This roundtable report reflects the authors’ understanding of key points made in the course of the discussion. It does not necessarily represent the views of the Center on Global Energy Policy. The summary may be subject to further revision.

Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available on our Partners page. Rare cases of sponsored projects are clearly indicated.

On September 14, 2023, the Center on Global Energy Policy at Columbia University SIPA hosted a private roundtable on the challenges to and opportunities of developing a low-carbon hydrogen (LC H2) industry in Brazil. The roundtable, conducted under Chatham House rules, brought together a diverse group of industry representatives, government officials, financial sector representatives, and other stakeholders from Brazil and around the world. The discussion revolved around two main themes: (1) lessons from the development—and financing—of LC H2 projects globally and their applicability to Brazil; and (2) the current investment landscape for LC H2 in Brazil and technical and non-technical barriers to scaling the country’s LC H2 project pipeline. This workshop report summarizes the key points that emerged from the dialogue around each theme.

Lessons Learned from Developing LC H2 Projects Globally and their Applicability to Brazil

- Getting the policy and politics right is key

Roundtable participants agreed that broad political consensus is essential to developing an LC H2 industry in any country. As one former government official pointed out, such consensus reduces the risk of policy reversal, which is particularly important in the case of LC H2 projects given their long-term nature and the significant upfront capital investments they demand.

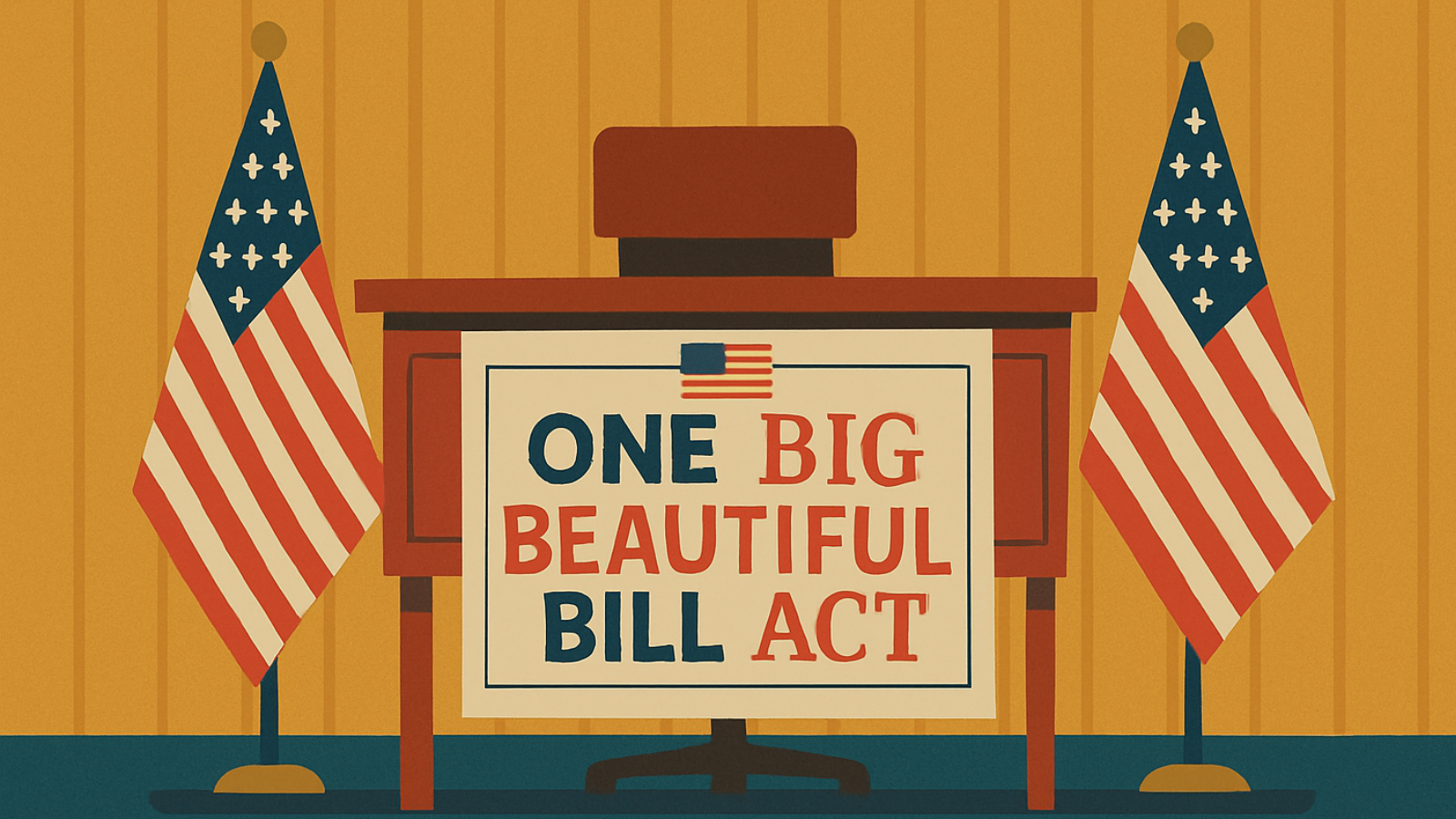

Participants also agreed on the importance of policy stability. This was especially important to the project developers, though the same former government official stressed that it was also key for off-takers. The participant noted that while Brazil might not have the level of funding to match the US Inflation Reduction Act (IRA), any government financial support would send a signal to investors that the government is committed to developing hydrogen projects (“skin in the game”). A representative from the Brazilian government outlined the government’s current policy framework for developing the LC H2 industry in Brazil (see below).

Among the operational risks that policymakers need to be aware of, the former government official cited grid and transmission constraints and land availability as being especially pertinent. As this official observed, a stable and constant flow of renewable electricity is needed to power electrolyzers, but some of that electricity might need to come from the grid to guarantee longer operation times and in turn amortize the high cost of the electrolyzers.

Another point participants raised was the need for coordination within government, particularly between energy and finance ministers, given the more hands-on role of the finance minister in energy policy.

- A major challenge to the bankability of LC H2 projects is the need for an off-taker.

A participant with experience in financing LC H2 projects globally explained that the commercial banks involved have taken on substantial technical, operational, policy, and currency risks (the latter in the case of emerging markets), making the off-take agreement a critical component of the bankability of a project.

In considering how to mitigate these risks, one participant from the financial sector discussed the case of Saudi Arabia’s NEOM project, the world’s largest renewable hydrogen production facility currently under construction. The project’s final investment decision was mainly supported by the 30-year off-take contract with Air Products, direct equity from the government, strong sponsors behind the NEOM Green Hydrogen Company (including NEOM, ACWA, and Air Products), and dollar-denominated cash flows. Participants saw all of these factors as key to the financial attractiveness of the project, signaling alignment between government, project sponsors, and off-takers.

This participant also viewed minimizing risks with strong sponsors and financial backers to be crucial. A project developer agreed with this view given the risks of cost overruns in this inflationary environment, stating that some LC H2 projects have seen a 60 percent increase in capital expenditures. This participant argued that, in the global energy transition currently underway, there is no advantage to being a first mover, creating a chicken and egg situation. In the view of this participant, smaller projects that involve turning stranded assets into green assets represent an interesting pathway.

Another participant mentioned the role that international oil companies (IOCs) could play in financing these projects, though a different participant observed that the oil and gas industry looked at LC H2 like they looked at LNG, notably in terms of their role in project development, structuring, and securing off-take agreements, except LNG at least had end demand.

One participant posited that the blended financing approach, with the use of public funding from off-takers, could be a model for risk mitigation. The participant cited as an example a Namibian project, where H2Global, deployed at the German and EU level, is expected to be instrumental in structuring the off-take contract.

- Developing local demand is essential, even in the context of trying to develop an export-oriented industry.

Participants also discussed export opportunities for LC H2, particularly in its derivative forms like methanol and ammonia. One robust aspect of this conversation concerned the need to develop a domestic market and how that market can accelerate the development of the industry and its supply chains.

Former policymakers in attendance pointed out that local demand is crucial to building the legitimacy of the low-carbon hydrogen industry and aligning stakeholders around its development.

However, several developers observed that the main challenge they have experienced in developing these projects was exactly lack of local demand due to an unwillingness to pay the green premium. One project developer argued that there is a disconnect between the need for sustainability and the willingness to pay for it. Another participant stressed that this disconnect explains why so few of the many projects announced globally (38 million tons planned and expected to start by 2030) have taken a final investment decision.

- The US Inflation Reduction Act (IRA) has made LC H2 projects more attractive in the US than in other jurisdictions, but challenges remain, including permitting.

Project developers in attendance argued that the IRA has been instrumental in providing the commercial backing needed to develop the LC H2 industry in the US. One developer argued that the significant financial incentives for hydrogen development offered by the bill shifted the focus of investors and project developers from projects in Latin America and elsewhere to those in the US. But this participant also predicted that production in the US will only be for local use.

Other participants pointed to remaining challenges. One developer suggested, for instance, that the IRA alone may not incentivize sufficient local demand to lower current high prices for LC H2, and that additional measures like carbon taxes or specific demand incentives may be needed. Another developer said that first movers in the hydrogen industry find themselves at a disadvantage due to the evolving electrolyzer price curve.

Some participants were more optimistic, seeing the opportunities posed by the IRA as reminiscent of the early days of solar and wind energy. Others were less convinced and wondered if electrolyzer costs would decrease just as solar and wind costs did.

Another participant underscored permitting as a key challenge given the complexity and scale of the infrastructure needed for major LC H2 projects, including power generation, transmission lines, gas pipelines, water desalination plants, and ports. The long lead times involved mean that obtaining approvals for such projects can be a lengthy process.

A global developer participant cited transmission restrictions as one of the challenges to the US hydrogen industry. A different participant raised supply chains linked to critical minerals as another challenge.

- Local policies and local state capabilities matter even in the context of a national program.

One current US government official from New York State discussed the relevance of developing a hydrogen regulatory framework and hydrogen technocratic capabilities at the state level. This participant pointed out that New York state has a goal of zero grid emissions by 2030 and net zero by 2040, and that the state sees clean hydrogen as a tool to decarbonize hard-to-abate sectors. Given the high cost of renewables, especially in New York, the use of clean hydrogen must be focused on sectors that are hard to electrify.

The IRA’s tax incentives are also key to the state’s decarbonization. Regional funding supports the development of clean hydrogen hubs, solving the first mover problem in building infrastructure.

Other participants discussed local state capacity, particularly in emerging markets like Latin America, as an important challenge. Developing such capacity where the projects are being developed is essential to reducing those projects’ political risks. One project developer cited the absence of an operating license from the local municipality as a risk factor. Another pointed out that if local municipalities do not see value in projects, they might not get approved. Local governments in emerging markets lack experience in evaluating and approving billion-dollar projects. Participants saw training and deploying government officials in these regions as essential to developing these projects.

- Certification, standardization, and regulations are improving, but more needs to be done.

One participant stated that ensuring that low-carbon hydrogen and its derivatives meet global standards is crucial for export. Another participant argued that Brazil should have a say in the determination of global standards because different countries have their own realities and cannot solely adhere to European rules, which do not consider biomass and hydroelectricity. One participant argued that emerging markets need to influence global standards in order to ensure a broader definition of low-carbon hydrogen. In response to this point, another participant pointed out that Brazil does have a voice and together with France has been working on developing LC H2 standards.

A different participant observed that various countries are implementing their own national certification schemes. The participant argued that these countries must communicate with each other to enable the fungibility of certificates. In this participant’s view, international cooperation is key to ensuring mutual recognition of certification schemes. Another participant argued that the industry must be able to compare projects at a global level from a carbon intensity perspective, and the ISO methodology provides a global benchmark to calculate the carbon intensity of hydrogen. This participant referred to the EU Taxonomy for Sustainable Finance, which draws on both EU and ISO rules to qualify hydrogen production as low-carbon.

This kind of certification and standardization is key because, as one participant argued, the quality or purity of the hydrogen matters to consumers, especially those who are sensitive to fuel quality considerations.

Opportunities for and Challenges to Developing an LC H2 Industry in Brazil

- The Brazilian government is ready to provide financing, an appropriate regulatory framework, investment protection, and mandates for incentivizing demand.

A Brazilian government official discussed Brazil’s National Hydrogen Program, which is run by the National Energy Policy Council, an inter-ministerial body led by the Ministry of Energy and Mines. This program is designed to address the development and deployment of LC H2 in the country. The government official explained the three-year action plan,[i] which outlines 65 specific actions including institutional responsibilities and time frames, and stressed that 32 of the actions are already being implemented. The six pillars invoked by the Brazilian government representative as the cornerstones of the National Hydrogen Program are technology and innovation, human program capacity building, energy planning, a conducive legal and regulatory environment for hydrogen projects, market development, and international cooperation.

According to this same official, the Brazilian strategy includes a plan with clear milestones, including in the short term (before 2025) establishing pilot and demonstration projects across the country. The government official cited $30 billion in potential LC H2 projects already announced to date. The goal is to establish Brazil as among the most competitive LC H2-producing countries in the world by 2030. The Brazilian official stated that Brazil estimates that the country has the technical capacity to produce about 1.8 gigatons per year of LC H2 at very competitive costs, and that once Brazil has demonstrated its competitiveness, hydrogen hubs can be established at a larger scale in the medium to long term.

The government official also discussed the need to support domestic demand and address financing risks.

In terms of financing, the Brazilian government is pledging to increase funding to about BRL 200 million ($40 million) per year and to mobilize low-cost financing under the climate investment fund for LC H2 solutions including to help develop Brazilian LC H2 hubs such as the Port of Pecém[ii] in the Northeast.

- Brazil has many advantages for developing an LC H2 industry.

One participant stated that Brazil has a very favorable starting point to become a leader in LC H2— specifically, the country has low-cost renewable energy that can be scaled and an interconnected grid based on over 90 percent hydroelectricity, renewable, and nuclear supply, allowing the kind of high utilization capacity that reduces hydrogen’s production costs. Another participant proposed other pathways such as LC H2 being obtained from bio-energy sources, notably biomethane.

The other major advantage identified by the first participant is the array of domestic uses in Brazil’s hard-to-abate sectors in the first phase and then the export market once it is developed. In fact, this participant expected that between ammonia, methanol, long-haul transport, and green steel, local demand for LC H2 would reach 0.5–1.5 Mt by 2030. This participant expected Brazil to become a major exporter of LC H2 derivative products to Europe in the next decade before becoming a major global exporter by 2050, though cautioned that realizing this potential will necessitate reducing taxes, finding favorable funding mechanisms to mitigate project risks and reduce capital costs, and developing fiscal incentives in line with other national LC H2 programs.

Some participants agreed that Brazil is particularly well placed to develop a local market for LC H2 given the many applications available. One participant suggested that most demand would come from steel— Brazil is among the largest exporters of iron ore, and LC H2 presents an opportunity to produce higher-value export products. Another participant observed that an obvious demand outlet is fertilizers, as Brazil currently imports 85 percent of its nitrogen-based fertilizer and local production of green fertilizer can reduce this dependency.

- Although there is significant potential local demand for LC H2 in Brazil, lack of willingness to pay the premium poses a huge obstacle.

Some participants cautioned against too much enthusiasm for LC H2 in Brazil and called for a reality check. As they pointed out, consumers are not yet committing to buying these low-carbon products, as evidenced by the lack of signed off-take agreements. Brazilian farmers will likely not be able to pay for low-carbon fertilizers—there is a disconnect between the desire for sustainability and the willingness to pay for it. One participant raised the possibility of building an export hub close to a port as a way of exporting the LC H2-based steel to Europe at a price premium. However, another participant retorted that even with Europe’s carbon border adjustment mechanism, the price differential remains high. There appears to be a massive gulf between now and 2030–35, with current costs being too high and demand failing to materialize as the product is too expensive.

In Brazil, companies such as Petrobras and Vale could be potential off-takers. One participant mentioned that LC H2 was already part of Petrobras’ strategy and that blending it could be part of a new strategy that the company is expected to announce.

Acknowledgements: The authors would like to thank the Brazil Climate Summit organizers, and more specifically Luciana Ribeiro, for their invaluable help in the organization of this workshop.

[i] Ministério de Minas e Energia, Programa Nacional de Hidrogênio, “Plano de Trabalho Trienal 2023–2025,” https://www.gov.br/mme/pt-br/assuntos/noticias/PlanodeTrabalhoTrienalPNH2.pdf.

[ii] Climate Investment Funds, “Climate Investment Funds Approves $70 Million to Enable $9 Billion Energy Transformation in Brazil,” press release, June 30, 2023, https://www.cif.org/news/climate-investment-funds-approves-70-million-enable-9-billion-energy-transformation-brazil.