Après la Russie, comment le piège du gaz naturel américain s’est refermé sur l’Europe

DÉCRYPTAGE - Les Vingt-Sept cherchent désormais des solutions pour sortir de cette nouvelle dépendance à l’égard d’un État qui ne leur veut pas toujours du bien.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Last week, the top Republicans on the Senate Energy Committee and House Energy And Commerce Committee sent a letter to the Executive Director of the International Energy Agency, Dr. Fatih Birol, expressing concern about recent IEA analysis related to the clean energy transition in the context of the IEA’s historic energy security mandate.

The letter builds on growing criticism from some quarters of IEA analysis and its various energy outlook scenarios. Questions have since persisted related to whether the IEA has strayed dramatically and outside the scope of its mandate, or if its goals have evolved naturally and logically over time to reflect an ever-changing global energy landscape that has changed significantly since it was founded 50 years ago.

As part of this public discourse, Bob McNally, a Non-Resident Fellow at the Center on Global Energy Policy and former Special Assistant to the President on the National Economic Council from 2001-2003, published an op-ed in the Wall Street Journal critical of how the IEA’s mission has changed to where it is today. In response, Jason Bordoff, the Founding Director of the Center on Global Energy Policy, shared reflections and critiques of points made in the piece on LinkedIn.

A back-and-forth discussion ensued on LinkedIn between Bob and Jason over the course of several days, further analyzing the questions about the IEA’s mission and focus. Contained in full below is that entire exchange, beginning with Bob McNally’s Op-Ed and following the chronological back-and-forth between Bob and Jason on the topic that took place on LinkedIn.

The entirety of their exchange is collected here by the Center on Global Energy Policy for ease-of-access and in chronological order, with the intent to serve as a resource for future reference by the global energy policy and scholarly community in future conversations or debate around the IEA’s mission. The exchange reflects the Center on Global Energy Policy’s values and mission to provide a forum for diverse viewpoints, allow for respectful and evidence-based dialogue and disagreement in search of common understanding, and inform the public dialogue about key energy and climate issues.

Robert McNally

Feb. 12, 2024 4:16 pm ET

The Wall Street Journal

The U.S. and other oil-importing countries established the International Energy Agency in 1974, a year after the disruptions of the Arab oil embargo. The IEA’s founders intended to create a multinational organization that would bolster energy security by providing authoritative data and analysis; scrutinizing energy markets, policies and geopolitics; and orchestrating responses to emergencies. But today the IEA looks more like a climate-obsessed nongovernmental organization. As IEA members gather this week in Paris, they should consider several steps to restore the agency’s reputation and bolster energy security.

For most of the past five decades, the IEA fulfilled its watchdog duties. It became the gold standard for timely data, impartial analysis and forecasts devoid of political bias. The agency navigated energy crises, providing data and policy coordination during the two Gulf Wars, the 2019 Iranian attack on Saudi Arabia’s Abqaiq oil facility, and various natural disasters affecting energy supply and basic energy trends.

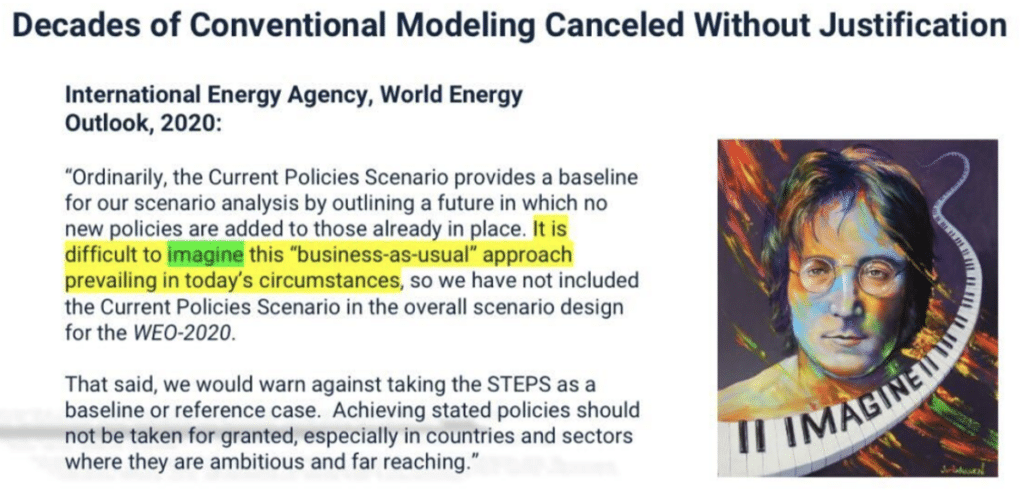

Unfortunately, in recent years, the IEA has succumbed to politicization and strayed from its security mission. In 2020 the IEA bowed to enormous pressure from climate activists and ceased publication of oil and gas demand forecasts that didn’t show demand for those fuels would soon peak because of imaginary future climate policies. Green groups had been angry over IEA baseline forecasts showing what the activists regarded as too much oil and gas demand. This was because these baseline forecasts assumed only the laws currently on the books and didn’t engage in conjecture about future green policies. As a result, IEA’s influential demand forecasts now reflect wishful thinking about the timing and cost of a peak in oil and gas consumption.

IEA’s capitulation to political pressure transcends mere technical debates among energy-forecasting experts. Bullying the world’s respected energy authority to mislead the world into thinking that oil and gas demand will soon peak might align with the preferences of certain governments and activists. But the distortion and politicization of the IEA’s once-respected forecasts pose significant risks.

Skewing forecasts to signal a near-term peak in fossil-fuel demand perpetuates the myth that there’s no need for further investment in new oil and gas fields. The IEA has announced that under its imaginary scenario, in which the world marches toward “net zero” emissions, new investments in oil and gas won’t be required—and therefore none will be permitted. The media and activists have gleefully interpreted the IEA’s observation as a plea by the world’s energy authority to ban new oil and gas investment, with little clarifying pushback from the IEA. In the past few weeks, the Biden administration has jumped on the IEA’s forecast for a near-term peak in natural-gas demand, using it as a key rationale for halting the processing of applications for new liquefied natural gas projects.

Basing decisions to limit or prohibit investments in oil and gas on official forecasts influenced by political agendas undermines energy security and borders on energy self-sabotage. Fossil fuels lifted humanity from millennia of squalor, darkness and immobility. For decades fossil fuels have accounted for 80% of global energy consumption. While renewables are growing strongly from a small base, oil and gas will continue to power modern society. By encouraging calls to ban oil and gas supply, an agency established to protect consumers against painful energy crises is helping to ensure the next one takes place.

The IEA’s cave-in to zealous green censors presents another significant risk: Without unbiased, policy-neutral baseline forecasts, elected officials can’t evaluate the trade-offs, costs and benefits of energy and climate proposals. Pulling the wool over officials’ eyes is especially dangerous as policymakers propose radical and potentially exorbitant climate measures. President Biden wants to ban natural gas and coal, which account for 60% of the nation’s power generation, in all electric plants by 2035. That’s the same year some states plan to outlaw the sale of new gasoline-powered vehicles.

The world has enough climate NGOs. What it needs in a time of energy-roiling conflicts in Europe and the Middle East is an impartial and respected energy security agency. The U.S. and other IEA members should urge the agency to resume producing unbiased, policy-neutral forecasts. The IEA should also clarify that it opposes any disastrous halt in new oil and gas supply. And it should follow the example of the U.S. Energy Information Administration and make all taxpayer-financed IEA data, assumptions, and methodologies available to the public.

The world’s energy-security watchdog has gone missing. With energy risks and challenges aplenty, all IEA members must restore the agency’s credibility and walk it back to its vital security mission.

Mr. McNally is an energy consultant and author of “Crude Volatility: The History and the Future of Boom-Bust Oil Prices.” He served as a special assistant to the president on the National Economic Council, 2001-03.

Originally published on Jason Bordoff’s LinkedIn on February 15, 2024 along with the caption:

One of the best things about my friendship with Bob McNally, whose expertise I benefit from so often, is the ability to occasionally respectfully disagree. While there are reasons to critique the International Energy Agency (IEA), Bob’s recent WSJ op-ed goes too far, in my view, in attacking this vitally important organization. Outlined in brief below are a few key points I take issue with.

I’ve learned so much from Bob McNally over the years and from his excellent book, Crude Volatility, which the Center on Global Energy Policy was proud to publish as the very first book in our Columbia University Press book series. A great part of our friendship, mutual respect, and working relationship that I have always valued has been the ability to learn from each other even when we disagree. With that in mind, while there may be reasons to be critical of the International Energy Agency (IEA), his recent op-ed goes too far, in my view, in attacking this vitally important organization with a proven track record of providing valuable analysis to the global energy community. Outlined in brief below, I would take issue with a few key points.

As Bob explains, the IEA was indeed founded with energy security, specifically with regard to oil, as its mandate. This work continues in its mission today, as seen from two recent coordinated oil stock releases. It also recently provided data, policy advice, and coordination to help European countries navigate the loss of Russian pipeline gas supplies as a result of the Russian war in Ukraine. And just this week they launched a new security program for critical minerals for the energy sector.

Yet the world has evolved since the 1973 oil crisis that spurred the IEA’s creation, and the IEA has appropriately evolved with it. Today, climate change also poses severe risks, including to energy security and to an orderly transition, as I’ve written. Fatih Birol has appropriately broadened the IEA’s mandate to address the threat of climate change, as well as to work with non-OECD countries, which today are among the largest energy users.

The IEA does not only engage in “wishful thinking”, as Bob suggests. Its new reference case (STEPS) looks at policies in existence and under development to help us understand where the world is headed. Bob is correct that the old Current Policy Scenario, which assumes no new policies are added to those in place, was jettisoned a few years ago, and there are legitimate reasons one might argue, as Bob does, it should still be produced as one scenario among many. But IEA has been clear about why it made its shift, and there is a strong argument that STEPS is more suitable to a dynamic policy environment and energy system in transition than CPS, which takes an excessively conservative view of the policy framework and made more sense for a more stable energy system.

The IEA projects oil demand will rise 1.2 million barrels per day this year. In STEPS, it sees oil demand peaking at 102 mb/d before falling back to 101 mb/d in 2030. Given the current trends for rising oil demand, it’s certainly reasonable to disagree with the IEA’s projection that oil demand will peak this low or this soon, but the view that oil demand rises a bit more this decade and then plateaus is not wildly out of line with other forecasts. Wood Mackenzie’s base case, to pick one example, sees oil demand peaking in 2032 at around 108 mb/d and falling to 90 mb/d by 2050.

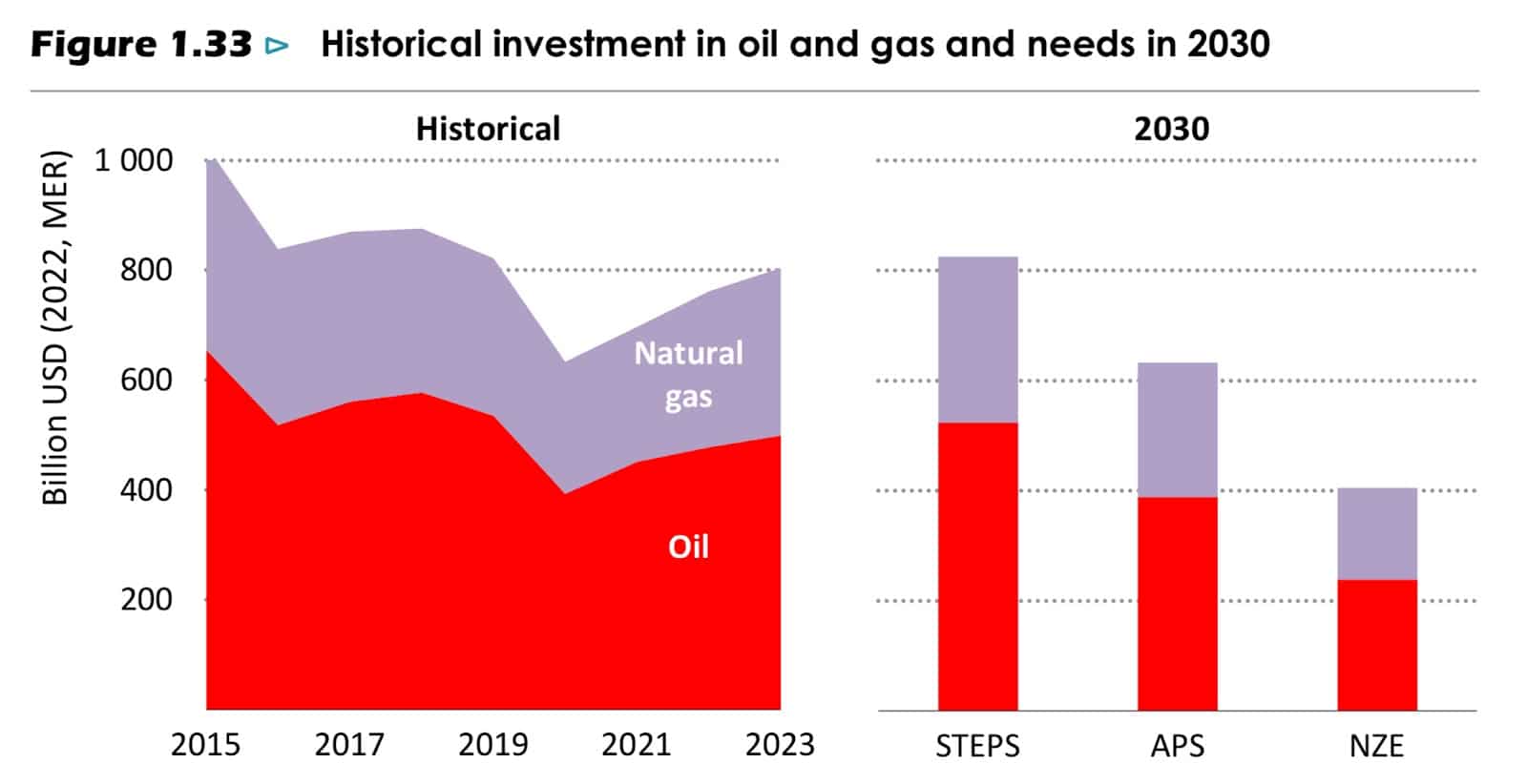

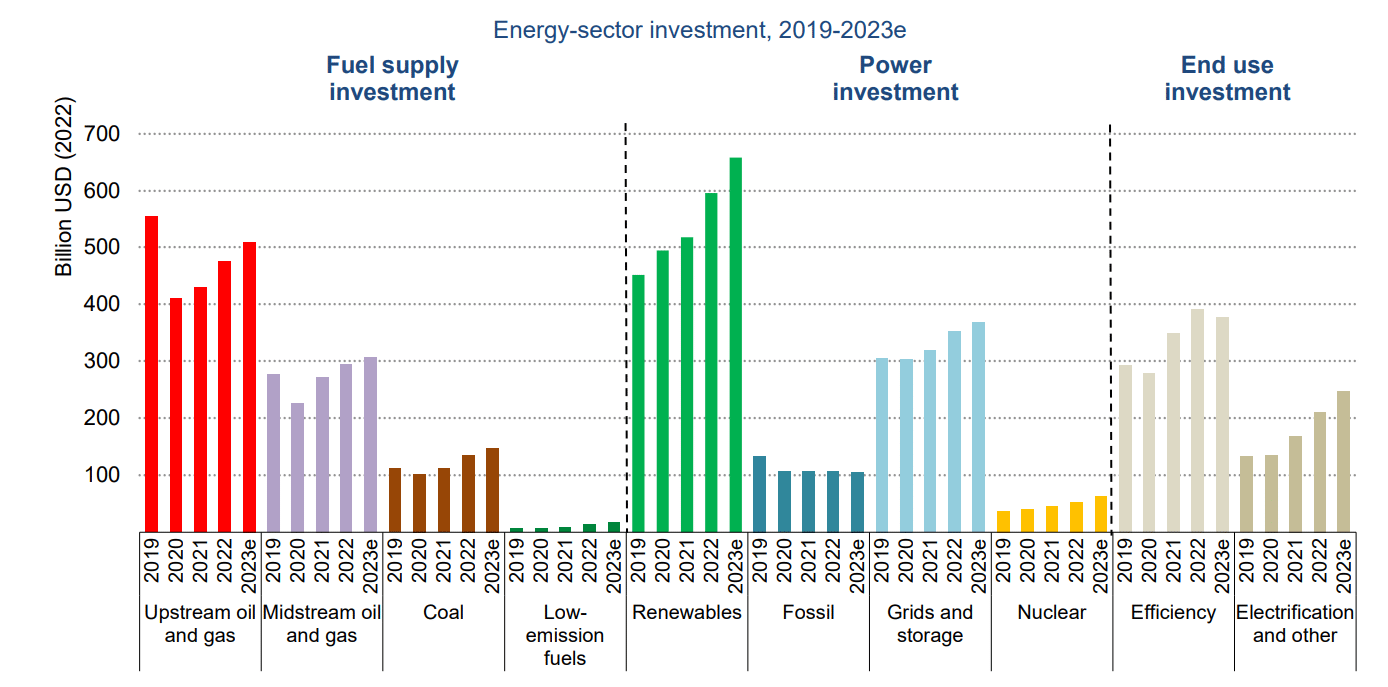

Bob argues IEA’s projection of peak oil demand is harmful because it “perpetuates the myth that there’s no need for further investment in new oil and gas fields.” Except the IEA explicitly says the opposite. It explains that in STEPS or even APS, a scenario in which countries meet their pledges, “investment is needed in both new and existing oil and gas projects.” Indeed, even with oil demand peaking, IEA finds the level of investment in 2030 would be higher than today in its baseline scenario (below).

With the urgency of the climate crisis leading the international community to commit to achieve net-zero emissions by 2050, it was appropriate and helpful for the IEA in 2021 to provide a roadmap for what achieving that goal would actually entail (NZE scenario)—a report prepared at the request of the United Kingdom’s COP26 presidency, not just “zealous green censors.” It was in this scenario, which admittedly seems highly unlikely at this point unfortunately, that the IEA found investment in new fields would not be necessary.

It is fair to criticize IEA’s messaging around this finding, leading people to believe that ceasing investment in new fields would bring about a net-zero world. As the IEA has since taken pains to clarify, achieving net-zero means investment in new fields is not needed, not the other way around. “Simply cutting spending on oil and gas will not get the world on track for the NZE scenario; the key to an orderly transition is to scale up investment in all aspects of a clean energy system,” the IEA wrote in its most recent outlook. As I have written, if we stop investing in oil before we stop using oil, either prices spike or other producers, like the nationally owned companies that supply more than half of the world’s oil supply, will just increase their supply.

Bob calls on the IEA to “clarify that it opposes any disastrous halt in new oil and gas supply.” But the IEA published a major report on the oil and gas industry just before COP28 in Dubai, which included the following top-line bullet point in the executive summary: “Oil and gas investment is needed in all scenarios.”

He calls on the IEA to “make all taxpayer-financed IEA data, assumptions, and methodologies available to the public.” Except it is not all taxpayer funded. The IEA turns to external funding because the contributions from its member states are insufficient to cover its lean budget, hence the need to charge for access to some data and reports. The IEA would be thrilled to make its data available for free if its member governments would increase their contributions, as it has proposed in the past.

There are fair criticisms of the IEA, including how some of its recent messaging elides the nuance of its actual underlying analysis. But a fair assessment of the IEA’s analysis should look beyond headlines. The work done by the IEA’s analysts is invaluable to those of us seeking to understand today’s complex and dynamic energy landscape. Its net-zero 2050 scenario is not “magical thinking”, as derided by some, but the best analysis in existence to help understand what is actually needed to achieve this exceedingly ambitious goal and how staggeringly difficult it is. It would be far worse for energy security, core to the IEA’s mission, to ignore the risks of climate change or fail to produce the data needed to understand what is actually required to rise to the climate challenge. As the IEA celebrates its 50th anniversary, all of us who care about a secure and rapid energy transition should celebrate this milestone and be grateful for the IEA’s work.

Originally published on Bob McNally’s LinkedIn on February 15, 2024 along with the caption:

I welcome and appreciate the critique of my Wall Street Journal essay on the International Energy Agency (IEA) by my friend Jason Bordoff. I collected some thoughts in response and welcome comments from him and others, asking just that we keep it civil as Jason and I have. Please see attached.

I will include a link to Jason’s post in a separate post below.

Thank you, Jason Bordoff, for civilly raising objections to my Wall Street Journal Op-ed criticizing the IEA for dangerously straying from its mission as an unbiased security agency. And let me also return the compliment by saying how much I’ve learned from you. I especially admire the very rare and valuable qualities that you exhibit in spades – rationality and objectivity – and the powerhouse energy think tank you have built in the Columbia Center on Global Energy Policy, where I’m a proud non-resident fellow.

And let me say I share your admiration for the talented and hardworking staff at IEA. It gives me no joy to be compelled say out loud what many if not most energy experts nowadays think. I’d rather be advocating for more resources for IEA and its sister agencies like EIA to analyze energy markets and policy. But with the Biden administration now invoking biased IEA forecasts to justify halting LNG permits, it’s clear to me that IEA’s dereliction of duty is being weaponized by policymakers and the time to speak up has come. There’s an old Washington expression: “Elections have consequences.” Well, when it comes to IEA, “forecasts have consequences.”

OK, now let me address some of the issues you raised with my piece.

We can start with a point of agreement. I believe we both think the IEA should clarify that it does not recommend a halt in new greenfield upstream oil and gas investment? Yes, IEA has not called for halting all investment. Investment in existing fields would continue, as Jason noted.

But I’m talking about investment in new greenfield oil and gas projects, like the Willow project in Alaska that President Biden approved last year. That’s where IEA has been curiously ambiguous and allowed the impression to remain that it calls for a ban.

That clarification is sorely needed because the press missed the signal by a large margin when IEA released its May 2021 Net Zero Roadmap report (see headlines below).

IEA calls for no new investment in fossil fuels as part of net-zero plan, The Hill, 5/18/21

To reach climate goals, new oil and gas investment must be stopped, energy agency says, NYT, 5/18/21

Scrap the sale of gasoline cars and stop investing in fossil fuels to meet net-zero targets, IEA says, CNBC, 5/18/21

End new oil, gas and coal funding to reach net zero, says IEA, Reuters, 5/18/21

Stop New Oil Investments to Hit Net-Zero Emissions, IEA Says, WSJ, 5/18/21

It escapes me why the IEA simply won’t clearly state that banning new greenfield oil and gas investment would be disastrous for economic growth and security and that’s not what they intended to signal the world should do in its Net Zero road map.

Next, you did not address my key point that by depriving officials of a policy-neutral reference case forecast, they cannot evaluate the costs and benefits of energy or climate policies. We both have evaluated policy proposals for Presidents in the same White House positions. We, along with our colleagues who objectively analyze energy trends, understand that a policy-neutral reference case is indispensable for sound policy development. Therefore, it escapes me why an energy security agency would deprive officials of an essential tool they need to estimate the costs and benefits of policy.

Can you, or anyone else, think of a good reason for canceling a reference case scenario?

You say that IEA has “been clear about why it made its shift” from including a CPS scenario and canceling one. Has it? I have looked but can’t find that explanation. Here’s what IEA said in its 2020 World Energy Outlook when it announced the shift:

Apparently it simply an undefined failure of IEA imagination?

But to my knowledge (please correct me if I’m wrong) IEA did not then nor explained its very unusual and controversial shift. After all, it was hardly self-evident in 2020 that the world has barreling fast toward stringent climate policies. President Trump had just eased fuel economy rules, France had backed off a small carbon tax on diesel after it sparked massive protests, and China was phasing out EV purchase subsidies. And since 2020 we’ve seen plenty of climate policy delays, walk backs and weakening, including in Europe. Yet IEA continues to publish, indeed double down on, scenarios that only show oil demand peaking by end-decade – where’s the beef?

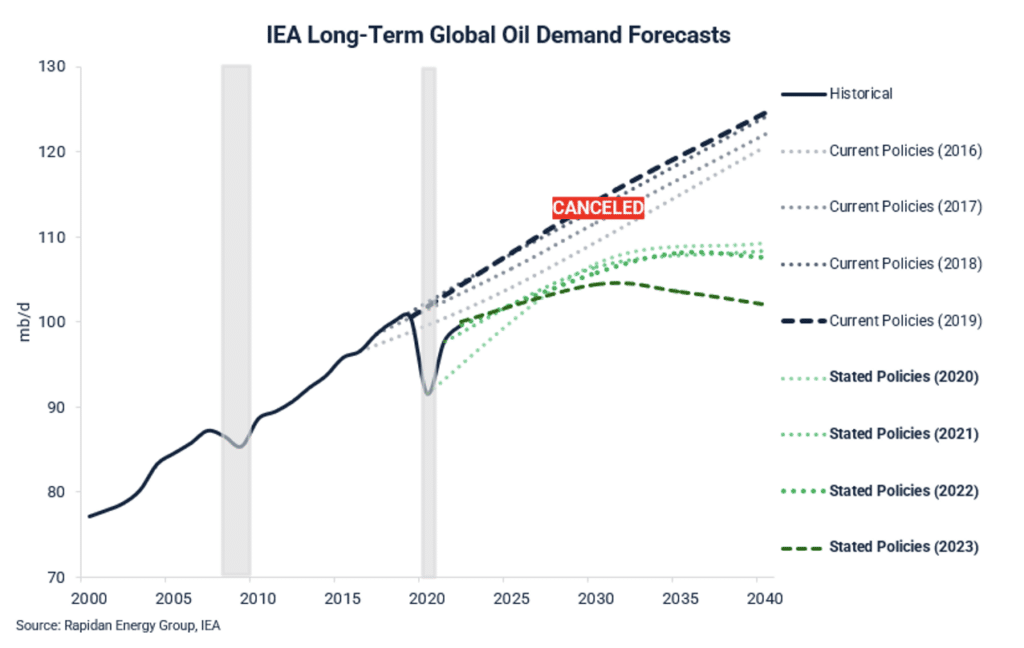

Finally, this chart below illustrates the enormous difference in oil demand outlooks between CPS and STEPs. Not small! I understand why climate activists would not want to see a CPS scenario in public, but why would anyone else be opposed?

Most forecasters follow the IEA’s lead. IEA drives the consensus. Duping the consensus in to expecting an imminent peak demand will come back to bite us as it will divert capital from supply and contribute to economically devastating oil prices spikes the IEA was created to prevent.

We all know ludicrously aspirational targets are common in energy policy history, with both parties engaging in it. John Stewart did a nice monologue on that in 2010.

The difference now is that the world’s energy security watchdog is skewing its analysis to encourage investors to bet the farm on fantasies while blinding officials to the costs of radical climate policies and exposing consumers to harmful oil price spikes. That’s not a laughing matter.

My Op-ed asked IEA members to do three things:

I meant to emphasize transparency. The Energy Information Administration is the model: Data, assumptions, and methodologies freely available to the public. We both enjoy energy because the stakes for growth, security, and the environment could not be higher. Can’t have enough sunshine when we’re debating how to seize energy opportunities and manage risks.

I did not say climate change isn’t important or the IEA should ignore it. To the contrary, an objective and depoliticized IEA is essential for proper analysis and debate on climate and other energy-related subjects. IEA analyses should not be weaponized against fossil fuels, as they manifestly have been.

It’s a sign of the crazy times that my three reasonable proposals are even controversial. Implementing them would restore IEA’s role and reputation as the trusted, objective security watchdog we once enjoyed, and that future energy security and sound climate policy require.

Originally published on Jason Bordoff’s LinkedIn on February 19, 2024 along with the caption:

Thank you to my friend and colleague Bob McNally for his thoughtful response to my reflections on his recent Wall Street Journal Op-Ed. I am encouraged by the evolving and constructive discourse I’ve seen around our conversation here, and in closing have offered a few final thoughts on the topic. Despite our differences of opinion, I’m pleased to see we also agree on a lot, including the talent and dedication of the International Energy Agency (IEA) staff. We can all express gratitude to them on their 50th Anniversary for all of the hard work, data, and analysis that has informed policy discussions throughout the energy industry.

Bob, Thanks for taking the time to so thoughtfully reply to my post.

Apologies for the delay in responding, as I spent the weekend at the Munich Security Conference, where the risks of conflict (especially escalation of the wars in Ukraine and Gaza), US-China competition and rivalry, economic fragmentation and protectionism, 2024 elections (especially in the U.S.), artificial intelligence, authoritarianism, and climate change all loomed large over the agenda.

For me, it was a poignant reminder that we can’t take energy security for granted and, as I wrote in my reply to you, of both the continued importance of the IEA’s original mandate to protect energy security and also the IEA’s expansion of that mandate to include the growing threats of climate change.

I also very much appreciate your kind words about my work and that of the Center on Global Energy Policy, where we’re proud to have you as part of our team as a non-resident fellow.

Not surprisingly, we agree on a lot, including the talent and quality of the people who work at the IEA and the importance of funding it adequately. We also agree, as I wrote, that the messaging around the original Net-Zero 2050 scenario created the false impression (since clarified) that ceasing investment in new fields would bring about a net-zero world, not the other way around.

One criticism is of the IEA’s creation of the Net-Zero 2050 (NZE) “imaginary scenario” in the first place, and of how many have used or (mis)interpreted the findings. I believe NZE was a valuable contribution. Countries have come together, most recently at COP28 in Dubai, to pledge to limit temperature rise to below 1.5 degrees Celsius, a target driven by our scientific understanding of the risks and impacts of climate change beyond this level. If policymakers are going to commit to such a target, it’s necessary to have a clear understanding of the scale and magnitude of energy system transformation needed to achieve it—which is why I called it “staggeringly difficult”. Some may look at this scenario and decide it is so staggeringly difficult as to be impossible—“magical thinking,” or “La La Land” as one prominent energy minister famously called it. But the other way to think about this is that the only reason one can judge the 1.5-degree target to be “magical thinking” is because the IEA created this scenario in the first place. Otherwise, people would not even understand what was needed—and how hard or easy it might be—to achieve the goal to which so many countries have now formally committed themselves.

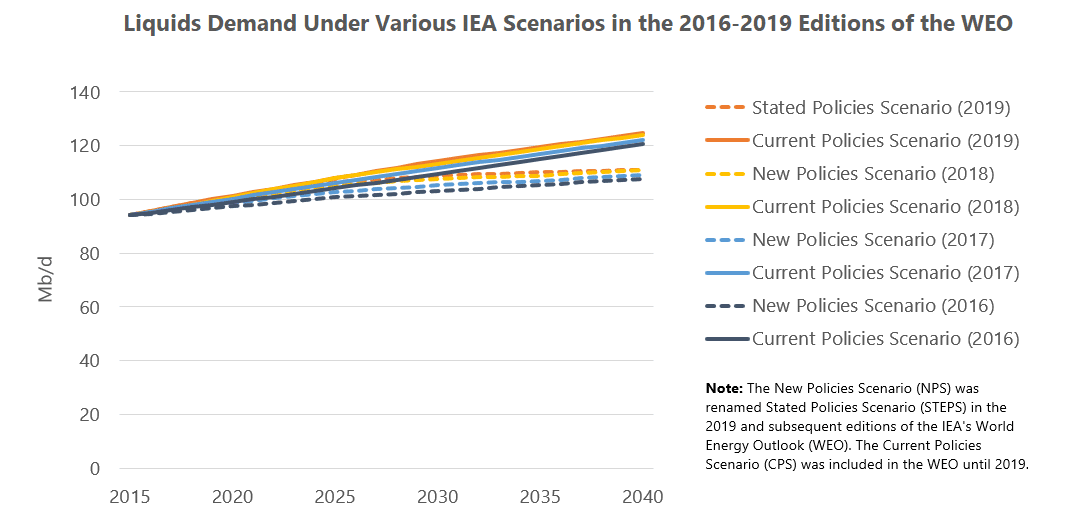

The other criticism is of the choice of STEPS rather than CPS as the baseline or reference scenario. As I acknowledged in my response, reasonable people can disagree about this—and I understand why one might ask for a CPS as an additional scenario to inform decision makers. I agree completely with you that a baseline is needed to evaluate potential policy choices. As you say, you and I have both been in these policy roles, and there’s no way to understand the impact of proposed policy changes unless you have a reference case that explains the energy outlook absent those changes. That is why I always defended the IEA against attacks from the environmental community that its outlooks were excessively conservative because they underestimated the growth of renewables and clean energy. The higher-than-expected growth in clean energy resulted from stronger policies (as well as new technological innovations), and the need for those additional policies was only apparent because we had reference cases that did not “imagine” they would happen, as you say.

But there’s a gray area between an excessively conservative current policy scenario that is entirely static and one that makes best guesses about where the current, not promised and pledged (that’s a different scenario), policy landscape is headed. There are inevitably judgment calls to make by the IEA to assess where current policy is headed. For example, President Obama’s Clean Power Plan was enacted but then stayed by the Supreme Court in advance of an election, leading one to need to make judgments about whether it is current policy or not. The same is true for fossil fuel supply projections by the IEA. For example, the official energy strategy documents of countries like Mexico and Venezuela used to include sharp increases in oil production, with little credible investment plans or development programs; are those current policy or not?

By the way, I fully acknowledge that this more flexible approach to a dynamic policy environment might cut in the other direction, too. Net-zero by 2050 is arguably a “stated policy” in Europe given that it is legislated, but do we really think Europe is on track for that? Similarly, in some countries, clean energy policies on the books are actually being weakened or delayed by governments now in response to voter concerns about affordability or reliability, such as the UK’s recent decision to scrap a plan that would have fined boiler companies for missing production targets for heat pumps.

Having said all that, I think you overstate the significance of the IEA’s choice. Your chart compares pre-2020 CPS scenarios with post-2020 STEPS scenarios. But the Covid shock of 2020 together with numerous other policy and technology shifts account for part of the sharp differences between pre- and post-2020 scenarios, not just the choice to move from CPS to STEPS (which was called New Policies Scenario or NPS until 2019). It is more accurate to compare pre-2020 CPS with STEPS and NPS projections for the same years. As you can see below, the difference is smaller than your figure suggests (although not insignificant). It’s also worth pointing out that, if you compare the outlook from 2016-2019 with today’s outlook from groups like Wood Mac or S&P, NPS/STEPS has proven to be more accurate than CPS.

You are right, of course, that both elections and scenarios have consequences—although it does seem like the powerful and detrimental impact you attribute to the IEA may be a bit overstated. Investments in fossil fuel supply have been growing steadily since the 2020 slump, IEA messaging around the Net Zero report notwithstanding.

You refer to “weaponization” of IEA scenarios for decisions like the recent pause on new permits of LNG. In reading the Biden administration’s explanation of that decision, I saw discussion of the need to study how various developments in the last decade might change the analysis of the market and climate impacts of LNG exports necessary to make a national interest determination, not a justification based on IEA’s projection of peak demand this decade (although Deputy Secretary of Energy David Turk did cite that finding in his recent testimony). In other words, it’s far from obvious that the administration’s decision (which people can surely disagree with) would have been different if the IEA had included a Current Policies Scenario in its more recent outlooks in addition to STEPS.

I do want to acknowledge that your oped raises a very important tension between the IEA’s traditional energy security mandate and its expanded energy transition mandate. If all its member countries cared about was keeping today’s energy supplies as secure and affordable as possible, the IEA might be championing much larger investments in coal, oil and gas, especially in light of the geopolitical risks I mentioned at the outset, which were highlighted at this weekend’s Munich Security Conference. But as I wrote in my reply, today’s reality is that the risks to energy security (and much more) extend far beyond adequate oil supplies to include the threats of climate change. That requires a difficult balancing of multiple policy objectives—ensuring near-term security and affordability while simultaneously avoiding actions that undermine our ability to sharply accelerate the clean energy transition, something I’ve tried to address in my writing.

Finally, I do want to acknowledge my thinking on these issues has benefited a lot from the dialogue we’ve been having within the Center on Global Energy Policy since your op-ed came out, including with many of my great colleagues who have worked at the IEA, such as Anne-Sophie Corbeau, Antoine Halff, Akos Losz, Pierpalo Cazzola, and Lilly Lee. (And special thanks to Akos and Lilly for their help thinking through my exchange with you.) Even within the Center on Global Energy Policy, there’s a healthy debate going on around this topic, but one thing that’s clear is the respect they all have for the quality, productivity and efficiency of the roughly 350 people who work at the IEA, producing 250+ reports per year plus many other workshops, ministerial meetings, emergency exercises, public presentations, technical assistance to partner countries, etc. So even as we respectfully debate recent IEA choices, messaging, and analysis, let’s raise a glass to the IEA team on the occasion of its 50th anniversary, with gratitude for all their hard work, data and analysis. 🍻

Originally published on Bob McNally’s LinkedIn on February 19, 2024 along with the caption:

Thanks a lot Jason Bordoff,

Your points are as usual fair, astute and balanced. I too see a lot more agreement than disagreement. And I appreciate the thoughtful and largely civil commentary our discussion has generated among our fellow travelers.

I agree COVID and other factors threw a big monkey wrench into comparisons of recent demand forecasts. Looking forward, hopefully we’ll enjoy a few years of solid, black-swan-free economic growth to test the consensus expectation, fostered in no small part by IEA’s recent choices on which demand scenarios to omit and which to continue publishing, that oil demand is decoupling sharply enough from economic activity due to automobile fuel efficiency regulations and EV penetration that it will peak roughly six years from now. We agree that IEA forecasts matter, and big farms are being bet on that one.

I also agree that your approach to comparing IEA CPS and STEPS scenarios more precisely illustrates the magnitude of the differences between them as they evolved in recent years. My chart is intended to illustrate the abrupt, portentous and less-than-magnificently-justified-and-communicated message shift that non-energy experts heard from the influential IEA starting in 2020 about the timing of peak oil and gas demand and the implied appropriateness for continued investment.

Finally, like you, I’m traveling and will join many of our professional colleagues at IEF – International Energy Forum tomorrow in Riyadh where demand outlooks will feature (pop over if you’re still in the neighborhood?)

Otherwise, let’s iron out the few remaining wrinkles and set the world straight on April 16 in NY when we, our Columbia Center on Global Energy Policy colleagues (comprising many veteran and accomplished former International Energy Agency (IEA) officials as you noted) and diverse, distinguished guests will gather for the Columbia Global Energy Summit.

Best regards,

Bob

I’m en route home after a week in Europe—first at the Oslo Energy Forum and then at the Munich Security Conference. Munich generated considerable news and drama, but...

Wright became the highest-ranking Trump administration official to travel to Venezuela since the capture of former dictator Nicolas Maduro.

Highlights from Davos, and the latest career moves in the global development sector.

As the train pulls away from Davos Dorf station through the snow-capped Swiss mountains, I find myself reflecting on a rather extraordinary week at the World Economic Forum’s Annual Meeting in Davos. While many questioned Davos’ continuing relevance last year, it is difficult to argue that this year’s gathering was not among the most consequential in recent memory, shaped in large part by President Trump’s dominant presence throughout the week’s discussions.

The United States is at a rare inflection point for nuclear energy, with unprecedented momentum behind deployment and regulatory reform as nuclear becomes central to energy security, AI competitiveness, and state and corporate climate goals.

Lawmakers today should study the Energy Security Act of 1980.

The energy transition is not inevitable—but neither is business as usual.