China moves to supercharge green hydrogen as US pulls back

The country's new policy is likely to boost the production of green hydrogen, which the country aims to use to decarbonize airplanes, ships, and heavy…

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Amid plans to nearly double its steel production capacity by 2030 to serve its growing infrastructure needs, the world’s No. 2 steel producer India[1] has released plans to reduce greenhouse gases from the sector,[2] which account for about 10 percent of the nation’s total emissions.[3] This piece explores India’s steel sector and the challenges it may face to reduce emissions on par with other producing nations. These include India’s steel production’s heavy reliance on coal, the structure of its market, and the market’s technology mix. The piece also discusses India’s green steel plans within an international context where steel is the latest area of climate and trade competition between countries. India’s definitions of “green” or lower emissions steel may suit domestic needs. While carbon tariffs disproportionately increase costs for Indian steel exports, these exports are a fraction of total production. Likewise, India’s planned carbon emissions trading scheme may make a dent in steel emissions if designed stringently. Lastly, India’s green steel plans will leverage international partnerships.

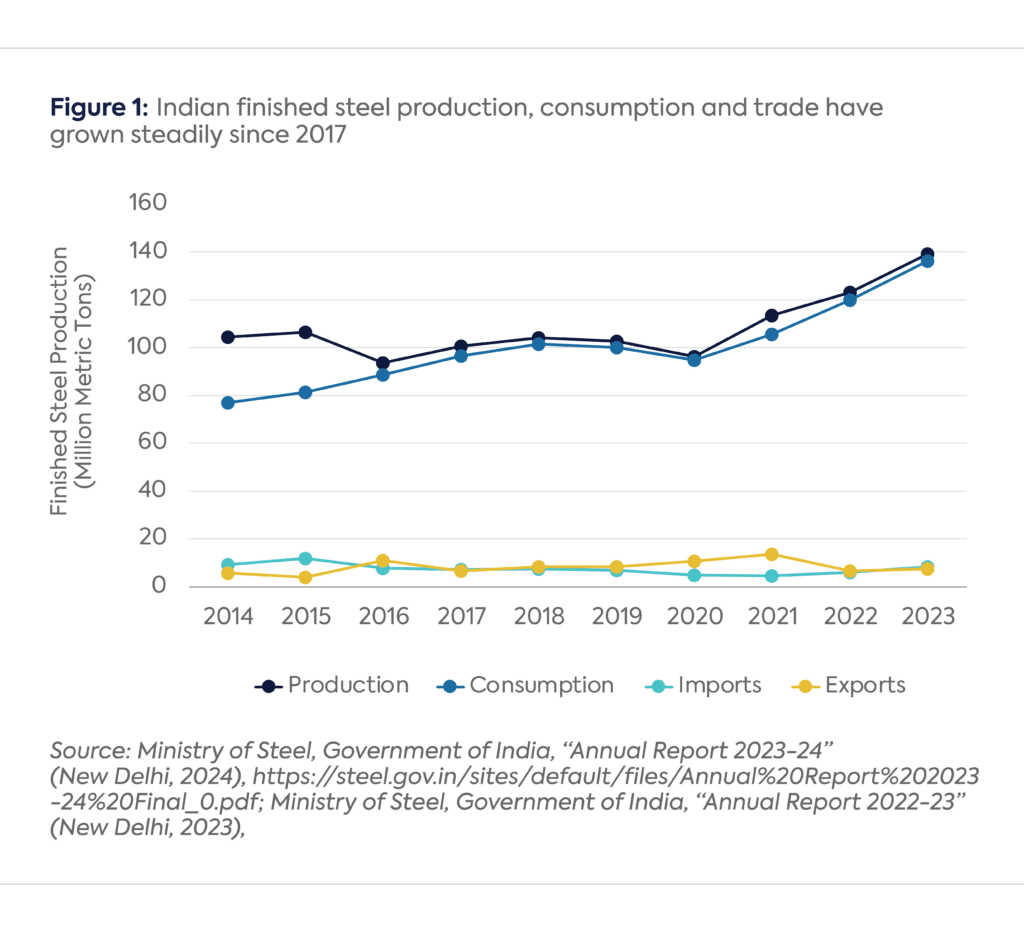

India’s steel production has grown since 2017, rising on average 6% per year, faster than global steel production and consumption.[4] The country consumes most of its own steel production (Figure 1).

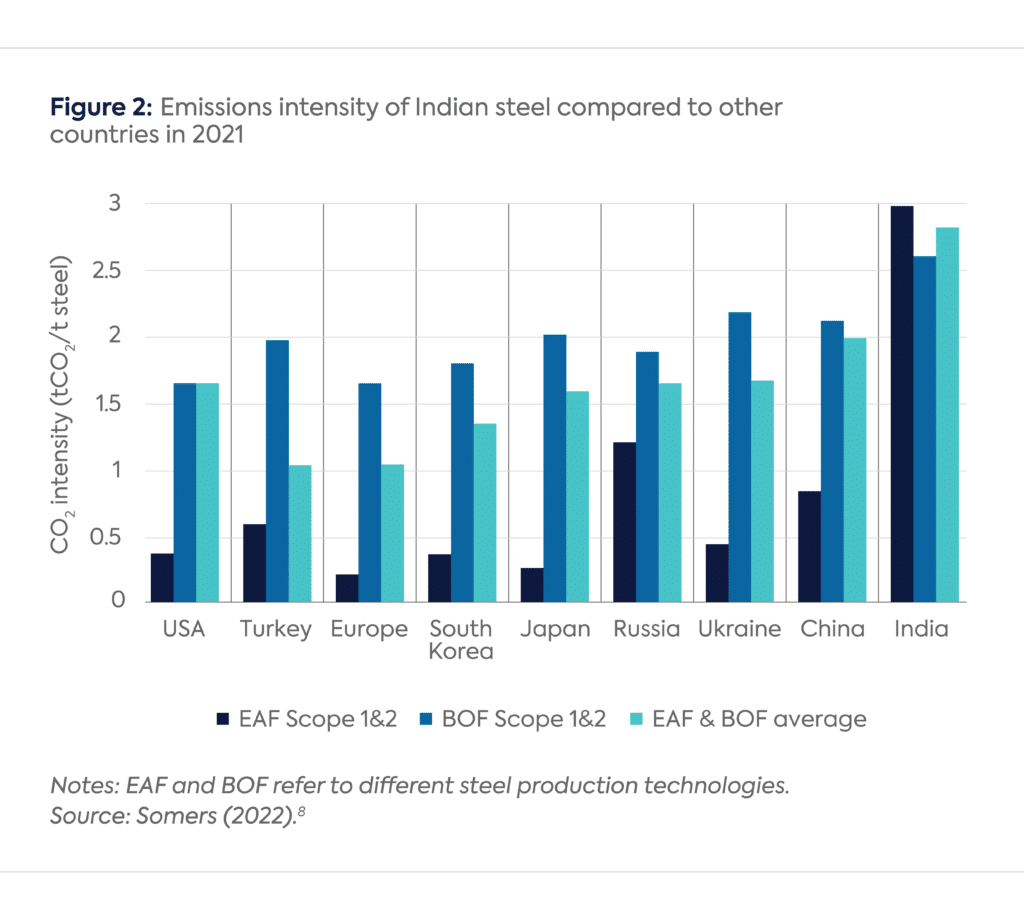

India is less efficient among major steel producing nations. Every ton of Indian steel uses more energy and emits more greenhouse gas emissions than steel produced in other major countries. (Figure 2). India ranks the third most energy intensive, using about a quarter more energy per ton produced than the global average.[6] Greenhouse emissions of Indian steel rank highest, about 30% more intensive than global averages.[7]

The energy and emissions of Indian steel are due to three factors: coal-dependence, market structure, and technology mix.[9]

While coal is a major input to make steel worldwide, India’s dependence on coal is especially large. Less than 10 percent of natural gas is used in steel processing, and a large share of the electricity used comes from coal.[10] This coupled with the lack of scrap material to produce recycled steel increases emissions and energy use.[11] In contrast, in the United States, natural gas directly fuels about a third of production or is a significant share of the electricity mix, and most production uses scrap steel.[12]

The Indian steel sector is also split into two producer segments that utilize different technologies for production. The first are a handful of integrated producers who can spend more capital on energy-saving technologies, expensive imported natural gas, or upskilling their workforces. Consequently, they can achieve economies of scale and produce larger amounts of steel from raw materials. These producers are mostly private companies with sizable international presences outside India (e.g. Tata Steel and JSW Steel), although a minority are state-owned enterprises.[13] The second are hundreds of medium and small enterprises who each have smaller production capacities. They vary in economic formality (i.e. registered and subject to government regulation), have less trained workers, and cater to regional steel demand. These producers depend on cheaper, inefficient technologies and domestic coal, increasing their emissions and energy use.[14]

The Ministry of Steel’s strategy to decarbonize Indian steel is ambitious and multipronged, the culmination of an 18-month process with stakeholders. In the short term, India will increase energy efficiency technologies, renewable energy, and steel recycling to reduce emissions from coal-based steel production. In the medium term, the strategy envisions increased hydrogen and carbon capture technologies. It also addresses bottlenecks such as defining “green steel,” adopting financing mechanisms for decarbonization, and workforce development.

The plan provides a policy signal and a strong evidence base to decarbonize Indian steel. However, actual budgetary allocations in the next Indian federal budget (out in February 2025) and government regulations will determine how effective the plan is. In addition, the list of proposed actions by the government are subject to political, economic, and bureaucratic constraints in the coming years.[15]

The author thanks Dr. Gautam Jain for his comments on an earlier draft of this piece.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] World Steel Association, “2024 World Steel in Figures” (Brussels: World Steel Association, 2024), https://worldsteel.org/wp-content/uploads/World-Steel-in-Figures-2024.pdf; International Energy Agency, “India Energy Outlook 2021,” World Energy Outlook Special Report (Paris, 2021), https://www.iea.org/reports/india-energy-outlook-2021.

[2] Neha Verma et al., “Greening the Steel Sector in India: Roadmap and Action Plan” (New Delhi: Ministry of Steel, Government of India, September 2024), https://steel.gov.in/sites/default/files/GSI%20Report.pdf.

[3] Johannes Friedrich et al., “This Interactive Chart Shows Changes in the World’s Top 10 Emitters,” World Resources Institute (blog), March 2, 2023, https://www.wri.org/insights/interactive-chart-shows-changes-worlds-top-10-emitters.

[4] World Steel Association, “2024 World Steel in Figures,” 5.

[5] Ministry of Steel, Government of India, “Annual Report 2023-24” (New Delhi, 2024), https://steel.gov.in/sites/default/files/Annual%20Report%202023-24%20Final_0.pdf; Ministry of Steel, Government of India, “Annual Report 2022-23” (New Delhi, 2023), https://steel.gov.in/sites/default/files/MoS%20AR%202022-23.pdf; Ministry of Steel, Government of India, “Annual Report 2021-22” (New Delhi, 2022), https://steel.gov.in/sites/default/files/Download_0.pdf.

[6] Verma et al., “Greening the Steel Sector in India: Roadmap and Action Plan,” 103–5; Ali Hasanbeigi, “An International Benchmarking of Energy and CO2 Intensities” (Florida, United States: Global Efficiency Intelligence, 2022), https://www.globalefficiencyintel.com/steel-climate-impact-international-benchmarking-energy-co2-intensities.

[7] Verma et al., “Greening the Steel Sector in India: Roadmap and Action Plan,” 40; J. Somers, “Technologies to Decarbonise the EU Steel Industry.” (Luxembourg: Publications Office of the European Union, 2022), 18, https://data.europa.eu/doi/10.2760/069150.

[8] Somers, “Technologies to Decarbonise the EU Steel Industry.”

[9] International Energy Agency, “Iron and Steel Technology Roadmap – Towards More Sustainable Steelmaking” (Paris: International Energy Agency, 2020), https://www.iea.org/reports/iron-and-steel-technology-roadmap.

[10] Alexandra Mallett and Prosanto Pal, “Green Transformation in the Iron and Steel Industry in India: Rethinking Patterns of Innovation,” Energy Strategy Reviews 44 (November 2022): 100968, https://doi.org/10.1016/j.esr.2022.100968.

[11] Verma et al., “Greening the Steel Sector in India: Roadmap and Action Plan,” 30; Will Hall et al., “Achieving Green Steel: Roadmap to a Net Zero Steel Sector in India” (New Delhi: The Energy and Resources Institute, 2022), https://www.teriin.org/sites/default/files/2022-07/Achieving%20Green%20Steel%20Roadmap%20to%20a%20Net%20Zero%20Steel%20Sector%20in%20India%20updated.pdf.

[12] Ali Hasanbeigi and Cecilia Springer, “How Clean Is the U.S. Steel Industry?” (San Francisco: Global Efficiency Intelligence, 2019), https://www.belfercenter.org/sites/default/files/pantheon_files/files/publication/how-clean-is-the-us-steel-industry-nv.pdf.

[13] Mallett and Pal, “Green Transformation in the Iron and Steel Industry in India.”

[14] Verma et al., “Greening the Steel Sector in India: Roadmap and Action Plan,” 32–35.

[15] Verma et al., 373–79.

[16] Verma et al., 63.

[17] Press Trust of India, “Goyal Suggests Talks on Carbon Tax Issue with Top Steel Industry Leaders,” Business Standard, September 5, 2024, https://www.business-standard.com/industry/news/goyal-suggests-talks-on-carbon-tax-issue-with-top-steel-industry-leaders-124090500446_1.html; Manoj Kumar and Ohri Nikunj, “India Sees EU Carbon Tax Proposal as Unfair and Not Acceptable, Official Says,” Reuters, July 29, 2024, https://www.reuters.com/world/india/india-sees-eu-carbon-tax-proposal-unfair-not-acceptable-official-says-2024-07-29/.

[18] Maryla Maliszewska et al., “How Developing Countries Can Measure Exposure to the EU’s Carbon Border Adjustment Mechanism,” World Bank Blogs (blog), June 13, 2023, https://blogs.worldbank.org/en/trade/how-developing-countries-can-measure-exposure-eus-carbon-border-adjustment-mechanism.

[19] International Trade Administration, “India Steel Exports Report” (Washington, D.C.: U.S. Department of Commerce), accessed September 20, 2024, https://www.trade.gov/data-visualization/india-steel-exports-report.

[20] Benjamin Parkin, “EU’s Carbon Border Tax Plans Trigger Alarm in India,” Financial Times, June 21, 2024, sec. Indian business & finance, https://www.ft.com/content/6f324116-2707-440d-8808-c98749f8bc87.

[21] Verma et al., “Greening the Steel Sector in India: Roadmap and Action Plan,” 373.

The Trump administration is increasingly using equity investments as a tool of industrial policy to support domestic critical minerals supply chains.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

President Trump has ended the federal government’s use of the "social cost of carbon" (SCC), an official estimate of the harms caused by carbon dioxide emissions.

In July, Republicans in Congress passed their signature domestic policy package, the One Big Beautiful Bill Act (or, H.R. 1).

H2 projects will have to compete for a shrinking pipeline of zero-carbon electricity with energy-intensive data centres.

A nuclear energy resurgence is vital to meet rising electricity demand.