Could a strategic lithium reserve kickstart US supply chain development?

NEW YORK -- A strategic lithium reserve is being mooted as a solution to stabilize volatile prices that have hindered American mining projects, allowi

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Despite the ongoing military conflict between Russia and Ukraine that began in February 2022, Russian gas transit to Europe through Ukraine continues to this day at a rate of 35–40 million cubic meters per day (mcm/d). Although the volumes have been reduced to around a third of their pre-war levels, the mere existence of these transit flows during the war defies expectations, especially in light of the sharp curtailment of Russian gas deliveries to Europe across the board—and the complete halt of shipments through the Nord Stream and Yamal corridors since 2022. In this Q&A, the author discusses why these transit flows through Ukraine remain at considerable risk and how the countries that continue to rely on these shipments have varying degrees of ability to adjust to a disruption.

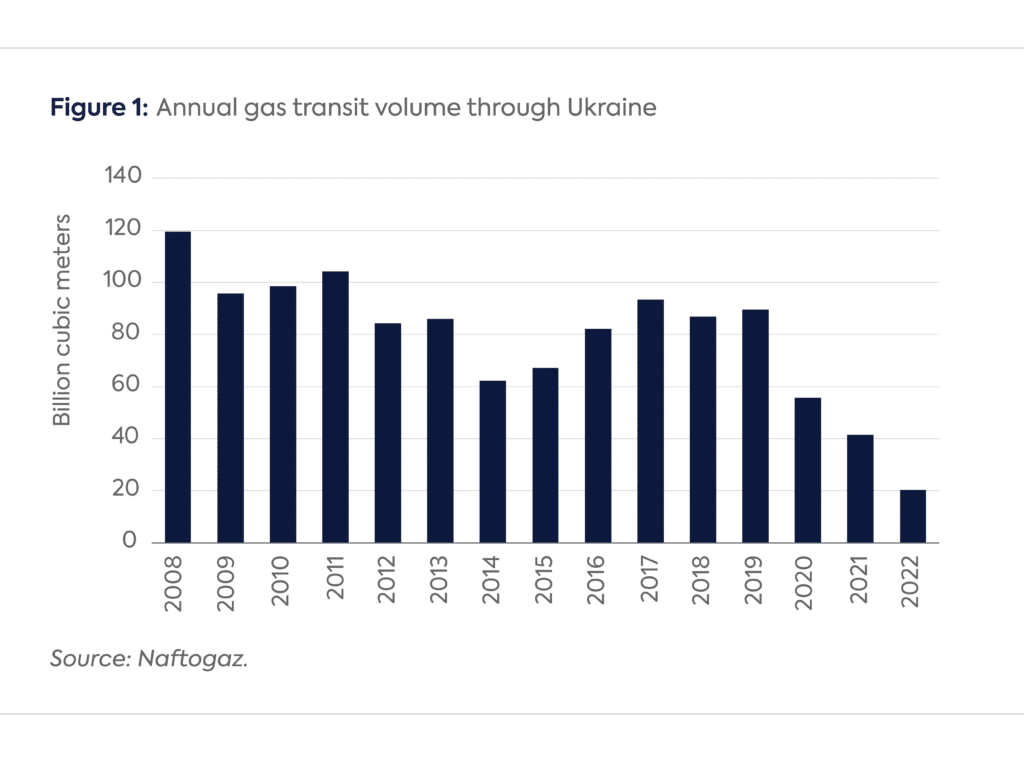

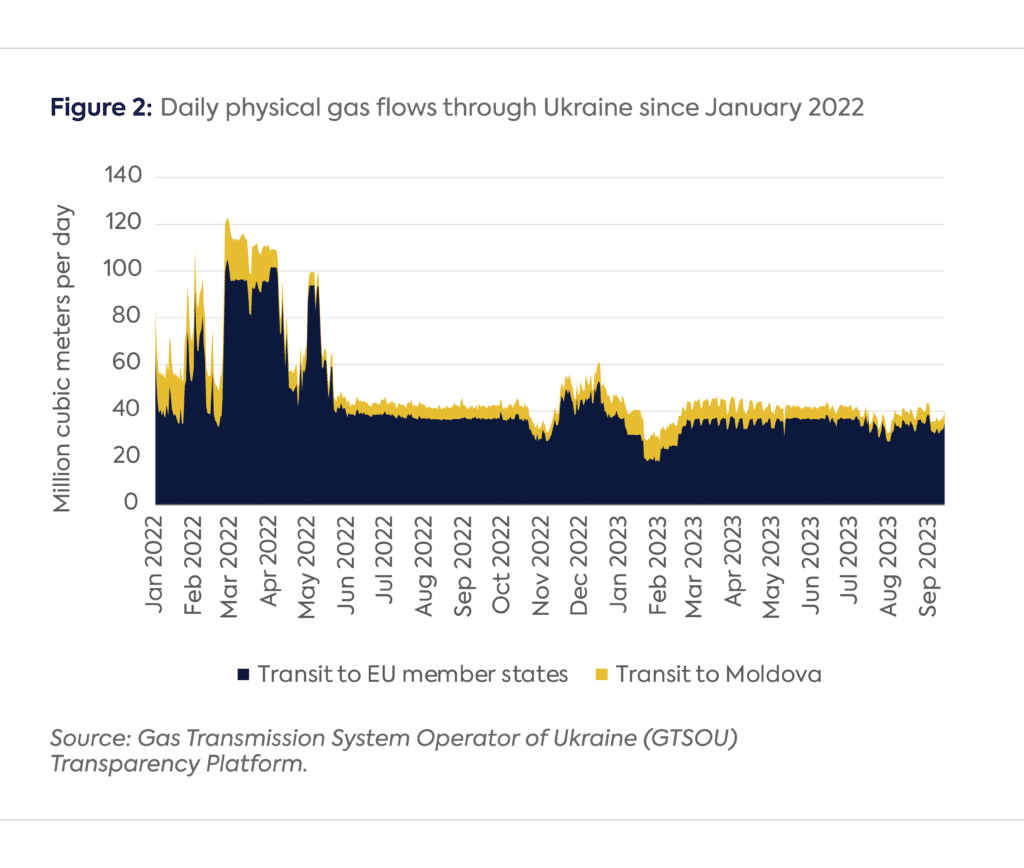

In the first half of 2023, physical gas transit through Ukraine averaged 40 mcm/d, equivalent to nearly 15 billion cubic meters (bcm) on an annualized basis. Of this about 33 mcm/d was shipped to the European Union (EU) (equal to 12 bcm on a full-year basis) and 7 mcm/d to Moldova (equivalent to 2.6 bcm per annum).[1] This volume is only a fraction of the average 90 bcm per year Ukraine transited between 2008 and 2019, when it served as the primary conduit for Russian pipeline gas to Europe (Figure 1).

Current deliveries are also considerably lower than the 40 bcm annual volume Gazprom committed to transit through Ukraine between 2021 and 2024 (or pay for the capacity) under the 2019 gas transit agreement.[2] The latest drop in transit flows occurred in May 2022, when the Gas Transmission System Operator of Ukraine (GTSOU) declared force majeure[3] and halted transit flows through Sokhranivka, one of the two entry points of Russian gas to Ukraine, citing gas theft and lack of operational control over physical infrastructure on territory occupied by Russia.[4] Since the second half of 2022, however, transit flows through the sole remaining entry point, Sudzha, have been remarkably stable at close to the current level, and fluctuations were mostly influenced by nominations from Gazprom’s remaining European customers rather than by any disruption to physical flows amid the war in Ukraine (Figure 2).[5]

Notwithstanding the stable deliveries since mid-2022, multiple risks could further reduce or completely cut off Russian gas transit through Ukraine in the near future.

The Ukrainian gas transmission system has cross-border interconnections with four EU member states (Poland, Slovakia, Hungary, Romania) and with Moldova. In the 12-month period between July 2022 and June 2023, six EU countries (Slovakia, Austria, Italy, Hungary, Slovenia, and Croatia) and Moldova continued to receive Russian gas through the Ukrainian transit corridor (Figure 3).[8]

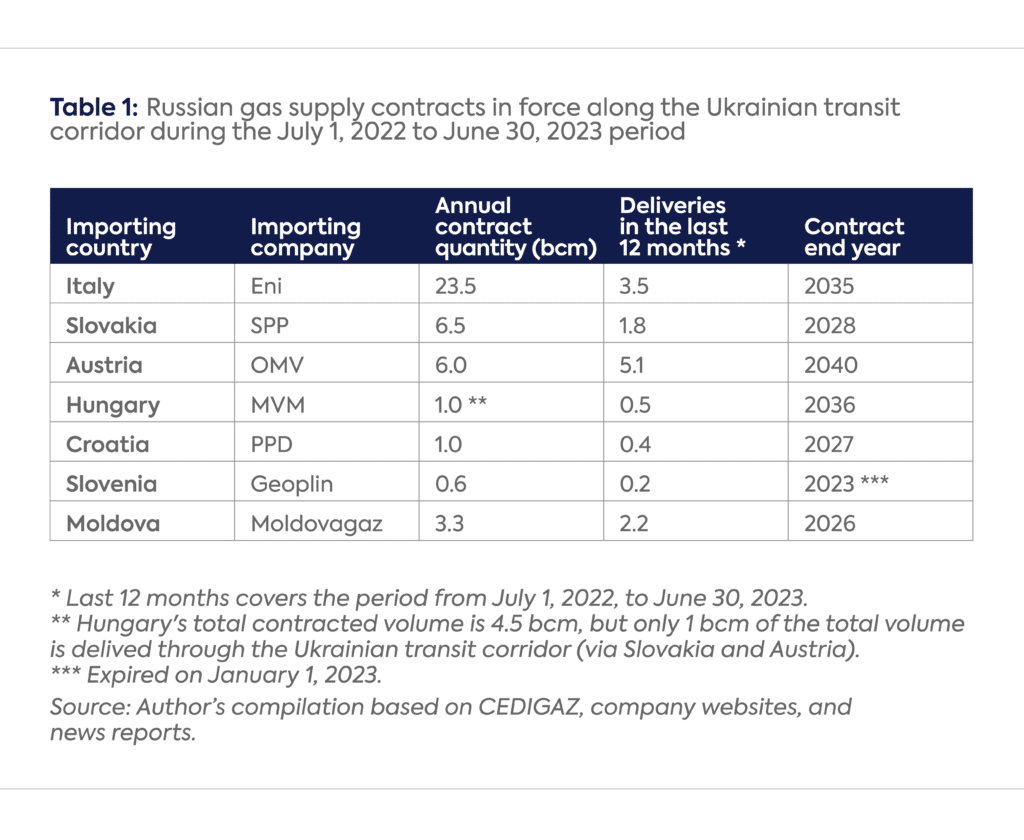

Austria imported the highest volume (about 5 bcm) in absolute terms through Ukraine over the last 12 months, accounting for nearly half of the country’s total imports over the same period. Italy also received a significant amount of Russian gas by pipeline via Ukraine (estimated at between 3 and 4 bcm), but this represented only a small (less than 5 percent) share of total imports. Slovakia (at close to 2 bcm) took approximately one-third of its imports from Russia via Ukraine. Hungary received only a fraction of its Russian-sourced gas via the Ukrainian route (through Slovakia and Austria), while the majority of its Russian imports have been rerouted through the European leg of the TurkStream pipeline via the Balkans since 2021.[9] Slovenia and Croatia received minuscule volumes of Russian gas via Ukraine in the last 12 months, and Slovenia’s imports dropped to near-zero since the expiration of Geoplin’s contract with Gazprom on January 1, 2023. Moldova received nearly all of its natural gas imports via Ukraine, which added up to around 2.2 bcm in the July 2022 to June 2023 period.

Russian gas deliveries along the Ukrainian transit corridor take place under long-term contracts between Gazprom and its remaining European customers. However, delivered volumes in most cases fell significantly below the contracted amount over the last 12 months (Table 1). This widespread under-delivery was due to a combination of politically motivated supply curtailments by Russia, lower nominations by Gazprom’s European customers along the Ukrainian transit route, payment issues (in the case of Moldova),[10] and a preference for using the TurkStream corridor (in the case of Hungary).

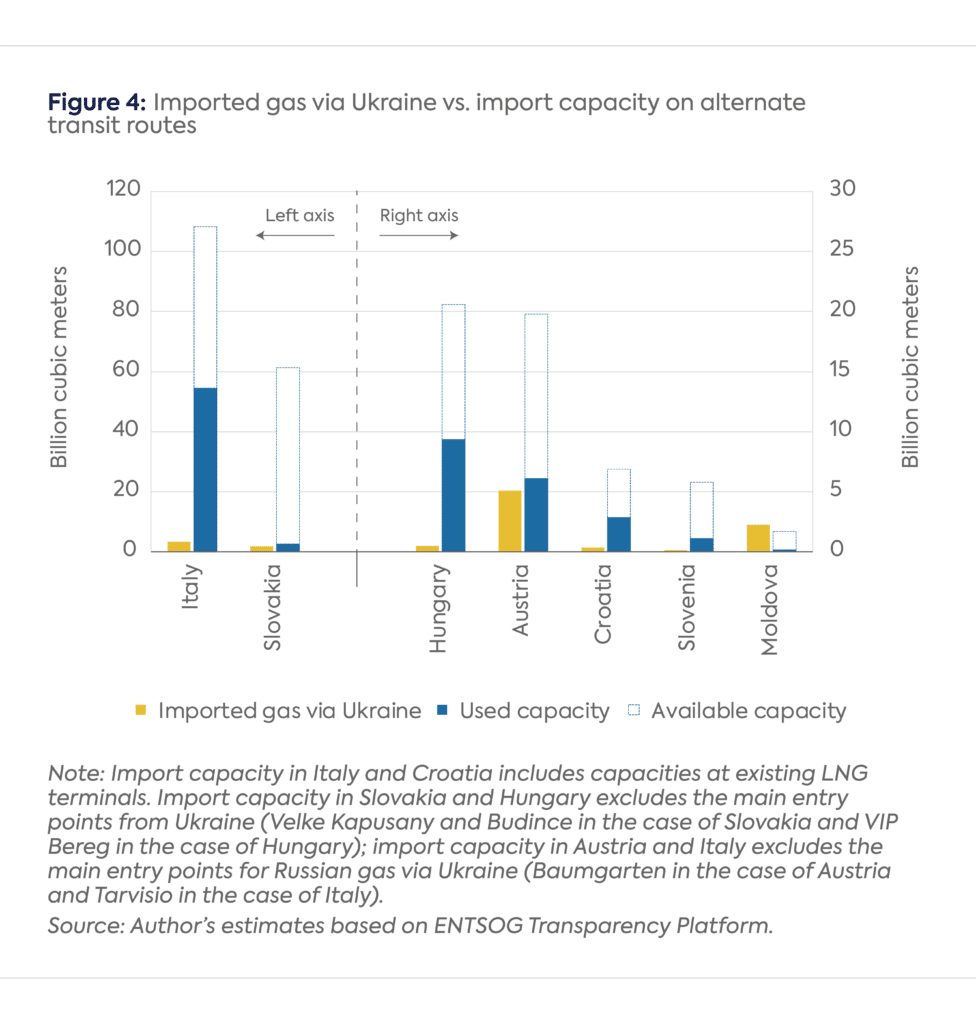

A sudden halt to the remaining gas flows through Ukraine to Europe would be disruptive and raise gas prices in the affected countries and beyond. However, it would not leave the majority of recipient countries without viable alternative supply routes. In each EU member state that relied on the Ukrainian transit route in the 12 months to June 2023, the available entry capacity on existing cross-border pipelines—and LNG terminals in the case of Italy and Croatia—significantly exceeds the volume of Russian gas imports through Ukraine (Figure 4).[11] This option does not guarantee supply in the event of a cutoff of Ukrainian gas transit, and capacity bottlenecks further away (or a simultaneous disruption on TurkStream,[12] for example) could hinder the smooth replacement of Russian molecules. But if enough additional gas can be mobilized—from LNG and non-Russian pipeline gas suppliers or neighboring countries with the ability to switch fuels—and transited to the affected region, then the existing import infrastructure in each at-risk country within the EU should be able to easily handle the replacement molecules.

The options for Moldova are more limited. Moldova depends heavily on Russian gas imports through Ukraine, and in the event of a complete shutdown of the Ukrainian transit corridor, the only alternative import route to supply the country would be through Romania.[13] The capacity of this entry point falls short of the country’s import requirements. Therefore, some additional backhaul flows from the EU via Ukraine would be needed to supplement the volumes arriving through Romania in order to meet all of Moldova’s demand for gas.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] Transit volumes represent exit flows from Ukraine only; import flows from the EU and Moldova to Ukraine are excluded.

[2] The current gas transit agreement between Gazprom and Naftogaz (Ukraine’s state-owned gas utility) was signed on December 30, 2019 following negotiations involving Russia, Ukraine, Germany, France, and the European Commission. Under the agreement, Gazprom committed to transit 65 bcm of gas through Ukraine in 2020 and 40 bcm per year in the 2021-2024 period on ship-or-pay terms. See: Anne-Sophie Corbeau and Tatiana Mitrova, “Will the Ukrainian Gas Transit Contract Continue Beyond 2024?,” Center on Global Energy Policy, June 8, 2023, https://www.energypolicy.columbia.edu/will-the-ukrainian-gas-transit-contract-continue-beyond-2024/.

[3] A clause in contracts that frees parties from liability under extraordinary circumstances that fall outside of the contracting parties’ control.

[4] Stuart Elliot, “Ukraine’s Gas Grid Operator to Suspend Russian Gas Flows via Sokhranivka,” S&P Global Commodity Insights, May 10, 2022, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/051022-ukraines-gas-grid-operator-to-suspend-russian-gas-flows-via-sokhranivka.

[5] Mike Fulwood and Jack Sharples, “Quarterly Gas Review: Gas Markets in 2023,” Oxford Institute for Energy Studies, April 2023, p.7, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2023/04/Quarterly-Gas-Review-Issue-21.pdf.

[6] Stuart Elliot, “Russia Could Still Impose Sanctions against Ukraine’s Naftogaz: Gazprom CEO,” S&P Global Commodity Insights, July 6, 2023, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/070623-russia-could-still-impose-sanctions-against-ukraines-naftogaz-gazprom-ceo.

[7] Shotaro Tani and David Sheppard, “Russia Gas Flows through Ukraine Could Stop Next Year, Kyiv Says,” Financial Times, June 22, 2023, https://www.ft.com/content/bfe11756-a8be-42ea-a439-88b7d0f88f8d.

[8] Ukraine’s interconnection points with Poland, Romania, and Hungary saw only negligible westward flows in H2 2022 and H1 2023, and each of these cross-border points were primarily used in reverse-flow mode to supply non-Russian gas to Ukraine since mid-2022.

[9] Hungary signed a 15-year long-term contract with Gazprom in 2021 for a total annual volume of 4.5 bcm. The contract specifies that 3.5 bcm of the volume is to be delivered to Hungary from the south via TurkStream, and 1 bcm is to be delivered at the Hungarian border with Austria (via the Ukrainian transit corridor). The supplementary volumes the Hungarian counterparty to the contract requested from Gazprom in 2022 were also delivered via TurkStream. See: Gergely Szakacs, “Gazprom Ramps Up Gas Flows to Hungary via TurkStream Pipeline, Official Says,” Reuters, August 13, 2022, https://www.reuters.com/business/energy/gazprom-ramps-up-gas-flows-hungary-via-turkstream-pipeline-official-says-2022-08-13/.

[10] Alexander Tanas, “Moldova Puts Its Debt to Gazprom at $8.6 million, Russian Firm Disagrees,” Reuters, September 7, 2023, https://www.reuters.com/business/energy/moldova-puts-its-debt-gazprom-86-mln-russian-firm-disagrees-2023-09-06/.

[11] This is true even after excluding the available capacities on the East-West transit corridor via Ukraine, Slovakia, Austria, and Italy, which mainly serves as the conduit of Russian gas flows into Europe.

[12] The TurkStream pipeline operated at just under 60 percent of its technical capacity (21.4 mcm/d) at the Serbia-Hungary interconnection point during the 12 months to June 30, 2023, delivering approximately 4.5 bcm of Russian gas to the Hungarian border during this period. However, the utilization of TurkStream jumped to nearly 85 percent in July and close to full capacity in August and September 2023, as Hungary increased both its injections into domestic storage and the volume of gas it transited to Ukraine for temporary storage (under Ukraine’s customs warehouse regime) in Q3 2023. For additional details on Ukraine’s storage situation and the challenges and opportunities for EU-based entities to store gas in Ukraine, see: Akos Losz and Ira Joseph, “Ukraine’s Underused Gas Storage Capacity,” Center on Global Energy Policy, May 30, 2023, https://www.energypolicy.columbia.edu/ukraines-underused-gas-storage-capacity/.

[13] In a sign of closer integration between Romania’s and Moldova’s natural gas transmission systems, Transgaz, the Romanian gas transmission system operator (TSO) became the operator of the gas transmission network in Moldova in September 2023, taking over the role from Moldovagaz, which is 50 percent owned and controlled by Gazprom. See: Iulian Ernst, “Romania’s Transgaz to Operate Moldova’s Natural Gas Transport System,” Romania-Insider, September 5, 2023, https://www.romania-insider.com/transgaz-operate-moldova-gas-transport-system-2023.

Geopolitical uncertainty associated with Russian gas exports could swing the range of those exports by an estimated 150 bcm per year.

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

President Putin's trip to China marks a turning point in the trajectory of Russian pipeline gas flows to the country.

Despite producing little natural gas, the EU could become the most powerful entity in global gas markets in the decades to come.