan) have been added since the last edition of the tracker was published in May, and were not included in the previous blog.

[ii] Hydrogen Council, Hydrogen Insights 2023, December 2023, https://hydrogencouncil.com/wp-content/uploads/2023/12/Hydrogen-Insights-Dec-2023-Update.pdf.

[iii] Water is also needed for steam-methane reforming.

[iv] Pyrolysis enables the splitting of methane into hydrogen and solid carbon.

[v] Yushan Lou et al., “The Potential Role of Biohydrogen in Creating a Net-Zero World,” Center on Global Energy Policy, Columbia University, January 9, 2023, https://www.energypolicy.columbia.edu/publications/the-potential-role-of-biohydrogen-in-creating-a-net-zero-world/.

[vi] In cases of a range of forecasts, the average was used.

[vii] Hydrogen Council, Hydrogen Insights 2023.

[viii] Martin Polly, “’Severe overcapacity’ | The Global Supply of Electrolysers far Outstrips Demand from Green Hydrogen Projects: BNEF,” Hydrogen Insights, March 28, 2024, https://www.hydrogeninsight.com/electrolysers/severe-overcapacity-the-global-supply-of-electrolysers-far-outstrips-demand-from-green-hydrogen-projects-bnef/2-1-1618327.

[ix] Hydrogen Council, Hydrogen Insights 2023.

[x] BNEF, “Hydrogen Supply Outlook: A Reality Check,” May 2024, https://about.bnef.com/blog/hydrogen-supply-outlook-2024-a-reality-check/.

[xi] Including thermal biomass.

As Indian Prime Minister Narendra Modi makes his first visit to Washington in the second Trump administration, energy will likely take a front seat in United States-India relations. Due to...

During a speech at the World Economic Forum in Davos last month, President Donald Trump urged Saudi Arabia and OPEC to increase oil production to lower prices and exert...

When the Inflation Reduction Act (IRA) was passed in August 2022, it triggered unprecedented enthusiasm among potential hydrogen suppliers.[1] More than two years later, progress on final investment...

Saudi Arabia is experiencing a significant economic transformation under its Vision 2030 plan to reduce the country’s dependence on oil revenues by diversifying its economy. The Saudi government’s...