Power prices are expected to soar under new tax cut and spending law

In states without policies to drive renewable energy, power prices could surge as federal tax incentives for clean energy disappear, according to Energy Innovation, a think tank.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Fact Sheet by Kevin Brunelli, Lilly Yejin Lee & Tom Moerenhout • December 20, 2023

This fact sheet represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision.

Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners page. Rare cases of sponsored projects are clearly indicated.

An increased supply of lithium will be needed to meet future expected demand growth for lithium-ion batteries for transportation and energy storage. Lithium demand has tripled since 2017[1] and is set to grow tenfold by 2050 under the International Energy Agency’s (IEA) Net Zero Emissions by 2050 Scenario.[2] Currently, the lithium market is adding demand growth of 250,000–300,000 tons of lithium carbonate equivalent (tLCE) per year, or about half the total lithium supply in 2021 of 540,000 tLCE.[3] For comparison, demand growth in the oil market is projected to be approximately 1% to 2% over the next five years.[4]

Leading experts estimate a supply deficit by the 2030s, creating pressure to increase lithium production and processing. Benchmark Mineral Intelligence, an information provider on the lithium-ion battery supply chain, estimates a 300,000 tLCE supply deficit by 2030 in its business-as-usual demand scenario.[5] Albemarle, one of the largest lithium producers, estimates a 500,000 tLCE deficit by then.[6] Deutsche Bank sees an even greater shortage of 768,000 tLCE by 2030.[7]

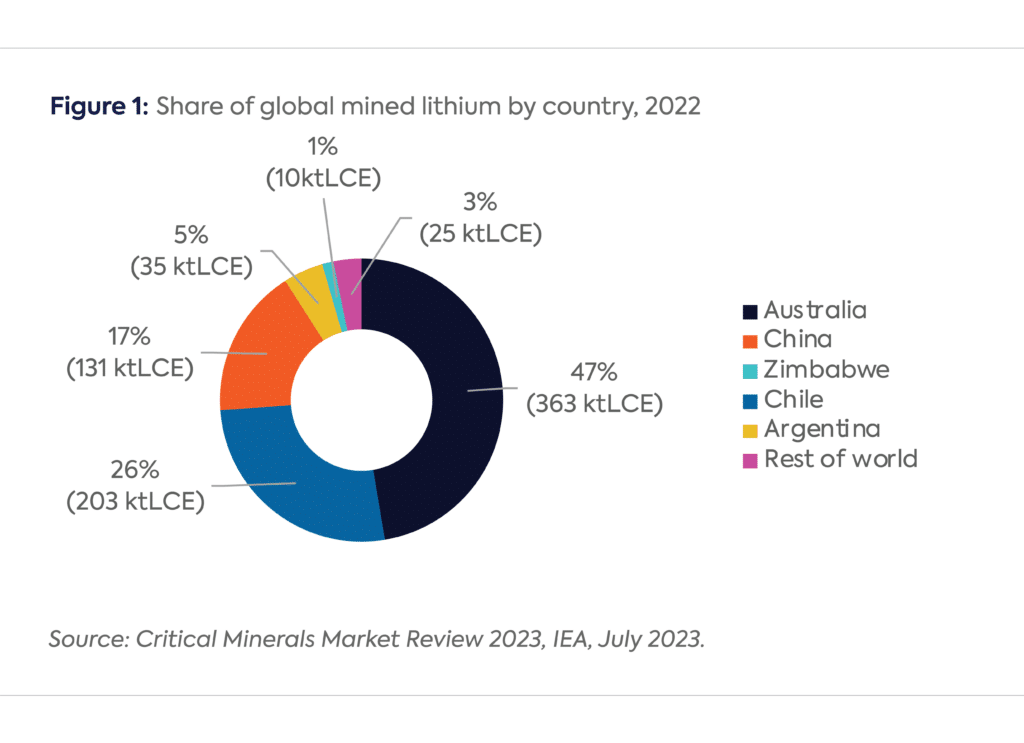

The upstream portion of the lithium supply chain, namely mining, is severely concentrated in a few countries: Australia, Chile, and China account for 90% of production.[8] (See Figure 1.) These three countries, together with Argentina, hold most of the economically viable reserves. The concentration, or grade, of the lithium resource is a strong determinant of economic viability. Other countries, such as Bolivia, possess lithium resources that are currently considered uneconomical. The limited geographical distribution of lithium production tightens the market despite the metal’s abundance in the earth’s crust.[9]

Higher lithium grades equate to lower capital and operating expenses per ton of lithium produced. Lower lithium grades lead to more mining, waste, and processing per ton. Lithium is found predominantly in salt brines (salars) or hard rock deposits. Brines can be directly processed into lithium carbonate, suited for cheaper but less energy-dense cathodes. To extract the lithium, brine in underground aquifers is pumped to the surface into a series of evaporation ponds. This process requires a hot and arid climate with considerable space, as the evaporation ponds can be kilometers long, making the Atacama Desert in Chile, for example, an ideal location. Brines are measured in milligrams per liter (mg/l) or parts per million (ppm), with brines over 200 mg/l considered economically viable.[10] Albemarle’s Salar de Atacama brine mine in Chile measures 2,211 mg/l.[11]

Hard rock deposits are measured in percentage of lithium oxide (Li2O).[12] These deposits can be processed into lithium carbonate or lithium hydroxide, which are used in higher energy-density cathodes. Australia is the leading producer of hard rock lithium, with the state of Western Australia being the main location for lithium mining.[13] The mineral spodumene has the highest lithium grade among hard rock deposits, and is economically viable at between 1% and 2% Li2O.[14] The Greenbushes mine in Australia, the largest spodumene mine in production, is 1.47% Li2O.[15]

Currently, the only lithium production in the United States is from Albemarle’s Silver Peak brine facility in Nevada.[16] Direct lithium extraction (DLE), an emerging lithium production technology, could allow for additional domestic brine production, especially in the Smackover region of Arkansas and the Salton Sea in California.[17] DLE could potentially allow for lithium brine production without evaporation ponds, with the brine being reinjected underground after lithium is extracted. There are currently no hard rock lithium mines in production in the United States, but production is expected to begin this decade at Lithium America’s Thacker Pass and Ioneer’s Rhyolite Ridge in Nevada[18] and Albemarle’s Kings Mountain in North Carolina.[19]

Many lithium mines located in American-allied countries are financed by Chinese investment, locking in existing and future capacity for Chinese companies. These investments have allowed China to further influence the supply chain despite lacking domestic resources. For example, Chinese companies have acquired lithium mining rights in Africa, Australia, and Latin America.[20] Chinese company Tianqi Lithium owns a 26% share in the Greenbushes mine and an approximately 22% share in SQM, a leading lithium chemical producer in Chile.[21] Chinese companies Ganfeng Lithium, CATL, and Huayou Cobalt have stakes in projects in Africa, Australia, and South America.[22]

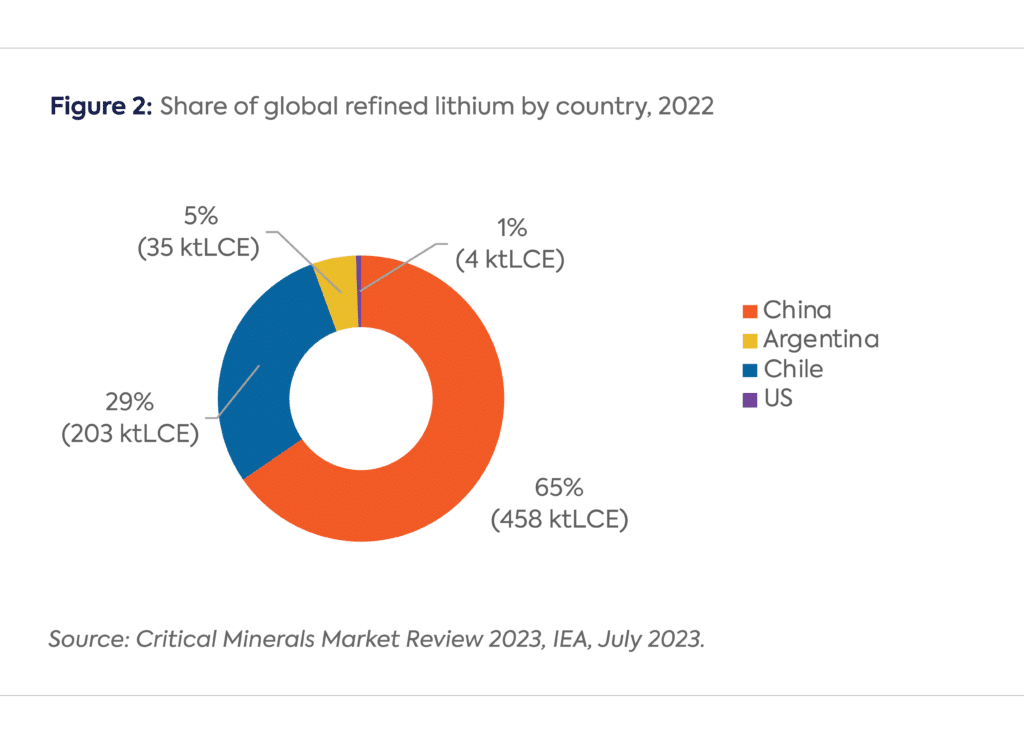

Lithium must be “processed,” or refined into a chemical in the form of lithium carbonate or lithium hydroxide, before being used in batteries. In the midstream sector, approximately 65% of the world’s lithium processing capacity is concentrated in China, solidifying the country’s dominant role.[23] (See Figure 2.) Chile and Argentina account for 29% and 5% of processing, respectively, focusing on in-country conversion of lithium from brines to lithium carbonate. Despite being the world’s largest lithium producer, Australia is only now trying to diversify into processing. Ninety-eight percent of Australian spodumene was exported to China for processing in fiscal year 2022–23.[24]

Looking into the next decade, China is likely to strengthen its hold on lithium chemical production. The United States and Australia are expected to show remarkable increases in terms of growth percentage, but China is projected to more than triple its current capacity and maintain a commanding position, accounting for well over half of the world’s lithium processing.[25]

The local content requirements and foreign entity of concern restriction in the Clean Vehicle Tax Credit of the US Inflation Reduction Act incentivize the construction of lithium processing facilities outside of China. The Clean Vehicle Tax Credit attempts to build an ex-China supply chain for mining and processing by limiting the tax credit to vehicles whose critical minerals are mined and processed in the United States or Free Trade Agreement countries. Additionally, the foreign entity of concern restriction severely limits the role of Chinese companies in the supply chain, even when those companies are involved in mining or processing projects in Free Trade Agreement countries.[26]

Albemarle and Piedmont Lithium, an emerging American lithium company, are constructing lithium processing facilities in the United States and have received financial support from the US government.[27]

[1] International Energy Agency, “Critical Minerals Market Sees Unprecedented Growth as Clean Energy Demand Drives Strong Increase in Investment,” July 11, 2023, http://bit.ly/3tcr7Q0.

[2] International Energy Agency, “Critical Minerals Data Explorer,” accessed December 8, 2023, https://bit.ly/3Tngjcu.

[3] Confidential Market Assessment; Andy Home, “Lithium Still Super-Charged as Supply Chases after Demand,” Reuters, December 15, 2022, https://reut.rs/3RAIWBN.

[4] International Energy Agency, “Oil 2023,” June 2023, https://bit.ly/3NokzF3.

[5] Simon Moores, “Opinion: Albemarle’s Turbo-Charged Demand Data Showcases Lithium’s Growing Supply Problem,” Benchmark Mineral Intelligence, January 26, 2023, https://bit.ly/48awTR9.

[6] Ernest Scheyder, “Lithium Producers Warn Global Supplies May Not Meet Electric Vehicle Demand,” Reuters, June 22, 2023, https://reut.rs/3NokG3r.

[7] Lee Ying Shan, “A Worldwide Lithium Shortage Could Come as Soon as 2025,” CNBC, August 29, 2023, https://cnb.cx/3t4iXcF.

[8] US Geological Survey, “Lithium,” mineral commodity summary, January 2023, https://on.doi.gov/4acFfcF.

[9] Seaver Wang et al., “Future Demand for Electricity Generation Materials under Different Climate Mitigation Scenarios,” Joule 7, no. 2 (2023): 309–332, https://doi.org/10.1016/j.joule.2023.01.001.

[10] Dwight Bradley et al., “A Preliminary Deposit Model for Lithium Brines,” US Geological Survey, 2013, https://on.doi.gov/3GEpw8I.

[11] US Securities and Exchange Commission, “Form 10-K/A, Albemarle Corporation,” https://bit.ly/3RhkDHI.

[12] SGS Minerals Services, “Hard Rock Lithium Processing,” 2013, https://bit.ly/3NoRd9g.

[13] Sergey Alyabyev, Murray Edstein, Aleksandra Krauze, and Mads Yde Jensen, “Australia’s Potential in the Lithium Market,” McKinsey & Company, June 9, 2023, https://mck.co/48flijx; Geoscience Australia, “Lithium,” June 7, 2023, https://bit.ly/3uQvW1P.

[14] IGO Limited, “Greenbushes Lithium Operation Site Visit Presentation,” July 31, 2022, https://bit.ly/46TtIfp.

[15] US Securities and Exchange Commission, “Form 10-K/A, Albemarle Corporation”; International Energy Agency, “Critical Minerals Market Review 2023,” July 2023, https://bit.ly/3TjaVHi.

[16] Albemarle, “North America,” accessed December 8, 2023, https://bit.ly/41krUuW.

[17] Standard Lithium, “Arkansas Smackover Projects,” accessed December 8, 2023, https://bit.ly/3RDjhbA; US Office of Energy Efficiency & Renewable Energy, “US Department of Energy Analysis Confirms California’s Salton Sea Region to Be a Rich Domestic Lithium Resource,” November 28, 2023, https://bit.ly/3RCYTHH.

[18] Lithium Americas, “Thacker Pass,” accessed December 8, 2023, https://bit.ly/3RD3YzG; Ioneer, “Rhyolite Ridge Lithium-Boron Project,” accessed December 8, 2023, https://bit.ly/48ec3A6.

[19] Albemarle, “The Proposed Mine Project: Kings Mountain, a World-Class Facility, a World-Class Resource,” accessed December 8, 2023, https://bit.ly/3t4jXxr.

[20] Jiyeong Go, “Chinese Companies Expanding Footprint in Global Lithium Mines,” FDI Intelligence, August 29, 2022, https://bit.ly/3uYJCbq.

[21] Tianqi Lithium, “Investments,” accessed December 8, 2023, https://bit.ly/3TmaDj8.

[22] Ahmed Mehdi and Tom Moerenhout, “The IRA and the US Battery Supply Chain: Background and Key Drivers,” Center on Global Energy Policy, Columbia University, June 2023, https://bit.ly/41pxL2c.

[23] International Energy Agency, “Critical Minerals Market Review 2023.”

[24] Australian Department of Industry, Science and Resources, Office of the Chief Economist, “Resources and Energy Quarterly,” September 2023, https://bit.ly/3RlrWOq.

[25] International Energy Agency, “Critical Minerals Market Review 2023.”

[26] Kevin Brunelli and Tom Moerenhout, “China Hawks Are Putting the Green Transition at Risk,” Foreign Policy, December 6, 2023, https://bit.ly/3GE0ruF; US Internal Revenue Service, “Credits for New Clean Vehicles Purchased in 2023 or After,” accessed December 8, 2023, https://bit.ly/3RCp4xY.

[27] US Department of Energy, “Bipartisan Infrastructure Law Battery Materials Processing and Battery Manufacturing & Recycling Funding Opportunity Announcement,” October 2022, https://bit.ly/3RCKsmT.

This special CGEP blog series, featuring six contributions from CGEP scholars, analyzes the potential impacts of the OBBBA across a range of sectors.

The US Department of Defense has announced a multibillion-dollar public-private partnership with MP Materials.

The report outlines five foundational choices if a stockpiling strategy is adopted, as bipartisan support suggests is possible.

Full report

Fact Sheet by Kevin Brunelli, Lilly Yejin Lee & Tom Moerenhout • December 20, 2023