This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Last month, US President Joe Biden signed into law new sanctions aimed at reducing the flow of Iranian oil to China, which purchases about 90 percent of Iran’s oil exports.[1] In this Q&A, the authors discuss the new sanctions and their likely impact.

What do the new US sanctions entail?

As part of last month’s Ukraine aid bill, President Biden signed into law two new pieces of legislation targeting Iran’s oil exports. The Stop Harboring Iranian Petroleum Act (SHIP Act) requires the US government to impose sanctions on port operators, shipowners, and refineries that participate in Iran’s oil trade.[2] Potential targets include ports that dock vessels carrying Iranian petroleum, the vessels themselves, and refineries that purchase Iranian oil.

Even before the SHIP Act became law, the US government possessed the authority to impose sanctions on any of these targets. From a technical perspective, therefore, the SHIP Act contains nothing new. But it will give the White House more incentive to implement the sanctions vigorously, as the administration is now required to do so by law.[3]

The second piece of legislation is the Iran-China Energy Sanctions Act of 2023.[4] It clarifies that any transaction made by a “Chinese financial institution” involving the purchase of Iranian oil is sanctionable. The US already possessed the authority to sanction banks involved in Iran’s oil trade, but this act levies an unambiguous threat to Chinese banks, and could coax many of them to avoid refineries that buy Iranian oil.

The new laws require the Biden administration to annually produce detailed reports on Iran’s oil trade and the involvement of Chinese entities. The first report is due by August, and the administration is legally required to start enforcing the SHIP Act sanctions in October. In the coming months, pressure will mount on Chinese entities to quit the Iranian oil trade and on the Biden administration to impose sanctions on them if they do not.

What sanctions on Iran’s oil exports are already in effect?

Since 2012, the United States has imposed wide-ranging sanctions on Iran’s oil exports. Two sanctions have been particularly impactful. The first—codified in Section 1245 of the National Defense Authorization Act for Fiscal Year 2012—threatens secondary sanctions on buyers of Iranian oil unless their home countries significantly reduce their total purchases every six months.[5] Between 2012 and the signing of the Iran nuclear deal in 2015, this sanction resulted in a 60 decline in Iran’s oil exports.[6] The second—codified in Section 504 of the Iran Threat Reduction and Syria Human Rights Act of 2012—uses the threat of secondary sanctions to require importers to make payments for Iranian oil into restricted bank accounts, which Iran can only use to finance bilateral trade.[7] By 2015, this sanction led to more than $100 billion in Iranian oil proceeds accruing in restricted bank accounts.[8]

The Obama administration lifted both oil sanctions as part of the 2015 Iran nuclear deal, but the Trump administration reinstated them in 2018.

The Biden administration is enforcing these sanctions, though they are not working as well as in the past. Both rely on the threat of secondary sanctions to change the behavior of participants in Iran’s oil trade, especially refineries and banks. As small-scale independent Chinese refineries, known as “teapots,” now purchase most of Iran’s oil exports, the threat of secondary sanctions has become less potent because these refineries have minimal ties to the US economy. Chinese banks, by contrast, remain wary of US sanctions, so Iran still does not enjoy unfettered access to its oil revenues, which continue to accrue in bank accounts in China.

The Biden administration could impose secondary sanctions on some of the teapots, but it is not clear that doing so would decrease China’s oil imports from Iran. The biggest obstacle to effective sanctions is the fact that China is now the only major buyer of Iranian oil, whereas in 2012 there were more than a dozen countries buying Iranian oil.[9] Decreasing Iran’s oil exports would require a substantial shift in China’s energy relationship with Iran—and that is unlikely to happen unless Beijing is on board.

How much oil does China import from Iran?

In 2023, China imported 1.1 million barrels per day (bpd) of Iranian crude, accounting for 10 percent of China’s oil imports.[10] This is the largest annual volume of Iranian crude China has ever imported.[11] Iran was China’s fourth-largest oil supplier, after Russia (2.15 million bpd), Saudi Arabia (1.73 million bpd), and Iraq (1.19 million bpd).[12]

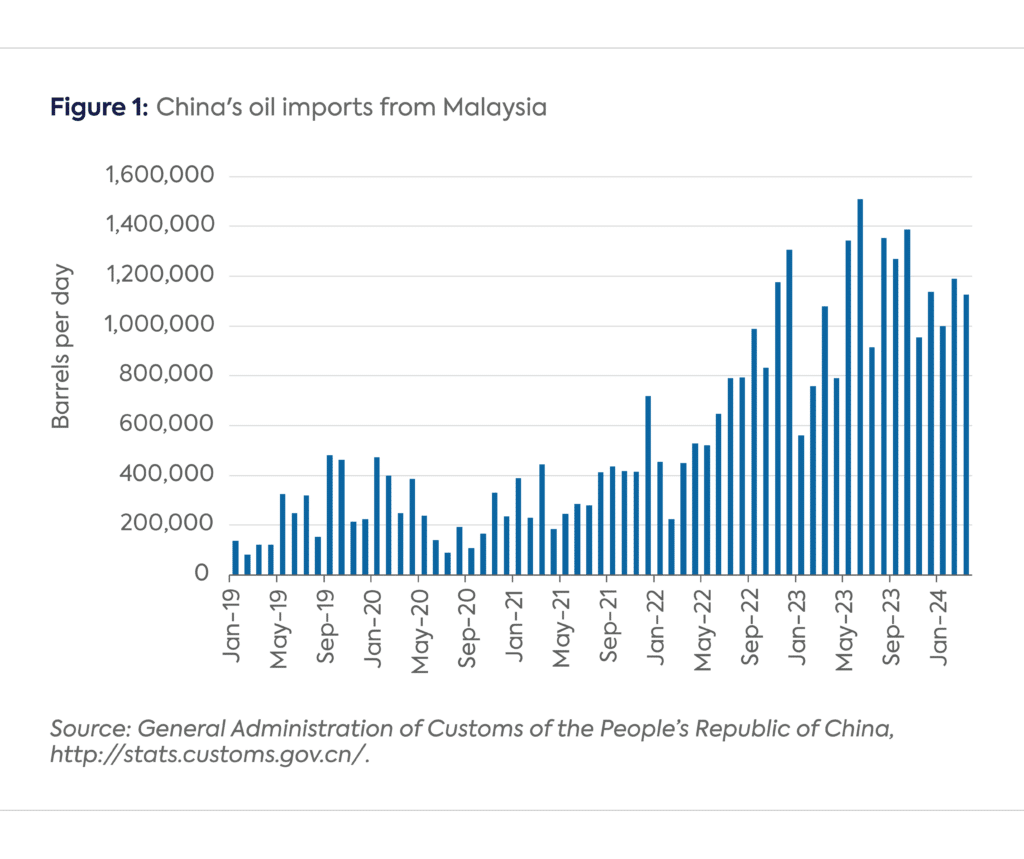

However, Chinese customs reports that China did not import any Iranian oil in 2023. This is because Iranian barrels are classified as originating from other countries, especially Malaysia but also Oman and the United Arab Emirates.[13] Ship-to-ship transfers occur in the waters off these countries, where Iranian crude is blended with crude from other locations, relabeled, and delivered to China.[14] China’s oil imports from “Malaysia” skyrocketed from 242,000 bpd in 2019 to 1.1 million bpd in 2023 and January–April 2024 (see Figure 1).[15]

Teapot refineries purchased all of the Iranian crude China imported in 2023.[16] They are opportunistic buyers that hunt for bargains.[17] Discounts on sanctioned crude prompted the teapots to buy 98 percent of their crude from Iran, Russia, and Venezuela in 2023.[18]

Will China stop importing Iranian oil?

Probably not. While some refineries and banks may end their participation, it’s likely others will decide that participating in the Iranian oil trade is worth it, even if they come under US sanctions, especially if Beijing supports them. China’s Iranian oil imports increased despite previous sanctions on Chinese refineries and banks.[19]

China’s teapot refineries are less concerned about US sanctions than China’s national oil companies. CNPC and Sinopec stopped importing Iranian oil after Washington decided not to renew sanctions exemptions for Iranian crude buyers in May 2019, due to concerns about losing access to the US financial system.[20] By contrast, many teapots have minimal exposure to the dollar-based financial system.[21] Teapots that use US technology, on the other hand, have not purchased Iranian oil.[22]

Beijing is unlikely to prevent Chinese entities from buying Iranian oil. It opposes unilateral sanctions and attempts by third countries to interfere in China’s energy trade, which officials reiterated after President Biden signed the new sanctions.[23] Additionally, discounts on Iranian crude have benefitted China’s refining industry as China faces economic headwinds. In January–September 2023, the teapots saved about $4.2 billion on their Iranian crude imports due to discounts as steep as $17 per barrel versus Brent crude, the global benchmark.[24] The spot price of Brent averaged $81 per barrel over the same period.[25]

Moreover, the teapots’ private ownership provides Beijing with an excuse for not stopping their Iranian oil purchases. After all, the teapots have a history of advancing corporate interests at the expense of national ones.[26]

Are there any geopolitical tradeoffs for the US in imposing Iran sanctions?

Washington will need to decide how to prioritize Chinese purchases of Iranian oil against other US policy objectives, including hampering China’s support of Russia’s war in Ukraine. Sanctioning Chinese entities for involvement in Iran’s oil trade might make it more difficult to secure Chinese cooperation on other issues. Beijing has warned that the threat sanctions pose to China’s trade with Iran “creates serious obstacles for China-US cooperation in relevant areas.”[27] Additionally, if the teapots were to stop buying Iranian oil, they would likely purchase more from another sanctioned country: Russia.[28]

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] Rosemary Griffin and Aresu Eqbali, “Iran’s Crude Production Upside Faces Risks of Further Western Sanctions,” S&P Global, March 26, 2024, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/032624-irans-crude-production-upside-faces-risk-of-further-western-sanctions.

[2] “H.R.815 – Division J. SHIP Act,” Congress.gov, accessed May 12, 2024, https://www.congress.gov/bill/118th-congress/house-bill/815/text.

[3] The SHIP Act also requires the US Energy Information Administration to publish a detailed report on Iran’s oil trade, so the potential targets of the sanctions will be well-known to members of Congress and the media.

[4] “H.R.815 – Division S. Iran-China Energy Sanctions Act of 2023,” Congress.gov, accessed May 12, 2024, https://www.congress.gov/bill/118th-congress/house-bill/815/text.

[5] US Department of State, “Section 1245 of the National Defense Authorization Act for Fiscal Year 2012,” November 8, 2012, https://2009-2017.state.gov/e/eb/tfs/spi/iran/fs/200286.htm.

[6] Ladane Nasseri and Bruce Stanley, “Iran Won’t Give In After 60% Decline in Oil Exports,” Bloomberg News, January 5, 2015, https://www.bloomberg.com/news/articles/2015-01-05/iran-won-t-give-in-after-60-decline-in-oil-exports.

[7] “H.R.1905 – Iran Threat Reduction and Syria Human Rights Act of 2012,” Congress.gov, accessed May 12, 2024, https://www.congress.gov/bill/112th-congress/house-bill/1905/text.

[8] “Lifting Sanctions Will Release $100 Billion to Iran. Then What?” NPR, July 16, 2015, https://www.npr.org/sections/parallels/2015/07/16/423562391/lifting-sanctions-will-release-100-billion-to-iran-then-what.

[9] “Iran’s Oil Exports,” New York Times, January 7, 2012, https://archive.nytimes.com/www.nytimes.com/imagepages/2012/01/07/world/middleeast/07irangraphic3.html.

[10] Oceana Zhou and Daisy Xu, “China’s Small Independent Refineries to Continue Favoring Iranian Crudes in 2024,” S&P Global, January 19, 2024, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/011924-chinas-small-independent-refineries-to-continue-favoring-iranian-crudes-in-2024#:~:text=The%20volume%20of%20Iranian%20crudes,of%20Russian%20and%20Venezuelan%20crudes; General Administration of Customs of the People’s Republic of China, http://stats.customs.gov.cn/.

[11] Muyu Xu, “Explainer: Iran’s Expanding Oil Trade with Top Buyer China,” Reuters, November 10, 2023, https://www.reuters.com/markets/commodities/irans-expanding-oil-trade-with-top-buyer-china-2023-11-10/; General Administration of Customs of the People’s Republic of China, http://stats.customs.gov.cn/.

[12] General Administration of Customs of the People’s Republic of China, http://stats.customs.gov.cn/.

[13] Chen Aizhu and Bozorgmehr Sharafedin, “China’s Iranian Imports Ease on Poor Margins, Lure of Russian Oil,” Reuters, May 9, 2022, https://www.reuters.com/business/energy/chinas-iranian-oil-imports-ease-poor-margins-lure-russian-oil-2022-05-09/.

[14] “China’s Oil Buyers to Weather Tighter US Sanctions on Iran,” Bloomberg News, April 23, 2024, https://www.bloomberg.com/news/articles/2024-04-23/china-s-oil-buyers-set-to-weather-tighter-us-sanctions-on-iran; “Malaysia Plays Key Role in Iran Oil Trade,” Petroleum Intelligence Weekly, August 13, 2019, https://www.energyintel.com/0000017b-a7d8-de4c-a17b-e7da7da20000.

[15] General Administration of Customs of the People’s Republic of China, http://stats.customs.gov.cn/.

[16] Zhou and Xu, “China’s Small Independent Refineries to Continue Favoring Iranian Crudes in 2024.”

[17] Chen Aizhu and Muyu Xu, “China Saves Billions of Dollars from Record Sanctioned Oil Imports,” Reuters, October 11, 2023, https://www.reuters.com/markets/commodities/china-saves-billions-dollars-record-sanctioned-oil-imports-2023-10-11/.

[18] Zhou and Xu, “China’s Small Independent Refineries to Continue Favoring Iranian Crudes in 2024.”.

[19] US Department of the Treasury, “Counter Terrorism Designations and Designations Removals” press release, May 25, 2022, https://ofac.treasury.gov/recent-actions/20220525; US Department of the Treasury, “Treasury Sanctions Kunlun Bank in China and Elaf Bank in Iraq for Business with Designated Iranian Banks” press release, July 31, 2012, https://home.treasury.gov/news/press-releases/tg1661.

[20] Chen Aizhu and Florence Tan, “Sinopec, CNPC Skip Iran Oil Purchases for May to Avoid U.S. Sanctions,” Reuters, May 10, 2019, https://www.reuters.com/article/idUSKCN1SG0EO/.

[21] Xu, “Explainer: Iran’s Expanding Oil Trade with Top Buyer China.”

[22] Oceana Zhou, Daisy Xu, “China Independent Refineries: Refiners’ Shift to Sanctioned Iranian Crude Gives World Breathing Space,” S&P Global, September 6, 2023, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/090623-china-independent-oil-refineries-refiners-shift-to-sanctioned-iranian-crude-gives-world-breathing-space#:~:text=Chinese%20independent%20refiners’%20strategic%20shift,flow%20in%20the%20Shandong%20market.

[23] Ministry of Foreign Affairs of the People’s Republic of China, “Foreign Ministry Spokesperson Lin Jian’s Regular Press Conference on April 29, 2024,” April 29, 2024, https://www.fmprc.gov.cn/eng/xwfw_665399/s2510_665401/2511_665403/202404/t20240429_11291107.html; Ministry of Foreign Affairs of the People’s Republic of China, “Ambassador to Russia Zhang Hanhui accepted a written interview with Russia Today’” (驻俄罗斯大使张汉晖接受“今日俄罗斯”书面采访), May 5, 2024, https://www.mfa.gov.cn/zwbd_673032/wjzs/202405/t20240509_11301749.shtml.

[24] Chen and Xu, “China Saves Billions of Dollars from Record Sanctioned Oil Imports.

[25] US Energy Information Administration, “Europe Brent Spot Price FOB,” May 15, 2024, https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=M.

[26] See, for example, Erica Downs, “The Rise of China’s Independent Refineries,” Center on Global Energy Policy, Columbia University, September 2017, https://www.energypolicy.columbia.edu/wp-content/uploads/2017/09/CGEPTheRiseofChinasIndependentRefineries917.pdf.

[27] Ministry of Foreign Affairs of the People’s Republic of China, “Foreign Ministry Spokesperson Lin Jian’s Regular Press Conference on April 29, 2024.

[28] China already purchases most of Russia’s ESPO crude; the teapots’ preferred Russian crude grade, but they could increase purchases of Urals and Sokol if the price is right.

More on Energy Explained Energy Explained

Carbon Competitiveness: Industry Steps Up as Global Priorities Shift

Economic, political, and fiscal realities have shifted energy policy priorities across the globe toward the goals of affordability and competitiveness.

Six Key Issues That Defined Climate Week 2025

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

Tensions With the United States and the EU Could Threaten India’s Role as Refinery Hub

The US imposed tariffs of 50 percent on about half of Indian exports on August 27, following a Trump administration executive order targeting the country for its continued imports of discounted Russian oil.

Q&A: Why India Is Being Targeted with Russian Oil Import Tariffs, and What It Will Mean for Markets

US tariffs on India for purchasing Russian oil may stem more from frustrations in US-India trade negotiations than from a concern about funding Russia’s war in Ukraine.

Relevant

Publications

Trends and 2025 Insights on the Rise of Electric Vehicles in the USA

Plug-in electric vehicles (EVs) are reshaping the transportation energy landscape, providing a practical alternative to petroleum fuels for a growing number of applications. EV sales grew 55× in the past decade (2014–2024) and 6× since 2020, driven by technological progress enabled by policies to reduce transportation emissions as well as industrial plans motivated by strategic value of EVs for global competitiveness, jobs and geopolitics. In 2024, 22% of passenger cars sold globally were EVs and opportunities for EVs beyond on-road applications are growing, including solutions to electrify off-road vehicles, maritime and aviation. This Review updates and expands our 2020 assessment of the scientific literature and describes the current status and future projections of EV markets, charging infrastructures, vehicle–grid integration and supply chains in the USA. EV is the lowest-emission motorized on-road transportation option, with life-cycle emissions decreasing as electricity emissions continue to decrease. Charging infrastructure grew in line with EV adoption but providing ubiquitous reliable and convenient charging remains a challenge. EVs are reducing electricity costs in several US markets and coordinated EV charging can improve grid resilience and reduce electricity costs for all consumers. The current trajectory of technology improvement and industrial investments points to continued acceleration of EVs. Electric vehicles are increasingly adopted in the USA, with concurrent expansion of charging infrastructure and electricity demand. This Review details these trends and discusses their drivers and broader implications.

Geopolitics and Oil Markets in Uncertain Times: Roundtable Report

CGEP recently hosted a private roundtable conducted on a not-for-attribution basis that focused on key geopolitical issues and oil markets in various hotspots, including the Middle East, Russia/Ukraine, China, and the Americas.