‘Toothless’ sanctions

Why the world’s largest waste management company made a $3 billion bet on the US.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

CGEP Founding Director Jason Bordoff spent the past few days participating in the annual meeting of the World Economic Forum in Davos. He offers the following reflections on his experience this year, the significant gaps that remain between ambition and reality, and what is needed to make progress on our climate change goals.

I am on my way back from the annual meeting of the World Economic Forum in Davos, which seemed at times more like a climate change conference. In prior years, energy and climate change were important but largely relegated to the sidelines relative to other global economic and geopolitical issues. This year, climate change was squarely at the heart of the entire event, permeating nearly all panel discussions and private meetings.

President Trump attacked climate activists as “perennial prophets of doom,” while Greta Thunberg chastised the global elite for failing to take real action on climate change. I attended both speeches, and the dissonance could not have been more striking.

President Trump previewed his reelection stump speech by trumpeting what he called “America’s extraordinary prosperity.” Energy featured prominently in his speech, as he touted low gasoline prices and America’s surging oil and gas production and exports. He said, “The United States no longer needs to import energy from hostile nations,” and he urged European allies to buy American energy rather than “be vulnerable to unfriendly energy suppliers.”

Greta, by contrast, criticized talk of “net” zero emissions and technologies like carbon capture or removal (“technologies that don’t even exist today at scale and that science says perhaps never will”) and “offsets” through natural climate solutions as insufficient and distractions.

She demanded that all companies, banks, institutions and governments: “Immediately halt all investments in fossil fuel exploration and extraction. Immediately end all fossil fuel subsidies. And immediately and completely divest from fossil fuels. We don’t want these things done by 2050, 2030 or even 2021. We want this done now.”

The leaders of many major financial institutions pushed back on such calls, arguing that they could not stop investing in all fossil fuels when demand was still rising and the transition would take decades.

Still, business leaders in Davos pledged to take much stronger action on climate change in response to rapidly rising social pressure and protests. In private conversations, many participants noted with alarm this pressure, from the massive backlash against Siemens in recent weeks for supplying a piece of rail infrastructure as part of an Australian coal project, to Roger Federer’s coming under fire for sponsorship with Credit Suisse because the bank invests in fossil fuels. Mark Carney again issued warnings about systemic economic risk from climate change, and Prince Charles told delegates a new economic model was needed to address climate change.

In response, many companies promised action. Blackrock said it would prioritize climate change in its investment strategy; Microsoft issued a major announcement to not only go carbon negative but remove its historical emissions (see my colleague Julio Friedmann’s comments on CNBC about why this could be a major boost to direct air capture technology); Lloyds pledged to cut by more than 50 percent the carbon emissions generated by the projects it finances by 2030; and business and government leaders promised to plant 1 trillion trees.

The issue of climate change was top of the agenda as well for leaders of the oil and gas industry, who discussed the role of the industry in an energy transition, how to respond to rising pressure when oil and gas demand is still rising, and whether to expand their emission reduction targets—as a few have—to include emissions from the use of their products.

REFLECTIONS

For someone who has devoted a career to working on our most pressing energy and climate challenges, it was gratifying and encouraging to see these issues rise to the top of the agenda at Davos and to see so many of the world’s most powerful public and private sector leaders pledging strong action to address climate change.

At the same time, significant gaps remain that are preventing stronger climate action and make me concerned about the path ahead. Let me highlight three.

First, a huge gap exists between ambition and real action. It’s not just that President Trump withdrew from the Paris Agreement. Despite calls from political leaders for urgent action, almost no country is on track to meet its commitments under the Paris Agreement. As a result, financial leaders are pledging stronger targets, yet still operate within a system in which oil, gas, and even coal use are still rising globally. Oil and gas companies face growing pressure to shift more of their capital budgets more quickly toward low-carbon energy sources, and yet risk being penalized in their share prices if they move too quickly in that direction because they can’t earn the same returns and because oil and gas demand globally remains robust.

Last year, I recall one participant at Davos commenting on how unbelievable it would have seemed if a decade earlier someone had predicted that solar costs would fall nearly 90 percent or wind costs 50 percent. Or that nearly all (85% percent) of the investment in power generation would be going into low-carbon sources and technology to enable them, as last year. I replied, however, that it would have been seen as a failure if someone a decade ago had predicted that global greenhouse gas emissions would continue to rise nearly each and every year. Yet, indeed, both have been and remain true, as global energy demand continues to rise.

The pledges from corporate leaders are welcome but insufficient. And the rhetoric of many policymakers is not being matched at all by the actual stringency of climate policy that will change the current trajectory of emissions and energy use. Something has to change.

Second, there is a massive gap between those subject to social pressure today and those we actually need to be part of delivering a clean energy transition. The majors, seven large integrated oil and gas companies, are visible targets for rising public and shareholder pressure to shift investments away from oil and gas, yet they only represent 15 percent of world oil production. Large European and American financial institutions and oil majors are under pressure to divest from fossil fuels, but there is no lack of private capital in the world. It is unclear why any pullback in investment by them would not simply be replaced by national oil companies, privately held companies, or private equity firms. Absent stronger policy or technological change, oil and gas demand will remain healthy, and capital investment and production could simply shift toward actors less susceptible to those pressures.

This gap is also geographic. Much of the focus in Davos was on American and European policymakers and American and European firms, yet solving climate change requires far greater focus on China, South Asia and other parts of the world where emissions are rising fastest. Europe constitutes only 9 percent of global emissions, for example. There still remains far too little discussion of coal. As I wrote in the Wall Street Journal five years ago, coal is not dead and remains a critical part of the energy mix across the globe. It remains responsible for 40 percent of global energy-related carbon dioxide emissions and is not projected to decline in the years ahead. While old coal plants in the U.S. and Europe have retired, the average age of coal plants in Asia is only 12 years old. Even if we never build another new coal plant, we cannot meet our climate targets if the existing coal fleet operates until the end of its normal life and investors recoup their investments. Serious global climate action must prioritize far more policy and financial strategies to retire these plants early.

Third, there is a serious gap in public trust and understanding of the role of incumbent energy firms in the energy transition. This was the topic of an excellent report released by the International Energy Agency at Davos.

Part of the gap is between energy math and climate math. Several energy CEOs expressed the view that continued increases in energy production including oil and gas are needed to meet rising global demand in lower-income parts of the world and deliver rising levels of prosperity to those who consume a fraction of per capita energy consumption levels that we do, and that continued investment is needed to offset oil decline rates even in a sustainable development scenario. That is why over the last several years renewables have been by far the fastest growing forms of energy, and yet coal, oil and gas use have continued to rise as well. The problem is that climate math is unforgiving, and continued growth in emissions from hydrocarbons is simply incompatible with warming targets like 1.5 or 2 degrees Celsius. At current emission rates, the carbon budget to limit warming to a 1.5 degree target will be used up in around 15 years.

There is also a gap between public understanding of where emissions come from and the full suite of technologies that will be needed to deliver deep decarbonization, which was also underscored by the IEA’s report on the potential role for the oil and gas industry in the transition. At a minimum, the industry needs to take steps to reduce the emissions that come from producing and delivering oil and gas to consumers, which constitutes 15 percent of global energy-related GHG emissions—not an insignificant number. This requires stronger action on industrial energy efficiency (for example, at refineries), flaring, reducing methane leaks and decarbonizing operations.

More importantly, industry needs to invest in technologies that can deliver carbon-free energy at scale, and this involves far more than just generating electricity from renewables or other sources. Electricity is only 20 percent of final energy consumption. Even if that grows, hard-to-abate sectors like industry, heating, shipping, aviation and trucking will require solutions that are not visible or at least cost-competitive today, such as carbon capture, carbon removal, hydrogen, biogas, biofuels and more. Large oil and gas companies have the engineering, financial and project management capabilities to develop and scale such technologies. At present, investment by oil and gas companies outside their main businesses is minuscule, and this will need to change to realize a clean energy transition.

The industry will also face rising calls for it to take steps to reduce or offset emissions from the use of its products, as its leaders reportedly discussed in Davos. There is not yet agreement on whether or how to assign responsibility to oil and gas firms for these emissions or how to address them, although some companies have begun to make commitments to do so. There are both nature-based and technology-based ways to remove CO2 from the air, which is the focus of the major Carbon Management Initiative we have built at the Center on Global Energy Policy under Dr. Julio Friedmann’s leadership.

Yet the climate activists calling for rapid action in Davos have no trust in the industry, no faith that it won’t stymie progress, and don’t believe industry to be part of the solution—a skepticism and mistrust not without some justification given some of the industry’s past behavior. Given the range of technologies and scale of investment needed to accelerate a clean energy transition, rebuilding some measure of common ground and trust between the climate community and oil and gas community is an important, and daunting, challenge. It will require concerted work by the companies and much greater transparency by the industry about the results of its actions.

In the end, I return to the need for—and absence of—stronger policy as the key problem to solve for. It is commendable to see so many major institutions, from Blackrock to Microsoft, pledging to take stronger actions to account for climate risk and reduce emissions in their own businesses. But they are still operating, with a fiduciary obligation to shareholders, within an energy system dominated by hydrocarbons and an energy outlook in which that is unlikely to change. There is a limit to what any one company can do to change that. If companies really wanted to lead on climate change, as I wrote in the Wall Street Journal recently, they should be allocating far more political and financial capital to advocating for stronger climate policies around the world. That holds true for oil and gas companies as well. To chart a path forward that allows them to survive, and even thrive, in an energy transition requires they reduce their own emissions, address emissions from the use of their products, and invest in new technologies like CCUS or hydrogen. But just as important, if not more so, is that they advocate for stronger climate policy—and certainly do not stymie it. Otherwise they will continue to face rising social pressure to shift their capital investments away from oil and gas faster than consumer demand itself shifts, which will not be economically viable. Stronger policy should include a significant carbon price, which is a necessary aspect—albeit not sufficient on its own—of a robust climate plan, as research within CGEP’s Carbon Tax Research Initiative has demonstrated.

The dramatic increase in urgency and attention to the issue of climate change at Davos was very welcome indeed, but much work remains to be done to build understanding and common ground to find effective and sensible policy and technological solutions that will put us on the pathway we need to achieve our climate goals while meeting the world’s growing need for energy.

–Jason Bordoff

Why the world’s largest waste management company made a $3 billion bet on the US.

The Trump administration didn't send a delegation to Brazil.

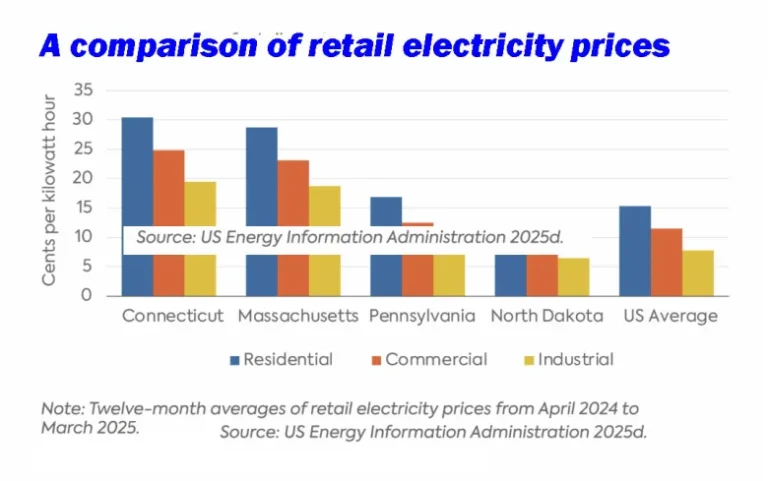

Connecticut needs an honest debate, and fresh thinking, to shape a climate strategy fit for today, not 2022.

As diplomats meet in Brazil for COP30, global resolve to tackle the climate challenge appears badly frayed.