Trump delayed a global carbon tax. Now he wants to finish the fight.

American officials are drafting a diplomatic cable that warns dozens of countries against adopting a climate fee on the shipping industry.

Current Access Level “I” – ID Only: CUID holders, alumni, and approved guests only

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

On June 20, China National Petroleum Corporation (CNPC) and QatarEnergy signed a liquefied natural gas (LNG) supply agreement under which CNPC will purchase 4 million tons of LNG per year from Qatar for 27 years—one of the longest known durations for such a contract.[1] CNPC will also take a 5 percent equity stake in one production train at Qatar’s North Field East (NFE) expansion project.[2] CNPC followed in the footsteps of China Petroleum & Chemical Corporation (Sinopec), which reportedly signed a near-identical supply contract in November 2022, also taking a 5 percent equity stake in one NFE production train in April 2023.[3] In this Q&A, the authors assess the expanding China-Qatar LNG relationship.

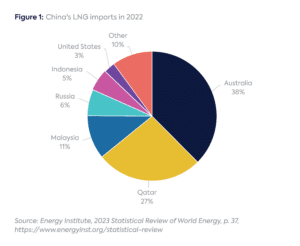

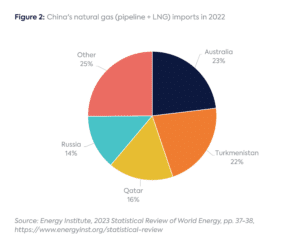

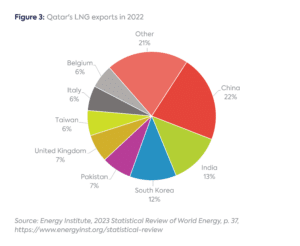

In 2022, Qatar was China’s second-largest LNG supplier, delivering 24.8 billion cubic meters (bcm) or 18 million tons, which accounted for 26.6 percent of China’s LNG imports (Figure 1) and 16 percent of China’s total natural gas (pipeline and LNG) imports (Figure 2).[4] China was Qatar’s largest LNG buyer, accounting for 21.7 percent of Qatar’s exports (Figure 3).[5]

Sinopec secured relatively competitive terms[6] with a Brent oil price indexation and 12.7–12.8 percent slope, which would result in a price around $10 per million British thermal units (MMBtu) at current Brent crude prices of $75 per barrel. This is reasonable compared to the monthly Japan-Korea Marker (JKM) forward prices for spot deliveries into Northeast Asia of $7–12 per MMBtu in 2027–28, when deliveries under this contract are expected to begin.[7] Similar details are not available for CNPC’s deal, but it is likely that the two Chinese deals have similar contract terms.[8]

Record LNG spot prices in 2022 due to Europe’s need to replace Russian gas illustrated the importance of long-term, oil-indexed prices in an importer’s portfolio. These new contracts are likely delivered-ex-ship (DES), giving the Chinese companies supply security, while they can use free-on-board (FOB) contracts with other suppliers, such as the US, more flexibly for delivery into China or for trading internationally.

The deals could generate business for Chinese firms in related strategic industries, such as shipbuilding. Other countries have linked long-term LNG contracts with LNG carrier construction agreements.[9] If leaders of China’s national oil companies (NOCs) are able to do the same, they would gain political capital for themselves and their companies.

Similarly, the deals may foster renewable energy collaboration. CNPC’s chairman said the company will explore cooperation on green and low-carbon energy.[10] The intent to use solar energy to power North Field operations will reduce the carbon footprint of Qatar’s LNG, keeping it competitive.

The deals support Chinese leader Xi Jinping’s goal of deepening China’s ties to Gulf Cooperation Council (GCC) countries, key members of his Belt and Road Initiative. During a speech at a China-GCC Summit in December 2022, Xi identified energy as an area for deeper cooperation and said China would purchase more LNG from GCC countries.[11] Current political tensions also make it preferable for China to not be too reliant on LNG from Australia and the US.

This is a continuation of the approach Chinese NOCs have taken to upstream acquisitions since the mid-2010s: take stakes in assets of large resource holders in politically friendly countries that are major suppliers to China. This group includes Brazil, Iraq, Russia, and the United Arab Emirates. This latest upstream equity entry follows a dramatic slowdown in the buying of overseas assets by these NOCs during the past few years due to a variety of reasons, including overpaying for assets (especially during 2011–13) that underperformed, such as CNOOC Ltd.’s acquisition of Nexen.[12]

In addition, the equity stakes may provide CNPC and Sinopec with insights into NFE’s development and production. This could give their subsidiaries an advantage in competition for lucrative technical service agreements with QatarEnergy.

These deals are consistent with China’s efforts to maintain a diversified import portfolio. In 2022, 75 percent of China’s natural gas imports came from four countries(Figure 3)[13] that are likely to remain its top suppliers. The United States may become a larger supplier—based on 14 China-US LNG contracts since Q1 2021 totaling 46.9 bcm (34 million tons)—accounting for nearly half of the total volume of LNG contracts Chinese firms signed during this period.[14]

China is discussing new import pipelines with Russia and Central Asia, but has made no commitments. Beijing wants to avoid overdependence on any single supplier and is now Russia’s only large-scale future market following the loss of most of its European customers. China can secure better terms from both Russia and Qatar by creating this competitive tension.

The deals underscore the NOCs’ view that natural gas supports China’s energy transition.[15] Gas has been important in replacing coal to improve air quality. Sinopec’s chairman said Qatari LNG will help meet China’s increasing demand for clean energy.[16]

High LNG prices in 2022 saw China’s LNG imports fall by 19 percent year-on-year.[17] Because of competition against coal and renewables, China is a relatively price-sensitive buyer. The moderate prices implied by the Sinopec deal might promote further market penetration of gas from 2027 onward.

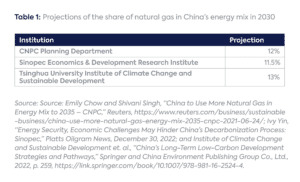

However, there is uncertainty about how large a role natural gas will play in helping China achieve its goals of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060. Several recent projections of the share of natural gas in China’s energy mix in 2030 are below the government’s 15 percent target (Table 1).[18] Some Chinese institutions lowered projections of China’s peak gas demand after Xi announced China’s carbon peaking and neutrality goals in September 2020.[19]

China is crucial to Gulf hydrocarbon exporters’ market strategies. It is a huge market, likely overtaking Japan this year as the world’s biggest LNG importer. It has substantial growth potential, while traditional East Asian markets are mature or shrinking.[20]

Qatar has an enormous volume of LNG to market from its NFE and North Field South expansions, expiring legacy contracts, and equity volumes from the Golden Pass terminal in the US.[21] European customers are reluctant to commit to long-term contracts because of their decarbonization plans.[22]

The deals lock in demand over a long period, and may incentivize CNPC and Sinopec to develop new domestic markets for LNG. They also help Qatar compete against other LNG suppliers, notably the US and Australia. US sellers offer destination-free contracts, which are attractive to Chinese buyers with flexibility to resell LNG, while the Qatari contracts provide secure baseload supply.

China is also a crucial strategic partner. Its profile in the Gulf rose significantly after it brokered a resumption of diplomatic relations between Iran—with whom Qatar shares the North Field—and Saudi Arabia in March 2023. Saudi Arabia had embargoed Qatar in 2017–21 over political disagreements, and a heavyweight political friend like China is welcome in Doha.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

[1] Andrew England and Simeon Kerr, “Qatar Strikes Second Big LNG Supply Deal with China,” Financial Times, June 20, 2023, https://www.ft.com/content/4a647749-c88e-4819-9d06-f4cb30579be5; and Eric Yep, “China’s Sinopec Acquires 1.25% Share in Qatar’s North Field East LNG Expansion,” S&P Global, April 12, 2023, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/lng/041223-chinas-sinopec-acquires-125-share-in-qatars-north-field-east-lng-expansion.

[2] Andrew Mills and Maha El Dahan, “Qatar Strikes Second Big LNG Supply Deal with China,” Reuters, June 20, 2023, https://www.reuters.com/business/energy/qatar-set-strike-second-big-lng-supply-deal-with-china-ft-2023-06-20/.

[3] Ibid; Yep, “China’s Sinopec Acquires 1.25% Share in Qatar’s North Field East LNG Expansion.” Same headline numbers, i.e., 4 million tons per year for 27 years.

[4] World Energy Institute, 2023 Statistical Review of World Energy, pp. 37–38, https://www.energyinst.org/statistical-review.

[5] World Energy Institute, 2023 Statistical Review of World Energy, p. 37.

[6] Yep, “China’s Sinopec Acquires 1.25% Share in Qatar’s North Field East LNG Expansion.”

[7] “LNG Japan/Korea Marker (Platts) Futures – Quotes,” CME Group, https://www.cmegroup.com/markets/energy/natural-gas/lng-japan-korea-marker-platts-swap.html. For more on LNG pricing in Asia, see Ira Joseph, “Asia’s Fragmented Future on LNG Pricing,” Center on Global Energy Policy, March 21, 2023, https://www.energypolicy.columbia.edu/asias-fragmented-future-on-lng-pricing/.

[8] Chen Aizhu and Marwa Rashad, “Exclusive: China’s CNPC Set to Seal Mega Qatari LNG Deal – Sources,” Reuters, February 13, 2023, https://www.reuters.com/markets/deals/chinas-cnpc-set-seal-mega-qatari-lng-deal-sources-2023-02-13/.

[9] These countries include Japan and South Korea.

[10] Zheng Xin, “CNP Inks 27-year Deal with Qatar,” China Daily, June 22, 2023, https://www.chinadaily.com.cn/a/202306/22/WS6493884ea310bf8a75d6b29c.html.

[11] “Full Text of Xi Jinping’s Keynote Speech at China-GCC Summit,” China Daily, December 10, 2022, https://www.chinadaily.com.cn/a/202212/10/WS6393e690a31057c47eba3b6c.html#:~:text=China%20and%20GCC%20countries%20share,future%20of%20China%2DGCC%20relations.

[12] Erica Downs, “China’s National Oil Companies Return to the World Stage: Navigating Anticorruption, Low Oil Prices, and the Belt and Road Initiative,” in Asia’s Energy Security and China’s Belt and Road Initiative, National Bureau of Asian Research Special Report #68 (November 2017), pp. 1–14, https://www.nbr.org/publication/chinas-national-oil-companies-return-to-the-world-stage-navigating-anticorruption-low-oil-prices-and-the-belt-and-road-initiative/.

[13] World Energy Institute, 2023 Statistical Review of World Energy, pp. 37–38.

[14] Authors’ estimates based on databases including Refinitiv and GIIGNL and press releases of announced deals.

[15] China National Petroleum Corporation, “2021 Annual Report,” p. 11, http://www.cnpc.com.cn/en/2021enbvfgrme/202208/9f9800629f2b49e1bb7108eed28d1a30/files/6865c18423a444a0ae4a976d3708cd1d.pdf; and “Ma Yongsheng, Academician of the Chinese Academy of Engineering: Natural Gas is the Most Realistic Choice for China’s Energy Transition” (中国工程院院士马永生:天然气是中国能源转型最现实的选择), NetEase (网易), May 29, 2023, https://www.163.com/tech/article/I5TVPGOF00097U7T.html.

[16] Sinopec Group, “Sinopec and QatarEnergy Ink Long-Term LNG Deal,” November 22, 2022, http://www.sinopecgroup.com/group/en/Sinopecnews/20221125/news_20221125_373494806630.shtml.

[17] Xu Yihe, “China Records Largest Decline in LNG Imports in 2022,” Upstream, January 6, 2023, https://www.upstreamonline.com/lng/china-records-largest-decline-in-lng-imports-in-2022/2-1-1384070.

[18] National Development and Reform Commission, “Energy Supply and Consumption Revolution Strategy” (能源生产和消费改革战略 [2016-2030]), December 2016, p. 8, https://www.ndrc.gov.cn/xxgk/zcfb/tz/201704/W020190905516411660681.pdf.

[19] “China’s Gas Consumption Seen Peaking by 2035,” Argus, June 25, 2021, https://www.argusmedia.com/en/news/2228275-chinas-gas-consumption-seen-peaking-by-2035.

[20] These markets include Japan, South Korea, and Taiwan.

[21] Ira Joseph and Anne-Sophie Corbeau, “Qatar’s Contracting Quandary,” Energy Explained, Center on Global Energy Policy, April 26, 2023, https://www.energypolicy.columbia.edu/qatars-contract-quandary/.

[22] A recent 15-year deal to sell gas to Germany is about the longest that can be expected. Andrew Mills and Maha El Dahan, “Germany to Get New Qatari LNG Flows Through QatarEnergy, ConocoPhillips Deal,” Reuters, November 29, 2022, https://www.reuters.com/business/energy/qatarenergy-conocophillips-sign-lng-supply-deal-germany-2022-11-29/.

Iran has among the world's largest natural gas resource bases, but its ability to supply regional and global markets is constrained by sanctions, underinvestment, and limited export infrastructure.

Iran appears to be a natural gas giant, due to its large proved gas reserves and significant gas production and consumption.

Venezuela holds 70% of Latin America's natural gas reserves, which it could export to Colombia and Trinidad to increase revenues.

Geopolitical uncertainty associated with Russian gas exports could swing the range of those exports by an estimated 150 bcm per year.

Anne-Sophie Corbeau and leading experts explore how Europe's gas sector is being reshaped by geopolitical shocks.