Download the commentary

This is part 1 of a series of essays on this subject. Subsequent essays will compare current social cost of carbon estimates with alternative approaches, including a new proposal, and provide initial empirical estimates.

By 1960, the number of American deaths from car accidents had been climbing for seven decades to top 50,000 Americans annually, including thousands of children. A consensus emerged that this number was far too high, and the government needed to act. Both the US House and Senate unanimously passed the National Traffic and Motor Vehicle Safety Act of 1966, directing the newly created National Highway Transportation Safety Administration (NHTSA) to develop automobile safety standards.

This essay is about climate change policies, and climate risks are very different from the risks of car crashes. Still, the development of car safety standards provides a useful precedent. The country determined the risks of fatal car crashes should be lowered, although certainly not to zero. No empirical analysis could determine the “right” level of risk, and no policy tools were available to achieve a precise level of risk. Despite these uncertainties, NHTSA pushed forward and created safety standards, such as seat belt requirements, where it deemed the benefits were likely to exceed the costs. [1] By the 1970s, for the first time in the 20th century, annual deaths from car crashes began to fall.[2]

The task of developing policies to reduce greenhouse gas (GHG) emissions can be described in similar terms. If left unchecked, climate change will bring unacceptable risks, and public policies can mitigate these risks. But there is no “right” level of climate risk to shoot for, and policy makers could not achieve a precise level of climate risk even if they wanted to. Like NHTSA in late 1960s, US policy makers are now confronting the problem of how to take action on climate change in the face of these risks and uncertainties.

The Social Cost of Carbon Is Created and Safely Wades into Public Policy

Decades ago, as the risks of climate change were becoming increasingly clear, economists may have been forgiven for not calculating the “optimal” policy response and instead treating climate change like other large risk management problems. However, there was precedent for responding to air pollution with “Pigouvian taxes,” an elegant economic theory that says the most efficient way to reduce pollution is to implement a tax at a level such that market prices fully incorporate the damages caused by pollution. Even Milton Friedman, perhaps the modern economist most associated with opposition to government action, supported Pigouvian taxes on air pollutants.[3] So, in the early 1990s, as the first countries were implementing carbon taxes, it was natural for economists to apply Pigouvian pricing to climate change and ask: What is the optimal price of carbon dioxide emissions, or, equivalently, what is the “social cost of carbon” (SC-CO2)?

Economists including William Nordhaus, Richard Tol, and Chris Hope produced the first estimates of the SC-CO2, which involved the combination of the following:

- global macroeconomic projections for centuries into the future;

- climate models that project the effects of emissions on temperatures and other climate impacts;

- “damage functions” that provide monetary estimates of the impacts of climate change on the economy and human welfare; and

- economic methods that aggregate centuries of impacts into a single value representing the net benefits of emissions reductions.[4]

The difficulty of undertaking these calculations is staggering. But these were largely academic exercises. For the few decades of its life, SC-CO2 estimates gained a good deal of attention, praise, and criticism, but they were not used in public policy.

This changed when the US government confronted a problem that the SC-CO2 could help solve. Since the early 1980s, US federal agencies were required to quantify the benefits and costs of major regulations before deciding whether to impose these regulations and how stringent to make them.[5] Then, in two court rulings in 2007, the Supreme Court established a federal government role in regulating GHG emissions, and a federal court of appeals rejected a Department of Transportation decision not to monetize the benefits of GHG emissions reductions, saying that while a range of values was acceptable, “the value of carbon emissions reduction is certainly not zero.”[6] For the first time, the US government needed to identify a value for the benefits of GHG emissions reductions.

Starting at the end of the George W. Bush administration, US federal government agencies began to use estimates of the SC-CO2s in regulatory analyses. In the early years of the Obama administration, a group of technical experts dubbed the Interagency Working Group on the Social Cost of Carbon (the “IWG”), was tasked with identifying SC-CO2s that could be used uniformly across the US government. The IWG found that the best science and economics pointed to a very wide range of potential SC-CO2s. When last updated in 2016, the SC-CO2 estimates for 2020 were about $15 to $150 per metric ton in today’s dollars (“USG SC-CO2s”). The IWG emphasized the importance of using the full range of estimates.[7]

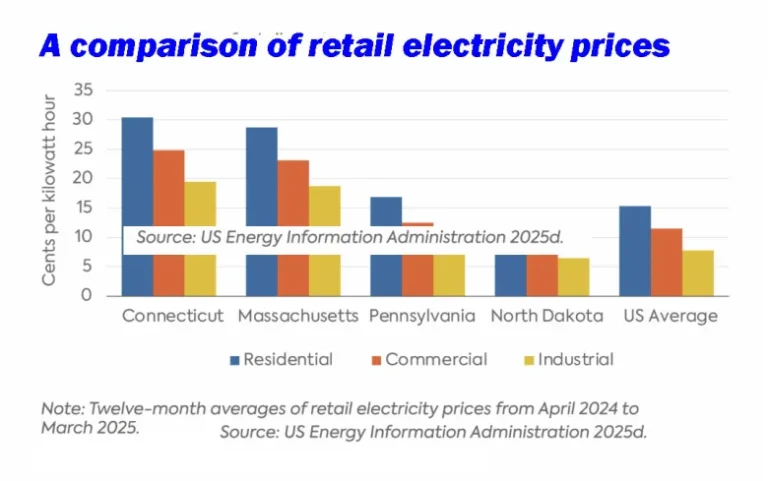

From a policy-making perspective, the difference between $15 and $150 per metric ton of CO2 is massive. It is the difference between a weak climate policy and a strong climate policy. For a natural gas power plant, adding $15 per ton of CO2 might increase fuel costs by 20 percent, and would likely benefit the average plant owner over the next decade due to the switch away from more carbon-intensive coal-fired generation. In contrast, a $150 per metric ton CO2 adder could increase fuel prices by 200 percent, which would put many plants out of business before long.[8] Such a wide range of USG SC-CO2 estimates is little more than a mathematical affirmation of the federal court’s judgment that “the value of carbon emissions reductions is certainly not zero.”

However, for the purpose the USG SC-CO2 was developed—regulatory impact analysis (RIAs) for US federal regulations—such a wide range of SC-CO2s is not necessarily a problem. RIAs include benefit-cost analysis for major regulations, but federal agencies are under no obligation to “optimize” the regulations based on the results of the analysis. In fact, typically, the estimated benefits of regulations far outweigh the costs.

Consider the most prominent regulations in which the SC-CO2 has been used: According to the RIA for the Clean Power Plan (a regulation of existing power plants), the costs of the regulation were expected to be outweighed solely by the benefits of reduced local air pollution.[9] Similarly, the RIA for the light-duty vehicle GHG standards (issued alongside NHTSA’s CAFE standards) shows that expected costs are outweighed by consumer fuel savings alone. Finally, the use of the SC-CO2 in an energy efficiency standard for commercial refrigeration equipment attracted attention because of a legal challenge from manufacturers that the calculation of the SC-CO2 was “irredeemably flawed.” But, in upholding the use of the SC-CO2, the court’s ruling does not even mention the range of values used, perhaps because the benefits of the regulation were estimated to be over ten times larger than the costs before accounting for any benefits of GHG reductions.[10]

These are not isolated cases. An analysis by the Electric Power Research Institute (EPRI) identified 65 federal rules and 81 subrules with regulatory analyses that used the USG SC-CO2s between 2008 and 2016 and examined how climate benefits compared to total estimated benefits and costs of the proposed regulatory actions. EPRI found “the inclusion of benefits from policy-induced CO2 emissions changes does not change the sign of net benefits. In other words, the net benefits are positive with and without consideration of CO2 reduction benefits.”[11]

While the US federal government may have brought the social cost of carbon into the realm of policy making, it did so in an extremely cautious way. A wide range of SC-CO2 values was used to justify actions that could have been justified solely with non-climate rationales.

USG SC-CO2 Estimates beyond Their Depth? Recent Use in Taxes and Subsidies

Policy makers around the world are increasingly proposing and implementing policies that put a price on carbon dioxide emissions. Justifying carbon taxes or clean energy subsidies in general terms is easy, but justifying specific tax or subsidy level is difficult. Often lacking complex modeling tools to do their own analysis, policy makers are turning to USG SC-CO2 estimates as an “off the shelf” metric for this purpose.

The use of USG SC-CO2 estimates in taxes and subsidies represents a fundamental shift compared to their use by the Obama administration. First, when used in taxes and subsidies, SC-CO2s directly determine policy outcomes, including GHG emissions and payments to and from energy producers and consumers. Second, policy makers need a single value to set a tax or a subsidy. So instead of the very wide range recommended by US government IWG, policy makers are using the SC-CO2 that the IWG refers to as its central value (“USG Central SC-CO2”), which is roughly $50 per metric ton of CO2 emitted in 2020 and increasing by about 2 percent per year thereafter.

In recent years, uses (and proposals) of the USG Central SC-CO2 in taxes and subsidies include:

In addition, the US federal government recently raised its tax credit for carbon capture and sequestration to $50 per metric ton,[17] and the Canadian federal government is requiring provinces to implement carbon prices of at least C$ 50 by 2022.[18] While no rationale was given in these instances, they further indicate that policy makers are coalescing around the USG Central SC-CO2 value as an appropriate price on carbon. (Of course, most carbon prices around the world are far lower than $50 per metric ton and not set based on the SC-CO2.)

Because the IWG labeled it as the “central value,” the USG Central SC-CO2 is often interpreted as a “best estimate” in the face of uncertainty. And given the history of the social cost of carbon, developed and often referred to by economists as an “optimal price on CO2 emissions,” the USG Central SC-CO2 would appear to be a natural choice when a single value is needed for a tax or subsidy.

However, the USG SC-CO2s were developed by the IWG with a methodology to fit the specific purpose of a benefits estimate to be added to a regulatory impact analysis, and not to be an “optimal CO2 tax,” which would have involved balancing benefits and costs. Instead, USG SC-CO2s are calculated by estimating the damages associated with a range of possible emissions trajectories, and thus the benefits of avoiding these damages. Costs are not considered.[19]

Perhaps more importantly, the USG Central SC-CO2 is not a best estimate of the benefits of reducing GHG emissions. A meaningful best estimate is not possible using the methodology that produced the USG SC-CO2s. To explain why, it may be helpful to describe and distinguish between various types of uncertainties that affect estimates of the SC-CO2:

- data limitations and uncertainty in model structure;

- uncertainty due to omitted impacts of climate change; and

- uncertainty due to value judgments.

These categories of uncertainty suit the purpose of this essay, but they do not constitute a comprehensive list, and they are not mutually exclusive.

Data limitations and model structure uncertainty are most amenable to a “best estimate.” For example, a given change in GHG emissions leads to a certain level of sea-level rise, which causes economic damages. A statistical relationship can be developed for each of these steps, leading to a range of damage estimates, from which a “best estimate” (e.g., an average value) can be calculated. Such estimates are enormously uncertain because we lack a complete understanding of the magnitude and effects of sea-level rise, but the best estimate may improve and the range of uncertainty may narrow over time with better data and tools.

Omitted from SC-CO2 estimates are some impacts of climate change, like ocean acidification, for which there is strong scientific evidence of negative consequences that are exceedingly difficult to estimate in monetary terms. Also omitted are impacts that are not yet scientifically proven (or even provable), like the potential for climate change to lead to economic strife and conflicts among nations, but could have highly important effects on human welfare.[20] Finally, omitted impacts include unlikely catastrophic or potentially even civilization-threatening events that scientists warn could be spurred by climate change.[21] Calling the SC-CO2 a “best estimate” without accounting for these omitted impacts is a bit like counting up all the stars you can see in the sky and claiming the result is a best estimate of total stars.

However, not all omitted impacts point in the same direction—for example, some argue that climate economics models omit ways in which humans are likely to adapt in the face of climate risks[22]—so the USG SC-CO2s should not be interpreted as “lower bound” estimates. Still, there is a broad consensus among experts that what is missing from SC-CO2s are predominately negative impacts of climate change. In a poll of 1,100 experts on the economics of climate change, over 50 percent responded that the USG Central SCC is likely too low of an estimate for the benefits of emissions reductions, 18 percent said it was a likely estimate, and fewer than 10 percent said it was likely too high.[23]

A third category of uncertainty relates to value judgments that heavily influence SC-CO2 estimates. For these assumptions, the tools of science, economics, or statistics are incapable of providing a “best” or single value. Consider the following three examples:

- The benefits of avoiding damages in future generations. The USG Central SC-CO2 estimate uses a three percent “discount rate,” which implies that costs incurred 100 years from now are roughly five percent as important as costs incurred today. The appropriate value for the discount rate depends on various questions without precise answers, including how much we value the welfare of our children versus our great-grandchildren and how much wealthier (or poorer) society will be in the future. Consequently, there is no agreement on what discount rate(s) should be used to estimate the SC-CO2, and different choices lead to SC-CO2 estimates that differ by hundreds of dollars per ton.[24]

- The benefits of avoiding large risks. The USG Central SC-CO2 estimate assumes “risk neutrality,” which means there is no particular benefit associated with avoiding risk.[25] The insurance industry proves that in fact, we receive considerable benefits from avoiding risk, particularly when the consequences are severe. But insurance data cannot tell us, for example, the benefits we receive from reducing the probability of unlikely catastrophic events that climate change could cause a century or more from now. Studies have found that adding the benefits of risk reduction could raise the USG Central SC-CO2 anywhere from a small amount to a factor of four or five.[26]

- The benefits of avoiding damages to the most vulnerable. The USG Central SC-CO2 estimates also do not take into account how the benefits of reduced GHG emissions may differ across the global population, instead focusing on the effects on an average person. But the benefits to an average person are likely to pale in comparison to the benefits to those who are especially poor and vulnerable to the effects of climate change. Studies show that factoring in either “inequality aversion” or a priority for the worse off among us can significantly increase SC-CO2 estimates, into the hundreds of dollars per ton or higher.[27] On the other hand, much of this vulnerable population lives outside the United States, and some argue that US SC-CO2 estimates should not fully include benefits accrued outside the country, or at least not until other nations are doing the same.[28] Omitting international benefits can lead to SC-CO2 estimates that are far below the USG Central SC-CO2.[29]

For each of these examples, there is no serious argument over the existence and potential significance of the benefit, and different value judgments lead to SC-CO2 estimates that span a range at least as wide as the range produced by the Obama administration. Without imposing these judgments, producing a wide range of SC-CO2 estimates is simply the best we can do using this methodology, and it is the best we will ever be able to do.

The USG Central SC-CO2 is not an optimal price of CO2 emissions or a best estimate of the benefits of CO2 reductions. It is a noncomprehensive estimate of the benefits of GHG reductions using one set of assumptions that is arguably defensible given the theoretical and methodological challenges associated with the approach. Other equally defensible sets of assumptions would produce lower SC-CO2 estimates, and still others would produce higher (and much higher) estimates.

Evaluating the Use of USG Central SC-CO2s in Taxes and Subsidies

The limitations described in the previous section do not necessarily make the USG Central SC-CO2s unsuitable for use in taxes and subsidies. But they raise important concerns.

Like virtually all climate policies, such taxes and subsidies will be subject to vigorous challenges, including lawsuits. The Obama administration had the benefit of defending a wide range of SC-CO2 estimates that had no direct bearing on regulatory outcomes and were derived with a methodology designed for the purpose in which they were used. Those defending USG Central SC-CO2s in taxes and subsidies will have none of those advantages. Lawsuits against these policies will point to tangible effects of the specific SC-CO2s on regulatory costs, electricity prices, and emissions outcomes. As an initial test, a New York county supreme court will hear arguments in 2018 based on a complaint that the New York Public Service Commission “misapplied the social cost of carbon metric” in its subsidies for nuclear energy.[30] Carbon taxes set by legislatures are safer from legal challenges, but they are likely to spur a public debate on the proper carbon tax rate that the USG Central SC-CO2 may not be able to withstand due to the limitations described earlier.

A related concern is how easily policy makers can justify climate policies of virtually any stringency level using the models that produced the USG SC-CO2s. This is already happening in a regulatory context. In Minnesota, where electric utilities must use the estimated benefits of reduced GHG emissions to help guide their resource planning decisions, the Public Utility Commission opted to use the USG SC-CO2s but chose to lower the range of estimates. Specifically, the commission adopted only the lowest two (of four) USG SC-CO2 estimates, and it modified the lowest estimate by omitting damages occurring after 2100. More prominently, the Trump administration has used a far lower range of SC-CO2s estimates in federal government regulatory analyses (roughly $1 to $6 per metric ton of CO2) by modifying the IWG calculations to incorporate higher discount rates and no international benefits. [31] Likewise, policy makers will be able to justify taxes and subsidies of virtually any level by finding a set of modeling assumptions that produce the desired SC-CO2.

A third concern is potential reputational damage. Complex models are useful tools only when they provide insights beyond which simpler approaches are capable. When taxes and subsidies rely on single estimates of the SC-CO2 from models that can just as easily produce results that would justify radically different policies, the models underlying these SC-CO2 estimates are only providing an illusion of rigor. Such false precision is not good practice for policy making in any realm, but it is particularly worrisome in this context, given the politically charged debate over climate change. Climate models have performed remarkably well,[32] and yet climate scientists have been subject to attacks from politicians and well-funded groups that oppose action on climate change. Such groups already point to the deficiencies of the economic models that are used to produce SC-CO2 estimates as evidence against climate action. Setting taxes and subsidies based on the results of these models may add fuel to false claims that strong climate policies lack scientific justification.

In the decades following the passage of the National Traffic and Motor Vehicle Safety Act of 1966, NHTSA implemented various automobile safety standards, including a requirement for automatically activated safety devices, such as automatic seat belts. [33] In 1981, with the deregulatory push that followed the election of President Reagan, NHTSA rescinded this requirement due to problems it cited with automatic seat belts. The insurance industry objected, and the dispute turned into a landmark Supreme Court case.

In National Motor Vehicles v. State Farm, the Supreme Court ruled that while it could only intervene if NHTSA made a clear error in judgment, it had done just that by failing to consider an obvious alternative approach to achieving the same objective: a requirement for air bags.[34] The Supreme Court thus struck down NHTSA’s action as “arbitrary and capricious,” the seminal application of one of the most commonly used legal doctrines to this day.[35]

Whether or not courts apply the “arbitrary and capricious” standard to the use of the SC-CO2s in taxes and subsidies, the logic provided in the Supreme Court opinion is applicable: the use of USG Central SC-CO2 in taxes and subsidies should not be assessed in a vacuum, without comparing it to alternative approaches of achieving the same objective. Given the concerns mentioned earlier, the main argument for using the USG Central SC-CO2s in taxes and subsidies is, to quote the website Carbon Brief, that “the [SC-CO2] could well be the worst way to value CO2—except for all the other ways to do it.”[36] In other words, if there is no preferable alternative approach to achieving the same objective that is easily available to policy makers, then the use of the USG Central CO-CO2 in taxes and subsidies is justified.

After all, a carbon price of zero is indefensible. Courts have already ruled that an SC-CO2 of zero is “arbitrary and capricious” in a regulatory context,[37] and, since the 2007 federal court ruling that “the value of carbon emissions reduction is certainly not zero,” evidence for a significant price on carbon has only strengthened. Even a somewhat arbitrary number is better than one that we can confidently say is wrong.

However, even if no off-the-shelf alternatives exist today, the concerns with using USG Central SC-CO2 in taxes and subsidies are sufficiently large that climate economists should consider developing these alternatives. Part 2 of this series will compare the attributes of the USG Central SC-CO2 to various other approaches to accomplishing the same objective, including a new proposal for consideration.

[2] Far too many Americans are still killed in car crashes: over 30,000 per year.

[4] For further information about the these models, see: National Academies of Sciences, Engineering, and Medicine.

2017. “Valuing Climate Damages: Updating Estimation of the Social Cost of Carbon Dioxide.” Washington, DC: The National Academies Press. doi: https://doi.org/10.17226/24651.

[7] Interagency Working Group on Social Cost of Carbon, United States Government, “Technical Support Document:

Social Cost of Carbon for Regulatory Impact Analysis under Executive Order 12866,” Washington D.C. February 2010, page 3.

[10] Zero Zone, Inc., et al. v. United States Department of Energy, U.S. Court of Appeals, Seventh Circuit, argued September 30, 2015, decided August 8, 2016.

[11] Rose, S and J. Bistline, “Applying the Social Cost of Carbon: Technical Considerations.” EPRI Palo Alto, CA: 2016. 300200f4659.

[12] The most recent version, released in February 2018, was also sponsored by Congressmen Earl Blumenauer (D-OR) and David Cicilline (D-RI) in the House.

[24] Jiehan Guo, Cameron J. Hepburn, Richard S.J. Tol, David Anthoff. “Discounting and the social cost of carbon: a closer look at uncertainty,” Environmental Science and Policy. 2006. Pages 205-216.

[25] In its 2010 Technical Support Document, the U.S. government IWG recognized the potential problem with the risk neutrality assumption and included one “high damage” SC-CO2 scenario in order to proxy for the effect of risk aversion (among other rationales for this scenario). The USG Central SC-CO2 estimate includes no such proxy.

[27] Matthew Adler, David Anthoff, Valentina Bosetti, Greg Garner, Klaus Keller & Nicolas Treich. “Priority for the worse-off and the social cost of carbon,” Nature Climate Change volume 7, pages 443–449 (2017)

doi:10.1038/nclimate3298.

[28] Ted Gayer and W. Kip Viscusi. “Determining the Proper Scope of Climate Change Policy Benefits in U.S.

Regulatory Analyses: Domestic versus Global Approaches,” Review of Environmental Economics and Policy, August 2016, Volume 10, Issue 2, 1 July 2016, Pages 245–263, https://doi.org/10.1093/reep/rew002.

[31] The assumptions used by the Trump administration to produce SC-CO2 estimates as low as $1 per metric ton include a seven percent discount rate, which is an extreme assumption that is supported by few climate economists.

[34] The Supreme Court opinion also took issue with the plaintiff’s criticism of automatic seatbelts.

[37] Center for Biological Diversity v. National Highway Traffic Safety Administration, U.S. Court of Appeals, Ninth Circuit, 538 F.3d 1172 (9th Cir. 2008).