The Center on Global Energy Policy released a new report today, “American Gas to the Rescue? The Impact of US LNG Exports on European Security and Russian Foreign Policy,” co-authored by Jason Bordoff, Founding Director, Center on Global Energy Policy, and Trevor Houser, Partner, Rhodium Group.

As Western governments have responded to Russia’s continued efforts to destabilize Ukraine, the potential for US natural gas exports to inflict economic pain on Moscow and undermine its influence in Europe have made for some eye-catching headlines. To cut through the hyperbole surrounding this issue, the authors undertook a study that provides a cool-headed examination of the impact of US LNG exports on European energy security and Russian foreign policy.

The key findings include:

- The US shale gas boom has already helped European consumers and hurt Russian producers by expanding global gas supply and freeing up liquefied natural gas (LNG) shipments previously planned for the US market. This has strengthened Europe’s bargaining position, forcing contract renegotiations and lowering gas prices. US LNG exports will have a similar effect.

- Over the long term, US exports, along with growth in LNG supply from other countries such as Australia, will create a larger, more liquid and more diverse global gas market. This will increase supply options for Europe and other gas consumers, and give them even more leverage in future negotiations with Russia and other producers. Maximizing the benefits of this opportunity, however, requires changes in European policy and infrastructure that focus on reducing vulnerability to Russian supply disruption, not only dependence on Russian gas overall.

- While there are important longer-term benefits for Europe from US LNG exports, they are not a solution to the current crisis. Those terminals already approved will not be online for several years. Terminals pending approval, if constructed, will not be available until after 2020.

- Although US LNG exports increase Europe’s bargaining position, they will not free Europe from Russian gas. Russia will remain Europe’s dominant gas supplier for the foreseeable future, due both to its ability to remain cost-competitive in the region and the fact that US LNG will displace other high-cost sources of natural gas supply. In our modeling we find that 9 billion cubic feet per day (93 billion cubic meters per year) of gross US LNG exports results in only a 1.5 bcf/d (15 bcm) net addition in global natural gas production.

- By forcing state-run Gazprom to reduce prices to remain competitive in the European market, US LNG exports could have a meaningful impact on total Russian gas export revenue. While painful for Russian gas companies, the total economic impact on state coffers is unlikely to be significant enough to prompt a change in Moscow’s foreign policy, particularly in the next few years.

Relevant

Publications

Opinion: Financial engineering will not suffice for Africa’s climate needs

Also in today’s newsletter, why private capital will not suffice for Africa’s climate needs

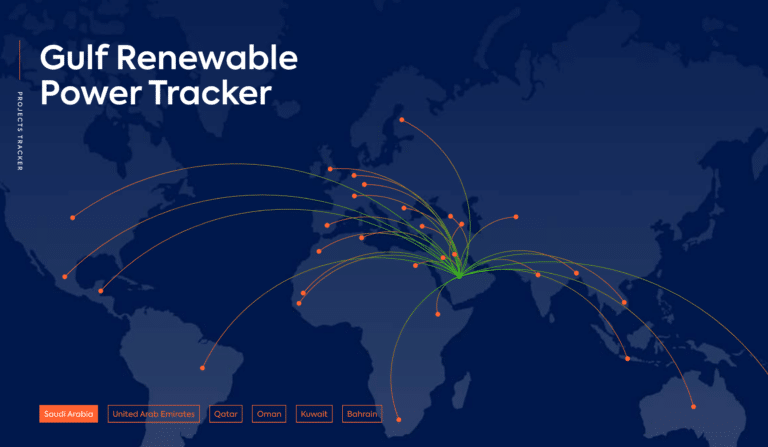

Gulf Renewable Power Tracker

The Gulf Renewable Power Tracker is an interactive and visual database of Gulf state-owned and state-related renewable power investments and developments on a global scale.

Saudi Arabia’s Renewable Energy Initiatives and Their Geopolitical Implications

Saudi Arabia is experiencing a significant economic transformation under its Vision 2030 plan to reduce the country’s dependence on oil revenues by diversifying its economy. The Saudi government’s...