This report represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. More information is available here. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website. See below a list of members that are currently in CGEP’s Visionary Annual Circle.

-

CGEP’s Visionary Annual Circle

-

(This list is updated periodically)

Air Products

Anonymous

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Occidental Petroleum Corporation

Ray Rothrock

Kimberly and Scott Sheffield

Tellurian Inc.

Executive Summary

A significant gap exists globally between the financing needed and the current level of spending to meet net-zero goals. The problem is particularly acute for emerging market and developing economies (EMDE), as they face higher spending on the energy transition as a percentage of gross domestic product (GDP) and are likely to be affected more severely by climate change than advanced economies. Thematic bonds that target specific investment themes, including climate change mitigation, can help narrow the financing gap, but EMDE’s share of the global thematic bond market remains small.

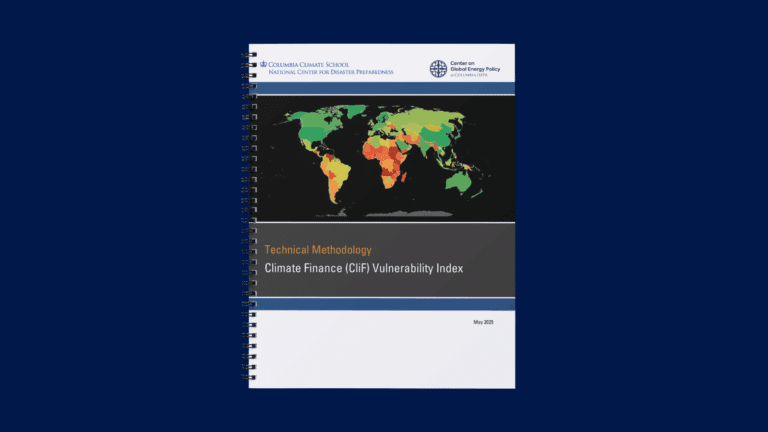

This report explains the urgency of raising financing for EMDE to address climate change and discusses the evolution of thematic bonds. It finds that the asset class has the potential to achieve significant further growth. As part of Columbia University’s Financing the Energy Transition initiative, it offers policy recommendations to governments and development banks interested in increasing thematic bond issuances from these countries. Options to consider include addressing local currency risk using structured finance, adapting institutional frameworks such as Green Bond Principles (GBP) to national contexts, addressing accessibility issues in domestic markets, and providing tax incentives.

Other key takeaways from the report include the following:

- Even as the thematic bonds market has grown, the share of EMDE within it has plateaued at a low level. Excluding China, the total green bond issuance from EMDE has amounted to just 13 percent of global issuance to date and only 3 percent in local currencies.

- Headwinds to EMDE thematic bond issuances range from the costs and complexity of setting up a green bond framework for issuers to regulatory hurdles and local currency risk for investors.

- Green bonds trade with a premium and should, therefore, be very appealing to EMDE issuers and investors alike. The average premium across bonds analyzed in this study is seven basis points, with a premium observed 73 percent of the time in the historical secondary market trading of the green bonds in the sample.

- Other thematic bonds don’t trade with a premium, but issuers could still benefit from issuing them because they attract a different and growing class of investors focused on environmental, social, and governance (ESG) metrics.