Power prices are expected to soar under new tax cut and spending law

In states without policies to drive renewable energy, power prices could surge as federal tax incentives for clean energy disappear, according to Energy Innovation, a think tank.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Commentary by Anne-Sophie Corbeau, Juan Camilo Farfan & Sebastian Orozco • May 24, 2023

This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at Our Partners. Rare cases of sponsored projects are clearly indicated.

In June 2022, the European Commission allowed Spain and Portugal to decouple the price of gas from that of electricity for 12 months.[1] Worried about the impact of skyrocketing power prices on their consumers and economies, the two countries had argued that they should be allowed to cap gas prices in the power sector given their limited energy interconnections with the rest of Europe, low gas dependency on Russia,[2] and high share of renewables. Over the past 11 months, this so-called Iberian exception has allowed Iberian power prices to diverge from other European prices. The measure has had some positive outcomes for consumers, but also possible drawbacks. This commentary analyzes the case of Spain to assess the impacts of the policy and the implications of extending it beyond 12 months or to other EU countries.

Spanish wholesale power prices in the first four months of 2022 averaged €219.2 per megawatt hour (MWh) compared with €111.9/MWh in 2021 and €47.7/MWh in 2019.[3] The rise in wholesale electricity prices particularly impacted the 10.6 million Spanish households and small- and medium-sized enterprises (SMEs) supplied under regulated electricity tariffs (Precio Voluntario para el Pequeño Consumidor, or PVPC), which represent around 40 percent of all Spanish households and SMEs and 10 percent of Spain’s total power demand, as well as social tariffs pegged to the PVPC. These tariffs are directly linked to wholesale prices.[4]

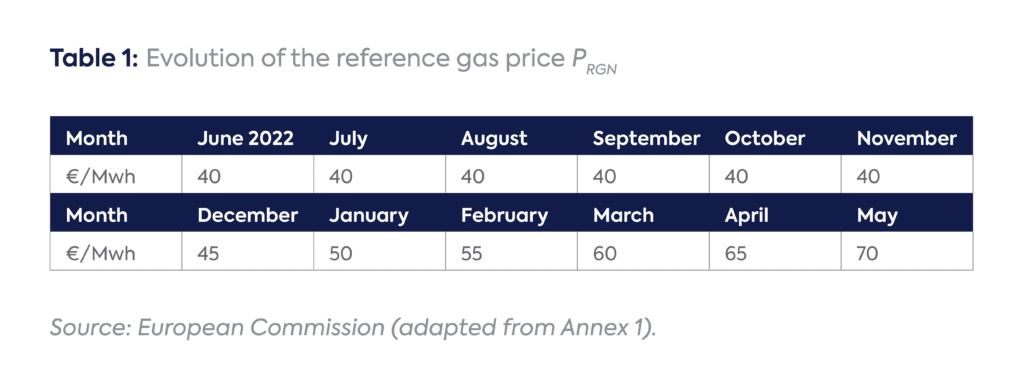

The Iberian exception was proposed by the Spanish government as a solution to the burden faced by these households and enterprises in order to lower wholesale power prices. It had been estimated to cost €6.3 billion, based on initial assessments of gas prices and fossil-based generation to be supported.[5] The cap passed under Royal Decree 10/2022 of May 13, 2022,[6] was formally approved by the European Commission under the EU State Aid rules on June 8,[7] and was implemented on June 15.

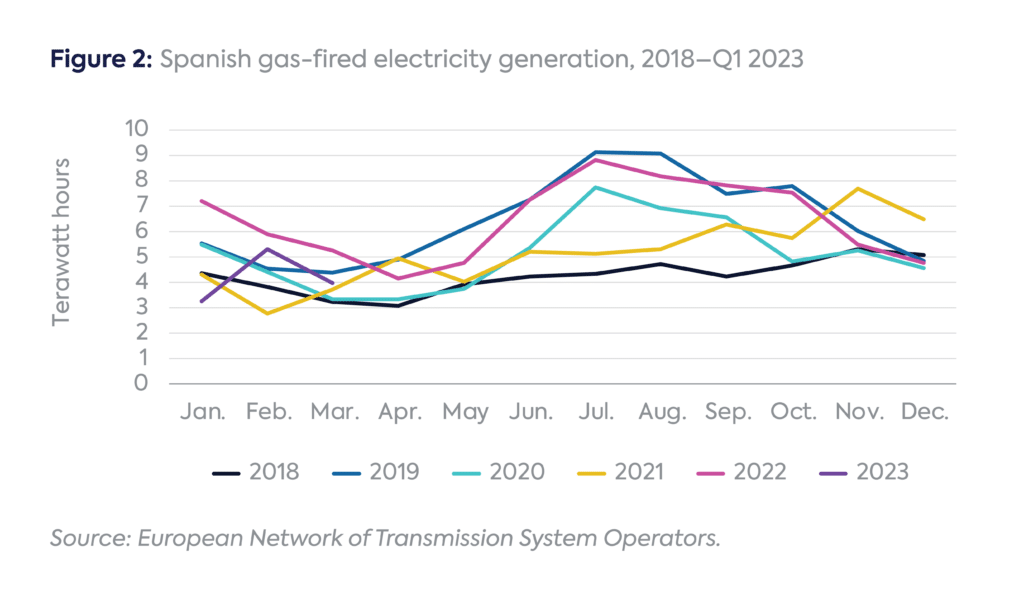

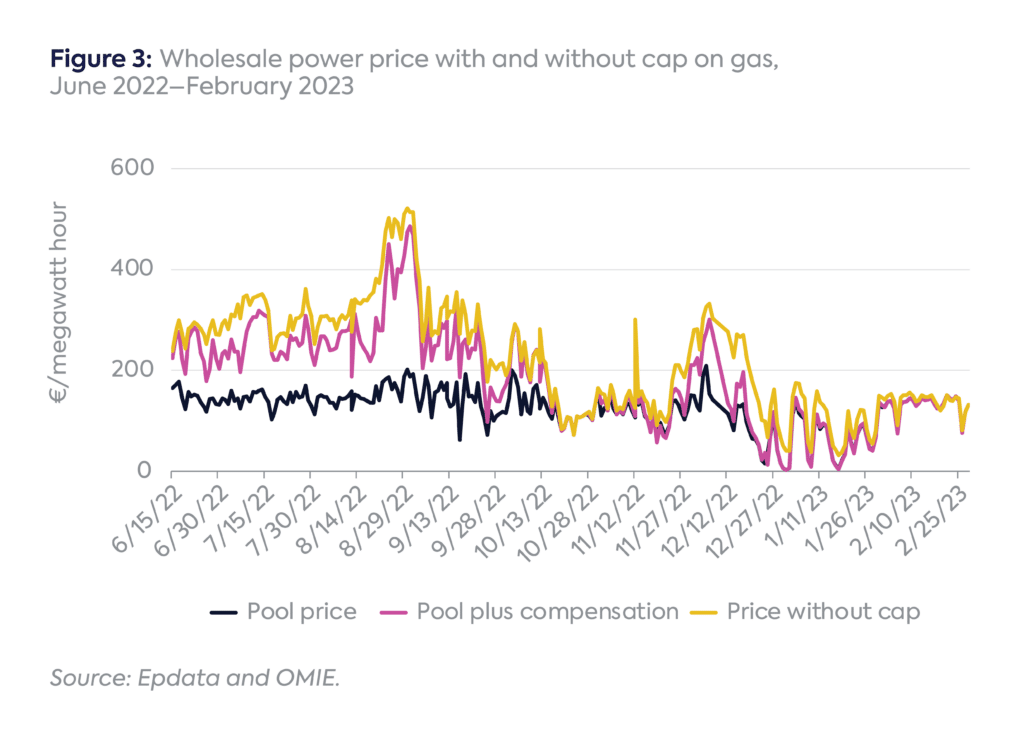

The Iberian exception essentially operates as an adjustment mechanism that switches the marginal producer through a price cap on gas used in electricity generation. It covers combined-cycle gas power plants, coal-fired plants, and cogeneration plants that rely on natural gas, biomass, or oil derivatives (unless they are regulated). The price cap on gas lowers the clearing power price whenever gas is the marginal price-setter.[8] Although the calculation of the adjustment is made based on gas prices, it covers all eligible technologies regardless of fuel used.[9] In order to avoid eligible generators going bankrupt, the marginal cost above the cap that generators incur is paid through the adjustment mechanism. The Operator of the Iberian Energy Market (OMIE) publishes the daily cost of the adjustment paid to power generators on its website.[10]

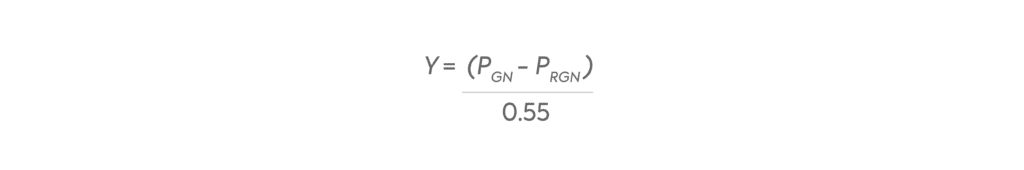

This adjustment mechanism is determined by the following formula:

Where,

If is negative, the adjustment amount is equal to zero.

The financing of the adjustment is achieved in two ways:

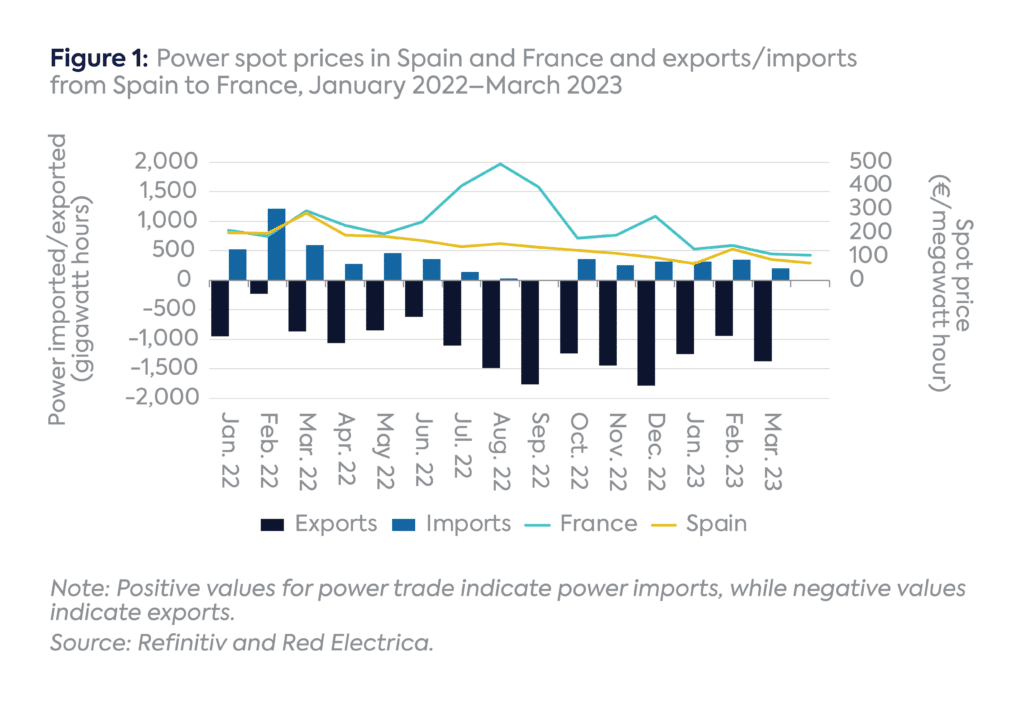

The measure has had several positive impacts so far. Between its passage and the end of 2022, Spanish wholesale electricity prices effectively distanced themselves from other European markets (such as France, Italy, and Germany), where prices remained very high. Between June 2022 and February 2023, Spanish power prices averaged €127.9/MWh, compared with €273.2/MWh in France, €240.5/MWh in Germany, and €306.2/MWh in Italy.[16] While power prices in many European countries spiked to above €300/MWh during summer 2022, Spanish prices actually decreased (Figure 1).

Moreover, the Spanish government estimates that the savings for all final electricity consumers between June 15, 2022, and January 31, 2023, amounted to €5 billion.[17] Recent economic studies also highlight that Spain has weathered the energy crisis better than other EU countries, with a much lower inflation rate that is in part attributable to the Iberian exception.[18]

However, the measure has also had unintended consequences, which policy makers should consider before extending it or replicating it elsewhere.

As European leaders continue to work on reforming the EU power model, some EU countries have expressed interest in late 2022 in extending the Iberian exception to the whole EU power market.[28] In early 2023, Portugal proposed introducing an emergency price cap similar to the Iberian exception as part of reforms to the EU electricity market. It saw the cap as a way to contain the market’s extreme volatility. This request, as well as the idea of extending the model to the rest of Europe, received pushback from the European Commission, which was aware of the measure’s potential negative impacts at the EU level (as described above) and in particular the potential increase in gas demand in the power sector in times of extreme gas scarcity.[29] EU countries are also working on comprehensive power market reforms that Spain—which will hold the EU presidency during the second half of 2023—hopes to complete before the end of 2023.

Meanwhile, Spain and Portugal will maintain the Iberian exemption until the end of 2023 as approved by the European Commission, even though they had initially requested that it extend through 2024.[30] However, the gas price at which the measure is triggered will be reset to between €55 and €65/MWh, with an increase of around €1/MWh per month. This reflects the fact that MIBGAS prices have been on a downward trend and ranging between €33 to €45/MWh during March and mid-May 2023.

In Spain, all consumers will now be impacted regardless of whether they are on the regulated or free market. In its early stages in 2022, the measure was paid first by customers on the regulated market and then by those on the free market when their fixed-price contracts were expiring. As most free market contracts last one year, all consumers on the free market with fixed-price contracts are likely to see their contracts impacted and include the new variable adjustment when revised.[31] Consumers signing up for a new offer or changing electricity supplier must be careful to check whether and how the adjustment mechanism is included in the new tariff.

As market conditions—in terms of price levels—have improved considerably since January 2023, it is questionable whether the Iberian exception should have been extended, and will be more so if none of the negative impacts are addressed. Although the gas price at which the measure is triggered is lower than €70/MWh, it may not be triggered again based on current forward prices standing below that level. However, it is possible that market conditions evolve and the market tightens, leading to volatile and high gas prices.

Additionally, the Iberian exception has to cohabitate with new European measures passed in the second half of 2022, such as the gas price cap and the €180/MWh power price cap on inframarginal producers.[32] The EU gas price cap is triggered at TTF gas prices reaching €180/MWh, a much higher level than what triggers the Iberian exception. Meanwhile, Spanish power prices exceeded €180/MWh on only 12 days since June 15, so the cap on inframarginal producers would have been triggered only for that very limited number of days. This measure can be expected to have little importance as long as the Iberian exception is in force. The seven-month period until the end of 2023 will provide further evidence regarding whether the Iberian exception is actually helping Iberian consumers or further distorting the market through unintended consequences.

[1] European Commission, “State Aid: Commission Approves Spanish and Portuguese Measure to Lower Electricity Prices Amid Energy Crisis,” June 8, 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_3550. Both countries are subject to the EU’s common market rules for electricity, which aim to create a single market for electricity across the EU to increase competition and reduce consumer prices. (See: European Commission, “Electricity Market Design,” accessed January 2023, https://energy.ec.europa.eu/topics/markets-and-consumers/market-legislation/electricity-market-design_en.)

[2] Neither country imports Russian pipeline gas, but both import some Russian LNG.

[3] Boletín Oficial del Estado, “Real Decreto-ley 10/2022,” May 14, 2022, https://www.boe.es/boe/dias/2022/05/14/pdfs/BOE-A-2022-7843.pdf.

[4] European Commission, “State Aid SA. 102454 (2022/N) – Spain and SA.102569 (2022/N) – Portugal – Production Cost Adjustment Mechanism for the Reduction of the Electricity Wholesale Price in the Iberian Market,” June 8, 2022, https://energia.gob.es/electricidad/Documents/1_EN_ACT_part1_v4.pdf.

[5] Ibid.

[6] Ibid.

[7] European Commission, “State Aid: Commission Approves Spanish and Portuguese Measure to Lower Electricity Prices Amid Energy Crisis,” June 8, 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_3550.

[8] The wholesale market is where electricity is bought and sold by different market participants, such as power plants, generators, and large energy companies. In Europe, wholesale electricity prices are determined by the cost of the marginal power plant, i.e., the most expensive plant that is required to serve any level of power demand at any given time. The ranking of power plants based on their marginal costs is called merit order. The wholesale electricity price can vary depending on several factors, including the availability of different sources of electricity, the demand for electricity, and the costs of producing electricity of each source. Generally, the marginal producer that clears the market tends to be gas. Given the high gas prices due to the war in Ukraine, the Iberian exception seeks to avoid this effect in the Iberian market.

[9] Coal plays a minor role in the Spanish power sector, accounting in 2021 for less than 2 percent of power generation. Additionally, the Spanish authorities argued that coal prices are strongly correlated to gas prices. In the event coal prices were to diverge from gas prices and coal-fired plants have lower marginal costs than nuclear or renewables generators, a provision in the Spanish Royal Decree Law enables the government to stop paying the support to coal-fired power plants and prevent a strong increase in coal-fired generation at the expense of nuclear and renewables generation.

[10] OMIE, “Precio Horario del Mecanismo de Ajuste a los Consumidores en el Mercado,” accessed March 16, 2023, https://www.omie.es/es/market-results/daily/average-final-prices/hourly-price-consumers?scope=daily&date=2022-06-30. This webpage will show the price of June 30, 2022, as an example.

[11] This yields an average gas price of €48.8/MWh over the 12-month period that is sometimes quoted when mentioning this measure.

[12] Evergreen Electrica, “What Does the New Concept on Invoices Mean?,” accessed March 12, 2023, https://evergreen-electrica.com/what-does-the-new-concept-on-invoices-mean?lang=en.

[13] Red Electrica, “Red Electrica Publishes Electricity Prices New Tariff for Small Consumers,” May 31, 2021, https://www.ree.es/en/press-office/news/press-release/2021/05/red-electrica-publishes-electricity-prices-new-tariff-for-small-consumers.

[14] It will apply to new contracts or renewals with fixed prices as of April 26, 2022.

[15] Óscar Arnedillo and Jorge Sanz, “Así es Cómo Impacta la Excepción Ibérica en la Factura de la Luz de Los Consumidores Españoles,” El Periodico de la Energia, June 6, 2022, https://elperiodicodelaenergia.com/impacto-excepcion-iberica-factura-luz-consumidores/. There were 600 MW of forward contracts concluded in December 2021, which would not bring any congestion revenues to the transmission system operators.

[16] Boletín Oficial del Estado, “Real Decreto-ley 3/2023,” March 29, 2023, https://www.boe.es/boe/dias/2023/03/29/pdfs/BOE-A-2023-7937.pdf.

[17] Ibid.

[18] “Spain’s Economy Will Slow Down in 2023 but Not Enter a Recession,” Esade, February 21, 2023, https://www.esade.edu/en/news/spains-economy-will-slow-down-in-2023-not-enter-a-recession; “Annual Inflation Down to 6.9% in the Euro Area,” Eurostat, April 19, 2023, https://ec.europa.eu/eurostat/documents/2995521/16324910/2-19042023-AP-EN.pdf/ff3d6b28-9c8f-41cd-714f-d1fd38af0b15#.

[19] Óscar Arnedillo, Jorge Sanz, and Marcelo Rabinovich, “Analisis de los Efectos de la Excepcion Iberica (II): A Corto Plazo,” El Periodico de la Energia, March 22, 2023, https://elperiodicodelaenergia.com/analisis-de-los-efectos-de-la-excepcion-iberica-ii-a-corto-plazo/. The authors estimate the total income transfer to Portugal, France, and Morocco at €1,912 million, most of which goes to France.

[20] ENTSOE, Transparency Platform, accessed January 24, 2023, https://transparency.entsoe.eu. Generation statistics can differ from other sources of electricity generation statistics, such as the International Energy Agency’s Monthly Electricity Statistics, for the following reasons: ENTSOE covers transmission-level data only, while IEA data also include auto-producer plants, and ENTSOE data come from transmission system operators while IEA data come from national statistical agencies. The data can also differ from what the gas transmission system operator Enagas reports as gas demand in the power sector.

[21] Enagas, “Statistical Bulletin—December 2022,” January 10, 2023, https://www.enagas.es/content/dam/enagas/en/files/gestion-tecnica-del-sistema/energy-data/publicaciones/boletin-estadistico-del-gas/Monthly-Bulletin-Gas-December-2022.pdf. Enagas splits gas demand in two categories: power and conventional (industry and residential/commercial users).

[22] Daniel Flores, “El Tope al Gas Cierra el Año con un Ahorro del 17% en el Coste de la Luz,” RTVE, January 3, 2023, https://www.rtve.es/noticias/20230103/balance-tope-precio-gas/2413426.shtml; Manuel Hidalgo Pérez, Ramón Mateo Escobar, Natalia Collado Van-baumberghen, and Jorge Galindo, “Estimando el Efecto del Tope al Precio del Gas,” Esade, September 30, 2022, https://www.esade.edu/ecpol/es/publicaciones/estimando-el-efecto-del-tope-al-precio-del-gas/.

[23] Sandra León, “El Tope de Gas: El Gobierno Introduce un Nuevo Concepto en la Factura de la luz que Dispara Todavía Más su Precio,” Libre Mercado, September 1, 2022, https://www.libremercado.com/2022-09-01/el-tope-de-gas-el-gobierno-introduce-un-nuevo-concepto-en-la-factura-de-la-luz-que-dispara-todavia-mas-su-precio-6927425/.

[24] David Page, “Las Eléctricas Presionan a Ribera Para Cambiar Quién Paga la ‘Excepción Ibérica’ Hasta 2025,” Activos, January 11, 2023, https://www.epe.es/es/activos/20230111/electricas-presionan-ribera-cambiar-excepcion-iberica-2025-80999159.

[25] Anne-Sophie Corbeau and Ann-Kathrin Merz, “Understanding Germany’s Gas Price Brake: Balancing Fast Relief and Complex Politics,” Center on Global Energy Policy, February 6, 2023, https://www.energypolicy.columbia.edu/publications/understanding-germanys-gas-price-brake-balancing-fast-relief-and-complex-politics/.

[26] “Spain’s Parliament Approves Energy Saving Plan,” Euractiv, August 26, 2022, https://www.euractiv.com/section/energy/news/spains-parliament-approves-energy-saving-plan/.

[27] EEX, “Investing Ourselves Out of the Energy Crisis with Market-Oriented Solutions, Recommendations for a Sound Long-Term EU Electricity Market Design Reform,” December 21, 2022, https://www.eex.com/fileadmin/Global/News/EEX/EEX_Opinions_Expert_Reports/20230110_EEX_EPEX_Policy_Paper_Market_Design.pdf.

[28] Sandrine Morel, “Spain’s Gas Price Cap Proves Effective Albeit with Some Negative Side Effects,” Le Monde, October 28, 2022, https://www.lemonde.fr/en/economy/article/2022/10/28/in-spain-a-gas-price-cap-is-effective-but-is-having-perverse-effects_6002059_19.html.

[29] Ana Matos Neves, “Commission Dashes Portuguese Proposal of EU-Wide Iberian Mechanism,” Euractiv, March 1, 2023, https://www.euractiv.com/section/politics/news/commission-dashes-portuguese-proposal-of-eu-wide-iberian-mechanism/.

[30] “EU Agrees to Extend Spain-Portugal Gas Price Cap Until End-December,” Reuters, March 28, 2023, https://www.reuters.com/business/energy/eu-agrees-extend-spain-portugal-gas-price-cap-until-december-31-2023-03-28/.

[31] Comunidad de Madrid, “Novedades en la Factura de la Luz. Nuevo Concepto: Tope del Gas,” March 30, 2023, https://www.comunidad.madrid/servicios/consumo/novedades-factura-luz-nuevo-concepto-tope-gas#.

[32] European Commission, “Actions and Measures on Energy Prices,” accessed March 20, 2023, https://energy.ec.europa.eu/topics/markets-and-consumers/action-and-measures-energy-prices_en.

The European Commission published a proposed regulation on June 17 to end Russian gas imports by the end of 2027.

China’s dependence on the energy supplies that move through the Strait of Hormuz makes it especially vulnerable to any possible closure of the waterway by Iran in retaliation for attacks by Israel and the United States.

This has become a decade of disruption for energy, especially for natural gas

Full report

Commentary by Anne-Sophie Corbeau, Juan Camilo Farfan & Sebastian Orozco • May 24, 2023