Could a strategic lithium reserve kickstart US supply chain development?

NEW YORK -- A strategic lithium reserve is being mooted as a solution to stabilize volatile prices that have hindered American mining projects, allowi

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Regions planning massive hydrogen investments receive a lot of attention, but very little is given to hydrogen’s current state and potential in Southeast Asia. The region consists of 11 countries, is home to more than 680 million inhabitants,[1] has a combined GDP of around $4 trillion,[2] and accounts for about 5 percent of global primary energy demand.[3] The lack of attention on its hydrogen initiatives is not for lack of activity. A review of investment plans in hydrogen and its derivatives reveals that one country is particularly active in this region—Japan.

This article analyses Japan’s investments in the region and discusses how Japanese companies are not only investigating potential hydrogen imports from Southeast Asia but also exporting their technologies to develop low-carbon hydrogen and ammonia end-use.

Southeast Asia produces around 3 million metric tons of hydrogen, or 3 percent of global hydrogen production. It is mostly based on natural gas, given that the region’s largest hydrogen producers, such as Indonesia and Malaysia, are also major gas producers. In contrast to the many potential low-carbon hydrogen exporters that have published their strategies and publicized their objectives, such as Australia, Oman, Morocco, Namibia, or Chile, only one Southeast Asian country, Singapore, has published its hydrogen strategy.

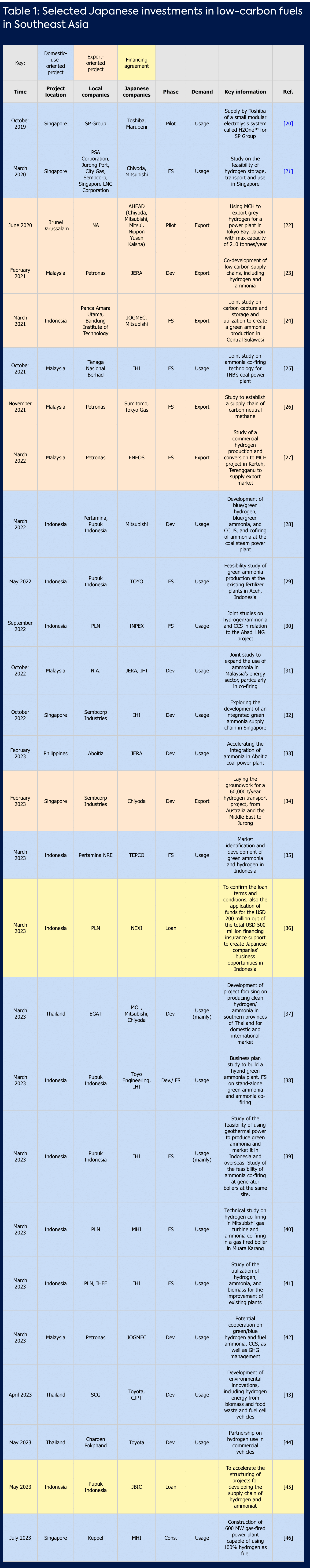

Around half of the region’s projects or agreements announced publicly since 2020 originated from Japan (Table 1). However, most initiatives are still at the stage of memorandums of understanding and feasibility studies. Since the country is planning to import hydrogen, Japanese companies have been looking at various ways to transport hydrogen or its derivatives over long distances, using ammonia, liquid organic hydrogen carriers, liquid hydrogen, or e-methane.

Chiyoda and other Japanese companies have been testing the feasibility of using methylcyclohexane (MCH) as a hydrogen carrier from Brunei to refineries in Japan within the framework of the Advanced Hydrogen Energy Chain Association for Technology Development.[4] Additionally, Japanese petroleum company ENEOS is targeting final investment decision in 2023 on the first commercial-scale renewable hydrogen-to-MCH project in partnership with Malaysia’s Petronas that will supply hydrogen to ENOES’ refineries.[5]

Japanese companies have also signed agreements with Indonesian petrochemical company Panca Amara Utama[6] and with Malaysia’s Petronas to co-develop low-carbon ammonia and hydrogen production plants in Indonesia and Malaysia. These agreements aim at investigating ammonia and hydrogen production feasibility in each country, potentially as a first step in promoting exports to Japan. Meanwhile, Japanese expertise may also be used to transport renewable hydrogen or ammonia to Singapore.[7] Finally, Petronas is doing a feasibility study regarding transporting e-methane produced in Malaysia to Japan.[8]

There is, obviously, a difference between feasibility studies and concrete investments. Southeast Asia offers Japan the advantage of proximity and established relationships—between the region’s LNG champions and Japanese players—with potential to be active in hydrogen and ammonia. It remains to be seen whether hydrogen or its derivatives produced in Southeast Asia can be competitive against those produced elsewhere. According to the International Renewable Energy Agency, the region’s technical potential to produce renewable hydrogen at below $1.5 per kilogram by 2050 amounts to a mere 64 exajoules (EJ)—against 2,715 EJ in sub-Saharan Africa.[9] The region also boasts gas resources, which could be used to produce low-carbon hydrogen, provided that carbon capture and storage is developed as well. Hydrogen currently produced in some of these pilot projects uses unabated natural gas, and hence is not low-carbon hydrogen.

In addition to fulfilling domestic demand, Japanese companies are looking to earn revenues by supplying their technology abroad. Some are investing in hydrogen (or its derivatives) end-use in select Southeast Asian countries, focusing on the sectors in which they are investing in Japan, such as ammonia co-firing for power generation and the use of hydrogen in the power and transport sectors. These companies are also investing in decarbonizing local ammonia production. This is part of the Asia Energy Transition Initiative (AETI), launched in 2021 by the government of Japan,[10] and reinforced by the Green Transformation (GX) Basic Policy unveiled in December 2022. Through the Asia Zero Emissions Community (AZEC), Japan aims to support Asian countries facing similar issues as Japan in achieving carbon neutrality, through technologies such as hydrogen and ammonia, while recognizing their different circumstances.[11]

Companies such as JERA and IHI Corporation are at the frontlines of the development of co-firing ammonia in coal-fired power plants. They are testing a 20 percent co-firing ratio (ammonia replaces 20 percent of coal) at the Hekinan thermal plant, Japan’s largest coal-fired plant.[12] Japanese companies are implementing a similar strategy in some Southeast Asian countries, especially those with a significant—often, recent—coal fleet, some of which was financed by Japan. JERA is investigating the use of ammonia in Aboitiz’s coal-fired plants in the Philippines.[13] JERA Asia Pte. Ltd. and IHI Asia Pacific Pte. Ltd. plan to explore potential use of ammonia in Malaysia’s energy sector.[14] Mitsubishi Heavy Industry and PLN have started to investigate co-firing feasibility with hydrogen and ammonia in Indonesia.[15]

In Singapore, several projects are underway to test 100 percent ammonia direct combustion, hydrogen co-firing, as well as the potential use of ammonia for bunkering. Finally, MOL, Mitsubishi, and Chiyoda are cooperating with Thailand’s EGAT on the production and utilization of clean hydrogen and ammonia and supplying them to domestic and international markets.[16]

Japanese companies would likely prefer to keep coal-fired plants in Japan or Southeast Asia for longer by attempting to decarbonize them, to avoid having stranded assets. To accelerate decarbonization, the following actions may help. First, the hydrogen or ammonia must be certified low carbon. It’s just as important to not incentivize the continuation of coal-fired plants with no co-firing, or even build new ones, in the hope that they will be cleaner later. Additionally, the technical transition to burning 100 percent cleaner fuels—and not just 20 percent—in coal-fired plants should ideally happen in the early 2030s, ahead of the current goal of achieving this in the 2040s.[17] But a massive switch from coal-fired plants to ammonia might then create a problem of availability of this clean fuel, given the slow build-up of projects.[18] Finally, to decarbonize Southeast Asian economies, hydrogen or ammonia will also have to be affordable: according to the International Energy Agency, co-firing at 60 percent with ammonia at $250–$380 per metric ton would multiply the cost of Indonesian electricity three to four times.[19]

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] World Bank, World Bank Open Data, Accessed on July 18,2023, https://data.worldbank.org/indicator/SP.POP.TOTL?locations=ID-MY-SG-TH-PH-TL-BN-VN-MM-KH-LA.

[2] IMF, IMF Real GDP Growth 2023, April 2023, https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/SMQ/SEQ.

[3] Energy Institute, Statistical Review of World Energy, July 2023, https://www.energyinst.org/statistical-review.

[4] Chiyoda, “The World’s First Global Hydrogen Supply Chain Demonstration Project,” July 27, 2017, https://www.chiyodacorp.com/meida/170727_e.pdf; ENEOS, “Commencement of Demonstration for Extraction of Hydrogen from Organic Hydride (MCH) at ENEOS Refineries,” August 10, 2021, https://www.eneos.co.jp/english/newsrelease/2021/pdf/20210810_01.pdf.

[5] Petronas, “PETRONAS Partners ENEOS For First Commercial Scale Hydrogen-To-MCH Project,” March 11, 2022, https://www.petronas.com/media/media-releases/petronas-partners-eneos-first-commercial-scale-hydrogen-mch-project-0. Hydrogen is produced from a hydro-powered electrolyzer facility.

[6] Mitsubishi, “Signing of Memorandum of Understanding regarding CCS Joint Study for Clean Fuel Ammonia Production in Indonesia,” March 19, 2021, https://www.mitsubishicorp.com/jp/en/pr/archive/2021/html/0000046720.html.

[7] Asia Nikkei, “Singapore Hydrogen Strategy Draws Local Energy Firms, Foreign Tech,” February 3, 2023, https://asia.nikkei.com/Business/Energy/Singapore-hydrogen-strategy-draws-local-energy-firms-foreign-tech.

[8] Sumitomo, “Joint Feasibility Study in Malaysia to establish Supply Chain of Carbon Neutral Methane,” November 25, 2021, https://www.sumitomocorp.com/en/jp/news/release/2021/group/15280.

[9] IRENA, “Geopolitics of the Energy Transformation. The Hydrogen Factor,” January 2022, https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen.

[10] METI, “Asia Energy Transition Initiative (AETI),” May 2021, https://www.meti.go.jp/english/press/2021/pdf/20210528001_aetieng.pdf.

[11] METI, “Japan’s Energy Policy Toward Achieving GX,” March 22, 2023, https://www.enecho.meti.go.jp/en/category/special/article/detail_178.html.

[12] JERA, “Signing Ammonia Sales and Purchase Agreement with Mitsui for the Large-Volume Co-firing of Fuel Ammonia in the Demonstration Project at Hekinan Thermal Power Station,” June 16, 2023, https://www.jera.co.jp/en/news/notice/20230616_1503.

[13] FuelCellWorks, “Aboitiz Power and JERA Partner to Investigate Ammonia and Hydrogen Fuel in the Philippines,” February 13, 2023, https://fuelcellsworks.com/news/aboitizpower-and-jera-partner-to-investigate-ammonia-and-hydrogen-fuel-in-the-philippines/.

[14] JERA, “Collaboration with IHI Asia Pacific for the Expansion of Ammonia Usage in Malaysia,” October 26, 2022, https://www.jera.co.jp/en/news/information/20221026_995.

[15] Mitsubishi Heavy Industry, “MHI and PLN Nusantara Power to Jointly Investigate Co-Firing with Hydrogen, Ammonia and Biomass in Indonesia’s Power Plants,” March 3, 2023, https://www.mhi.com/news/23032302.html.

[16] Offshore Energy, “MOL Working on Hydrogen/ammonia Supply Chain in Thailand,” March 6, 2023, https://www.offshore-energy.biz/mol-working-on-hydrogen-ammonia-supply-chain-in-thailand/.

[17] Reuters, “ Japan’s JERA Signs Ammonia Supply MOUs with Yara, CF Industries,” January 17, 2023, https://www.reuters.com/markets/deals/japans-jera-signs-ammonia-supply-mous-with-yara-cf-industries-2023-01-17/.

[18] Hydrogen Council, “Hydrogen Insights,” May 2023, https://hydrogencouncil.com/en/hydrogen-insights-2023/.

[19] International Energy Agency, “The Role of Low-Carbon Fuels in the Clean Energy Transitions of the Power Sector,” October 2021, https://www.iea.org/reports/the-role-of-low-carbon-fuels-in-the-clean-energy-transitions-of-the-power-sector.

[20] Toshiba, “Toshiba’s H2One™ Selected to Support Singapore’s Research Efforts in Energy Sustainability,” October 30, 2019, https://www.global.toshiba/ww/news/energy/2019/10/news-20191030-01.html?utm_source=www&utm_medium=web&utm_campaign=since202202ess.

[21] AAEnergy, “Companies to Explore Hydrogen Use as Fuel in Singapore,” March 30, 2020, https://www.aa.com.tr/en/energy/energy-projects/companies-to-explore-hydrogen-use-as-fuel-in-singapore/28820.

[22] SPGlobal, “AHEAD launches Brunei-Japan hydrogen supply chain for power generation in Tokyo Bay,” June 25, 2020, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/062520-ahead-launches-brunei-japan-hydrogen-supply-chain-for-power-generation-in-tokyo-bay.

[23] JERA, “JERA and PETRONAS Conclude MOU on Cooperation in the Decarbonization Sector,” February 10, 2021, https://www.jera.co.jp/en/news/information/20210210_622.

[24] Mitsubishi Corporation, “Signing of Memorandum of Understanding regarding CCS Joint Study for Clean Fuel Ammonia Production in Indonesia,” March 19, 2021, https://www.mitsubishicorp.com/jp/en/pr/archive/2021/html/0000046720.html.

[25] IHI, “IHI and Partners Launching Ammonia Co-Firing Technology Feasibility Assessments at Coal Power Stations in Malaysia with Partners and for Other Companies to Establish Local Carbon-Free Ammonia Supply Chain,” October 07, 2021, https://www.ihi.co.jp/en/all_news/2021/resources_energy_environment/1197552_3360.html.

[26] Sumitomo Corp, “Joint Feasibility Study in Malaysia to establish Supply Chain of Carbon Neutral Methane,” November 25, 2021, https://www.sumitomocorp.com/en/jp/news/release/2021/group/15280.

[27] Petronas, “Petronas partners ENEOS for first commercial scale hydrogen to MCH project,” March 11, 2022, https://www.petronas.com/media/media-releases/petronas-partners-eneos-first-commercial-scale-hydrogen-mch-project-0.

[28] Pertamina, “Pertamina, PT Pupuk Indonesia, and Mitsubishi Corporation agree to develop blue/green hydrogen and ammonia business,” March 3, 2022, https://www.pertamina.com/en/news-room/news-release/pertamina-pt-pupuk-indonesia-and-mitsubishi-corporation-agree-to-develop-blue-green-hydrogen-and-ammonia-business.

[29] TOYO, “TOYO to commence a Feasibility Study for Green Ammonia production in Indonesia,” May 31, 2022, https://www.toyo-eng.com/jp/en/company/news/?n=2399.

[30] INPEX, “INPEX Extends MOU on LNG Supply to Indonesian Domestic Market and Incorporates Joint Studies in Hydrogen/ammonia and CCS for Abadi LNG Project, Masela Block, Indonesia,” September 27, 2022, https://www.inpex.co.jp/english/news/assets/pdf/20220927.pdf.

[31] JERA, “Collaboration with IHI Asia Pacific for the expansion of ammonia usage in Malaysia,” October 26, 2022, https://www.jera.co.jp/en/news/information/20221026_995.

[32] IHI, “IHI and Partners Launching Ammonia Co-Firing Technology Feasibility Assessments at Coal Power Stations in Malaysia with Partners and for Other Companies to Establish Local Carbon-Free Ammonia Supply Chain,” October 07, 2021, https://www.ihi.co.jp/en/all_news/2022/resources_energy_environment/1198067_3488.html.

[33] Reuters, “JERA, Aboitiz Power to study ammonia co-firing at Philippines coal power plants”, February 10, 2023, https://www.reuters.com/article/japan-philippines-jera/jera-aboitiz-power-to-study-ammonia-co-firing-at-philippines-coal-power-plants-idUSL8N34Q1FZ.

[34] Tani, Mayuko, “Singapore hydrogen strategy draws local energy firms, foreign tech,” Nikkei Asia, February 3, 2023, https://asia.nikkei.com/Business/Energy/Singapore-hydrogen-strategy-draws-local-energy-firms-foreign-tech.

[35] Pertamina, “Pertamina NRE-TEPCO HD Consolidate Green Hydrogen and Green Ammonia Development,” March 3, 2023, https://www.pertamina.com/en/news-room/news-release/pertamina-nre-tepco-hd-consolidate-green-hydrogen-and-green-ammonia-development.

[36] NEXI, “NEXI signs Amendment of the MOU with PT PLN (Persero),” March 3, 2023, https://www.nexi.go.jp/en/topics/newsrelease/2023030101.html.

[37] MOL, “MOL Concludes MoU on Building Clean Hydrogen/Ammonia Value Chain in Thailand,” March 6, 2023, https://www.mol-service.com/news/mou-clean-hydrogen-ammonia-value-chain-thailand

[38] Pupuk Indonesia, “Supporting The Net Zero Emission Target, Pupuk Indonesia Collaborates with Japan to Review The Construction of a Green Ammonia Plant,” March 9, 2023, https://www.pupuk-indonesia.com/media-info/161/detail.

[39] IHI, “IHI Looking to Produce and Green Ammonia and Run Co-firing Business in Indonesia,” March 7, 2023, https://www.ihi.co.jp/en/all_news/2022/resources_energy_environment/1198208_3488.html.

[40] MHI, “MHI and PLN Nusantara Power to Jointly Investigate Co-Firing with Hydrogen, Ammonia and Biomass in Indonesia’s Power Plants,” March 23, 2023, https://www.mhi.com/news/23032302.html.

[41] IHI, “IHI to Participate in Feasibility Study of Green Energy-Based Power System in Indonesia,”, March 8, 2023, https://www.ihi.co.jp/en/all_news/2022/resources_energy_environment/1198212_3488.html.

[42] Petronas, “Petronas, JOGMEC to cooperate in energy transition initiatives,” March 6, 2023, https://www.petronas.com/media/media-releases/petronas-jogmec-cooperate-energy-transition-initiatives

[43] SCG, “ SCG, Toyota, and CJPT Team Up to Advance Thailand’s Carbon Neutrality Goals with Innovation Development in Hydrogen Energy, Solar Power, and Big Data; Enhance Transport and Logistics through Hybrid Electric and Fuel Cell Vehicles,” April 3, 2023, https://scgnewschannel.com/en/scg-news/scg-toyota-and-cjpt-team-up-to-advance-thailands-carbon-neutrality-goals-with-innovation-development-in-hydrogen-energy-solar-power-and-big-data-enhance-transport-and-logistics-through-hybrid-e/.

[44] Toyota, “A 10,000 km Hydrogen Journey Linking Thailand and Hokkaido,” May 9, 2023, https://toyotatimes.jp/en/newscast/016.html.

[45] JBIC, “JBIC Signs MOU with PT Pupuk Indonesia (Persero) of Indonesia,” May 23, 2023, https://www.jbic.go.jp/en/information/press/press-2023/0523-017803.html

[46] Leigh Collins, “Construction begins on 600MW ‘hydrogen-ready’ gas-fired power station in Singapore”, Hydrogen Insights, July 19, 2023, https://www.hydrogeninsight.com/power/construction-begins-on-600mw-hydrogen-ready-gas-fired-power-station-in-singapore/2-1-1488871.

This special CGEP blog series, featuring six contributions from CGEP scholars, analyzes the potential impacts of the OBBBA across a range of sectors.

When the Inflation Reduction Act (IRA) was passed in August 2022, it triggered unprecedented enthusiasm among potential hydrogen suppliers.

China’s commitment to what it calls its “dual carbon” goals of carbon neutrality by 2060 and to ammonia’s potential role as a hydrogen derivative and carrier have fostered expectations that its renewable ammonia market will expand significantly and thus so will production.

This blog post is a comparative analysis of the various production pathways each nation is considering.

H2 projects will have to compete for a shrinking pipeline of zero-carbon electricity with energy-intensive data centres.