White House, private sector ‘closely looking’ at Venezuelan critical minerals

But given practical hurdles and huge political risk, experts say U.S. access to the deposits is likely a pipe dream.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Reports by John Larsen, Noah Kaufman, Peter Marsters + 3 more • October 20, 2020

This report represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated. For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Annual Circle.

(This list is updated periodically)

Jay Bernstein

Breakthrough Energy LLC

Occidental Petroleum Corporation

Putting a price on carbon dioxide (CO2) emissions can help governments reduce them rapidly and in a cost-effective manner. While 10 carbon tax bills have been proposed in the 116th US Congress, carbon prices alone are not enough to reach net-zero emissions by midcentury. Additional policies are needed to complement an economy-wide carbon tax and further cut CO2 from the US energy system.

This study aims to provide a better understanding of such policy combinations. It projects the energy CO2 emissions impacts of two carbon taxes, starting in 2021, that span the rates in the carbon tax bills in Congress. The “low” tax scenario starts at $30 per ton in 2021 and rises at 5 percent plus inflation per year, reaching $44 by 2030, while the “high” carbon tax starts at $15 per ton and rises $15 per year, reaching $150 by 2030. The paper then describes the barriers inhibiting emissions reductions beyond those achieved by the carbon taxes alone for each major sector: electricity, transportation, buildings, and industry. Finally, it explores the energy system changes needed to overcome those barriers and the policy interventions that could deliver those changes. For certain key energy system changes, it provides quantitative estimates of emissions reductions incremental to the two carbon taxes.

This paper is part of a joint effort by Columbia University’s Center on Global Energy Policy (CGEP) and Rhodium Group to help policy makers and other stakeholders understand the important decisions associated with the design of carbon pricing policies and the implications of these decisions. The paper finds the emissions impacts of the low and high carbon taxes alone lead to economy-wide energy CO2 emissions reductions by 2030 of 33 percent and 41 percent, respectively, below 2005 levels. A carbon tax combined with policy actions that support comprehensive, ambitious energy system changes could lead to emissions reductions in the range of 40 to 45 percent, arguably consistent with US midcentury deep decarbonization goals for the energy system.

In the 2020s, the bulk of these emissions reductions are likely to occur in the power sector, even under a broad decarbonization strategy, due to the significant barriers to large near-term emissions reductions in the transportation, buildings, and industrial sectors.

In addition, the paper finds:

Figure ES-1: Summary of results

On November 6, 2025, in the lead-up to the annual UN Conference of the Parties (COP30), the Center on Global Energy Policy (CGEP) at Columbia University SIPA convened a roundtable on project-based carbon credit markets (PCCMs) in São Paulo, Brazil—a country that both hosted this year’s COP and is well-positioned to shape the next phase of global carbon markets by leveraging its experience in nature-based solutions.

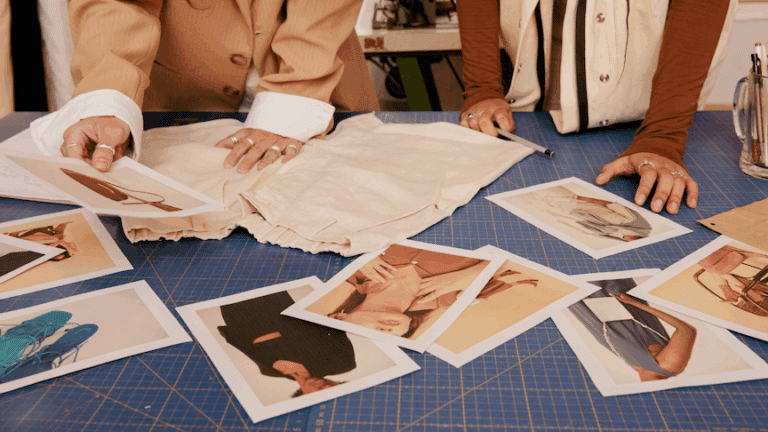

The fashion industry sits at the intersection of climate, energy, and consumption, facing growing pressure to cut emissions, transition to clean energy, and build circular systems across global supply chains.

Full report

Reports by John Larsen, Noah Kaufman, Peter Marsters + 3 more • October 20, 2020