On with Kara Swisher: Venezuela After Maduro, Can Trump Control Caracas From Afar?

The arrest of Venezuelan President Nicolas Maduro, on Saturday, sent shockwaves across the globe. And although the targeted military operation was a success, th

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Luisa Palacios & Juan José Guzmán Ayala • September 28, 2023

This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated.

Global clean energy investments are seeing record flows, likely increasing to US $1.7 trillion in 2023, an 8 percent increase over 2022.[i] Despite this overall growth, a huge disparity persists between advanced economies and emerging market and developing economies (EMDEs) with the exception of China. In some EMDEs, such as those in Latin America, clean energy investments in recent years have remained relatively flat.[ii] Given that the International Energy Agency (IEA) estimates EMDEs (excluding China) need to invest, on average, about $1.6 trillion annually between 2026 and 2035—about six times the current pace of investment—in the energy transition to net-zero emissions, mobilizing financing in EMDEs is a challenge for global climate goals.[iii]

The need to mobilize finance for the energy transition in EMDEs featured prominently in the United Nations Conference on Trade and Development’s (UNCTAD) 2023 World Investment Report.[iv] Mobilizing financing for EMDEs has also been at the center of various international gatherings this year, including the Paris Summit for a New Global Financing Pact,[v] and will likely be a prominent topic at this year’s UN Climate Change Conference (COP 28) in Dubai. However, as the World Bank argues, insufficient attention has been placed on understanding the barriers to mobilizing financing for the energy transition in EMDEs.[vi]

The cost and availability of capital are key challenges to mobilizing this financing,[vii] but another obstacle is a lack of information by EMDE governments on how much investment is needed to achieve their energy transition goals as portrayed in their nationally determined contributions (NDCs).[viii] UNCTAD argues that only a third of EMDEs have translated their energy transition targets into investment requirements, impacting countries’ effectiveness in mobilizing financing—and therefore potentially impacting their ability to meet climate goals.[ix]

This is the case for Latin America and the Caribbean (LAC). According to the UN, LAC governments have penciled in only about $20 billion in annual financing in their NDCs to meet climate and energy transition goals.[x] This figure stands in stark contrast with IEA estimates, which identify more than $240 billion in annual investment needs in LAC until 2030 for the energy transition to net zero.[xi] Other estimates put annual investments to meet regional goals significantly higher: McKinsey & Company’s estimate is in the order of $700 billion.[xii]

This commentary seeks to shed light on the reasons behind the wide range of investment estimates for LAC’s energy transition. Such divergent views about the region’s investment needs may be clouding the extent of the financing gap in LAC’s clean energy investment, which in turn could be impacting the region’s ability to mobilize capital, evidenced by the lack of growth in clean energy investments in the region. The authors argue that the requirements presented in the region’s NDCs may not fully enumerate the investment needs of their climate commitments, and incomplete or misaligned estimates of investment needs could hinder the region’s case for mobilizing financial support in climate negotiations. A better grasp of different estimates of investment needs for LAC’s energy transition could help policymakers design policies to mobilize financing to more effectively support climate goals.[xiii]

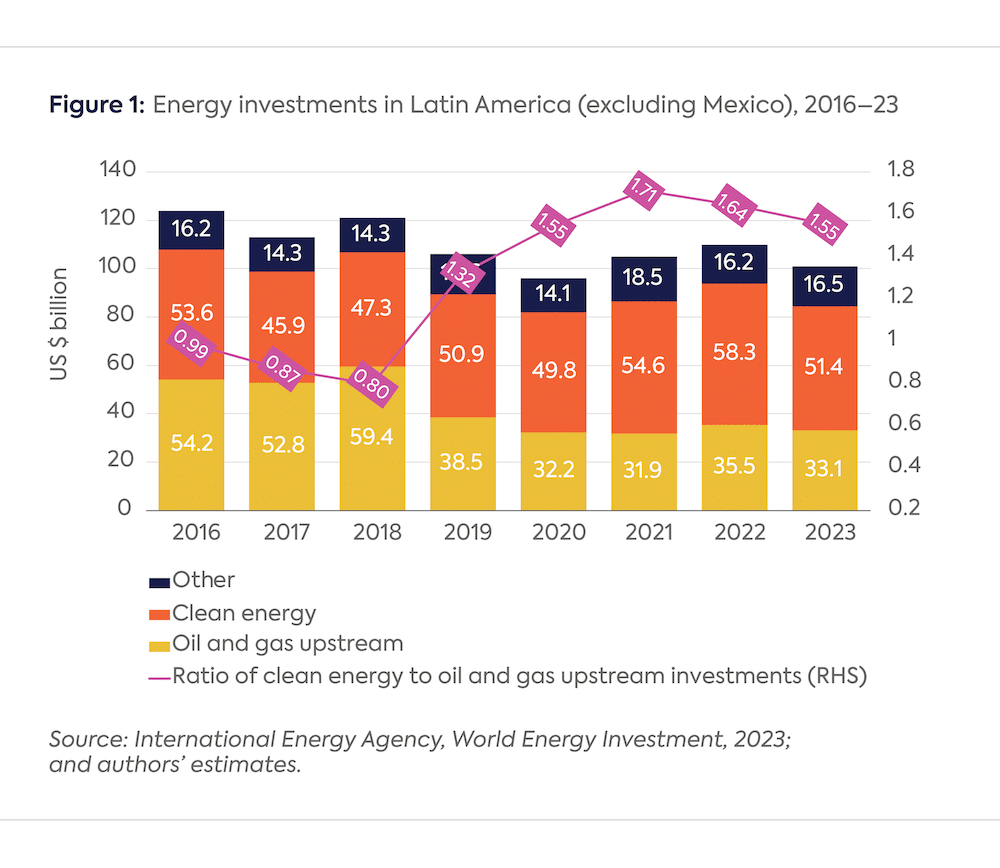

According to the IEA,[xiv] the LAC region (excluding Mexico) is likely to secure about $50 billion in clean energy investments in 2023,[xv] a 12 percent decline compared to 2022. Moreover, LAC represented only 2 percent of private energy transition investments in 2022.[xvi]

The expected decline in clean energy investments in 2023 in LAC is not a result of much larger investments in fossil fuels. In fact, clean energy investments have been more than 1.5 times larger than upstream oil and gas investments since 2020 (Figure 1). Latin America is attracting less investment in its energy sector as a whole, with its share of global energy investment also declining.[xvii]

These investment trends in LAC’s energy sector seem misaligned with the region’s increasing investment needs for the energy transition. A better understanding of the size of investments required could help policymakers map and narrow the gap.

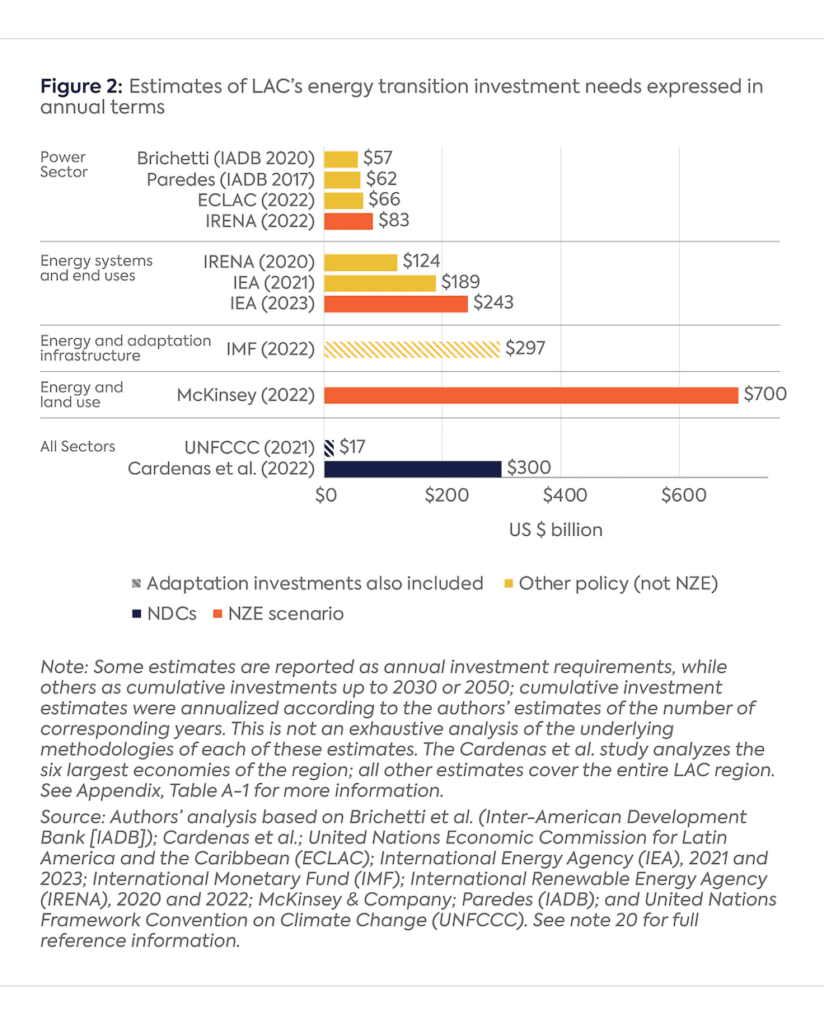

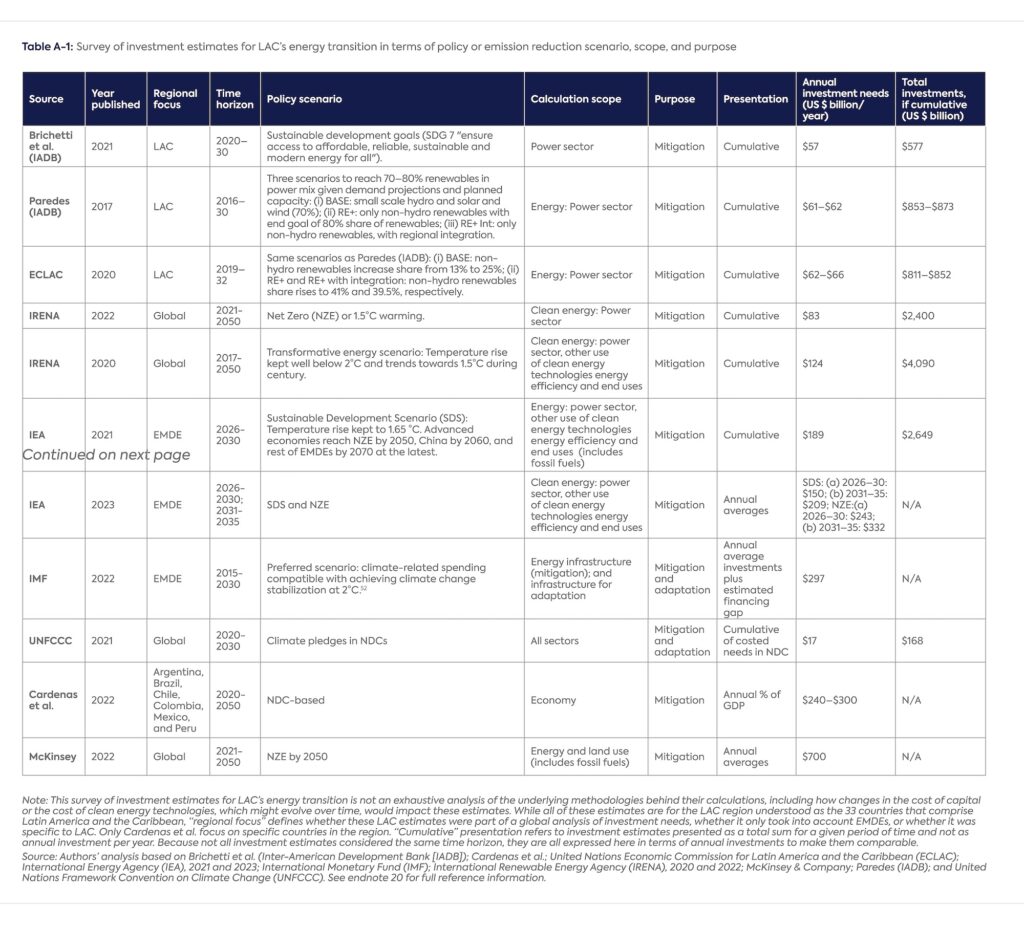

Estimates of annual investments required for LAC’s energy transition vary greatly (Figure 2 and Appendix, Table A-1), ranging from the United Nations Framework Convention on Climate Change’s (UNFCCC) $20 billion[xviii] to McKinsey & Company’s $700 billion.[xix] They differ in terms of scope (applicable sectors), policy or energy transition scenario, and purpose (whether investment is geared only to mitigation goals or both to mitigation and adaptation goals):

Note: Some estimates are reported as annual investment requirements, while others as cumulative investments up to 2030 or 2050; cumulative investment estimates were annualized according to the authors’ estimates of the number of corresponding years. This is not an exhaustive analysis of the underlying methodologies of each of these estimates. The Cardenas et al. study analyzes the six largest economies of the region; all other estimates cover the entire LAC region. See Appendix, Table A-1 for more information.

Source: Authors’ analysis based on Brichetti et al. (Inter-American Development Bank [IADB]); Cardenas et al.; United Nations Economic Commission for Latin America and the Caribbean (ECLAC); International Energy Agency (IEA), 2021 and 2023; International Monetary Fund (IMF); International Renewable Energy Agency (IRENA), 2020 and 2022; McKinsey & Company;Paredes (IADB); and United Nations Framework Convention on Climate Change (UNFCCC). See endnote 20 for full reference information.[xx]

The energy sector is responsible for about three-fourths of all global greenhouse gas (GHG) emissions.[xxi] This is why decarbonizing the world’s energy sector occupies a big place in discussions about climate action. But in Latin America, the energy sector accounts for only 55 percent of the region’s GHG emissions, with the power sector accounting for about 20 percent of LAC’s emissions in the energy sector.[xxii]

In the LAC region, renewable energy sources already represent, on average, about 60 percent of the power mix (compared to about 30 percent globally[xxiii]), with hydroelectricity making up about 40 percent of the region’s total generation capacity.[xxiv] Therefore, estimates that focus on investment needed to reduce emissions in the power sector, like those from the UN Economic Commission for Latin America and the Caribbean (ECLAC),[xxv] Brichetti et al. (Inter-American Development Bank [IADB]), and Paredes (IADB),[xxvi] arrive at lower estimates than those of the IEA[xxvii] or the International Renewable Energy Agency (IRENA) (2020) that consider the decarbonization of energy systems, including end uses (see Table A-1 in the appendix).[xxviii]

Brichetti et al. (IADB) estimate investment needs in LAC’s power sector to be 0.8 percent of GDP annually (close to $600 billion a year between 2020 and 2030) to be aligned with energy-related sustainable development goals. These goals seek to ensure universal access to affordable, reliable, and sustainable modern energy.[xxix] Even so, these investments might not necessarily align with Paris decarbonization goals. Another IADB study (Paredes 2017) estimates investment needs of $61 billion to $62 billion per year to decarbonize LAC’s power sector so that the share of renewables increases from 60 percent to 70–80 percent by 2030.[xxx] This estimate accounts for demand trends of almost 4 percent per year, or a 76 percent cumulative demand increase in the 2016–30 period, along with the stated investment plans of LAC countries for increases in generation capacity.[xxxi] An estimate by ECLAC based on IADB studies estimates similar annual investment needs, which would represent about 1 percent of LAC’s GDP.[xxxii] A more aggressive decarbonization scenario—consistent with NZE for the power sector—is presented by IRENA (2022), with estimates of more than $80 billion in annual investments for LAC in the 2021–50 period.[xxxiii]

The IEA (2021, 2023) and IRENA (2020) not only consider investment needs for transforming power generation into renewables and scaling networks and grids, but also incorporate the decarbonization of end uses such as transportation, heavy industry, and heating. Accounting for investment needs beyond the power sector is particularly relevant for LAC, because the transportation sector is responsible for 40 percent of CO2 emissions in the energy sector, and CO2 emissions from the industrial sector are comparable with those of power generation.[xxxiv]

While IRENA’s (2020) investment estimate for LAC of $124 billion annually (2017–50) and IEA’s (2021) estimate of $190 billion annually (2026–30) are not aligned with NZE, they do align with Paris Agreement–based decarbonization scenarios consistent with limiting the rise in global temperatures to well below 2°C by 2050 (see Table A-1).[xxxv] One of the main differences between IRENA (2020) and IEA (2021) is that the latter considers investments in fossil fuels for an orderly transition, not just renewable energy sources. A more recent estimate by the IEA (2023) that looks only at investments in clean energy in EMDEs for a transition to NZE puts investment needs in the region at more than $240 billion per year in the 2026–30 period, rising to more than $330 billion per year in the 2031–35 period for an average of $288 billion in the 2026–35 period.[xxxvi] To meet this required level of investment in clean energy in LAC, current investment would need to increase by a factor of almost five from its 2022 level of $66 billion.[xxxvii]

McKinsey’s $700 billion annual investment needs for LAC (2021–50) is by far the largest estimate, equivalent to 9 percent of the region’s GDP. McKinsey estimates that LAC will need to secure about 9 percent of global energy transition investments to be in line with NZE goals.[xxxviii] What sets McKinsey’s projection apart from others is that it not only incorporates investment needed for the energy transition in both the energy sector and its end uses (including the oil and gas sector), but also in agriculture, forestry, and other land use (AFOLU). The latter is a much larger source of emissions in LAC than in most other regions.

Some of the estimates reviewed here are based on LAC countries’ NDCs, which tackle investment needs for decarbonization in all sectors, including industry and AFOLU, not just energy and its end uses.

This is the case for the investments portrayed by the UNFCCC’s Standing Committee on Finance (SCF), which in its 2021 report identifies cumulative investment needs for LAC of $168 billion for 2020–30,[xxxix] or less than $20 billion annually (see Table A-1). If the NDCs tackle decarbonization efforts in all sectors, not only those specific to the energy sector, why are the investment needs shown by the UNFCCC dramatically lower than all others?

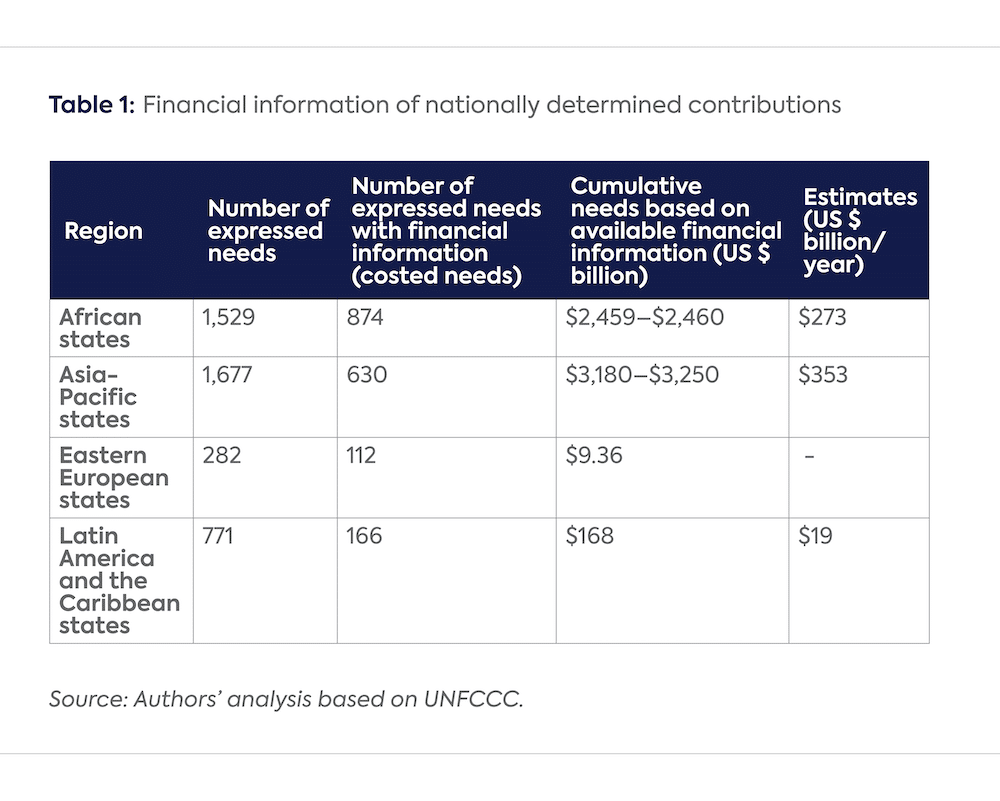

Because the UNFCCC’s SCF report (2021) reflects countries’ own NDCs, it includes only investment needs explicitly estimated by governments. According to the UNFCCC, only 22 percent of the expressed needs in LAC’s NDCs have financial information (i.e., are costed); the remaining 78 percent have no official cost estimates.[xl] As a comparison, African states have been able to provide financial information for about 57 percent of needs expressed in their NDCs, leading to required investment levels of $2.5 trillion in total, or about $270 billion annually (Table 1).

Lack of financial information in the region’s NDCs may be making it more difficult to mobilize climate finance—and thus meet climate pledges. Uncertainty about financial needs prevents governments from understanding the extent of the gap between current and required investments, and could hamper the design of policies to better mobilize financing to close those gaps. Countries have the prerogative to differentiate emission reductions that are contingent on securing financing and those that are unconditional.[xli] This differentiation underscores the importance of governments clearly listing their financing needs: enumerating needs can help countries and funders carve a path to achieving minimum climate goals and understand the external funding requirements for more ambitious ones. Working toward these higher contingent targets is particularly relevant because a number of LAC countries’ climate pledges are not aligned with NZE: of the 33 LAC countries, only 13 have incorporated net-zero pledges into policy documents or legislation.[xlii]

A report by the Independent Association of Latin America and the Caribbean (AILAC) presents an interesting example of the magnitude of LAC governments’ potential underestimations of the financial costs of their climate commitments. AILAC is a negotiating bloc of only eight countries (Chile, Colombia, Costa Rica, Guatemala, Honduras, Panama, Paraguay, and Peru) that make up about 21 percent of LAC’s regional GDP. AILAC estimated annual financial needs linked to their NDCs at $304 billion to 2030, or about $30 billion per year during the 2020–30 period.[xliii]

Similarly, a study by Cardenas and Orozco (2022) based on NDCs projected to 2050 placed the investment needs for decarbonization at an average of 6 percent of GDP, or about $240 billion to $300 billion per year for the six largest countries in Latin America.[xliv] However, even this substantial estimate for just a portion of the region does not include investments required for adaptation associated with climate change.

Some organizations have started to provide estimates of EMDEs’ infrastructure investment needs for climate change mitigation and adaptation. For example, in its Global Financial Stability Report, the International Monetary Fund (IMF) estimates the financing gap in mitigation and adaptation in EMDEs,[xlv] projecting the total level of investment for LAC at about $300 billion per year, or 4.5 percent of GDP annually.[xlvi] While the IMF estimates that almost 80 percent of LAC’s investment needs are for mitigation (including energy infrastructure and transportation), about $60 billion to $70 billion per year is assumed to be for adaptation, targeting water, sanitation, irrigation, and flood protection.

If mobilizing financing for the energy transition is challenging in EMDEs, it is even more difficult when it comes to financing adaptation. In its 2022 Adaptation Gap Report, the UN estimates that adaptation finance should be scaled 5 to 10 times from current (2022) levels to meet investment needs in EMDEs.[xlvii] Adaptation is an area where private sector financing is still very limited: in Latin America, the private sector represented only about 10 percent of total financing for adaptation needs in 2020, compared to 60 percent for mitigation.[xlviii]

One source of uncertainty about adaptation is associated with the pace of future emission reduction scenarios.[xlix] The slower the energy transition, the greater the investment required for adaptation. Cognizant of this dynamic, AILAC’s report estimates annual financing needs for adaptation surpassing those for mitigation in 2030–50.[l] Adaptation is also an area where LAC countries have yet to comprehensively quantify their investment needs in their NDCs and related documents.[li]

Estimates of the investment needs for LAC’s energy transition differ in terms of the sectors they cover (power sector, energy systems and end uses, energy and agriculture), the decarbonization objectives they support (alignment with NDCs, NZE scenarios, or others), and the purpose of investment (mitigation and/or adaptation), but they all point to considerable investment needs in the coming decades.

Noteworthy, however, is the difference between the investment needs enumerated in LAC’s NDCs and all other investment estimates. This discrepancy suggests that an immediate challenge for LAC governments may be reconciling their climate goals with a clear understanding of the investment needs associated with them, including accounting for needs associated with energy transition plans and adaptation. A better understanding of the investment needs associated with climate pledges could help governments not only measure the financial obstacles to achieving their energy transition and climate goals, but also mobilize financing more effectively.

Note: This survey of investment estimates for LAC’s energy transition is not an exhaustive analysis of the underlying methodologies behind their calculations, including how changes in the cost of capital or the cost of clean energy technologies, which might evolve over time, would impact these estimates. While all of these estimates are for the LAC region understood as the 33 countries that comprise Latin America and the Caribbean, “regional focus” defines whether these LAC estimates were part of a global analysis of investment needs, whether it only took into account EMDEs, or whether it was specific to LAC. Only Cardenas et al. focus on specific countries in the region. “Cumulative” presentation refers to investment estimates presented as a total sum for a given period of time and not as annual investment per year. Because not all investment estimates considered the same time horizon, they are all expressed here in terms of annual investments to make them comparable.

Source: Authors’ analysis based on Brichetti et al. (Inter-American Development Bank [IADB]); Cardenas et al.; United Nations Economic Commission for Latin America and the Caribbean (ECLAC); International Energy Agency (IEA), 2021 and 2023; International Monetary Fund (IMF); International Renewable Energy Agency (IRENA), 2020 and 2022; McKinsey & Company; Paredes (IADB); and United Nations Framework Convention on Climate Change (UNFCCC). See endnote 20 for full reference information.

[i] In World Energy Investment, the IEA provides “a full update on the investment picture in 2022 and an initial reading of the emerging picture for 2023.” International Energy Agency, World Energy Investment 2023, May 2023, 3,https://www.iea.org/reports/world-energy-investment-2023.

[ii] International Energy Agency, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies,” June 2023, https://www.iea.org/reports/scaling-up-private-finance-for-clean-energy-in-emerging-and-developing-economies.

[iii] According to the IEA, clean energy investments in EMDE (excluding China) was $262 billion in 2022. IEA, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies,”58.

[iv] According to UNCTAD, “developing countries need renewable energy investments of about $1.7 trillion annually but attracted foreign direct investment in clean energy worth only $544 billion in 2022.” See United Nations Conference on Trade and Development, “UNCTAD Calls for Urgent Support to Developing Countries to Attract Massive Investment in Clean Energy,” press release 2023/008, July 5, 2023, https://unctad.org/press-material/unctad-calls-urgent-support-developing-countries-attract-massive-investment-clean; and United Nations Conference on Trade and Development, World Investment Report 2023, July 2023, https://unctad.org/system/files/official-document/wir2023_en.pdf.

[v] The need to mobilize finance for EMDEs’ renewable energy investments and other sustainable development goals was at the center of the Summit for a New Global Financing Pact, held in Paris, June 22–23, 2023, https://nouveaupactefinancier.org/en.php.

[vi] See World Bank, “Scaling Up to Phase Down: Financing Energy Transition in Developing Countries,” April 2023, https://www.worldbank.org/en/topic/energy/publication/scaling-up-to-phase-down.

[vii] For analysis of the challenges and opportunities of financing the energy transition in emerging markets, see International Energy Agency, “Financing Clean Energy Transitions in Emerging and Developing Economies,” 2021, https://www.iea.org/reports/financing-clean-energy-transitions-in-emerging-and-developing-economies.

[viii] For an explanation of NDCs, see the United Nations Climate Change website: https://unfccc.int/process-and-meetings/the-paris-agreement/nationally-determined-contributions-ndcs.

[ix] UNCTAD, World Investment Report 2023, 14.

[x] See United Nations Framework Convention on Climate Change, “UNFCCC Standing Committee on Finance: First Report on the Determination of the Needs of Developing Country Parties Related to Implementing the Convention and the Paris Agreement,” 2021, https://unfccc.int/sites/default/files/resource/54307_2%20-%20UNFCCC%20First%20NDR%20technical%20report%20-%20web%20%28004%29.pdf.

[xi] IEA, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies.”

[xii] See McKinsey & Company, The Net-Zero Transition: Its Cost and Benefits, January 2022, https://www.mckinsey.com/capabilities/sustainability/our-insights/the-net-zero-transition-what-it-would-cost-what-it-could-bring.

[xiii] An important dynamic of the region’s renewable investments in Latin America is that more than 70% has come from domestic sources vs. almost 30% from foreign flows, underscoring the importance of domestic capital, but also the need to mobilize external flows. International Renewable Energy Agency, Global Landscape of Renewable Energy Finance, 2023, February 2023, 62, https://www.irena.org/ Publications/2023/Feb/Global-landscape-of-renewable-energy-finance-2023.

[xiv] IEA, World Energy Investment.

[xv] The IEA’s World Energy Investment includes Mexico as part of the North American region, Ibid.

[xvi] See BloombergNEF, Energy Transition Investment Trends 2023, January 2023, https://assets.bbhub.io/professional/sites/24/energy-transition-investment-trends-2023.pdf.

[xvii] According to the IEA, LAC represented about 4% of global energy investments and 3% of clean investments in the 2021–23 period, down from 5% and 4%, respectively in the 2016–20 period. IEA, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies.”

[xviii] UNFCCC, “UNFCCC Standing Committee on Finance.”

[xix] McKinsey, The Net-Zero Transition.

[xx] Juan Pablo Brichetti, Leonardo Mastronardi, Maria Eugenia Rivas, Tomás Seresbrisky, and Ben Solís, “The Infrastructure Gap in Latin America and the Caribbean: Investments Needed Through 2030 to Meet Sustainable Development Goals,” Inter-American Development Bank, 2021, https://publications.iadb.org/en/infrastructure-gap-latin-america-and-caribbean-investment-needed-through-2030-meet-sustainable; Mauricio Cardenas and Sebastian Orozco, “Climate Mitigation in Latin America and the Caribbean: A Primer on Transition Costs, Risks, and Financing,” Center on Global Energy Policy, October 2022, https://www.energypolicy.columbia.edu/research/report/climate-mitigation-latin-america-and-caribbean-primer-transition-costs-risks-and-financing; Economic Commission for Latin America and the Caribbean, “Construir un nuevo futuro: Una nueva recuperacion transformadora con igualdad y sostenibilidad,” October 2020, https://repositorio.cepal.org/bitstream/handle/11362/46227/S2000699_es.pdf?sequence=1&isAllowed=y; International Energy Agency, “Financing Clean Energy Transitions in Emerging and Developing Economies,” 2021, https://www.iea.org/reports/financing-clean-energy-transitions-in-emerging-and-developing-economies; International Energy Agency, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies,” June 2023, https://www.iea.org/reports/scaling-up-private-finance-for-clean-energy-in-emerging-and-developing-economies; International Monetary Fund, Global Financial Stability Report, October 2022, https://www.imf.org/en/Publications/GFSR/Issues/2022/10/11/global-financial-stability-report-october-2022; International Renewable Energy Agency, Global Renewables Outlook: Energy Transformation 2050, April 2020, https://www.irena.org/publications/2020/Apr/Global-Renewables-Outlook-2020; International Renewable Energy Agency, World Energy Transition Outlook: 1.5°C Pathway, March 2022, https://www.irena.org/publications/2022/mar/world-energy-transitions-outlook-2022; McKinsey & Company, The Net-Zero Transition: Its Cost and Benefits, January 2022, https://www.mckinsey.com/capabilities/sustainability/our-insights/the-net-zero-transition-what-it-would-cost-what-it-could-bring; Juan Paredes, “La Red del Futuro: Desarrollo de una red eléctrica limpia y sostenible para América Latina,” Inter-American Development Bank, December 2017, https://publications.iadb.org/es/la-red-del-futuro-desarrollo-de-una-red-electrica-limpia-y-sostenible-para-america-latina; United Nations Framework Convention on Climate Change, “UNFCCC Standing Committee on Finance: First Report on the Determination of the Needs of Developing Country Parties Related to Implementing the Convention and the Paris Agreement,” 2021, https://unfccc.int/sites/default/files/resource/54307_2%20-%20UNFCCC%20First%20NDR%20technical%20report%20-%20web%20%28004%29.pdf.

[xxi] According to the World Resource Institute, 75.6% of the world’s GHG emissions come from the energy sector. See https://www.wri.org/insights/4-charts-explain-greenhouse-gas-emissions-countries-and-sectors.

[xxii] UN Economic Commission for Latin America and the Caribbean, “Energy in Latin America and the Caribbean: Access, Renewability and Efficiency,” ECLAC Statistical Briefings, No. 5, May 2022, https://repositorio.cepal.org/server/api/core/bitstreams/cfde21e2-8d17-48f1-8f30-429984e09715/content.

[xxiii] These averages hide, for example, that non-fossil fuel power generation in Mexico represents less than 30% of total generation. See Luisa Palacios and Diego Rivera, “Mexico Has a Path to Meet Its Climate Pledges,” Americas Quarterly, March 20, 2023, https://americasquarterly.org/article/mexico-has-a-path-to-meet-its-climate-pledges.

[xxiv] See Organización Latinoamericana de Energía (OLADE) for LAC’s energy data: https://www.olade.org/.

[xxv] UN Economic Commission for Latin America and the Caribbean, “Building a New Future: Transformative Recovery with Equality and Sustainability,” October 2020, https://www.cepal.org/en/publications/46228-building-new-future-transformative-recovery-equality-and-sustainability.

[xxvi] Brichetti et al., “The Infrastructure Gap in Latin America and the Caribbean”; and Paredes, “La Red del Futuro.”

[xxvii] IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies.”

[xxviii] IRENA, Global Renewables Outlook.

[xxix] The bulk of these investments will go toward building new generation, transmission, and distribution infrastructure, but will also include maintenance costs of existing infrastructure and replacing obsolescent transmission and distribution assets to ensure reliability. See Brichetti et al., “The Infrastructure Gap in Latin America and the Caribbean.”

[xxx] The 2017 IADB study is not linked to a decarbonization scenario, but rather to a goal about the share of renewables in the power mix by 2030, in line with the “Renewables in Latin America and the Caribbean” (RELAC) initiative introduced in 2019. See website: https://hubenergia.org/en/relac.

[xxxi] See Paredes, “La Red del Futuro.”

[xxxii] ECLAC, jointly with OLADE, IRENA, and IADB. Building on IADB (2017), it considers the same three scenarios showing that a higher degree of regional interconnection yields lower investment needs. ECLAC, “Building a New Future,” 140.

[xxxiii] IRENA estimates a $2.4 trillion investment needs in renewable generation capacity alone in LAC to increase required capacity by a factor of 8 from 2020 levels to meet NZE. IRENA, World Energy Transition Outlook.

[xxxiv] According to OLADE’s statistical database, CO2 emissions from power generation in 2021 from LAC were responsible for 17% of emissions vs. 15% from industry. https://sielac.olade.org/default.aspx.

[xxxv] IRENA (2020) refers to this scenario as “transformative energy scenario,” andIEA (2021) calls this scenario “sustainable development scenario” (SDS). Both are consistent with limiting temperature rise to well below 2°C. IRENA, Global Renewables Outlook. Regional breakdowns were only available for IEA’s SDS. See IEA, “Financing Clean Energy Transitions in Emerging and Developing Economies,” 24.

[xxxvi] IEA, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies.”

[xxxvii] IEA, “Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies”; IEA, World Energy Investment.

[xxxviii] McKinsey, The Net-Zero Transition, 146.

[xxxix] UNFCCC, “UNFCCC Standing Committee on Finance.”

[xl] Ibid.

[xli] For example, if external financial support is secured, Mexico has committed to further reduce its GHG emissions by 40% by 2030 instead of its current target of 35%, which is unconditional on external financing. See UN Development Programme’s Mexico country website for a summary of the country’s climate commitments: https://climatepromise.undp.org/what-we-do/where-we-work/mexico.

[xlii] Climate Watch, accessed August 16, 2023, https://www.climatewatchdata.org/net-zero-tracker?locations=LAC.

[xliii] See Independent Association of Latin America and the Caribbean, “New Collective Quantified Goal on Climate Finance,” August 2022 https://www4.unfccc.int/sites/SubmissionsStaging/Documents/202208231116—AILAC%20submission%20on%20the%20new%20goal%20on%20finance_needs%20and%20priorities.pdf.

[xliv] Cardenas and Orozco present their findings in GDP terms. The dollar amount presented in this paper was provided by the authors. Cardenas and Orozco, “Climate Mitigation in Latin America and the Caribbean.”

[xlv] See the UN Environmental Program website for more on mitigation and adaptation activities: https://www.unep.org/explore-topics/climate-action/what-we-do/mitigation.

[xlvi] The IMF financial gap analysis is made for 2019 and 2020 without an explicit projection if these are also the levels of investment required annually by 2030 or 2050. IMF, Global Financial Stability Report.

[xlvii] The United Nations Environment Programme (UNEP) estimates annual adaptation investment needs for EMDEs equal to $160 billion to $340 billion by 2030 and $315 billion to $565 billion by 2050. See UNEP, Adaptation Gap Report 2022: Too Little, Too Slow – Climate Adaptation Failure Puts World at Risk, November 2022, https://www.unep.org/adaptation-gap-report-2022.

[xlviii] See Climate Policy Initiative, Global Landscape of Climate Finance 2021, December 2021, https://www.climatepolicyinitiative.org/wp-content/uploads/2021/10/Full-report-Global-Landscape-of-Climate-Finance-2021.pdf.

[xlix] See UNEP, Adaptation Gap Report 2022, chapter 3.

[l] AILAC, “New Collective Quantified Goal on Climate Finance,” 4.

[li] Estimates presented by UNEP suggests that annual adaptation financing needs for LAC could be as high as $62 billion per year in the 2021–30 period. See UNEP, Adaptation Gap Report 2022, 21.

On November 6, 2025, in the lead-up to the annual UN Conference of the Parties (COP30), the Center on Global Energy Policy (CGEP) at Columbia University SIPA convened a roundtable on project-based carbon credit markets (PCCMs) in São Paulo, Brazil—a country that both hosted this year’s COP and is well-positioned to shape the next phase of global carbon markets by leveraging its experience in nature-based solutions.

The fashion industry sits at the intersection of climate, energy, and consumption, facing growing pressure to cut emissions, transition to clean energy, and build circular systems across global supply chains.

Full report

Commentary by Luisa Palacios & Juan José Guzmán Ayala • September 28, 2023