This commentary represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available at https://energypolicy.columbia.edu/about/partners. Rare cases of sponsored projects are clearly indicated.

Rapidly accumulating knowledge in any scientific discipline requires building on the knowledge that has been developed to date. As Isaac Newton famously declared, “If I have seen further, it is by standing on the shoulders of giants.” But what happens if there isn’t a sturdy foundation on which to stand?

That is arguably the challenge facing economists applying the tool of cost-benefit analysis (CBA) to evaluate policies that affect greenhouse gas emissions. The traditional approach to CBA relies on a series of assumptions that are so engrained in the field that new CBA applications often do not even mention these assumptions, let alone justify them. In particular, the assumptions of CBA enable a focus on how policies affect the total wealth of society[1] and not the distribution of wealth. That means CBA’s usefulness to policy makers—who worry about how wealth is distributed—requires a story about how to otherwise compensate those who may be harmed by the policy alternative that is being evaluated. As explained below, it is virtually impossible to tell this story credibly in the context of policies that address greenhouse gas emissions due to the unique nature of climate damages, which include mortality risks to vulnerable individuals throughout the world.

The result is a schism in the world of climate economics. Some leading scholars continue to use the traditional approach to CBA (Carleton et al. 2022) while others warn policy makers against using these studies (Stern et al. 2022). Just in recent months, this practice has been labeled by experts as “thoroughly discredited” (Broome 2022) and “supported by standard economic theory” (Rennert et al. 2022). Strangely, both claims are arguably correct.

The stakes are high. Governments commonly require CBA to evaluate regulations, and there is an increasing recognition that effects on both climate and inequality should be factored into any major policy decision. As the US government updates its influential guidance on CBA (“Circular A-4”) and its estimates of climate damages (the social cost of greenhouse gases), President Biden has called for capturing distributional concerns in any quantitative analysis (White House 2021b). In the context of analyzing climate regulations, the best way to carry out the president’s mandate is unclear. A first step is to recognize the problem.

The Story That Justifies Ignoring Distributional Concerns in Traditional CBA

Cost-benefit analysis may not quite be a religion, but economists are certainty known for evaluating the economic efficiency of everything, including Christmas (Waldfogel 1993). In the realm of policy evaluations, CBA is the go-to tool. Entire textbooks, journals, and societies are devoted to CBA.

As traditionally undertaken (an alternative approach is discussed below), a CBA of a policy change can be summarized in a few steps (Boardman et al. 2018):[2]

- Decide which individuals have “standing” (i.e., whose benefits and costs to count).

- Estimate, in monetary terms, the value to each individual of the policy change, including costs and benefits, which are often measured as each individual’s willingness to pay for the policy change.[3]

- Add together these monetary values and label the sum as an estimate of the “net benefits” to society of the policy change.

- Provide the result to policy makers as an input to the policy decision.

The third step is highly controversial (Goulder 2007). It is not obvious that adding up how much each individual is willing to pay for a policy change is a useful proxy for how much a society benefits from the policy change, or a helpful metric for policy makers at all. After all, this metric is systematically biased in favor of the preferences of wealthy individuals (Acland and Greenberg 2022). Why should equal importance be given to the willingness of a poor person to pay $100—who values that amount of money a great deal—and of Elon Musk to pay $100, who places virtually no value on it?

The answer is what could be called the “CBA Story.” Textbook CBA teaches that distributional concerns are important but can be kept separate from CBA because the individuals who gain and lose will change across a portfolio of policies or because policy makers have better tools to accomplish the goal of redistributing resources. In other words, the philosophy is to use CBA to help determine whether a policy will make a society wealthier overall (i.e., “to grow the pie”), under the assumption that the tax and transfer system will separately be used to accomplish societal goals related to redistribution.[4]

According to the CBA Story, straying from the principle of valuing policies in accordance with how much individuals will pay for them actually risks exacerbating existing inequalities. As part of his “plea” to stop assigning equal values to mortality risks across individuals, former White House Office of Information and Regulatory Affairs administrator Cass Sunstein points out that the government does not require poor people to buy expensive cars with high safety ratings because it is not the most sensible way to help them, even though such a policy could be justified if a high enough value was placed on mortality risks (Sunstein 2004).

Even defenders of CBA typically concede its limitations. Tax systems cannot be changed easily to compensate those who are harmed by a policy change, and surely the effects across individuals do not perfectly even out over a portfolio of policies.[5] To some economists, the limitations are fatal: a quarter century ago, Nobel Laureate Kenneth Arrow and coauthors wrote that the CBA Story’s focus on whether compensation “could possibly occur” may have been sufficient 50 years earlier, but it was no longer accepted, and a “more modern” approach to CBA would ask “whether compensation is likely to occur” (Arrow et al. 1995; emphasis in the original).

Nevertheless, the practical advantages of CBA are important to consider as well. Market data can often be used as a proxy for the monetary value of changes in goods and services. In addition, and unlike alternative approaches, the traditional approach to CBA avoids the need for difficult assumptions about how a change in circumstance affects well-being across individuals (because under the CBA Story, everyone is compensated, so everyone is better off). So, much of the economics profession has largely viewed the limitations of CBA as caveats to be dutifully acknowledged and not causes for throwing the baby out with the bathwater.

The Unique Characteristics of Climate Change Do Not Fit the Traditional CBA Story

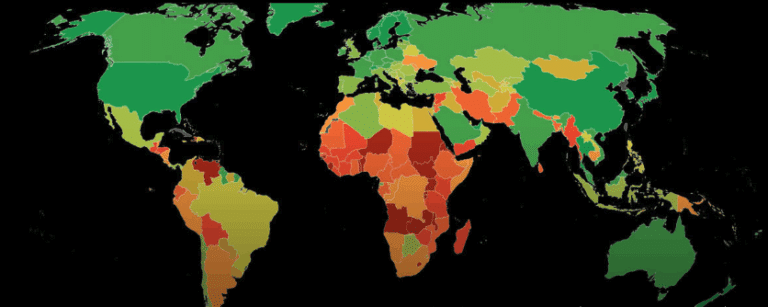

Climate damages will disproportionately affect those who cannot afford to prepare or respond (US Global Change Research Program 2018), so a metric that is disproportionately influenced by the preferences of wealthy individuals can mislead policy makers about the scale and scope of the climate challenge. The usefulness of the traditional approach to CBA in the context of climate change therefore hinges on a credible CBA Story that enables policy makers to evaluate the distributional consequences separately from the results of the CBA.

As it’s typically told, the CBA Story is controversial, but it is coherent: Paul from Pittsburgh may be harmed by a given policy change, but evidence that the policy change will lead to a wealthier country is arguably important for US policy makers to consider, because they have other ways of compensating Paul. However, this story loses its coherence when applied to the characteristics of climate damages, which are unique when considered in combination.

First, the CBA Story does not fit the global and intergenerational nature of climate change. Because carbon dioxide emissions disperse across the planet and remain in the atmosphere for centuries, climate damages will disproportionately accrue to people outside of the country and in future generations. These people are not reached by the domestic tax and transfer system, which is typically how the compensation takes place in the CBA Story.

The people in other countries who benefit from US climate actions do not pay the costs associated with these actions, so CBA can no longer be defended on the grounds that it avoids imposing undue burdens on the beneficiaries of a policy change. In his same “plea” for traditional CBA mentioned earlier, Cass Sunstein also explains the problem with the CBA Story in the international context: “The fact that a poor person in a poor nation would be willing to pay $1 to eliminate a risk…whereas a wealthy person in a wealthy nation would be willing to pay $100, cannot plausibly be used to defend the view that an international agency should devote its resources to the latter rather than the former” (Sunstein 2004).

Adding to the challenge is the evidence that climate damages may come primarily in the form of deaths and other irreversible impacts.[6] In such circumstances, the CBA Story of “maximizing the pie” is more difficult to tell, because that “pie” is not primarily the size of the economy but rather the sum of individuals’ willingness to pay to reduce mortality risks, with the bulk of that “value” coming from wealthy individuals. (In fact, federal agencies in the United States are told to adopt the CBA Story except for mortality risks, where richer and poorer Americans are valued equally.[7]) For local pollutants, perhaps we can compensate people adequately for taking on higher mortality risks. It is more difficult to imagine that any policy being evaluated in a CBA will be paired with compensation for the future residents of developing countries for the mortality risks caused by the greenhouse gas emissions in the United States today.[8]

Climate change affects everyone, but the typical victim is not Paul in Pittsburgh but rather a future Mohammad in Bangladesh. Policy makers may be able to convince themselves that they need not worry much about Mohammad, but the justification does not come from the CBA Story.

How to Proceed When the CBA Story Fails

Providing policy makers with information about the benefits, costs, and trade-offs of policy alternatives remains important regardless of whether the CBA Story can be credibly told. Options for a way forward can be grouped into the following categories:

Use distributional weights in CBA. Perhaps the most straightforward way to stop failing to account for distributional concerns in CBA is to start accounting for distributional concerns in CBA. Approaches for doing so are well developed[9] and have been applied to climate damages.[10] They are often referred to as “distributional weighting” because they stray from CBA’s insensitivity to distributional concerns.[11]

Distributional weighting addresses the problems highlighted above by converting estimates of monetary outcomes for individuals (their willingness to pay) into estimates of well-being using a “social welfare function,” which can incorporate concerns about total wealth and the distribution of wealth. For example, a social welfare function typically assumes that overall well-being increases by more when a certain amount of money is given to a poor person rather than a wealthy person (economists call this the diminishing marginal utility of income/wealth). Aside from its focus on well-being as opposed to monetary outcomes, estimating net benefits using distributional weights is similar to a traditional CBA.

In practice, the advantages of distributional weighting are somewhat dampened by the lack of sufficiently granular data to reflect the most relevant distributional concerns.[12] Distributional weighting also requires moral judgments that many economists and policy makers prefer to avoid.[13] Of course, the decision to undertake a traditional CBA that ignores distributional concerns requires a moral judgments about inequalities as well. Nevertheless, traditional CBA has the advantage of being the status quo approach.

Get more comfortable with nonquantified benefits. Many important benefits and costs cannot be reasonably quantified or monetized. In the United States, federal agencies can adopt regulations with quantified costs that far exceed quantified benefits due to the likelihood of large unquantified benefits, and they have done so in the past (US Environmental Protection Agency 2014).

The difficulty of capturing distributional concerns is just one of many reasons not to quantify the damages to the world over centuries caused by increasing greenhouse gases in the atmosphere to further unprecedented levels. If nonquantified benefits are too important for a CBA to provide useful information, policy makers can rely more on risk-management-focused approaches and separate analyses of distributional consequences (Weitzman 2009; Baumol 1971). The international community has largely followed this advice with respect to its climate change goals, with a focus on temperature and emissions targets.

For economists and federal regulatory analysis in the United States, moving away from applying CBA to climate policies would be a break from past practice. While emissions targets can be grounded in science, economics, and ethics, some have argued that political considerations are more likely to influence emissions targets than the assumptions of a CBA (Aldy et al. 2021).

Continue using traditional CBA. Given the inability to tell a credible CBA Story, it is difficult to justify the continued use of traditional CBA in the context of climate change because the results will not help policy makers decide between alternative actions. Continuing to systematically provide policy makers with traditional CBAs—with results declared as the benefits and costs of the policy change—surely gives the opposite impression. Just last year, the National Highway Traffic Safety Administration (NHTSA) rejected a proposal for a more stringent fuel economy standard using the justification that the quantified costs were larger than the quantified benefits (US National Highway Traffic Safety Administration 2021).[14]

However, for government-led CBA, influential scholars have recently recommended retaining this status quo for the time being, including President Biden’s nominee to lead the Office of Information and Regulatory Affairs. (As mentioned earlier, the US government uses traditional CBA but carves out an exception for the mortality risks to Americans, who are treated equally regardless of income levels.) These scholars argue that alternatives, such as distributional weighting, will be more vulnerable to legal challenges or undue political influence (McGartland 2021; Revesz and Yi 2022). In some situations, it may be possible to argue persuasively that omitting distributional concerns will bias net benefit estimates downward, which could make the results of a traditional CBA useful for justifying regulations with positive net benefits.

An Open Debate Would Help

Policy makers should carefully consider the benefits and costs of policy changes. However, the usefulness to policy makers of a traditional CBA—which is insensitive to concerns about the distribution of benefits and costs—requires a belief in a story that arguably cannot be justified in the context of policies that address greenhouse gas emissions.

This is not a new realization. Studies of climate damages using distributional weights have appeared in the literature since the 1990s, and in 2014, the Intergovernmental Panel on Climate Change (IPCC) declared that distributional weights should be applied to any monetary measures of benefits and harms (IPCC 2014). Decades earlier, when an IPCC report proposed assigning a value for mortality risks in proportion to national gross domestic product (as a proxy for victims’ willingness to pay), it caused an outcry among developing country representatives, with India’s environmental minister decrying the “absurd and discriminatory global cost/benefit analysis procedures” (Grubb 1995).

However, traditional CBA is so ingrained in the field that it continues to be applied to climate change by leading scholars in top academic journals (Carleton et al. 2022; Rennert et al. 2022), even as other leading scholars label this approach as no longer accepted (Arrow et al. 1996) or “clearly wrong” (Stern et al. 2022).

Reasonable people disagree about the best way forward. A good opportunity for an open debate among experts will come in the forthcoming public comment and peer review processes for the US government’s ongoing updates to its influential guidelines for regulatory analysis—“Circular A-4”—and its estimates of the damage caused by climate change—the social cost of greenhouse gas emissions (White House 2021a; White House 2021b).

References

Acland, Daniel, and David H. Greenberg. 2022. “Principles and Practices for Distributional Weighting: A New Approach.” Working paper. SSRN 4067472.

Aldy, Joseph E., Matthew J. Kotchen, Robert N. Stavins, and James H. Stock. 2021. “Keep Climate Policy Focused on the Social Cost of Carbon.” Science 373, no. 6557: 850–2.

Anthoff, D., and J. Emmerling. 2019. “Inequality and the Social Cost of Carbon.” Journal of the Association of Environmental and Resource Economists 6, no. 2: 243–73.

Arrow, Kenneth J., William R. Cline, Karl-Goran Maler, Mohan Munasinghe, and Joseph E. Stiglitz. 1995. “Intertemporal Equity, Discounting, and Economic Efficiency.” In Global Climate Change: Economic and Policy Issues. World Bank Environment Paper Number 12: 1-33.

Azar, Christian, and Thomas Sterner. 1996. “Discounting and Distributional Considerations in the Context of Global Warming.” Ecological Economics 19, no. 2: 169–84.

Baumol, William J., and Wallace E. Oates. 1971. “The Use of Standards and Prices for Protection of the Environment.” In The Economics of Environment, 53–65. London: Palgrave Macmillan.

Boadway, R. W. 1974. “The Welfare Foundations of Cost-Benefit Analysis.” Economic Journal 84, no. 336: 926–39.

Boardman, Anthony E., David H. Greenberg, Aidan R. Vining, and David L. Weimer. 2018. Cost-Benefit Analysis: Concepts and Practice. Fifth Edition. Cambridge: Cambridge University Press.

Broome, John. 2022. “How to Value a Person’s Life.” The 2022 Brocher Lecture. Brocher 2022 Summer Academy in Global Population Health. https://www.brocher.ch/content/events/56e2a_How_to_value_a_persons_life_-_Broome_Brocher_Lecture.pdf.

Budolfson, Mark B., David Anthoff, Francis Dennig, Frank Errickson et al. 2021. “Utilitarian Benchmarks for Emissions and Pledges Promote Equity, Climate and Development.” Nature Climate Change 11, no. 10: 827–33.

Callahan, Christopher W. and Justin S. Mankin. 2022. “National Attribution of Historical Climate Damanges.” Climatic Change 127, no. 40. https://link.springer.com/article/10.1007/s10584-022-03387-y.

Carleton, Tamma, Amir Jina, Michael Delgado, Michael Greenstone, et al. 2022. “Valuing the Global Mortality Consequences of Climate Change Accounting for Adaptation Costs and Benefits.” The Quarterly Journal of Economics 137, no. 4 (November): 2037–105. https://doi.org/10.1093/qje/qjac020.

Goulder, Lawrence H. 2007. “Benefit-Cost Analysis, Individual Differences, and Third Parties.” In Research in Law and Economics. Emerald Group Publishing Limited.

Grubb, Michael. 1995. “Seeking Fair Weather: Ethics and the International Debate on Climate Change.” International Affairs 71, no. 3: 463–96.

Hammitt, James K. 2021. “Accounting for the Distribution of Benefits and Costs in Benefit-Cost Analysis.” Journal of Benefit-Cost Analysis 12, no. 1: 64–84. https://doi.org/10.1017/bca.2020.29.

Hanemann, W. Michael. 1991. “Willingness to pay and willingness to accept: how much can they differ?” The American Economic Review 81, no. 3: 635–47.

Intergovernmental Panel on Climate Change. 2014. “Summary for Policymakers.” In Climate Change 2014: Mitigation of Climate Change, edited by O. Edenhofer, R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel, and J. C. Minx. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge: Cambridge University Press.

McGartland, Al. 2021. “Quality Science for Quality Decisions: Protecting the Scientific Integrity of Benefit-Cost Analysis.” Review of Environmental Economics and Policy 15, no. 2: 340–51.

Mirrlees, James A. 1971. “An Exploration in the Theory of Optimum Income Taxation.” Review of Economic Studies 38, no. 2: 175–208.

Pidcock, Roz and Sophie Yeo. 2017. “Explainer: Dealing with the ‘Loss and Damage’ Caused by Climate Change.” Carbon Brief. https://www.carbonbrief.org/explainer-dealing-with-the-loss-and-damage-c….

Posner, R. A. 1979. “Utilitarianism, Economics, and Legal Theory.” Journal of Legal Studies 8: 103–40.

Rennert, K., F. Errickson, B. C. Prest et al. 2022. “Comprehensive Evidence Implies a Higher Social Cost of CO2.” Nature. https://doi.org/10.1038/s41586-022-05224-9.

Revesz, Richard L., and Samantha P. Yi. 2022. “Distributional Consequences and Regulatory Analysis.” Environmental Law 52, no. 1: 53–98. https://policyintegrity.org/files/publications/Distributional_Consequences_and_Regulatory_Analysis.pdf

Stern, Nicholas, Joseph Stiglitz, and Charlotte Taylor. 2022. “The Economics of Immense Risk, Urgent Action and Radical Change: Towards New Approaches to the Economics of Climate Change.” Journal of Economic Methodology 29, no. 3: 181–216. https://doi.org/10.1080/1350178X.2022.2040740

Sunstein, Cass R. 2004. “Valuing Life: A Plea for Disaggregation.” Duke Law Journal 54: 385–445. https://scholarship.law.duke.edu/dlj/vol54/iss2/2.

US Environmental Protection Agency. “Cooling Water Intakes—Final 2014 Rule for Existing Electric Generating Plants and Factories.” Last updated April 4, 2022. https://www.epa.gov/cooling-water-intakes/cooling-water-intakes-final-2014-rule-existing-electric-generating-plants-and.

US Global Change Research Program. 2018. Impacts, Risks, and Adaptation in the United States: Fourth National Climate Assessment, Volume II, edited by D. R. Reidmiller, C. W. Avery, D. R. Easterling, K. E. Kunkel, K. L. M. Lewis, T. K. Maycock, and B. C. Stewart, 1515. Washington, DC: US GCRP. https://nca2018.globalchange.gov/

US National Highway Traffic Safety Administration. 2021. “Corporate Average Fuel Economy Standards for Model Years 2024-2026 Passenger Cars and Light Trucks.” Proposed rule. Federal Register. https://www.federalregister.gov/documents/2021/09/03/2021-17496/corporate-average-fuel-economy-standards-for-model-years-2024-2026-passenger-cars-and-light-trucks.

US Office of Management and Budget. 2003. “Circular A-4.” https://obamawhitehouse.archives.gov/omb/circulars_a004_a-4/.

Waldfogel, Joel. 1993. “The Deadweight Loss of Christmas.” The American Economic Review 83, no. 5 (December): 1328. https://jmvidal.cse.sc.edu/library/waldfogel93a.pdf.

Weitzman, Martin L. 2009. “On Modeling and Interpreting the Economics of Catastrophic Climate Change.” Review of Economics and Statistics 91, no. 1: 1–19.

White House. 2021a. “Executive Order on Protecting Public Health and the Environment and Restoring Science to Tackle the Climate Crisis.” https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/20/executive-order-protecting-public-health-and-environment-and-restoring-science-to-tackle-climate-crisis/.

White House. 2021b. “Modernizing Regulatory Review.” https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/20/modernizing-regulatory-review/.

[1] This description of traditional CBA as “wealth maximization” comes from Posner (1979). In reality the net benefits from CBA are a highly imperfect proxy for total wealth.

[2] These steps are simplified for the purpose of this commentary. See Boardman et al. (2018) or any similar textbook for further details.

[3] A literature in economics compares how much individuals are willing to pay for a given policy change versus how much compensation they would be willing to accept to bear the policy change (see, for example, Hanneman 1991). This commentary does not focus on this distinction because both of these metrics will be highly correlated with income/wealth.

[4] This combines a few lines of argument into a single narrative. According to Hammitt (2021), traditional CBA is often justified on three grounds: (1) it provides an adequate and practical approximation to a desired utilitarian calculus; (2) if used over many policy choices, the individuals who gain or lose will differ, and in total everyone will gain (relative to some alternative decision rule that is usually left unspecified); or (3) it maximizes the total goods and services available to the economy, and unwanted distributional effects can be ameliorated at a lower cost by transfer programs rather than by altering policy choices.

[5] The CBA Story has been critiqued from a technical standpoint as well. Hammitt (2021) explains that the separation of efficiency and distribution is misleading because, while traditional CBA assumes that the good in which benefits and costs can be measured is money (the “numeraire”), when individuals have different rates of substitution between different numeraires, the choice of which commodity to use as numeraire can affect the ranking of policies by their calculated efficiency. Boadway (1974) also points out that traditional CBA does not account for price changes caused by the compensation that occurs in the CBA Story, which can imply that those who gain from the policy change may not be able to compensate those who are harmed.

[6] For example, in Rennert et al. (2022), the estimated value of mortality risks accounts for about half of the present value of estimated climate damages.

[7] The guidelines to federal agencies for CBA in regulations (US Office of Management and Budget 2003) say to “ignore distributional effects” in estimates of net benefits. The guidance to federal agencies for CBA in federal programs/spending (US Office of Management and Budget 1992) says, “The principle of maximizing net present value of benefits is based on the premise that gainers could fully compensate the losers and still be better off.” However, in practice, federal agencies use a uniform value of mortality risk reduction (McGartland 2021).

[8] This commentary focuses on the damages caused by current and future emissions, because those are the emissions that will be affected by policies that a CBA may be evaluating. However, there is also an important debate about compensation for the historical emissions of developed countries that are causing harm to developing countries today; see, for example, Callahan and Mankin (2022) and Pidcock and Yeo (2017).

[9] The distributional weighting literature dates back further, but economists are most likely to be familiar with the optimal tax theory literature from the 1970s (Mirrlees 1971). Tax systems are widely understood to be vehicles for achieving distributional goals, so it makes little sense to assess the net benefits of tax policies with a traditional CBA that omits distributional concerns.

[10] For an early study, see Azar and Sterner (1996). For a recent study, see Budolfson et al. (2021).

[11] In the climate economics literature, distributional weighting is commonly referred to as “equity weighting.” There have been proposals, aside from distributional/equity weights, for adjusting CBA to account for distributional concerns. For example, Goulder (2007) argues for retaining the traditional CBA framework’s focus on the willingness to pay of individuals but including “third-party effects,” which he describes as the concern of

residents of the richer countries for the impacts not only on themselves but also on the impacts in other poorer countries.

[12] Projections of climate damages are typically aggregated at a national or regional level, so within the resulting “model regions” are individuals with a wide range of income levels. Moreover, methods for using distributional weights are not well developed for characteristics aside from income that are relevant to distributional concerns (e.g., race, education, health).

[13] In addition, the social welfare function framework only makes sense if interpersonal comparisons of well-being are possible, which is not uncontroversial. In contrast, the calculation of monetary values using CBA does not require interpersonal comparison of well-being due to its emphasis on compensating individuals for the harms caused by policy changes (Hammitt 2021).

[14] Specifically, NHTSA (2021) explained its rejection of a more stringent “Alternative 3” by saying: “The additional technology cost required to meet Alternative 3 (as evidenced by the negative net benefits at both discount rates) may yet make Alternative 3 too stringent for these model years,” and “However, with negative net benefits for Alternative 3 under both discount rates, it may be that for the moment, the costs of achieving those benefits are more than the market is willing to bear.” This language was removed from the final rule published earlier this year.