This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Steps by the second Trump administration show it is taking a tougher stance against the regime of Nicolas Maduro. Trump recently issued an executive order that could levy a 25 percent tariff on countries that directly or indirectly import Venezuelan oil starting on April 2, and it has modified Chevron’s oil license to operate in the South American nation. While Caracas has found workarounds to ameliorate sanctions in the past, these US measures are taking place in a different oil market and geopolitical environment. These factors could make it more difficult for Venezuela to circumvent the new US actions, and the impact of those measures could be felt in oil markets and beyond. Oil production and exports could decline, bringing additional economic and social turmoil to the Maduro regime, which is already facing rising macroeconomic instability and heightened risks of power outages.

Changes to Chevron’s oil license: A serious risk to Venezuela’s oil outlook

Chevron needs licenses from the US Treasury to operate in Venezuela through its minority joint venture partnerships with the national oil company PDVSA, a sanctioned entity. Chevron JV’s represent 25 percent of total production in Venezuela and an even larger share of the country’s official oil export receipts. Thus, Chevron’s oil license in Venezuela has become a critical metric for gauging the US foreign policy stance towards the Maduro regime.

On March 4, 2025, the Trump administration replaced Chevron’s General License (GL) 41, which had existed since November 2022, with GL 41A, which orders the winding down of Chevron’s operations in Venezuela by April 2, 2025, although the timing was extended to May 27 via GL 41B. One interpretation of such action is that this could signal the beginning of a pattern of short-term extensions that would be used as leverage to make the Maduro regime comply with the repatriation of Venezuelan migrants, an issue that has dominated the headlines about the US government relations with Venezuela.

While multiple extensions of this license cannot be ruled out, this change in Chevron’s original GL 41 oil license poses downside risks to oil production in Venezuela because it represents a significant change in the scope and time horizon of Chevron’s operations.

Chevron has had licenses since 2019, which have been renewed multiple times without having any material impact on the country’s oil production, even if the licenses authorized “transactions and activities ordinarily incident and necessary to operations in Venezuela involving PDVSA.” But it was under Chevron’s GL 41 that oil production in Venezuela saw a sustained recovery, growing by almost 200,000 barrels per day (b/d) in the 2022-2024 period to reach about 900,000 b/d in Q1 2025, according to OPEC’s secondary sources. More importantly, Venezuelan exports to the United States reached 250,000 b/d in January 2025, the highest level since the oil sanctions were imposed in early 2019.

The reason for this increase was twofold. First, GL 41 was an operating license, not a wind-down oil license, that explicitly allowed Chevron’s JVs with PDVSA to:

- Produce petroleum or petroleum products and related maintenance, repair, or servicing of operations;

- Export of petroleum and petroleum products to the US through Chevron; and

- Import diluents, condensates, petroleum, or natural gas products to Chevron’s operations in Venezuela, among other activities (Venezuela imported about 50,000 b/d of petroleum products from the US in 2024).

The built-in monthly six-month renewal also reduced uncertainty and provided sufficient visibility to Chevron to increase investments.

Chevron’s oil license cannot be seen in isolation. The threat of secondary tariffs could magnify any downside risks to oil production in Venezuela.

Secondary tariffs: Hitting at Venezuela’s ability to evade US oil sanctions

The threat of a 25 percent tariff on countries that import Venezuelan oil directly or indirectly through third parties is a novel use of tariffs in place of secondary sanctions to ensure compliance with US policy.

There are three potential reasons why the Trump administration could be pursuing this course of action: Trump’s preferences for tariffs vs. sanctions, a desire to hit at the Maduro administration’s ability to circumvent sanctions, and/or trying an alternative policy solution to reduce the administrative burden of compliance with Venezuelan sanctions in a low-stakes way.

One of the lessons from the 2019 oil sanctions in Venezuela was that there was very high compliance (bordering on over-compliance) with US government sanctions policy from US, European, and Asian companies linked to global financial markets. Therefore, without written reassurances from the US Treasury, companies like the Italian Eni and Repsol, but also Reliance, are likely to halt imports of Venezuelan oil (Repsol is trying to negotiate with the Trump administration to be able to maintain its operations in Venezuela).

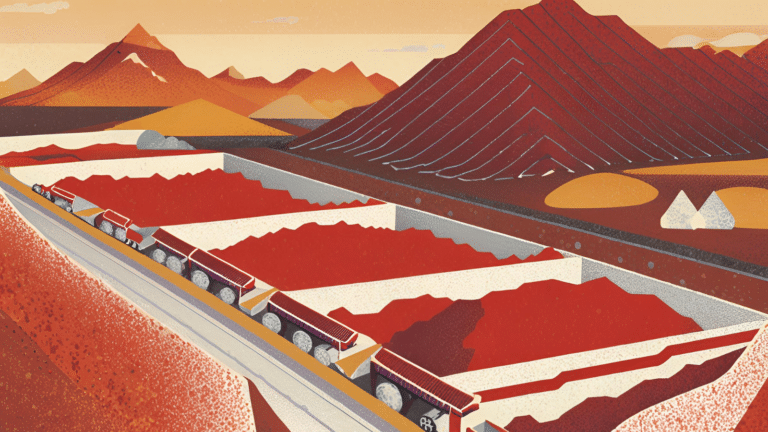

However, the 2019 oil sanctions also magnified the kleptocratic nature of the Maduro regime. Oil flows migrated into informal and illicit hands, hiding their origin even if the ultimate market was China, the leading destination for Venezuela’s oil exports. This, however, came at the cost of deep price discounts and lost revenues, which caused significant damage to PDVSA and government coffers.

The secondary tariffs might target this evasion mechanism, putting countries like Malaysia in the spotlight, given their suspected role in the market for sanctioned oil. Secondary tariffs put the burden of policing on third countries, significantly increasing the cost to the governments where such activities occur and thus the incentives for compliance. The United States, for example, is the second largest export market for Malaysia after Singapore, representing 13 percent of total exports.

Venezuela is unprepared for the effectiveness of tariffs

The 25 percent tariff threat on countries importing Venezuelan oil could imply an even more bearish scenario for Venezuela akin to the 2019 oil sanctions that led to a 60 percent decline in oil production in the country in the two-period after sanctions were imposed.

The likelihood of this scenario depends on how seriously the United States sustains this hawkish policy stance. It remains to be seen whether a move by the Maduro regime to repatriate migrants would be enough to satisfy the Trump administration and ease the threat of tariffs.

The effectiveness of these measures also depends on the Maduro government’s ability to evade sanctions and tariff measures and whether third-party countries would risk getting caught by the United States in order to receive Venezuelan oil. However, several factors may make evasion more difficult now than in 2019.

First off, US actions are taking place in a very different market environment for Venezuela. China’s oil demand was growing then, the United States was still a net oil importer, and OPEC had just reached a deal to cut 1.2 million b/d from the markets. The situation today is much less advantageous for Venezuela’s sanctioned oil for multiple reasons:

- The oil market may become oversupplied as OPEC plans to unwind its production cuts starting this month.

- Almost 14 percent of the world’s oil production is sanctioned (33 percent of OPEC+), and Venezuela is competing with countries like Iran and Russia for market share in China, the main destination for sanctioned oil. Russia and then Iran played a key role in helping Venezuela circumvent US oil sanctions, but it is unclear whether these countries will play the same role today.

- China’s oil demand outlook seems less supportive of global oil markets than in 2019. The larger Chinese refiners, facing higher EV penetration in China, are increasingly focusing on expanding into petrochemicals, leaving the Chinese independent refiners as the buyers of last resort for sanctioned oil.

- The US oil trade balance has shifted from 2.3 million b/d in net imports in 2018 to 2.3 million b/d in net oil exports in 2024, changing the conversation about the political impact of supply disruptions from Venezuela. Indeed, Trump has announced tariffs on Canada and Mexico, which are much larger oil suppliers to the United States than Venezuela. Intentional or not, tariffs or sanctions on these three major foreign suppliers of heavy oil to the US refinery system might incentivize increased use of the domestic lighter oil.

In addition to the shift in oil markets, other factors may make it difficult for Venezuela to evade the US measures and to navigate an effective US campaign of isolation in global oil markets. The impact of Trump’s tariffs and license announcements is already bringing additional economic turmoil to the Maduro regime. The recent devaluation of the local currency in the parallel market is causing upward revisions to the inflationary outlook with rising pessimism about economic activity. Making things more challenging, Venezuela is undergoing another cycle of power outages due to insufficient hydroelectricity. The government is reducing public sector working hours, including at PDVSA, to ration power.

Rising macroeconomic instability could increase social and political tensions at a time of heightened repression since the July 2024 presidential elections that have been widely condemned as fraudulent. Thus, the US government and Venezuela’s neighbors might want to be prepared for a scenario where Trump’s actions effectively curtail Venezuela’s ability to evade sanctions.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum

Tellurian

Foundations and Individual Donors

Anonymous

Anonymous

Aphorism Foundation

the bedari collective

Children’s Investment Fund Foundation

David Leuschen

Mike and Soa Segal

Kimberly and Scott Sheffield

Bernard and Anne Spitzer Charitable Trust

Ray Rothrock