Hormuz threat ‘hasn’t dampened demand for Gulf LNG’

Gulf LNG exports are likely to keep attracting customers despite the lingering threat that Iran might close the Hormuz Strait, analysts say

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Anne-Sophie Corbeau & Tatiana Mitrova • February 21, 2024

This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated.

Unlike Russian crude oil exports, which in 2023 exceeded the volumes of 2021,[i] Russia’s natural gas exports have dwindled by an estimated 42 percent since 2021,[ii] the year before the country invaded Ukraine. Most of this decline involved pipeline gas supplies to Europe (-120 billion cubic meters [bcm]). While Russian gas production has dropped in response, the country remains the largest holder of proven gas reserves and is still the second-largest gross gas exporter in the world, after the US. After a year of adapting to the shocking reduction in gas exports to Europe, Russia’s ambitions to remain a significant gas market player have not dimmed. It is gradually (and quietly) reshaping its gas strategy based on two expansion pillars: liquefied natural gas (LNG) and pipeline gas exports to key non-EU consumers (Turkey, China, and former Soviet Union [FSU] countries).

The first pillar looks increasingly challenged by recent US sanctions as well as new attempts from EU countries to ban Russian gas imports, notably LNG, faster than anticipated in the region’s REPowerEU plan tackling dependency on Russian fossil fuels.[iii] Meanwhile, the second pillar relies largely on new consumers’ willingness to become more dependent on Russia.

In this commentary, the authors explore how Russia’s export strategy has evolved over the past year in the face of mounting adversity and what it means for the world.

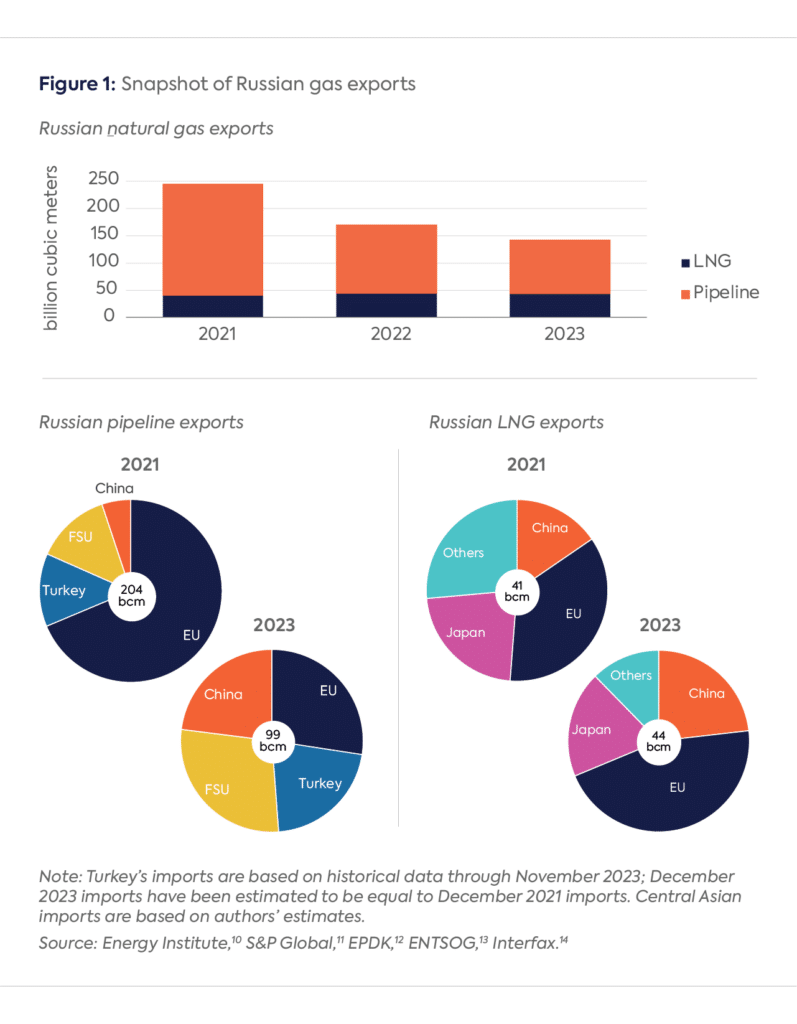

In 2023, Russia exported an estimated 142 bcm of gas, down sharply from around 244 bcm in 2021. This included about 99 bcm of pipeline gas to Europe, FSU countries, and China, and around 44 bcm of LNG globally (see Figure 1). Exports to Europe (including Turkey) still account for slightly under half of Russian gas exports. Following the start of the war in Ukraine and the cuts by Russia to EU countries,[iv] Russia’s pipeline exports to the EU collapsed from 140 bcm in 2021 to 63 bcm in 2022 and around 27 bcm in 2023. Those to Turkey dwindled from 26 bcm in 2021 to 22 bcm in 2022 and an estimated 21 bcm in 2023, due to lower Turkish gas consumption in 2022 but also to higher prices in new contracts being linked to the European TTF price benchmark.[v] In contrast, exports to both China and FSU countries have been rising. Exports to China have been driven by the contractual ramp-up of Power of Siberia 1 pipeline supplies from 10 bcm in 2021[vi] to an estimated 22.7 bcm in 2023. Exports to FSU countries have been buoyed by new Azerbaijan imports starting in late 2022 (1 billion cubic meters per year [bcm/y] through 2023) and Uzbekistan imports in late 2023, to deal with winter energy shortages.[vii]

Russian LNG exports, however, have remained relatively stable, hovering between 41 and 45 bcm/y between 2021 and 2023, with heavy maintenance at the Sakhalin-2 and Yamal LNG liquefaction plants last year.[viii] Around half of this LNG is exported to EU countries, a trend that has been increasing since 2021. China’s LNG imports have increased slightly as well. In contrast, Japan decreased its Russian LNG imports in 2023 (in line with lower LNG demand).[ix]

Sources: Energy Institute[x], S&P Global[xi], EPDK[xii], ENTSOG[xiii], Interfax[xiv].

Note: Turkey’s imports are based on historical data through November 2023; December 2023 imports have been estimated to be equal to December 2021 imports. Central Asian imports are based on authors’ estimates.

West-Oriented Pipeline Exports (EU and Turkey)

For six decades, the bulk of Russia’s pipeline gas exports were directed to the West. Now Russian pipeline gas exports to EU countries look extremely challenged, given the European Commission’s target to stop these imports by 2027 and the uncertainty regarding when and how the war with Ukraine will end. This target year is highly achievable given EU countries’ level of pipeline gas imports in 2023 (27 bcm, an 81 percent decline from 2021). Currently, Russian gas is transported to European markets via two pathways: Ukraine and one string of the TurkStream offshore pipeline. A Ukrainian transit agreement allowing Russian gas to pass through Ukraine looks unlikely to be extended at the end of 2024,[xv] although some ad hoc supplies based on short-term bookings could not be excluded. This leaves the 15.75 bcm/y string of the TurkStream pipeline as the main artery for Russian gas to European countries. Hungary, Austria, and Serbia, among others, may choose to continue importing some Russian pipeline gas beyond 2027, but that may eventually be undermined by new EU methane regulations that will apply maximum methane intensity values by 2030.[xvi]

Turkey has maintained good relations with Russia and is likely to remain the main Western market for Russian pipeline gas, despite its current struggles with related debt and payments. In 2021, Gazprom renegotiated its contracts with BOTAŞ to include a spot indexation, making them very expensive compared to previous oil-indexed contracts given the increase in spot prices observed in 2022 and 2023.[xvii] Several media sources reported that BOTAŞ’ debt soared during those two years due to the combination of increased supply costs and subsidies of sales to the domestic market; however, BOTAŞ denied that it owes Gazprom $27.5 billion.[xviii] The question is whether Russian gas would stay in Turkey or be transferred to Europe, given Turkey’s seeming ambition to become a hub and the potential opportunity to whitewash Russian gas.[xix] Turkey also possesses a significant import overcapacity, which could allow it to serve its own needs while transiting gas to EU countries.[xx] But this ability is limited by the capacity of the existing direct Russian pipelines (Blue Stream and the second string of TurkStream) at 31.75 bcm/y, while construction of any new offshore pipelines from Russia to Turkey seems highly unlikely given the sanctions environment and lack of necessary technologies. In any case, EU countries would be unlikely to welcome Russian gas transiting through Turkey, even if proving its origin would be complicated (for example, if Turkey created a blend of gas supplies from various sources).[xxi] A deal signed in January 2023 between Bulgargaz and BOTAŞ raised similar concerns about opening the door to Russian gas (as well as potential competition issues).[xxii]

East-Oriented Pipeline Exports

Russia began trying to pivot to the East in 2004, but encountered a decade of unsuccessful negotiations with China. Construction of the first Asia-oriented pipeline—the 38 bcm/y Power of Siberia—started only after Russia’s annexation of Crimea in 2014, when the geopolitical context had changed and Gazprom found it expedient to sign a deal with China as quickly as possible. The pipeline was completed in 2019. Its export volume was 22.7 bcm in 2023, and is expected to reach full capacity by 2025.[xxiii] A contract between Gazprom and China National Petroleum Corporation (CNPC) for the Far Eastern Route for an additional 10 bcm/y for 25 years was signed in February 2022, right before the invasion of Ukraine.[xxiv] Gazprom, however, is facing problems with production levels from the resource base in Sakhalin and might not reach the projected capacity before 2030, though the official start of deliveries is scheduled in 2027.[xxv]

The biggest prospective stake in the future of Russia’s pipeline gas exports is the 50 bcm/y Power of Siberia 2 pipeline project. Despite efforts from the Russian side to speed up the deal, no substantial progress was made during the past two years and the needed offtake (buyer) agreement with China is still missing. Meanwhile, Gazprom has completed the project’s feasibility study and design phase, and it seems Russia may take the highly unusual and risky step of starting the pipeline’s construction without a Chinese contractual commitment.[xxvi] According to Russian deputy prime minister Victoria Abramchenko, construction of the Mongolian section of the pipeline (Soyuz-Vostok) may commence as early as the first half of 2024. The pipeline could come online this decade and ramp progressively to capacity—similar to Power of Siberia 1—and possibly reach 15 bcm/y by 2030 and 50 bcm/y by 2035.

Even if the Power of Siberia 2 pipeline is completed and China agrees to buy the full Russian export capacity of 98 bcm/y by 2035, revenues are unlikely to match EU revenues because volumes and pricing terms will likely be much lower.[xxvii]

Russia has also been in talks for many years about construction of a gas pipeline to India and Pakistan, and Russian minister of energy Nikolay Shulginov said in early 2023 that the country has not ruled out the possibility of joining the TAPI (Turkmenistan, Afghanistan, Pakistan, and India) gas pipeline project.[xxviii] The pipeline has struggled to get momentum for decades, however; the economics of these deliveries appear doubtful, and the region it would cross, particularly Afghanistan and Baluchistan, is considered unstable.

In 2023, Iran and Russia agreed on gas swap deliveries, which involve a mutual offsetting of supplies for export to third parties, and the establishment of a joint gas hub (central pricing/trading point). Russian deputy prime minister Alexander Novak stated that, for the initial stage, an annual volume of 10 bcm of gas is being considered. He also implied that Russia would supply gas to northern Iran and that Iran could supply gas extracted from its southern fields to Pakistan and India through another potential pipeline project, the Iran-Pakistan-Indian pipeline—even though the Pakistani and Indian sections have yet to be financed and built.[xxix]

These plans may currently appear unrealistic, but Russia’s negotiations around them have intensified since the start of the war in Ukraine.

Former Soviet Union–Oriented Pipeline Exports

Facing a sharp decline in gas exports, Russia has also turned to markets in the former Soviet republics, supplies to which have grown since 2022. Russia signed a gas supply contract with Azerbaijan in November 2022, but EU concerns about whether Azerbaijan was importing Russian gas in order to export more gas to EU countries[xxx] led to the non-extension of the deal in 2023. However, both countries have agreed to restart supplies in 2024.[xxxi]

In December 2022, Russian president Vladimir Putin proposed a Trilateral Gas Union with Kazakhstan and Uzbekistan. Though the initial reaction of these Central Asian countries was skeptical, their severe seasonal gas deficits and political dependency on Russia forced them to finally accept the proposal.[xxxii]Uzbekistan agreed to import 2.8 bcm/y of Russian gas starting in October 2023, while Kazakhstan committed to providing gas transit through its territory and assessing potential demand for Russian gas supplies in its domestic market.[xxxiii] The three countries are also discussing potential transit of Russian gas to China through their territory, but this project would depend on the willingness of Chinese companies to receive these additional volumes. In all, it seems 30–40 bcm/y of traditional gas exports to FSU countries remain Russia’s captured market.[xxxiv]

Russia launched its first LNG exports in 2009 with the Sakhalin-2 project. Currently, LNG exports from four existing LNG plants (large-scale Sakhalin-2 and Yamal LNG and medium-scale Cryogas-Vysotsk and Portovaya LNG) account for around 41 bcm/y of LNG export capacity.[xxxv] As of early 2024, no sanctions have been applied on existing Russian LNG by its traditional importers—the EU, Japan, and Korea—though some European countries, such as the UK and Lithuania, have stopped importing Russian LNG since the invasion of Ukraine.[xxxvi] The US did ban Russian LNG in March 2022.[xxxvii]

EU imports of Russian LNG have actually risen since the start of the war in Ukraine (as shown in Figure 1). EU officials increasingly discussed halting LNG imports from Russia throughout 2023, but there was no concrete action leading to an actual drop in Russian LNG imports. Spanish minister Teresa Ribera asked Spanish companies in March 2023 not to sign new contracts to buy Russian LNG and said two months later that the EU would ban Russian LNG sooner rather than later, but admitted in September 2023 that the EU had no immediate plan to stop these imports.[xxxviii] The Netherlands has banned Russian LNG from arriving into its new floating LNG terminal at Eemshaven along with transshipment activities and new contracts for Russian LNG, but has not been able to cancel existing long-term contracts.[xxxix]

Full storage levels and lower gas prices at the end of 2023 seem to be pushing EU countries to take increased action. The European Council indicated in December 2023 that a new regulation on natural gas and hydrogen would contain provisions allowing member states to restrict supplies of Russian natural gas while taking security of supply and diversification objectives into account. As the regulation won’t be fully adopted before spring 2024, countries importing Russian LNG (notably France, Spain, and Belgium) will have some time to find alternatives. When significant additional LNG export capacity starts coming online in 2025 onward,[xl] a ban on Russian LNG by key importers looks increasingly likely as European buyers would have alternatives. Russian LNG would also face EU methane rules, which will start affecting exporters in 2027 onward by applying monitoring, reporting, and verification measures as well as maximum methane intensity values by 2030. These developments will likely force Russia, especially Novatek—the country’s largest LNG producer—to find an alternative home for its supplies.

Despite these headwinds, Russia plans to expand LNG export capacity with new projects, including:

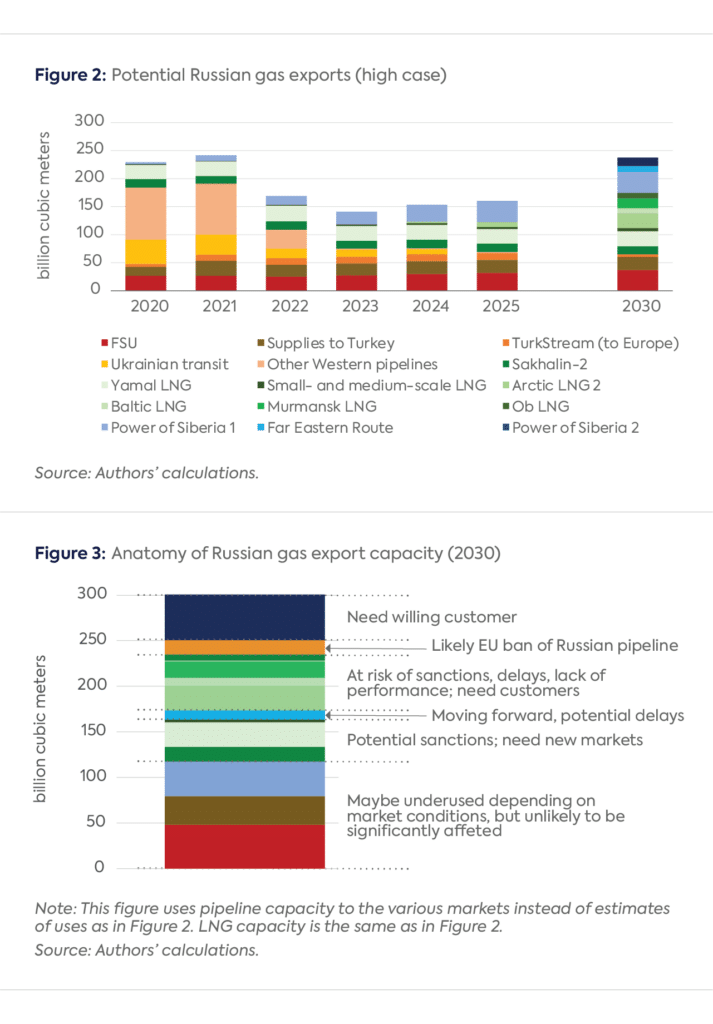

Together, these new Russian LNG projects would add around 80 bcm/y of LNG export capacity on top of the existing 41 bcm/y, but the most optimistic case would have around 60 bcm/y online by 2030 (Arctic LNG 2, one train at Ust-Luga, two trains at Murmansk, and Ob LNG).

Despite the country’s current expectations of a growth trajectory for LNG, serious global challenges could prevent or slow the Russian LNG buildout and complicate future LNG sales.

Hurdles to LNG Expansion

Four types of challenges confront Russia’s plans to expand LNG export capacity: restricted access to Western liquefaction technology, US sanctions on Russian entities, logistical issues related to shipping, and the need to find buyers for the additional output. All these challenges could prevent or slow the Russian LNG buildout and complicate future LNG sales.

Western sanctions are restricting Russian LNG players’ access to Western LNG technology, especially liquefaction technology. (Western companies continued to supply the Arctic LNG 2 project after the sanctions were put in place to execute previously signed contracts, but that practice has become more and more challenging due to the sanction risk.[xlvii]) The Russian gas industry expects that these sanctions are here to stay, so Russia’s new gas export strategy assumes that LNG projects will need to rely on domestic technologies. Novatek has its own small-scale liquefaction technology called Arctic Cascade that has been working on Train 4 of Yamal LNG since 2021,[xlviii] and recently obtained a patent for a proprietary technology called Arctic Mix for large-scale LNG trains (6 or more million metric tons per annum [mtpa]).[xlix] This Arctic Mix technology may be utilized not only for Novatek’s projects (Murmansk LNG, Ob LNG) but also for those of RusChemAlliance, a joint venture between Gazprom and RusGazDobycha that is implementing a gas processing complex project in Ust-Luga, in the Leningrad Region (including construction of the 13 mtpa Ust-Luga LNG plant).[l] However, the fact that Yamal Train 4 was delayed by more than a year, and that Novatek CEO Leonid Mikhelson admitted dissatisfaction with the work of Russian suppliers, raises doubts about whether some of this new technology will perform comparably to Western standards.[li] Another technical hurdle is that only 4 of 21 required gas turbines for the Arctic LNG 2 project were delivered by Baker Hughes before the first round of sanctions took place.[lii] Novatek is looking at replacing these with Chinese electric turbines, but Arctic LNG 2 output could be constrained in the short term.

US authorities seem very intent on decreasing Russia’s oil and gas revenues.[liii] The US government appears especially determined to curtail projects that would sustain Russia’s energy export capacity into the future, such as new LNG projects. A case in point is sanctions against Arctic LNG 2 issued by the US Department of State in coordination with the Department of Treasury on November 2, 2023.[liv] Arctic LNG 2 was added to the Specially Designated Nationals (SDN) List, which bars all US banks, companies, and individuals from doing any business with the Russian entity. The State Department also imposed sanctions in December 2023 against three companies involved in the Ust-Luga LNG project. Interestingly, the US has not yet sanctioned existing LNG projects, perhaps based on the understanding that they were needed to ensure the market balance until 2026, when, as noted, enough alternative LNG capacity is expected. If that is the case, when markets do rebalance, the US could move to sanction existing LNG projects.

On December 21, 2023, a month and a half after the sanctions were imposed, Novatek issued force majeure notifications to Arctic LNG 2’s LNG buyers. On December 25, the four foreign stakeholders in the project (TotalEnergies, China National Offshore Oil Corporation [CNOOC], CNPC, and a consortium between Japan’s Mitsui and the Japan Organization for Metals and Energy Security [JOGMEC]—each owning 10 percent of the project) also declared force majeure on their participation in the project, relinquishing their responsibilities to finance the project and fulfill offtake contracts.[lv] One obstacle to this US strategy is that some offtakers of Russian LNG, notably Chinese companies, may not want to give up on their investments and their contracted LNG. It is possible that Chinese companies will not abandon the project unless the US explicitly threatens secondary sanctions, which it has not yet done. Both CNPC and CNOOC have indeed asked the US government for exemptions from sanctions on Arctic LNG 2.[lvi] Additionally, Chinese foreign ministry spokesperson Mao Ning said on December 26 that no third party should interfere in economic cooperation between China and Russia.[lvii]

Logistics are even more challenging than liquefaction: the inclusion of Arctic LNG 2 in the US Treasury Department’s SDN List will further complicate the project’s logistical scheme, as it will require the engagement of a separate fleet of LNG tankers. Meanwhile, sanctions against Arctic Transshipment LLC, the operator of transshipment facilities at Murmansk and Kamchatka, complicate transshipment activities.[lviii] Novatek had planned to start navigating the Northern Sea Route year round starting in 2024.[lix] Novatek and Gazprom had successfully travelled through this route in June 2021 and September 2023, respectively.[lx] Being able to reach Asian markets more directly through that route may prove crucial if LNG imports from the EU stop, but would require a significant fleet of LNG carriers with icebreaking capabilities (such as the Arc7 LNG carriers currently serving Yamal LNG). Construction of these new LNG tankers had been moving ahead in South Korea and Russia,[lxi] but with the new sanctions and new LNG projects their number is insufficient. Of the 15 LNG carriers for Arctic LNG 2 ordered by Novatek from Samsung Heavy Industry in 2019, only 3 have been delivered and another 2 are under construction; the remaining 10 may never be delivered due to sanctions on payment processing.[lxii]

The solution could again come from China, which in recent years has contracted to build its largest-ever number of new LNG tankers, positioning itself in coming years as an alternative to South Korean shipyards, which currently dominate the LNG ship construction space.[lxiii] Russia turning to China for these tankers could be a reasonable assumption considering the participation of Chinese companies in the Arctic LNG 2 project.

With a forthcoming wave of new global LNG projects and growing questions about whether more LNG export capacity is needed beyond that,[lxiv] additional LNG supplies from Russia would be a hard sell in Europe, which, as discussed, (apart from Turkey) may ban Russian LNG when there is enough supply from other countries. Russia’s LNG would instead most likely end up in energy-hungry emerging market and developing economies. If Russia cannot find traditional buyers for its new LNG supply, it could choose to use it as a geopolitical tool with Global South nations, gaining political allies by offering affordable LNG to countries that otherwise have found the energy source out of reach due to volatile prices. With cheap feed gas, domestic liquefaction technology, low taxes (LNG has zero export duty compared to a 30 percent export duty on pipeline gas, and specific LNG projects enjoy additional tax breaks and incentives),[lxv] and a Chinese shipping fleet and perhaps insurance, Russian LNG can be price-competitive in these markets. It could mark the evolution of a new market segment operating under a different framework: with long-term contracts (under intergovernmental agreements), non-dollar and non-transparent payments, and non-Western shipping services. Russia could also provide an integrated LNG-to-power offer, which would secure LNG demand volumes and predictable prices both for Russia and for these countries. But the US could threaten importers from existing and new Russian LNG projects with secondary sanctions, which would both limit Russian LNG revenues and remove competition from its own LNG projects.

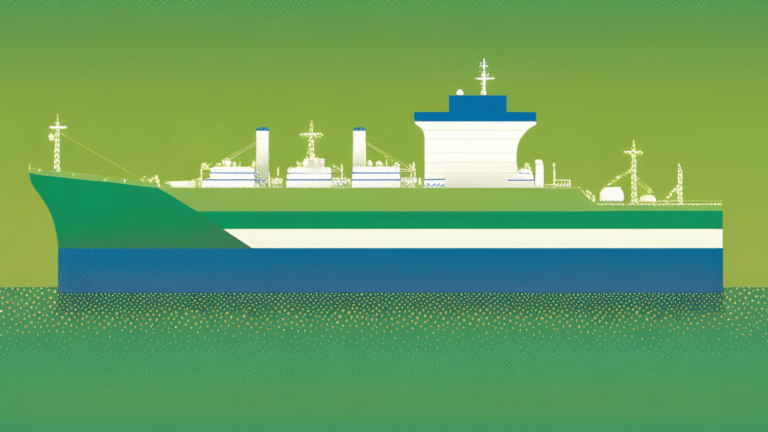

Based on the analysis above, it seems possible that by 2030 Russia could restore its presence and influence on global gas markets (Figure 2). However, beyond existing pipeline capacity targeting the FSU countries, China, and Turkey (around 118 bcm/y, but delivering around 100 bcm/y) and the likely rerouting of existing LNG flows (around 45 bcm/y), a significant part of this export capacity (around 135 bcm/y) faces various risks in terms of bans, sanctions, delays, satisfactory technical completion, logistical LNG shipping constraints, and the willingness of the main consumer (China) to contract more pipeline gas (Figure 3).

Tough competition also exists between Russian gas companies (Gazprom vs. Novatek vs. Rosneft), and Novatek is definitely leading the country’s LNG industry growth. The company is targeting Asian markets with its new projects, and Russian LNG may wind up competing against new Russian pipeline gas in an already over-contracted China.

A high degree of uncertainty is associated with Russia’s export strategy amid its ongoing war in Ukraine and Western sanctions. But even if Russia’s gas export volumes were to return to pre-war levels, revenues from gas and LNG exports are not likely to reach their prior levels—due to both a less favorable price landscape after 2026, when higher global volumes are expected to come onto the market, and higher transaction costs due to longer, more expensive routes. Lower margins will also result from the sanctions along with the lower profitability of the new Russian target markets, such as emerging markets. By 2030, Russian gas export revenues might fall by 55–80 percent compared to 2022, a year of record-high revenues for the Russian gas industry, at $165 billion.[lxvi]

But gas, unlike oil, has never been a key contributor to the Russian state’s budget revenues, and its exports have been more about geopolitics.[lxvii] The financial change will likely be more painful for specific gas companies. Gazprom in particular—which has already suffered a major blow from the export reduction and production drop—must finance massive new pipeline projects to countries such as China that are likely to pay less than EU consumers, and simultaneously faces an increasing tax burden.[lxviii] With LNG becoming a bigger driver of new Russian gas exports, the comparative power of rival gas companies (Gazprom, Novatek, and Rosneft) is clearly moving toward Novatek, with the potential challenge of Russian LNG competing against new Russian pipeline gas in China.

[i] Michael Kern, “Russia Says Its Oil Exports Rose by 7% in 2023 Compared to 2021,” OilPrice.com, December 21, 2023, https://oilprice.com/Latest-Energy-News/World-News/Russia-Says-Its-Oil-Exports-Rose-By-7-in-2023-Compared-to-2021.html.

[ii] Energy Institute, 2023 Statistical Review of World Energy, July 2023, https://www.energyinst.org/statistical-review; S&P Global, “LNG: Fundamentals and Outlooks,” accessed January 12, 2024, https://plattsconnect.spglobal.com/; EPDK, “Monthly Sector Report,” https://www.epdk.gov.tr/Detay/Icerik/3-0-95/dogal-gazaylik-sektor-raporu; European Network of Transmission System Operators for Gas, “Transparency Platform,” accessed January 12, 2024, https://transparency.entsog.eu/#/map; “Gazprom’s Exports to China Rose 61% in 7M,” Interfax, August 1, 2022, https://interfax.com/newsroom/top-stories/81826/; “Gazprom Exports to China in 2023 Will Exceed 22.5 bcm, Despite 22 bcm Contractual Obligation,” Interfax, December 28, 2023, https://interfax.com/newsroom/top-stories/98088/.

[iii] European Council, “Gas Package: Council and Parliament Reach Deal on Future Hydrogen and Gas Market,” press release, December 8, 2023, https://www.consilium.europa.eu/en/press/press-releases/2023/12/08/gas-package-council-and-parliament-reach-deal-on-future-hydrogen-and-gas-market/.

[iv] Anne-Sophie Corbeau, “A Divide and Rule Game: Will Russian Gas Supplies to Europe Be Cut?,” Center on Global Energy Policy, Columbia University, August 4, 2022, https://www.energypolicy.columbia.edu/publications/divide-and-rule-game-will-russian-gas-supplies-europe-be-cut/.

[v] Ilham Shaban, “Turkey Extended Contracts for Gas Imports from Russia,” Caspian Barrel, January 5, 2022, https://caspianbarrel.org/en/2022/01/turkey-extended-contracts-for-gas-imports-from-russia/; Aura Sabadus and Benjamin Schmidt, “Russian Gas by Any Other Name,” Center for European Policy Analysis, June 26, 2023, https://cepa.org/article/russian-gas-by-any-other-name/.

[vi] Ziwei Zhang, Shangyou Nie, and Erica Downs, “Inside China’s 2023 Natural Gas Development Report,” Energy Explained, Center on Global Energy Policy, Columbia University, September 11, 2023, https://www.energypolicy.columbia.edu/inside-chinas-2023-natural-gas-development-report/.

[vii] Bruce Pannier, “Central Asia in Focus: Russia Starts Shipping Gas to Uzbekistan,” Radio Free Europe, October 11, 2023, https://pressroom.rferl.org/a/32633417.html; European Parliament, “Increased Gas Exports from Russia to Azerbaijan,” November 28, 2022, https://www.europarl.europa.eu/doceo/document/P-9-2022-003854_EN.html.

[viii] “The Ministry of Energy Believes that LNG Exports from the Russian Federation in 2023 Will Remain at the Level of 2022,” Interfax, November 1, 2023, https://www.interfax.ru/business/928724.

[ix] Based on Japanese companies’ oil-indexed long-term contracts with Sakhalin-2.

[x] Energy Institute, 2023 Statistical Review of World Energy.

[xi] S&P Global, “LNG: Fundamentals and Outlooks,” accessed January 12, 2024.

[xii] EPDK, “Monthly Sector Report.”

[xiii] ENTSOG, “Transparency Platform,” accessed January 12, 2024.

[xiv] “Gazprom’s Exports to China Rose 61% in 7M,” Interfax; “Gazprom Exports to China in 2023 Will Exceed 22.5 bcm, Despite 22 bcm Contractual Obligation,” Interfax.

[xv] Anne-Sophie Corbeau and Tatiana Mitrova, “Will the Ukrainian Gas Transit Contract Continue Beyond 2024?,” Energy Explained, Center on Global Energy Policy, Columbia University, June 8, 2023, https://www.energypolicy.columbia.edu/will-the-ukrainian-gas-transit-contract-continue-beyond-2024/.

[xvi] Robert Kleinberg, Tim Boersma, and Anne-Sophie Corbeau, “How New European Rules Advance the Global Methane Pledge,” Energy Explained, Center on Global Energy Policy, Columbia University, November 21, 2023, https://www.energypolicy.columbia.edu/how-new-european-rules-advance-the-global-methane-pledge/.

[xvii] Gulmira Rzeyeva, “Turkey’s Supply-Demand Balance and Renewal of its LTCs,” Oxford Institute for Energy Studies, April 2022, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2022/04/Insight-113-Turkeys-supply-demand-balance-and-renewal-of-its-LTCs.pdf.

[xviii] Agata Łoskot-Strachota and Adam Michalski, “Turkey’s Dream of a Hub. Ankara’s Wartime Gas Policy,” OSW Centre for Eastern Studies, March 10, 2023, https://www.osw.waw.pl/en/publikacje/osw-commentary/2023-03-10/turkeys-dream-a-hub-ankaras-wartime-gas-policy; “Turkey Defers $600 Million Russian Energy Payment Under Deal –Sources,” Reuters, May 10, 2023, https://www.reuters.com/business/energy/turkey-defers-600-mln-russian-energy-payment-sources-2023-05-10/; Akil Nazli, “Turkey’s Botas Denies Debt Owed to Gazprom Stands at $27.5bn,” Intellinews, October 18, 2023, https://www.intellinews.com/turkey-s-botas-denies-debt-owed-to-gazprom-stands-at-27-5bn-297412/.

[xix] Aura Sabadus, “The Sour Scent of Russian Gas Leaks Into European Politics,” Center for European Policy Analysis, November 30, 2023, https://cepa.org/article/the-sour-scent-of-russian-gas-leaks-into-european-politics/.

[xx] International Energy Agency, “Turkey 2021—Energy Policy Review,” March 2021, https://iea.blob.core.windows.net/assets/cc499a7b-b72a-466c-88de-d792a9daff44/Turkey_2021_Energy_Policy_Review.pdf.

[xxi] Łoskot-Strachota and Michalski, “Turkey’s Dream of a Hub. Ankara’s Wartime Gas Policy.”

[xxii] Victor Jack and Gabriel Gavin, “Bulgaria-Turkey Deal Opens the Door for Russian Gas,” Politico, August 25, 2023, https://www.politico.eu/article/bulgaria-turkey-gas-deal-russia-imports-competition-ukraine-war/.

[xxiii] Milena Kostereva, “Новак: Россия нарастит поставки газа в Китай до 100 млрд куб. м в год” (“Novak: Russia Will Increase Gas Supplies to China up to 100 bcm/yr”), Kommersant, November 22, 2023, https://www.kommersant.ru/doc/6351582; “Gazprom Exports to China in 2023 Will Exceed 22.5 bcm, Despite 22 bcm Contractual Obligation,” Interfax.

[xxiv] “China, Russia Agree to Build Pipeline Section in Far East: Report,” Global Times, November 2, 2023, https://www.globaltimes.cn/page/202311/1301125.shtml.

[xxv] “Gazprom Exports to China in 2023 Will Exceed 22.5 bcm, Despite 22 bcm Contractual Obligation,” Interfax.

[xxvi] “Газопровод в Монголии могут начать строить уже в 2024 году” (“Gas Pipeline Construction in Mongolia May Begin as Early as 2024”), OilCapital, October 24, 2023, https://oilcapital.ru/news/2023-10-24/gazoprovod-v-mongolii-mogut-nachat-stroit-uzhe-v-2024-godu-3079188.

[xxvii] Sergey Vakulenko, “What Russia’s First Gas Pipeline to China Reveals about a Planned Second One,” Carnegie Endowment for International Peace, April 18, 2023, https://carnegieendowment.org/politika/89552.

[xxviii] “Россия может присоединиться к проекту газопровода ТАПИ” (“Russia May Join the TAPI Gas Pipeline Project”), TASS, January 19, 2023, https://tass.ru/ekonomika/16840041.

[xxix] Sergey Tikhonov, “Почему России нужен газопровод из Ирана в Индию” (“Why Russia Needs a Gas Pipeline from Iran to India”), Rossiyskaya Gazeta, August 20, 2023, https://rg.ru/2023/08/08/pochemu-rossii-nuzhen-gazoprovod-iz-irana-v-indiiu.html.

[xxx] David O’Byrne, “Azerbaijan’s Russian Gas Deal Raises Uncomfortable Questions for Europe,” Eurasianet, November 22, 2022, https://eurasianet.org/azerbaijans-russian-gas-deal-raises-uncomfortable-questions-for-europe.

[xxxi] Elena Alifirova, “Газпром и SOCAR обсудили вопросы сотрудничества” (“Gazprom and SOCAR Discussed Cooperation”), Neftegax.ru, October 27, 2023, https://neftegaz.ru/news/gas-stations/799407-gazprom-i-socar-obsudili-voprosy-sotrudnichestva-v-t-ch-po-gmt/.

[xxxii] Akos Losz and Tatiana Mitrova, “Central Asia’s Overlooked Energy Crisis: What It Means for the Global Gas Market,” Energy Explained, Center on Global Energy Policy, Columbia University, March 28, 2023, https://www.energypolicy.columbia.edu/central-asias-overlooked-energy-crisis-what-it-means-for-the-global-gas-market/.

[xxxiii] E. Alifirova, “Старт дан. Начались поставки российского газа в Казахстан и Узбекистан” (“The Start Has Been Given. Russian Gas Supplies to Kazakhstan and Uzbekistan Began”), Neftegas.ru, October 7, 2023, https://neftegaz.ru/news/transport-and-storage/797079-start-dan-nachalis-postavki-rossiyskogo-gaza-v-kazakhstan-i-uzbekistan/.

[xxxiv] These are average volumes of gas exports to FSU countries in 2014–2021 according to the Central Bank of Russia. (Table can be downloaded here: https://www.cbr.ru/vfs/statistics/credit_statistics/trade/gas.xls.)

[xxxv] These plants operate above nameplate capacity.

[xxxvi] Sophie Tetrel and Belén Belmonte, “Spain, France Won’t Ban Russia LNG Despite EU ‘Gesturing,’” Montel News, January 11, 2024, https://www.montelnews.com/news/1535027/spain-france-wont-ban-russia-lng-despite-eu-gesturing.

[xxxvii] White House, “Fact Sheet: United States Bans Imports of Russian Oil, Liquefied Natural Gas, and Coal,” March 8, 2022, https://www.whitehouse.gov/briefing-room/statements-releases/2022/03/08/fact-sheet-united-states-bans-imports-of-russian-oil-liquefied-natural-gas-and-coal/.

[xxxviii] “The EU Will Ban Russian LNG ‘Sooner than Later,’ Spain’s Energy Minister Says,” Reuters, May 16, 2023, https://www.reuters.com/business/energy/eu-will-ban-russian-lng-sooner-than-later-spains-energy-minister-says-2023-05-16/; “EU Has No Immediate Plans to Ban Russian LNG, Says Spain’s Ribera,” Reuters, August 9, 2023, https://www.reuters.com/business/energy/eu-has-no-immediate-plans-ban-russian-lng-says-spains-ribera-2023-09-08/.

[xxxix] “The Netherlands to Phase Out Russian Arctic LNG,” High North News, May 12, 2023, https://www.highnorthnews.com/en/netherlands-phase-out-russian-arctic-lng.

[xl] Anne-Sophie Corbeau, Ira Joseph, and Akos Losz, “Consequences of the Pause for US LNG,” Energy Explained, Center on Global Energy Policy, Columbia Univeristy, January 31, 2024, https://www.energypolicy.columbia.edu/consequences-of-the-pause-for-us-lng/.

[xli] Chen Aizhu and Marwa Rashad, “Russia’s Novatek Issues Force Majeure Notices over Arctic LNG 2 Project –Source,” Reuters, December 21, 2023, https://www.reuters.com/business/energy/russias-novatek-issues-force-majeure-notices-over-arctic-lng-2-project-sources-2023-12-21/.

[xlii] Artem Grishkov, “Газпром нашел замену Linde в проекте завода по сжижению газа в Усть-Луге” (“Gazprom Has Found a Replacement for Linde in the Gas Liquefaction Plant Project in Ust-Luga”), Vedomosti, September 27, 2023, https://spb.vedomosti.ru/technology/articles/2023/09/27/997318-gazprom-nashel-zamenu-linde-v-proekte-zavoda-po-szhizheniyu-gaza-v-ust-luge.

[xliii] US Department of State, “Taking Additional Sweeping Measures Against Russia,” press release, December 12, 2023, https://www.state.gov/taking-additional-sweeping-measures-against-russia-3/.

[xliv] Malte Humpert, “Putin Green-Lights Novatek’s Massive Murmansk LNG Project,” High North News, October 10, 2023, https://www.highnorthnews.com/en/putin-green-lights-novateks-massive-murmansk-lng-project.

[xlv] “Novatek CEO Confirms Parameters of Murmansk LNG Plant Project,” Interfax, June 6, 2023, https://interfax.com/newsroom/top-stories/91200/.

[xlvi] “Russia’s Novatek Expects Obsky LNG to Produce 5 Million Tonnes a Year,” Reuters, October 13, 2022, https://www.reuters.com/business/energy/russias-novatek-expects-obsky-lng-produce-5-million-tonnes-year-2022-10-13/; “LNG Decision Expected in 2024,” Interfax, September 12, 2023, https://interfax.com/newsroom/top-stories/94476/.

[xlvii] Jérémie Baruch, Adrien Sénécat, Arthur Carpentier, and Solène Reveney, “How French Group Technip Energies Participated in a Russian Gas Megaproject Despite International Sanctions,” Le Monde, October 19, 2023, https://www.lemonde.fr/en/les-decodeurs/article/2023/10/19/how-french-group-technip-energies-participated-in-a-russian-gas-megaproject-despite-international-sanctions_6189214_8.html.

[xlviii] Atle Staalesen, “Novatek’s Final Yamal LNG Train Comes Online,” Arctic Business Journal, June 3, 2021, https://www.arctictoday.com/novateks-final-yamal-lng-train-comes-online/.

[xlix] Novatek, “Novetek Develops Its Proprietary Arctic Mix LNG Process,” press release, June 13, 2023, https://www.novatek.ru/en/press/releases/index.php?id_4=5798.

[l] “Новатэк расширил портфель собственных СПГ-технологий, дополнив его Арктическим миксом” (“Novatek Expands Its Portfolio of Its LNG Technologies, Adding an Arctic Mix”), Neftegaz.ru, June 13, 2023, https://neftegaz.ru/news/standarts/783148-novatek-rasshiril-portfel-sobstvennykh-spg-tekhnologiy-dopolniv-ego-arkticheskim-miksom/.

[li] “Новатэк недоволен работой российских поставщиков оборудования для 4-й линии Ямал СПГ” (“Novatek Is Dissatisfied with the Work of Russian Suppliers of Equipment for the 4th Line of Yamal LNG”), TASS, September 3, 2021, https://tass.ru/ekonomika/12295617.

[lii] Seb Kennedy and Zach Simon, “Russia’s Stunted LNG Coup – Novatek Defies Arctic LNG-2 Sanctions, But Is the Triumph Symbolic?” Energy Flux, December 20, 2023, https://www.energyflux.news/p/russia-coup-arctic-lng-2-sanctions-natural-gas.

[liii] Malte Humpert, “New US Sanctions Target Russia’s Arctic LNG 2 – ‘Our Objective Is to Kill that Project,’” High North News, November 13, 2023, https://www.highnorthnews.com/en/new-us-sanctions-target-russias-arctic-lng-2-our-objective-kill-project; Tom Wilson and Chris Cook,

“US Aims to Halve Russia’s Energy Revenues by 2030, Says Official,” Financial Times, November 30, 2023, https://www.ft.com/content/277c1f9c-3f0f-4562-b0f0-80b390012087.

[liv] US Department of State, “Taking Additional Sweeping Measures Against Russia,” press release, November 2, 2023, https://www.state.gov/taking-additional-sweeping-measures-against-russia/.

[lv] “Foreign Shareholders Suspend Participation in Russia’s Arctic LNG 2 Project,” Moscow Times, December 25, 2023, https://www.themoscowtimes.com/2023/12/25/foreign-shareholders-suspend-participation-in-russias-arctic-lng-2-project-kommersant-a83553.

[lvi] “China Seeks Exemption from U.S. Sanctions on Russian LNG Plant –Source,” Reuters, December 22, 2023, https://www.reuters.com/business/energy/china-seeks-exemption-us-sanctions-russian-lng-plant-source-2023-12-22/.

[lvii] “China Criticises US Sanctions on Russia’s Arctic LNG-2 Project,” Business Times, December 26, 2023, https://www.businesstimes.com.sg/international/china-criticises-us-sanctions-russias-arctic-lng-2-project.

[lviii] Kennedy and Simon, “Russia’s Stunted LNG Coup – Novatek Defies Arctic LNG-2 Sanctions, But Is the Triumph Symbolic?”

[lix] Malte Humpert, “Russia to Begin Year-Round Shipping on Entire Northern Sea Route in 2024,” High North News, May 24, 2023, https://www.highnorthnews.com/en/russia-begin-year-round-shipping-entire-northern-sea-route-2024.

[lx] Aida Čučuk, “Gazprom Delivers its First LNG via Northern Sea Route,” Offshore Energy, September 18, 2023, https://www.offshore-energy.biz/gazprom-delivers-its-first-lng-via-northern-sea-route/; Stuart Elliott, “Yamal LNG Cargo Completes Ice-Covered Transit of Northern Sea Route: Novatek,” S&P Global, June 2, 2020, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/060220-yamal-lng-cargo-completes-ice-covered-transit-of-northern-sea-route-novatek.

[lxi] Malte Humpert, “Two Asian Shipyards Continue to Build LNG Tankers for New Russian Arctic Gas Project,” High North News, June 8, 2023, https://www.highnorthnews.com/en/two-asian-shipyards-continue-build-lng-tankers-new-russian-arctic-gas-project.

[lxii] “Russia Plans Shipbuilding Partnerships with China,” Maritime Executive, October 25, 2023, https://maritime-executive.com/article/russia-plans-shipbuilding-partnerships-with-china.

[lxiii] Cindy Liang, “Chinese Yards Set to Scale Up LNG Newbuild Construction at Record Pace,” S&P Global, September 12, 2023, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/lng/091223-chinese-yards-set-to-scale-up-lng-newbuild-construction-at-record-pace.

[lxiv] Anne-Sophie Corbeau, Ira Joseph, and Akos Losz, “Consequences of the Pause for US LNG.”

[lxv] Gazprom pays a 30 percent export duty for pipeline export, as well as a mineral extraction tax, income tax, and dividends to the Russian state. LNG exports have zero export duty, but pay a mineral extraction tax and profit tax, though some projects have excemptions. See Novatek, “Intergovernmental Agreement Regarding Cooperation on the Yamal LNG Project Enacted,” March 9, 2014, https://www.novatek.ru/en/business/yamal-lng/yamal_press_release/?id_4=860; International Group of Liquified National Gas Importers (GIIGNL), “Annual Report,” May 2022, https://giignl.org/wp-content/uploads/2022/05/GIIGNL2022_Annual_Report_May24.pdf; Vladimir Afanasiev, “Russian Tax Overhaul Seeks to Offset Drop in Revenues from Oil Companies,” Upstream, February 24, 2023, https://www.upstreamonline.com/focus/russian-tax-overhaul-seeks-to-offset-drop-in-revenue-from-oil-companies/2-1-1402417; “Russian Duma Passes Law Exempting Gazprom and Subsidiaries from Elevated 34% Profit Tax for LNG Exporters,” Interfax, February 9, 2023, https://interfax.com/newsroom/top-stories/87817/.

[lxvi] Daria Savenkova, “Газовая отрасль России может потерять по итогам 2023 года половину выручки” (“The Russian Gas Industry May Lose Half of Its Revenue by the End of 2023”), Vedomosti, August 7, 2023, https://www.vedomosti.ru/business/articles/2023/08/07/988772-gazovaya-otrasl-rossii-mozhet-poteryat-polovinu-viruchki.

[lxvii] Tatiana Mitrova, “The Geopolitics of Russian Natural Gas,” Belfer Center for Science and International Affairs, Harvard University, and Baker Institute Center for Energy Studies, Rice University, February 2014, https://www.belfercenter.org/sites/default/files/legacy/files/CES-pub-GeoGasRussia-022114.pdf.

[lxviii] Vladimir Afanasiev, “Russia Orders Gazprom Cash Cow to Pay More Tax Next Year,” Upstream, November 15, 2023, https://www.upstreamonline.com/production/russia-orders-gazprom-cash-cow-to-pay-more-tax-next-year/2-1-1551087.

This has become a decade of disruption for energy, especially for natural gas

Saudi Arabia’s recent moves into the liquefied natural gas (LNG) market may be a sign the giant oil exporter is looking to expand into a rapidly growing and politically influential market it had long ignored.

Over the past few decades, liquified natural gas (LNG) trade has evolved from the initial point-to-point business model of the 1960s to become more flexible.

Full report

Commentary by Anne-Sophie Corbeau & Tatiana Mitrova • February 21, 2024