China Halts U.S. LNG Imports Amid Tariff War

China has ceased importing liquefied natural gas from the United States since early February, as the ongoing tariff war impacts energy trade.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Luisa Palacios • November 15, 2021

This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at https://energypolicy.columbia.edu/about/partners. Rare cases of sponsored projects are clearly indicated.

The rise of ESG investing—investment focused on environmental stewardship, social responsibility, and corporate governance—in the 21st century has created significant pressures on oil companies. Some shareholders of international oil companies (IOCs) have pressed them to pay closer attention to ESG goals and diversify their business models away from hydrocarbons and into other sources of energy amid efforts to address greenhouse gas emissions.[1]

National oil companies (NOCs)—which currently control about 50 percent of the world’s oil production—have different corporate mandates than their IOC peers that might imply a more complicated relationship with ESG goals. NOCs are mainly owned by governments in the developing world, and thus face vastly different demands than IOCs answering to private sector shareholders.[2] But different does not mean NOCs do not or will not feel pressure to address ESG issues.

Given NOCs’ significant share of global oil production—and the fact that this share may increase as IOCs diversify—the pressures they face and changes they make could have a significant impact on the future of the oil and gas industry as well as countries’ abilities to meet climate goals. During the November 2021 COP 26 meetings in Glasgow, Saudi Arabia and India became the latest countries with strong NOCs to pledge to reach net-zero greenhouse gas emissions in the next decades.[3]

This commentary examines how the ESG agenda is impacting NOCs through the ecosystem of organizations and principles that have emerged from the UN’s Sustainable Development Goals and the Paris Agreement as well as from investors and regulators in global financial markets.

The piece then describes the three components of the ESG framework in relation to NOCs and the challenges of accurately measuring adherence to them due to insufficient standardization of metrics and the variety of reporting frameworks. Also, because environmental, social, and governance competence are not strictly related to one another, companies may be strong in some areas and weak in others, making it difficult to evaluate their ESG performance as a whole.[4] Finally, while ESG pressures are coming alongside discussions about the energy transition and climate change, ESG assessments do not evaluate companies’ energy transition plans, even if some aspects of ESG scores might provide insights about them.

The commentary pays special attention to the importance of corporate governance for national oil companies in achieving overall ESG goals, given the key differences between their ownership structure and that of private sector companies working in the oil industry.

Several areas of influence are converging to encourage NOCs to take ESG concerns seriously. First, a UN-led ESG ecosystem has emerged since the term ESG was first coined by the United Nations Environment Programme Finance Initiative in 2005. It has grown over the years into a complex web of organizations that is putting significant pressure on all actors, including NOCs and their shareholders, to improve their ESG performance.[5] This UN-led ESG ecosystem includes, for example, initiatives like the UN Global Compact, created in 2000 to garner pledges from nonfinancial corporates to uphold 10 principles around environmental responsibility, anticorruption practices, and labor and human rights. At least 16 NOCs are signatories to this compact.[6] Another initiative is the investor-led Principles for Responsible Investment, created in 2005 for asset managers and asset owners pledging to incorporate ESG principles into their investment decisions. Today, the principles are supported by 3,826 financial institutions from 80 countries, with about $120 trillion in assets under management.[7]

But it was not until a decade later that the ESG agenda received a decisive boost with the Paris Agreement in 2015 and commitments by governments to tackle climate change and reduce greenhouse gas emissions. This was followed the same year by the formal adoption by all UN member states of the United Nation’s 17 Sustainable Development Goals (SDGs), to be achieved by 2030. The SDGs refer to principles like climate action, affordable and clean energy, clean water and sanitation, respect for life on land and water, gender equality, peace, justice, and strong institutions. [8]

A second area of ESG influence involves financial institutions that have become signatories of the Principles for Responsible Investment. These investors have been putting pressure on IOCs and are starting to do the same with NOCs. Levers that investors are exercising with IOCs as shareholders might not be as strong and effective with NOCs, given government control over these companies’ boards. However, some of the largest NOCs issue bonds in international markets, and the need to access capital to finance their own capital investments and refinance their debt while also paying oil rents to governments represents a pressure point. Bondholders are starting to expect NOCs to be more ESG-compliant, and because these companies might be considered too big to fail, changes in their access to finance could have dire consequences for their countries.[9] Repercussions for less-compliant NOCs and their shareholder governments are also starting to emerge elsewhere in the financial world, one example being NOC removal from an ESG index.[10] The upshot might be that ESG considerations start to impact capital allocation and even divestment and investment decisions by NOCs.[11]

Third, pressures on the ESG performance of IOCs might in turn impact NOCs, particularly in the context of joint venture partnerships. This is because a focus on IOCs also means attention is being paid to the ESG performance of their non-operated assets. Non-operated assets are those in a joint venture partnership between IOCs with national oil companies in emerging markets in which IOCs are not the asset operators but have an equity position.[12] The International Energy Agency estimates that while IOCs directly own oil production of 10 million barrels per day, their equity stakes in producing fields mean they hold some level of influence over three times that amount.[13]

Fourth, some NOCs from emerging markets have listed minority shares in stock markets, including Saudi Aramco; Russia’s Rosneft and Gazprom; Brazil’s Petrobras; China’s Petrochina, Sinopec, and CNOOC; India’s ONGC; and Colombia’s Ecopetrol, among others. Publicly listed NOCs are responsible for about half of the oil produced by NOCs globally, and their combined oil production is approximately that of OPEC’s.

When NOCs list their shares in the stock market, they face the same reporting requirements as any other publicly listed company. Moreover, most of the NOCs that have decided to list their minority shares in their domestic stock markets have also done so in foreign markets. This means that heightened regulatory actions around ESG in global financial centers are likely to impact NOC reporting requirements in the same way they do IOCs’.

ESG disclosures and ratings have the potential to drive improvement in ESG performance by identifying the best in class and separating leaders from laggards. But the multitude of disclosure standards and divergence in how companies are graded on their ESG credentials has led to confusion about actual ESG performance.[14] Still, significant effort is being invested in identifying the ESG factors and metrics that are relevant[15] and material for each industry—meaning they can impact a company’s operating or financial performance.[16]

The relevant environmental metrics for integrated oil and gas companies, which fits with IOCs and the NOCs, by and large concentrate on the following topics: a company’s greenhouse gas (GHG) emissions, how it manages its toxic emissions and waste, water management, and impact on biodiversity and land use in the areas it operates.[17]

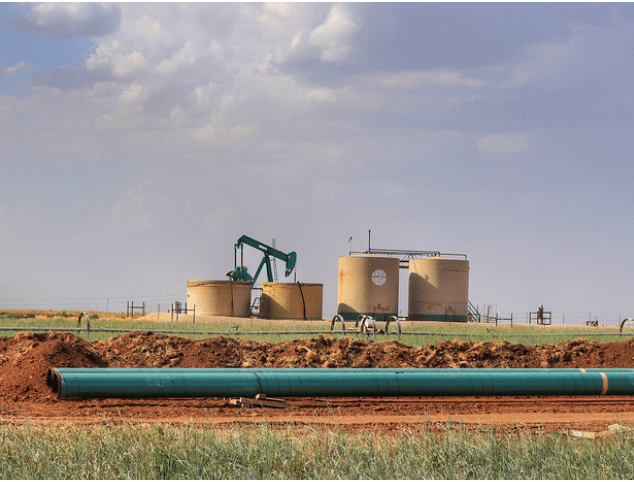

On GHG emissions, reporting involves quantitative metrics related to the carbon intensity of a company’s direct operations and methane emissions (scope 1 and 2 emissions), which are indeed a key focus of the climate change discussion. Pressures are mounting for disclosures on scope 3 emissions, which are generated indirectly across the entire value chain.[18]

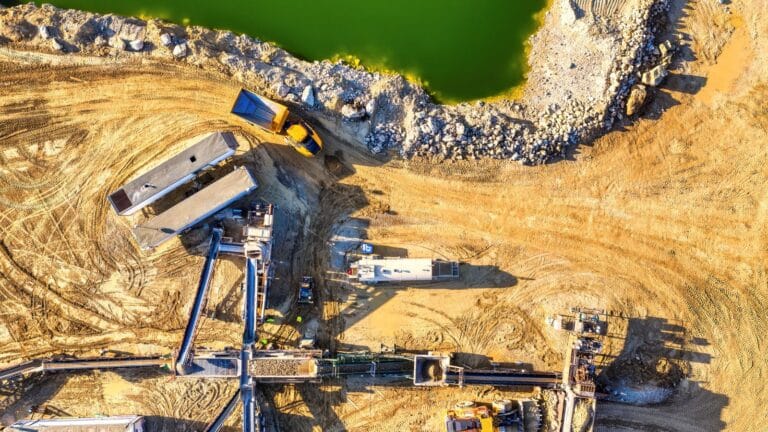

But the environmental component of ESG is also about the current management of environmental risks, such as water management,[19] toxic emissions, and waste management. These are of particular relevance to the oil industry because of the operational risks linked to spills, a release of pollutants, and mismanagement of industrial waste. Any such occurrences can result in large financial liabilities and have a significant impact on the communities where oil companies operate, causing very high reputational costs for IOCs and NOCs alike. On biodiversity and land use, the focus is on where oil and gas companies operate and their impact on the land, the ecosystem, and the wildlife in that area, as well as remedial and recovery actions by companies. This means that oil production near the Artic or rain forests could be more impacted by ESG-related concerns.

There have been many allegations of greenwashing in relation to environmental performance.[20] Some such criticisms identify the voluntary, unaudited, and self-reporting nature of ESG data.[21] Other possible shortcomings with environmental disclosures relate to the strength of the enforcement of environmental regulations and of regulatory agencies where the oil and gas production takes place,[22] as well as doubts about the accuracy of the data itself.[23]

Environmental scores also take into account the carbon intensity of the resource base of the production. While a company’s reduction of carbon intensity over time could be related to its energy transition strategies, the current carbon intensity metric more likely reflects a company’s resource endowment. For example, oil production from the Gulf nations could fare better than Canadian oil sands in some of the environmental metrics because of the inherent lower-carbon intensity of their oil production.[24]

The social component of the ESG agenda in the case of NOCs is a particularly complex category and less the subject of this commentary. But overall, social responsibility involves a company’s relations with its community as well as its labor management, which includes diversity and inclusion and a company’s health and safety record.[25] One aspect of the social dimension that is particularly relevant for an NOC in its management of environmental risks relates to the health, safety, and environment (HSE) of its workforce, as it reflects the company’s governance and compliance around operational risks. While HSE is part of the social responsibility of a company, it is also an indicator of a company’s corporate governance, a key aspect of the ESG agenda for NOCs.

Defining best in class from an ESG perspective can be a challenge within the oil and gas sector, with the multitude of players from different continents and their diverse ownership structures. The oil and gas sector comprises publicly listed companies from developed markets (e.g., Exxon, Chevron, Conoco, Total, BP, Shell), listed national oil companies from Europe (e.g., Equinor), national oil companies from emerging markets with listed minority shares in stock markets (e.g., Saudi Aramco, Rosneft, Petrobras, Gazprom, CNPC, Sinopec, ONGC, Ecopetrol, YPF, etc.), and NOCs that remain 100 percent government-owned but that issue debt in global financial markets (e.g., Pemex, Pertamina, Petronas, PDVSA).[26]

Some ESG rating agencies consider governance a foundational category for all industries.[27] But sound governance is essential for state-owned companies—especially national oil companies, given their particular ownership structure and their central role of economic importance in capturing and distributing oil rents.

Governance failures have become a growing financial material risk for investors.[28] In the context of increasing scrutiny over ESG metrics, the right governance structure is also seen as key to ensuring transparency, compliance, and veracity with the ESG corporate disclosures and metrics being requested by investors, rating agencies, and potentially regulators.[29]

Guidelines on best practices of state-owned companies in the extractive industries have been developed over the years by multilateral institutions, nongovernmental organizations (NGOs), and think tanks.[30] The ESG reporting and evaluations related to governance that are the most relevant to NOCs include:

A focus on these three elements can inform NOCs’ strategies for demonstrating effective governance in an increasingly ESG-centered business environment as well as investors wishing to gauge the quality of governance for a particular NOC.

Silvia Andrade, a master’s candidate in sustainability management at Columbia University and a research assistant at the Center on Global Energy Policy, provided research assistance for this commentary.

[1] Derek Browser, “ExxonMobil shareholders hand board seats to activist nominees,” The Financial Times, May 26, 2021, https://www.ft.com/content/da6dec6a-6c58-427f-a012-9c1efb71fddf.

[2] Øystein Noreng, The Oil Business and the State: National Energy Companies and Government Ownership (Abingdon, Oxon; New York, NY : Routledge, 2022).

[3] Yousef Saba, Saeed Azhar, and Marwa Rashad, “Top Oil Exporter Saudi Arabia Targets Net Zero Emissions By 2060” Reuters, October 24, 2021, https://www.reuters.com/business/cop/saudi-arabia-worlds-biggest-oil-exporter-unveil-green-goals-2021-10-23/https://www.ft.com/content/073563e1-157b-4023-ab37-7487bab83360.

[4] For example, in a study about ESG investing, the OECD finds a low correlation between the E score and the ESG score, which underscores that high-scoring ESG does not mean better management of carbon emissions or risk management with respect to climate change. See R. Boffo, C. Marshall, and R. Patalano, “ESG Investing: Environmental Pillar Scoring and Reporting”, OECD Paris, 2020, www.oecd.org/finance/esg-investing-environmental-pillar-scoring-and-reporting.pdf.

[5] The term ESG was used in this report, which sought to establish the legal basis for the integration of environmental, social, and governance issues into the investment framework of financial institutions: United Nations Environment Programme Finance Initiative, A Legal Framework for the integration of environmental, Social and Governance Issues into Institutional Investment, October 2005, https://www.unepfi.org/fileadmin/documents/freshfields_legal_resp_20051123.pdf.

[6] Some of the signatories include: Equinor, Oil India, ONGC, Petrobras, Sinopec, YPF, Empresa Nacional de Petroleo (ENAP), Petrochina, CNOOC, Ecopetrol, Rosneft, PTT Public Company Limited, Thai Oil Public Company Limited, Petroleum Development Oman, Pertamina, and Entreprise Tunisienne d’Activites Petrolieres.

[7] For an account of the number of signatories and assets under management, see https://www.unpri.org/pri/about-the-pri.

[8] For a comprehensive review of the UN’s 17 Sustainable Development Goals, see: https://sdgs.un.org/2030agenda.

[9] David Manley, David Mihalyi, and Patrick R. P. Heller, “Hidden Giants,” Finance and Development 56, no 4 (December 2019), https://www.imf.org/external/pubs/ft/fandd/2019/12/national-oil-companies-need-more-transparency-manley.htm.

[10] Rodrigo Campos, A. Ananthalakshmi, Bernadette Christina Munthe, “JPMorgan to exclude Petronas, Pertamina from EM ESG index,” Reuters, June 16, 2021, https://www.nasdaq.com/articles/jpmorgan-to-exclude-petronas-pertamina-from-em-esg-index-2021-06-15.

[11] Mauricio Cardenas and Luisa Palacios, “National Oil Companies and the Energy Transition: Ecopetrol’s Acquisition of an Electricity Transmission Company,” Columbia University’s Center on Global Energy Policy, August 13, 2021, https://www.energypolicy.columbia.edu/research/commentary/national-oil-companies-and-energy-transition-ecopetrols-acquisition-electric-transmission-company.

[12] “Emission Omission: A shareholder engagement guide to uncovering climate risks from non-operated assets in the oil and gas industry,” EDF and Rockefeller Asset Management, October 2020, https://business.edf.org/files/Emission-Omission-Final_10.12.20.pdf.

[13] “The Oil and Gas Industry in Energy Transitions,” IEA, January 2020, https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions.

[14] For a discussion on divergence of ESG ratings, see: Florian Berg, Julian Kölbel, and Roberto Rigobon, “Aggregate Confusion: The Divergence of ESG Ratings,” May 17, 2020, https://ssrn.com/abstract=3438533.

[15] For an explanation of the connection between oil and gas sector activities and their impact on the goals of the 2030 agenda for sustainable development, see the Global Reporting Institute’s ESG reporting guide for the oil and gas sector: GRI 11: Oil and Gas Sector 2021 (page 12), https://www.globalreporting.org/standards/standards-development/sector-standard-project-for-oil-and-gas/.

[16] For a map outlining the materiality of ESG metrics across different industries according to SASB, one of the ESG reporting firms, see: https://materiality.sasb.org/.

[17] For an example of the environmental metrics that go into an ESG rating, see MSCI ESG Industry Materiality Map: https://www.msci.com/our-solutions/esg-investing/esg-ratings/materiality-map.

[18] Amena Sayid, “Oil and Gas Companies Under Pressure to Manage Scope 3 Emissions,” IHS Markit, June 22, 2021, https://ihsmarkit.com/research-analysis/oil-gas-companies-under-pressure…

[19] Water usage, intensity, recycling, discharge, and treatment are part of the metrics that are becoming available for NOCs and IOCs. They can be of particular interests for oil and gas operations like shale that depend on hydraulic fracking. See the SASB Materiality Map for a full description of the water management metrics, https://materiality.sasb.org/.

[20] See, for example, Josh Eisenfeld, “Oil & Gas Companies Can’t Greenwash the Climate Crisis Away” Earthworks Blog, November 2020, https://earthworks.org/blog/oil-gas-companies-cant-greenwash-the-climate….

[21] “Can Universal ESG Standards Eliminate Greenwashing?” Oxford Business Group, September 2, 2021, https://oxfordbusinessgroup.com/news/can-universal-esg-standards-elimina… Ellen Pei-yi Yu, Bac Van Luu, and Catherine Huirong Chen, “Greenwashing in environmental, social and governance disclosures” Research in International Business and Finance 52 (April 2020): 101192, https://doi.org/10.1016/j.ribaf.2020.101192.

[22] “Environmental Laws Impeded by Lack of Enforcement, First-ever Global Assessment Finds”, IISD, January 2019, https://sdg.iisd.org/news/environmental-laws-impeded-by-lack-of-enforcement-first-ever-global-assessment-finds/.

[23] Chris Mooney et al., “Countries’ climate pledges built on flawed data, Post investigation finds,” The Washington Post, November 7, 2021, https://www.washingtonpost.com/climate-environment/interactive/2021/greenhouse-gas-emissions-pledges-data/.

[24] Mohammad S. Masnadi et al., “Global carbon intensity of crude oil production,” Science 361, no. 6405 (August 31, 2018): 851–853, https://www.science.org/doi/10.1126/science.aar6859.

[25] “What is the ‘S’ in ESG?” S&P Global, February 24, 2020, https://www.spglobal.com/en/research-insights/articles/what-is-the-s-in-esg.

[26] There remains a large contingent of NOCs that do not publish ESG reports or provide very little information about their financials. These NOCs, which fall out of the scope of this analysis, underscore the ESG divergence that exists in this industry.

[27] ”ESG Risk Ratings – Methodology Abstract,” Sustainalytics, Version 2.1, January 2021, https://connect.sustainalytics.com/hubfs/INV/Methodology/Sustainalytics_ESG%20Ratings_Methodology%20Abstract.pdf.

[28] Credit rating agencies are moving to look more systematically at how corporate governance risks could impact credit ratings. See, for example, “Governance and Credit Ratings,” Fitch Ratings, May 2021, https://www.fitchratings.com/research/corporate-finance/governance-credit-ratings-25-05-2021https://www.spglobal.com/marketintelligence/en/news-insights/blog/the-evolution-of-esg-factors-in-credit-risk-assessment-corporate-governance.

[29] For example, the Task Force on Climate Related Disclosures, the framework that is being used by many companies and regulators to guide climate related disclosures, states in its recommendation that the governance processes for climate disclosures would be similar to those used for existing public financial disclosures and would likely involve review by the chief financial officer and audit committee. See, “Recommendation of the Task Force on Climate-Related Financial Disclosures,” Financial Stability Board, June 2017, https://www.fsb.org/2017/06/recommendations-of-the-task-force-on-climate-related-financial-disclosures-2/.

[30] See, for example, OECD Guidelines on Corporate Governance of State-Owned Enterprises, 2015 Edition, chapter IV (OECD Publishing, Paris); “Guide to Extractive Sector State-owned Enterprises Disclosures,” National Resource Governance Institute, January 2018, https://resourcegovernance.org/analysis-tools/publications/guide-to-extractive-sector-state-owned-enterprise-disclosures.

[31]For example, the National Resource Governance Institute states that “in the highest performing NOCs in our survey, professional, independent management and boards, not politicians, make key business decision … this reduces the risk of capture by narrow political interests.” See, Patrick R. P. Heller, Paasha Mahdavi, and Johannes Schreuder, “Reforming National Oil Companies: Nine Recommendations,” The National Resource Governance Institute, July 2014, https://resourcegovernance.org/sites/default/files/documents/nrgi_9recs_eng_v3.pdf.

[32] See, for example, the recommendations on equitable treatment of shareholders in OECD Guidelines on Corporate Governance of State-Owned Enterprises, 2015 Edition, chapter IV (OECD Publishing, Paris).

[33] “Sustainability reporting guidance for the oil and gas industry,” IPIECA, March 2020, https://www.ipieca.org/our-work/sustainability/performance-reporting/sustainability-reporting-guidance/.

[34] GRI 11: Oil and Gas Sector 2021, Global Sustainability Standards Board, October 2021, https://www.globalreporting.org/standards/standards-development/sector-standard-project-for-oil-and-gas/.

[35] See the Extractive Industry Transparency Initiative guidelines for financial reporting and auditing in extractive industries: EITI Guidance Note #24, July 2016, https://eiti.org/document/guidance-note-eiti-requirement-24.

The Just Energy Transition Partnership (JETP) framework[1] was designed to help accelerate the energy transition in emerging market and developing economies (EMDEs) while embedding socioeconomic[2] considerations into its planning and implementation.

This analysis provides an overview of changes in production and economic outcomes in US oil and gas regions, grouping them by recent trends and examining their impact on local economies.

Full report

Commentary by Luisa Palacios • November 15, 2021