China Halts U.S. LNG Imports Amid Tariff War

China has ceased importing liquefied natural gas from the United States since early February, as the ongoing tariff war impacts energy trade.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

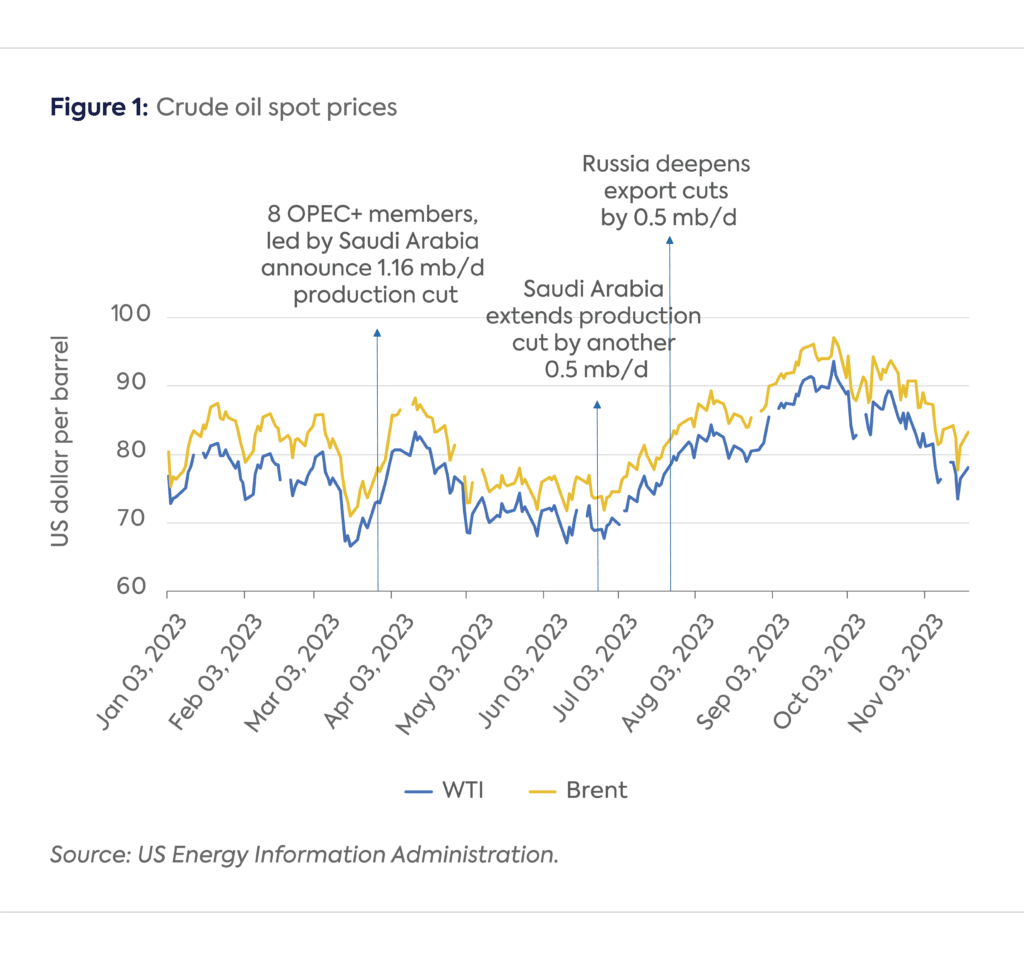

After a wobbly first half of 2023,[1] when crude oil prices were affected by a banking crisis in the United States and the prospects of a recession in the Organisation for Economic Co-operation and Development (OECD), production cuts by key OPEC+ members—led by Saudi Arabia—supported prices. Beginning in July 2023, with Saudi Arabia[2] and then Russia[3] deepening and extending their production cuts, prices printed nearly 9 percent higher compared to the first half of 2023. However, crude oil prices are now at their lowest levels since July[4] as some of the market tightness has eased.

With this as the backdrop, at its recent meeting on November 30,[5] OPEC+ members decided to expand the voluntary cuts to over 2 million barrels per day (mb/d) for the first quarter of 2024 (1Q24). The largest component of this decrease is a 1 mb/d cut by Saudi Arabia, with Russia expanding its cut from 300 thousand barrels per day (kb/d) to 500 kb/d. The group is expected to continuously monitor market conditions as it makes decisions beyond 1Q24; in this article, the authors analyze the market implications—and geopolitical drivers—of these latest oil outputs cuts, and assess what might lie ahead.

The unilateral production cuts first announced in April 2023[6] were to end by December 2023. According to both the US Energy Information Administration (EIA)[7] and the International Energy Agency (IEA),[8] the outlook for the first half of 2024 is expected to be softer, with much weaker demand growth and still-elevated supply growth. The outlook points to prices either staying muted or falling even further, likely contributing to this latest round of production cuts.

All of this will have an impact on the fiscal sustainability of OPEC members, especially in the Middle East. Saudi Arabia[9] is on course to post a full year deficit for 2023, having already extended the fiscal deficit to nearly $2.2 billion year-to-date in 2023 due to a significant drop in revenue from oil exports this year from lower prices and production cuts. This follows a record budget surplus of almost $30 billion in 2022, when higher oil prices boosted government revenues by 31 percent. Kuwait[10] is also forecasting a fiscal deficit of $22.1 billion for 2023–24 following a budget surplus of $20.8 billion in 2022–23. This deficit is predicated on an oil price of $70 per barrel. The United Arab Emirates[11] is less impacted, though even there the fiscal surplus is expected to ease from over 9 percent of GDP to just under 7 percent due to lower exports and crude oil prices.

The beneficiaries are Russia, as the price cap on its products has been breached, with no apparent plans to enforce it; Iran, on which sanctions are, for the most part, not being enforced (and that’s unlikely to change even with the recent Israel-Gaza flareup); and non-OPEC producers that are gaining market share, especially the United States, Brazil, and Guyana.

The IEA reported in its most recent monthly Oil Market Report[12] that Russian oil export volumes and revenues continue to increase, with total oil exports, including oil products, at 7.6 mb/d in September 2023 and the average crude export price at $81.80 per barrel of crude oil, narrowing its discount to Brent to its lowest since March 2022, when the war in Ukraine began. Iran[13] is reporting an increase in production by 50 percent in the last two years, with exports at their highest level since sanctions were imposed in 2018. Outside OPEC+, the US EIA[14] reports that domestic production has already reached a new high as of the last few months in 2023, and will likely continue to rise in 2024. Brazil’s government has set a target to become the world’s fourth-largest oil producer by 2029,[15] even as it will formally join OPEC+[16] in January as an observer, without any production targets for now. And in Guyana,[17] the other outstanding performer, production has grown four-fold since 2020 and is on track to increase to 1.2 mb/d by 2027.

Extending the production cuts into 2024 was an easy option, and the group agreed to do exactly that until March 2024. However, how long the Middle East producers could continue this strategy was questionable, with the desired price levels proving to be elusive. The loss of market share was clearly weighing on OPEC+, and in particular Saudi Arabia, which has been doing the heavy lifting in terms of the production cuts. The week-long postponement[18] of the meeting by the Joint Ministerial Monitoring Committee, the apex OPEC+ body formally charged with deliberating and enforcing production quotas among the group members, reflects how difficult these negotiations have been and their potential impact on group cohesion. The baseline revision requests for several African members[19] have also added another layer of internal pushback, which could simmer into next year. In particular, the production plans and targets for Angola, Congo, and Nigeria for 2024 are to be independently assessed by three upstream consultants given that these countries have consistently underperformed on their production targets.[20]

The decision to cut oil output may be based on geopolitical considerations rather than market conditions. The decision is also complicated by the ongoing war in Ukraine and the close relationship of the Russian president with both the Emirati leadership and the Saudi prime minister.[21] That relationship may have been tested by a potential US-Saudi security agreement that is now firmly on the backburner.[22] COP28 has made the role of the UAE more difficult, as there is always strong pressure on the host country to achieve a unanimous agreement at the end of the conference.

Moreover, there is popular pressure on the monarchies governing the Middle Eastern countries to act against the perceived Western bias toward Israel, even though cutting oil exports as an economic tool seems to be off the table.[23] In their official statements, OPEC+ members are against Israel’s war in Gaza, with Kuwait, Algeria, and Iran reportedly most agitated by the conflict.[24] Iran[25] has called for a complete and immediate oil embargo on Israel, but the Saudi oil minister[26] has said that only market fundamentals, and not political considerations, will drive OPEC+ decisions.

Local populations in the Middle East could demand restrictions on crude exports to hurt Western countries. With oil prices looming large in the upcoming US presidential elections, and given the perceived US bias toward Israel, production cuts led by Middle Eastern producers could start to echo the Arab oil embargo from half a century ago. However, an agreement on which countries will bear cuts— and for how long—is a difficult one and a tough decision that could negatively impact group cohesion. The latest cuts from OPEC+ may be the last roll of the dice in the cycle of production cuts that started in October 2022.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] https://www.energypolicy.columbia.edu/publications/options-for-opec-amid-weakening-oil-market-fundamentals/

[2] https://www.spa.gov.sa/en/620f8a971dh

[3] http://government.ru/en/news/48920/

[4] https://www.ft.com/content/47223166-55ba-4438-a45f-0455bcbea27e

[5] https://www.opec.org/opec_web/en/press_room/7267.htm

[6] https://www.opec.org/opec_web/en/press_room/7120.htm

[7] https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

[8] https://www.iea.org/reports/oil-market-report-november-2023

[9] https://www.zawya.com/en/economy/gcc/saudi-arabias-q2-budget-deficit-at-141bln-finance-ministry-wmv8ij0j

[10] https://www.bloomberg.com/news/articles/2023-01-31/kuwait-sees-16-4-billion-deficit-looks-to-boost-revenue

[11] https://www.elibrary.imf.org/downloadpdf/journals/002/2023/223/article-A000-en.xml

[12] https://www.iea.org/reports/oil-market-report-october-2023

[13] https://www.iea.org/reports/oil-market-report-october-2023

[14] https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

[15] https://oilprice.com/Energy/Energy-General/South-Americas-Offshore-Oil-Boom-Will-Challenge-OPECs-Dominance.html

[16] https://www.opec.org/opec_web/en/press_room/7265.htm

[17] https://oilprice.com/Energy/Energy-General/Guyanas-Oil-Boom-To-Gain-Momentum-In-Second-Half-Of-2023.html

[18] https://www.opec.org/opec_web/en/press_room/7261.htm

[19] https://www.opec.org/opec_web/static_files_project/media/downloads/Production%20table%20-%2035th%20ONOMM.pdf

[20] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/110923-opec-october-production-rises-180000-bd-led-by-iraq-and-iran-platts-survey

[21] https://www.reuters.com/world/middle-east/putin-talk-oil-uae-saudi-meet-crown-prince-mohammed-bin-salman-2023-12-06/

[22] https://www.reuters.com/breakingviews/saudi-is-wild-card-middle-easts-new-turmoil-2023-10-18/

[23] https://www.ft.com/content/b2828be2-a3a7-4b3f-bb50-d816ee7162ca?mod=article_inline

[24] https://www.ft.com/content/b2828be2-a3a7-4b3f-bb50-d816ee7162ca?mod=article_inline

[25] https://oilprice.com/Energy/Energy-General/Iran-Calls-For-Oil-Embargo-On-Israel-As-Middle-East-Tensions-Flare-Up.html

[26] https://www.reuters.com/business/energy/opec-decisions-not-politicised-saudi-energy-minister-says-2023-02-20/

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

CGEP recently hosted a private roundtable conducted on a not-for-attribution basis that focused on key geopolitical issues and oil markets in various hotspots, including the Middle East, Russia/Ukraine, China, and the Americas.