Could a strategic lithium reserve kickstart US supply chain development?

NEW YORK -- A strategic lithium reserve is being mooted as a solution to stabilize volatile prices that have hindered American mining projects, allowi

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Fact Sheet by Noah Kaufman • December 20, 2024

This policy memo represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision.

Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners page. Rare cases of sponsored projects are clearly indicated.

This analysis was prepared by Center on Global Energy Policy (CGEP) scholars in response to inquiries from policymakers and stakeholders on the impacts of provisions that would ease the permitting process for oil and gas projects in the Energy Permitting Reform Act of 2024, a bipartisan bill introduced in the United States Senate. Congressional staff and others asked for analysis of the fossil fuel provisions’ environmental impacts, particularly how they could contribute to greenhouse gas emissions in the US. CGEP is a nonpartisan organization and takes no institutional positions.

A bipartisan permitting-reform proposal in the US Senate includes provisions that reduce barriers to an improved electricity transmission system, which would help fortify the country’s energy system and accelerate the transition away from fossil fuels. The permitting-reform proposal also includes provisions aimed at encouraging additional fossil fuel production, which has raised concerns about the associated greenhouse gas emissions.

This memo analyzes provisions of the proposal related to processes for two categories of fossil-fuels: liquefied natural gas (LNG) export approvals and oil and natural gas leasing and permitting. It concludes that these fossil fuel provisions would have small effects on domestic markets and smaller effects on global markets.

The Energy Permitting Reform Act of 2024’s (EPRA) electricity transmission provisions would likely make important strides toward achieving the nation’s decarbonization targets, and its fossil fuel provisions are unlikely to hinder progress toward national or global climate goals.

On July 22, 2024, United States Senators Joe Manchin (I-WV) and John Barrasso (R-WY), chairman and ranking member, respectively, of the Senate Energy and Natural Resources Committee, released bipartisan bill S.4753, the EPRA,with the stated goal[1] of strengthening American energy security by accelerating the permitting process for energy and mineral projects in the United States.

The EPRA includes provisions related to the judicial review process that enables federal actions to be challenged, the leasing and permitting process for energy-related projects, the LNG export approval process, the hydropower license extension process, and the electricity transmission permitting and planning process.

Today’s antiquated electricity transmission system is a barrier to at least three national policy priorities: (1) accelerating the deployment of clean energy to achieve climate goals, (2) maintaining American leadership in artificial intelligence and other energy-intensive industries, and (3) ensuring the affordability, reliability, and resilience of the electricity system.

A range of barriers hampers efforts to expand the US electricity transmission system, and the EPRA is not a silver bullet to address all of the constraints. However, the EPRA would take important steps to enable new transmission and thus clean energy. The EPRA establishes a standard definition of the benefits of transmission so that the costs of transmission projects can be allocated to customers in proportion to how much they benefit from the new transmission capacity. It gives the Federal Energy Regulatory Commission the authority to permit interregional transmission projects that are in the national interest. It also requires neighboring regions to create joint plans for interregional electricity transmission.

Despite the provisions to advance the country’s climate ambitions—encouraging not only transmission but also specific clean energy sources such as geothermal and offshore wind—climate-focused policymakers are understandably concerned about offsetting effects of provisions of the EPRA that encourage additional fossil fuel production. The remainder of this memo analyzes concerns about provisions on LNG export approvals and oil and gas leasing and permitting.

The effects of the EPRA on additional US oil and gas production and LNG exports are likely to be small, and the effects on the aggregate global supply of oil and gas even smaller. While the electricity transmission provisions of the EPRA would reduce important barriers to achieving the nation’s decarbonization goals, the fossil fuel provisions are unlikely to meaningfully hinder (or facilitate) efforts toward national or global climate goals.

To be sure, other concerns may be raised about the EPRA proposal that this memo does not address, including the effects on local pollution (which would likely be positive in some places and negative in others), the potential impacts of reliability provisions on Environmental Protection Agency regulatory authority, and the potential inequities of streamlining judicial review processes.

The EPRA would effectively end the Biden administration’s “pause” on approving new permits for LNG export projects. It sets a 90-day deadline for the secretary of energy to grant or deny LNG export applications following environmental reviews, with applications deemed approved if the secretary fails to meet the deadline. It would further require the secretary to base decisions on existing studies of economic and emissions outcomes, unless and until new studies are completed.

Critics of the EPRA say[2] these LNG provisions will increase greenhouse gas emissions significantly. They assume the provisions would lead to the approval of at least five large projects and then estimate the emissions that will come from these projects.

Streamlining the approval process timeline encourages more LNG infrastructure and output. However, for the LNG provisions of the EPRA to translate into significant additional LNG supply and greenhouse gas emissions, a series of assumptions are required that likely do not reflect the realities of domestic and global gas markets.

First, the argument assumes that additional LNG permits will only be granted if the EPRA is enacted. However, the Biden administration’s “pause” on permit approvals[3] is a temporary measure while federal agencies update analyses of the economic and environmental effects of additional LNG export capacity. Future administrations may approve permits if they are deemed to be in the national interest, regardless of whether or not the EPRA becomes law.

Second, it assumes that future LNG projects that are permitted will be built. However, only a few additional projects are likely to move forward. The market is at risk of being oversupplied[4] because so much LNG production capacity is already under construction. According to Goldman Sachs,[5] a 50 percent increase in global capacity is expected over the next five years. This increased capacity is more than sufficient to meet global demand for LNG in the next decade, according to the International Energy Agency (IEA).[6] Additional actions on climate change, increasingly cheap renewables and storage, and the continued use of low-cost coal in Asia[7] may reduce the global demand for LNG, according to the IEA, further exacerbating the oversupply in the global market.

Third, it assumes that any additional LNG projects that are permitted and built will simply add to the total future LNG projects that are built in the US. However, newly permitted projects may displace projects that are already permitted but may never get built. US LNG projects are already struggling[8] to sign end use buyers under long-term contracts, which are necessary for most US LNG projects to obtain multibillion-dollar financing for construction of liquefaction equipment, port facilities, and tanker capacity. Particularly if new permits are granted, projects with less than 50 percent of their design capacity currently under long-term contracts are unlikely to move forward.

Fourth, it assumes additional US LNG capacity will simply add to global LNG capacity. However, if additional LNG is needed to meet global demand, foreign producers can ramp up their supply. Qatar is the world’s low-cost LNG producer and possesses abundant additional supplies[9] and potential export capacity. Russia is also rapidly expanding[10] its LNG export capacity, despite Western sanctions aimed at constraining its ability to do so. The decisions of these state-owned producers, which will factor in US export capacity, will also determine global LNG supply levels.

These considerations suggest that the effects of the EPRA on additional US LNG exports are likely to be small, and the effects on aggregate global LNG supply even smaller.

Finally, to the extent the EPRA affects global LNG supplies, the effects on global greenhouse gas emissions are unclear. Emissions will increase or decrease depending on whether LNG displaces energy sources with more or less greenhouse gas emissions intensity, such as coal or zero-carbon energy sources. (For LNG to deliver substantial climate benefits versus coal, methane leaks would need to be mitigated[11] along the gas supply chain.)

Additional demand for LNG projects may also have an outsized impact on US natural gas prices, if domestic prices start to converge with the higher natural gas prices abroad (an issue the Department of Energy is currently analyzing). Constraining US natural gas exports would put downward pressure on domestic gas prices by curbing demand and by reducing global price linkages; lower gas prices would increase domestic greenhouse gas emissions if natural gas primarily displaces zero-carbon energy rather than coal or oil.

The EPRA includes several provisions aimed at encouraging increased production of oil and gas. It mandates certain acreage for annual offshore lease sales, lengthens the duration of drilling permits from three to four years, provides clarity on lease nominations and fees, and eliminates duplicative permit requirements for oil and gas production on non-federal land. In addition, the bill’s judicial review provisions expedite legal challenges to federal decisions on energy and mineral projects.

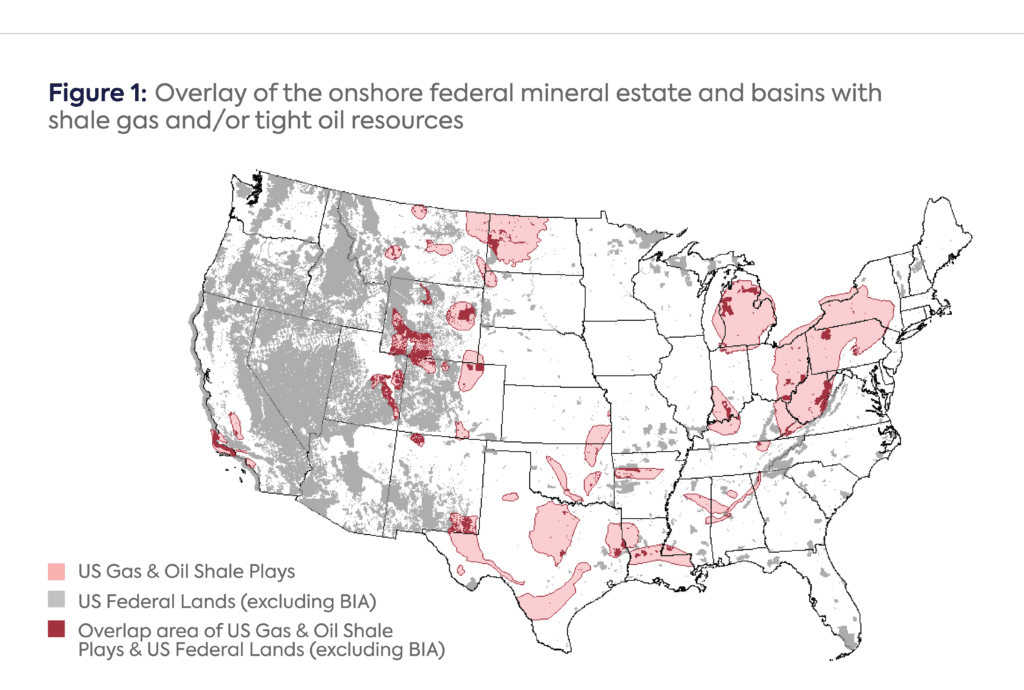

The EPRA only affects leases on federally controlled property. The US government controls a significant fraction of the land area of the United States and almost its entire offshore exclusive economic zone (see Figure 1). The growth of US oil and gas production over the last 15 years has been in shale gas and tight oil basins, primarily on private land, while offshore production of oil has been largely unchanged over this period.

Source: Testimony before the Subcommittee on Energy and Power, Committee on Energy and Commerce, 112th Cong. (2012) (statement of Adam Sieminski, Administrator, Energy Information Administration), https://www.eia.gov/pressroom/testimonies/sieminski_08022012.pdf.

Critics of the EPRA[12] worry that these provisions will translate into significant increases in domestic oil production. In reality, the effects of the EPRA on domestic oil production are likely to be modest for the following three reasons.

First, some of the mandated lease sales will occur regardless of whether the EPRA becomes law. For example, the proposal requires at least one offshore lease sale to be held from 2025 to 2029 in the Gulf of Mexico, with a minimum of 60 million acres in each sale. Under the Inflation Reduction Act, the government is already required to offer at least 60 million acres for sale prior to any year it offers an offshore wind lease sale. The Biden administration is already planning[13] offshore oil and gas lease sales in three of these years and the Trump administration may add additional sales.

Second, additional oil and gas lease sales from the EPRA are likely to result in a relatively small amount of production. Even when the government has offered very large acreages for lease sales, market demand has not exceeded[14] the amount already required by law. Indeed, in every year for the past dozen years (through the Obama, Trump, and Biden administrations), the amount of acreage leased to industry has been far below the amount of acreage offered for sale, even when the offered amount increased dramatically under the Trump administration. When some 12 million acres of federal land were made available for oil and gas leasing on attractive terms in 2017, for example, more than 90 percent of the land offered was not leased.

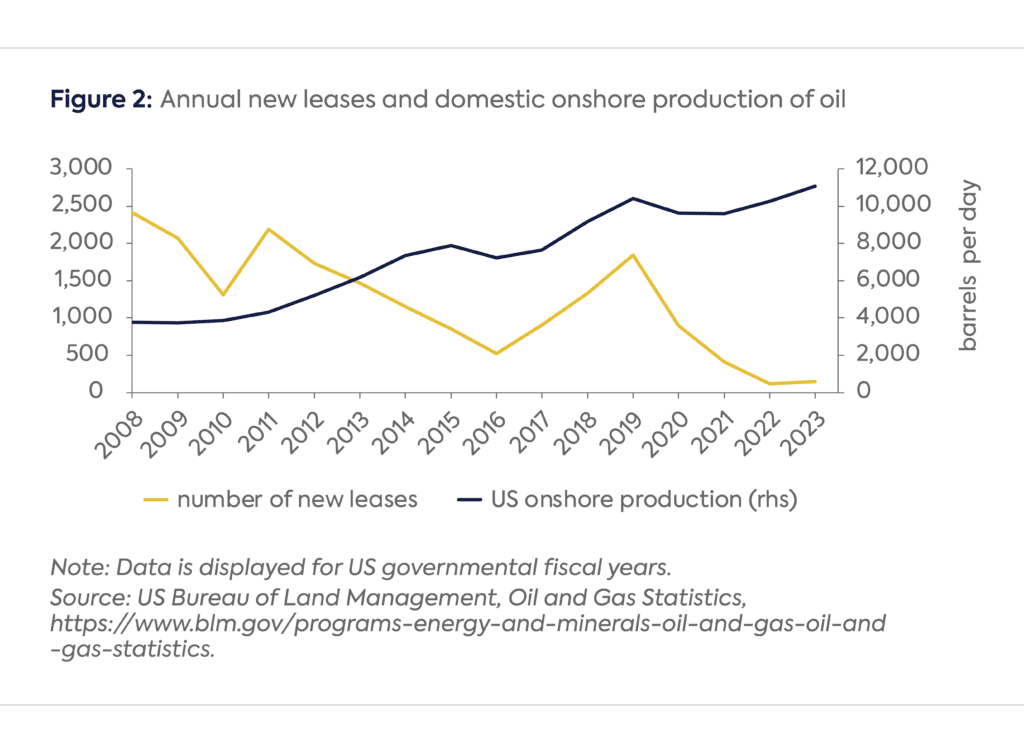

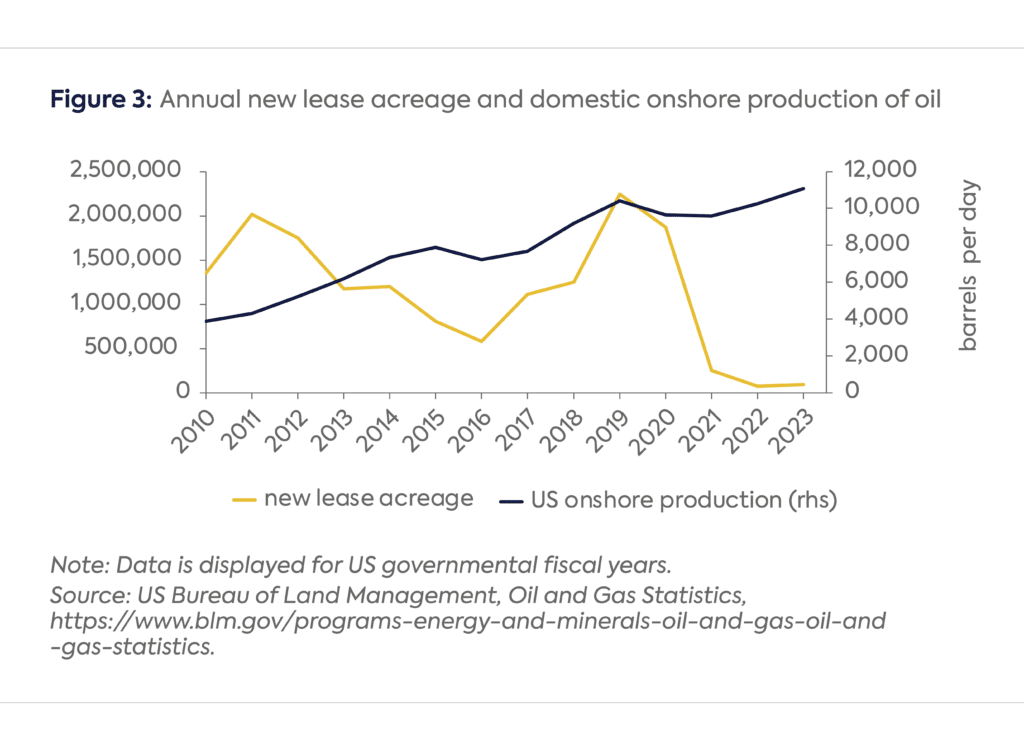

Third, federal leasing policy only minimally affects total domestic production. Figures 2 and 3 show that across the Obama, Trump, and Biden administrations, onshore US production (mostly from private lands) has continued to climb irrespective of swings in federal leasing policy, and has been driven mainly by oil prices. Most US oil and gas resources are on private or state lands that will be mostly unaffected by the EPRA. In places where federal lands and productive shale basins overlap, additional production on federal lands may substitute for production on private lands, just as the surge in oil production from shale in recent decades has halted projects in places like the Arctic.[15]

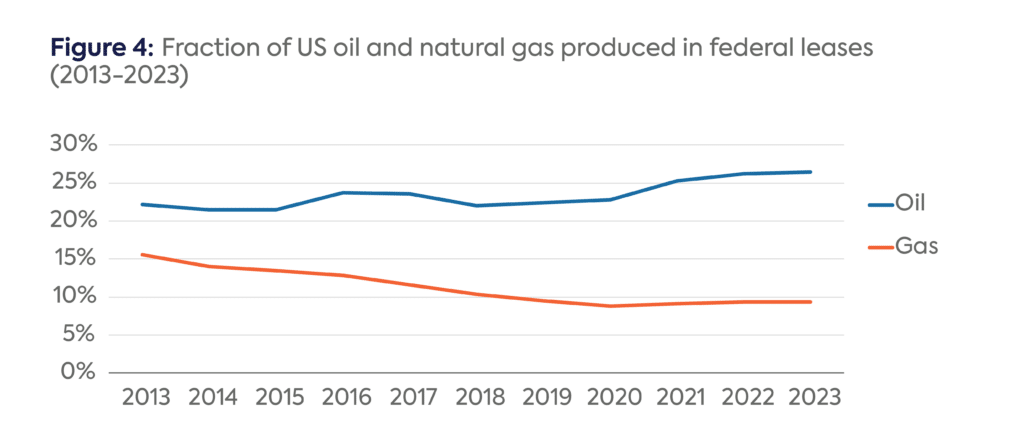

Despite these caveats, the EPRA is likely to increase domestic oil production by some small amount. It will encourage additional production from federal onshore and offshore leases, from which over one-quarter of total US production occurs (see Figure 4). A more predictable leasing environment could help to stabilize offshore Gulf of Mexico production after 2030, where new resources may be unlocked due to recent innovations in high-temperature and high-pressure drilling. That additional production will push prices lower, which leads to additional consumption and emissions, all else equal.

Sources: Department of Interior, Natural Resources Revenue Data, https://revenuedata.doi.gov/downloads/federal-sales/; EIA US crude oil and lease condensate production data, https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-petroleum-and-other-liquids-production; EIA US dry gas production data, https://www.eia.gov/dnav/ng/ng_prod_sum_a_EPG0_FPD_mmcf_m.htm.

But critics of the EPRA overstate the degree to which constraining US production would increase global prices and thus reduce global production and emissions. Changes in domestic oil supply are offset, to some extent, by changes in foreign production. Other nations currently possess the ability to increase their production levels, but they are restricting production to support higher prices. Saudi Arabia and other OPEC countries possess roughly 5 to 6 million barrels per day[16] of such so-called “spare capacity.” Over longer periods, further investments can increase production in many other countries, such as Brazil and Guyana. If the failure of the EPRA causes US production to be somewhat lower than it would have been otherwise, production is likely to increase in other countries in response.

In short, provisions of the EPRA on oil and gas leasing and permitting are likely to translate to small effects on total US production and even smaller effects on global production, as well as consumption and thus greenhouse gas emissions.

Critics of the EPRA highlight[17] the need for ambitious policies to accelerate the global transition away from fossil fuels. They praise provisions of the EPRA that will promote additional clean energy deployment. They conclude that “the inclusion of numerous provisions that expand the fossil fuel buildout in the United States completely undermines this otherwise worthwhile aim.” But this conclusion does not stand up to scrutiny.

To be sure, the world remains far off course[18] from its climate goals, particularly in the trajectory of emissions from oil and natural gas. Last year, global oil and natural gas production both increased to record levels,[19] while the production of these fuels will need to decrease dramatically to achieve net zero emissions[20] later this century. Transformational changes to energy systems and economies are needed.

For any policy change, policymakers should consider whether actions facilitate or hinder transformations to net zero pathways. Studies show[21] that inadequate transmission is a major barrier to accelerating the deployment of clean energy in the United States. Policies that enable improved electricity transmission systems, such as the EPRA, are widely recognized as important for facilitating net zero–consistent pathways.[22]

In contrast, the LNG and oil and gas provisions of the EPRA involve relatively small changes to leasing, permitting, and judicial review procedures. To be sure, that these effects are small does not make them irrelevant. After all, policies can create virtuous cycles with positive feedback loops—for example, widespread deployments of clean energy reduce their costs, enabling more deployments in the future. Other policies create vicious cycles, such as when a country abandons its climate policy ambitions and dampens global momentum to address climate risks.

However, it is difficult to imagine such virtuous or vicious cycles emanating from the fossil fuel provisions of the EPRA. Instead, the small effects on emissions are likely to be dwarfed by day-to-day and year-to-year fluctuations in oil and gas markets.

Critics of the EPRA say[23] that a comprehensive climate policy strategy must include policies that constrain the supply of US fossil fuels. This may be true. However, the need for supply-side climate policies does not mean that any action that discourages the supply of domestic production (such as the failure of the EPRA) will contribute to a comprehensive climate policy. The same aggressive, comprehensive, and thoughtful strategies to transition away from fossil fuels will be required regardless of whether the EPRA becomes law.

Finally, while the analysis of this memo points to the conclusion that the fossil fuel provisions of the EPRA would have a negligible effect on progress toward long-term climate goals, it does not enable an estimate of the incremental effects of the EPRA on greenhouse gas emissions. In fact, the emissions effects of the fossil fuel provisions of the EPRA are effectively unquantifiable, although the analysis in this memo suggests they are likely to be small. The effects on global markets and emissions depend on deep uncertainties, like the decisions of government officials in petrostates in response to minor changes in the global supply of oil and natural gas.

[1] https://www.energy.senate.gov/2024/7/manchin-barrasso-release-bipartisan-energy-permitting-reform-legislation

[2] https://x.com/dan_kammen/status/1844791614205477186

[3] https://www.whitehouse.gov/briefing-room/statements-releases/2024/01/26/fact-sheet-biden-harris-administration-announces-temporary-pause-on-pending-approvals-of-liquefied-natural-gas-exports/

[4] https://iea.blob.core.windows.net/assets/04f06925-a5f4-443d-8f1a-6daa31305aee/WorldEnergyOutlook2024.pdf

[5] https://www.goldmansachs.com/insights/articles/global-gas-market-to-grow-50–amid-energy-transformation

[6] https://iea.blob.core.windows.net/assets/04f06925-a5f4-443d-8f1a-6daa31305aee/WorldEnergyOutlook2024.pdf

[7] https://www.ciphernews.com/articles/in-southeast-asia-its-a-slow-road-to-phasing-out-coal/#:~:text=As%20aging%20coal%20plants%20are,last%2040%20to%2050%20years

[8] https://giignl.org/wp-content/uploads/_pda/2024/07/GIIGNL_2024-Annual-Report.pdf

[9] https://www.reuters.com/business/energy/qatars-new-lng-expansion-plans-squeeze-out-us-other-rivals-2024-02-27/#:~:text=Analysts%20estimate%20Qatar’s%20unit%20cost,cost%20or%20slipping%20behind%20schedule.

[10] https://www.energypolicy.columbia.edu/publications/russias-gas-export-strategy-adapting-to-the-new-reality/.

[11] https://www.energypolicy.columbia.edu/publications/house-select-committee-climate-crisis-cutting-methane-pollution-safeguarding-health-creating-jobs/

[12] https://x.com/dan_kammen/status/1844791614205477186

[13] https://www.reuters.com/business/energy/bidens-5-year-offshore-oil-plan-will-have-historically-low-lease-sales-no-sales-2023-09-28/

[14] https://blogs.law.columbia.edu/climatechange/2022/08/17/surprise-inflation-reduction-act-makes-oil-and-gas-development-on-federal-land-less-attractive/

[15] https://www.wsj.com/articles/shell-to-cease-oil-exploration-offshore-alaska-1443419673

[16] https://www.reuters.com/business/energy/factbox-opec-saudi-spare-oil-production-capacity-2024-01-30/

[17] https://x.com/dan_kammen/status/1844791614205477186

[18] https://wedocs.unep.org/bitstream/handle/20.500.11822/43922/EGR2023.pdf?sequence=3&isAllowed=y

[19] https://ourworldindata.org/grapher/natural-gas-production-by-region-terawatt-hours-twh

[20] https://iea.blob.core.windows.net/assets/f065ae5e-94ed-4fcb-8f17-8ceffde8bdd2/TheOilandGasIndustryinNetZeroTransitions.pdf

[21] https://repeatproject.org/docs/REPEAT_IRA_Transmission_2022-09-22.pdf; https://rmi.org/insight/the-electricity-transmission-and-greenhouse-gas-implications-of-the-epra-draft-legislation/

[22] https://www.iea.org/reports/world-energy-outlook-2024

[23] https://x.com/dan_kammen/status/1844791614205477186

The energy transition is not inevitable—but neither is business as usual.

The Trump administration is increasingly using equity investments as a tool of industrial policy to support domestic critical minerals supply chains.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

Full report

Fact Sheet by Noah Kaufman • December 20, 2024