This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

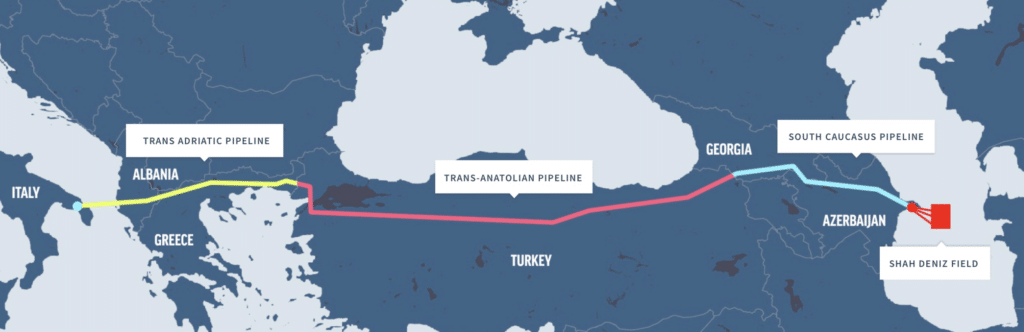

Pipeline development in the Caspian region comes with geopolitical complexity. The countries directly involved in the Southern Gas Corridor (SGC)—Turkey and Azerbaijan—as well as Turkmenistan, Russia, and Iran have diverging geopolitical goals. Turkey and Azerbaijan are trying to maintain relations with both Russia and the European Union (EU) and Turkmenistan is trying to balance gas supplies between China and the EU while avoiding deteriorating relationships with its northern neighbors: Russia, Uzbekistan, and Kazakhstan. Russia and Iran are trying to break geopolitical isolation, increase their influence in the region, and monetize locked-in gas reserves. Following an analysis of the economics of Caspian gas, in this Q&A, the author discusses how the challenge of balancing contradictory interests could be a risk for the EU, in terms of both the reliability of gas supply and instability in the region.

How is Russia reacting to the prospect of future Caspian joint gas projects for the European market?

Facing increasing pressure from the West, Russia has increased its efforts to reestablish a sphere of influence in Caspian and Central Asia. So far Russian authorities have taken the readiness of Azerbaijan and Turkey to increase gas supplies to the EU calmly, as they try to maintain friendly relations with the leaders of Azerbaijan, Turkey and Turkmenistan

There is no visible deterioration in relations between Russia and Azerbaijan[1] with presidents Vladmir Putin and Ilham Aliyev regularly meeting one another. Since 2022, Azerbaijan has provided an overland trade corridor between Iran and Russia, which has become extremely significant for Russia under sanctions [2]. There has also been a noticeable economic convergence between Russia and Turkmenistan in the past year and a half.[3] Amid frequent meetings, the two countries signed the Declaration on Deepening Strategic Partnership in June 2022. In particular, bilateral cooperation in the gas, oil and electricity sectors is growing, with Gazprom and Tatneft increasing their activities in the Turkmen market.[4]

Turkey has become a key Russian political and economic partner since the sanctions against Russia were introduced in 2022. Just before his re-election, Turkish President Recep Tayyip Erdogan had stated that “Russia and Turkey need each other in every possible field.”[5] Despite the country’s membership of NATO, Turkey has, in fact, stepped up its economic ties with Russia since the start of the war, increasing imports of Russian oil embargoed by European countries.[6] In 2022, 40 percent of Turkey’s gas imports came from Russia.[7]

For now, the benefits to Russia of maintaining good relations with Turkic countries outweigh any potential downsides, including competition with these countries in the EU gas market. As discussed in the previous article. Russia need not worry too much about competition; Azerbaijan itself is importing gas from Turkmenistan to fill gaps at the moment, while Turkmenistan is limited by the challenges of building the Trans-Caspian pipeline and commitments to China. And Turkey is now the biggest net importer of Russian gas.

Amidst declining export revenue, Russia is interested in holding onto the remaining opportunities to generate at least some income from gas exports to countries like Azerbaijan and Turkey. But there are still some “red lines”; Russia makes it clear that it would obstruct any attempt to build a Trans-Caspian pipeline on environmental grounds.[8]

Source: https://www.sgc.az/en.

How is Turkey balancing its relationship with the EU and Russia as it tries to become a regional gas hub?

Recep Tayyip Erdogan, re-elected as the President of Turkey in May 2023, has repeatedly announced his ambition to make Turkey a gas hub, while continuing to maintain special relations with Russia. He has frequently mentioned plans “to turn Turkey into a center in the energy sector of the Mediterranean, the Caspian region, and the Middle East.”[9] Putin echoes this rhetoric, but his statements seem to be motivated by the desire to send more Russian pipeline gas to Turkey, which can then be re-exported to Europe.[10] Putin observed in a meeting with Erdogan earlier this month that Gazprom has submitted a road map for the hub to Turkish energy company BOTAS.[11] This suggests the likelihood of further strengthening of ties between Turkey and Russia. At the same time, since his re-lection, Erdogan has also been speaking about Turkey’s ambition to join the EU, although he has recently scaled back his ambitions.[12] Turkey believes it can leverage its existing and new trade relations to become a gas hub and is pushing its own gas exporting agenda to the EU. Although Turkey is trying to balance its relations with Europe and Russia, it`s becoming apparent that it will be difficult to build up such a hub without infringing on the interests of either Russia or the EU.

How is Russia building up its strategy in Central Asia?

Following Russia’s invasion of Ukraine, Central Asian countries seemed to be distancing themselves from Russia. But Moscow, with an understanding of the energy and social problems of these countries, is drawing them into ever closer cooperation—and perhaps, even greater dependence in the future. Facing severe gas deficit and winter blackouts, these countries will likely continue to buy Russian gas. In addition to cooperation with Azerbaijan and Turkmenistan, Russia is also focusing on Kazakhstan and Uzbekistan. Agreements related to a tripartite gas union between Russia, Kazakhstan and Uzbekistan, proposed in November 2022 by Putin and involving the transportation of Russian gas through the territories of these countries,[13] are starting to materialize.[14] According to the officials, transit deliveries of Russian gas to Uzbekistan could reach up to 10 bcm per year.[15] Both Uzbekistan and Kazakhstan have obligations to supply gas to China and have significantly under-delivered in recent years due to domestic constraints. If Russian gas is supplied to Kazakhstan and Uzbekistan, at a favorable discount compared to the price of these countries’ exports to China, then Russia could somewhat make up for the loss of the EU market, while Kazakhstan and Uzbekistan could increase gas supplies to China, receiving much-needed export earnings.

How is Caspian gas shaping Russia’s relationship with Iran?

Russia is simultaneously tightening ties with Iran—also struggling to monetize its gas reserves. In August 2023, Russia and Iran reached agreements on the creation of an energy hub, according to Majid Chegani, Iran’s deputy oil minister and general director of the National Iranian Gas Company.[16] The idea may be to deliver gas to Iran through Uzbekistan, Turkmenistan via the gas pipeline system “Central Asia – Center” using it in reverse mode and potentially via Azerbaijan.[17] This could lead to the implementation of a gas pipeline from Iran to Pakistan and India. Another possibility is for Iran to collaborate with evolving Russian competences in LNG plant construction. Although these plans sound farfetched and do not look economically feasible, they are important for Russia from a geopolitical point of view—and cannot be completely ruled out.

How reliable are Turkey, Azerbaijan, and Turkmenistan as partners for the EU?

For years, the EU has supported the creation of SGC and has been looking at Caspian gas as a viable diversification option. However, with Russia working hard to reestablish its influence in the region, these supplies might come with increasing geopolitical risk.

The region is volatile, as shown most recently by Azerbaijan’s military offensive against Armenians in the breakaway region of Nagorno-Karabakh. Moreover, the countries participating in the SGC—Azerbaijan and potentially Turkmenistan—are authoritarian regimes lacking transparency.[18] Revenues from hydrocarbon exports are not used by the authorities to establish stable institutions. Instead, they primarily enrich the ruling elites.[19] This creates a risk that these countries may follow the path of other resource-based, unpredictable autocracies. Azerbaijan’s readiness to increase volumes through supplies from Russia and via Iran—while the Trans-Caspian is still in an early stage with questions about its future—adds additional risks to the expansion of SGC for the EU.

What is the future of the SGC?

Despite the MoU signed by President Aliyev and president of the European Commission Ursula von der Leyen to double gas supplies from Azerbaijan by 2027, and Turkmenistan’s recent statement on its readiness to proceed with Trans-Caspian pipeline, the future expansion of the SGC remains uncertain.

It is questionable whether Azerbaijan can ensure the required gas volumes without increasing its reliance on Russia or Turkmenistan (via Iran or through a direct route). Participation of Turkmenistan is not guaranteed; challenges related to the financing of the Trans-Caspian project, as well as geopolitical tensions in Caspian remain in place.

The timing is critical; Europe needs this gas urgently, not in a decade’s time. In the next 2-3 years, substantial LNG volumes would become available globally, and by then the EU may have resolved its current energy supply crisis and moved further along on its energy transition path.

Still, the discussion on expanding supplies through the SGC will continue in the coming years, as the negotiating process itself is important for Azerbaijan, Turkmenistan, and Turkey from a geopolitical perspective.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] https://carnegieendowment.org/politika/88651

[2] https://www.stimson.org/2023/russia-iran-converge-in-attempt-to-build-a-new-eurasian-order/

[3] https://1prime.ru/state_regulation/20230120/839535364.html

[4] https://tdh.gov.tm/ru/post/34395/turkmenistan-rossiya-kurs-na-diversifikaciyu-dvustoronnego-partnyorstva

[5] https://www.politico.eu/article/turkey-special-relationship-russia-grow-recep-tayyip-erdogan-valdimir-putin/

[6] https://www.politico.eu/article/turkey-special-relationship-russia-grow-recep-tayyip-erdogan-valdimir-putin/

[7] https://www.osw.waw.pl/en/publikacje/osw-commentary/2023-03-10/turkeys-dream-a-hub-ankaras-wartime-gas-policy

[8] https://eurasianet.org/turkmenistan-smashing-time

[9] https://tass.com/economy/1556141

[10] https://www.dw.com/en/will-turkey-ever-become-a-russian-gas-hub/a-65053534

[11] https://www.reuters.com/business/energy/disagreements-delay-russian-gas-hub-plans-turkey-sources-2023-09-14/

[12] https://www.reuters.com/world/middle-east/turkeys-erdogan-says-country-could-part-ways-with-eu-if-necessary-2023-09-16/

[13] https://www.uzdaily.uz/ru/post/73735

[14] https://podrobno.uz/cat/uzbekistan-i-rossiya-dialog-partnerov-/gazovyy-soyuz-rossii-uzbekistana-i-kazakhstana-mozhet-rasshiritsya/

[15] https://www.rbc.ru/business/15/08/2023/64db4b429a79477e12def06c?from=newsfeed

[16] https://news.day.az/world/1587706.html

[17] https://itek.ru/analytics/trojstvennyj-gazovyj-sojuz/

[18] https://freedomhouse.org/explore-the-map?type=fiw&year=2023

[19]https://www.transparency.org/en/news/azerbaijani-laundromat-grand-corruption-and-how-to-buy-influence

More on Energy Explained Energy Explained

Downside and Upside Scenarios for Iranian Gas

Iran has among the world's largest natural gas resource bases, but its ability to supply regional and global markets is constrained by sanctions, underinvestment, and limited export infrastructure.

How a Conflict in Iran Could Affect Oil Markets in the Gulf Arab States

Multiple US–Iran conflict scenarios carry materially different risks for global oil infrastructure, transit routes, and prices.

Where China Gets Its Oil: Crude Imports in 2025 Reveal Stockpiling and Changing Fortunes of Certain Suppliers, Including Those Sanctioned

China’s crude oil imports hit a record-high 11.6 million barrels per day in 2025, as geopolitical tensions, low oil prices, and global oversupply spurred China to increase its oil stockpiles, a trend likely to continue in 2026.

Iran’s Natural Gas Paradox: Vast Resources, Limited Export Capacity

Iran appears to be a natural gas giant, due to its large proved gas reserves and significant gas production and consumption.

Relevant

Publications