This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

The phrase “Golden Age of Gas,” popularized by the International Energy Agency (IEA) in its 2011 World Energy Outlook report, envisioned a future where natural gas played a dominant role in the global energy mix. This outlook for gas was driven by advancements in extraction technologies like hydraulic fracturing, a global push for less-carbon-intensive energy alternatives to coal and oil, and the increasing availability of liquefied natural gas (LNG) for transport across the globe. Gas was hailed as a “bridge fuel” to a low-carbon future, though its long-term environmental impact, particularly given fugitive methane emissions, was a topic of debate.

Over a decade later, reality is more complex across the globe. While gas demand has thrived in certain countries and regions, especially where stranded gas is plentiful and prices are low, the promise of a sustained golden age has been uneven. In the United States, for instance, growth has been fueled by three key factors:

- Low prices: Natural gas has outcompeted coal in the power sector due to lower prices, leading to the retirement of 130 gigawatts (GWs) of US coal plant capacity with another 132 GW still operating.

- Industrial advantage: North American industries, particularly those requiring gas as a fuel (power generation) or feedstock (e.g., chemicals and mineral processing), have benefited from the cost advantages of domestic gas.

- Export Growth: The US has leveraged its abundant shale gas resources to feed a growing LNG export market, capitalizing on significantly lower domestic prices compared to global markets. LNG will account for 25% of US gas demand by 2030.

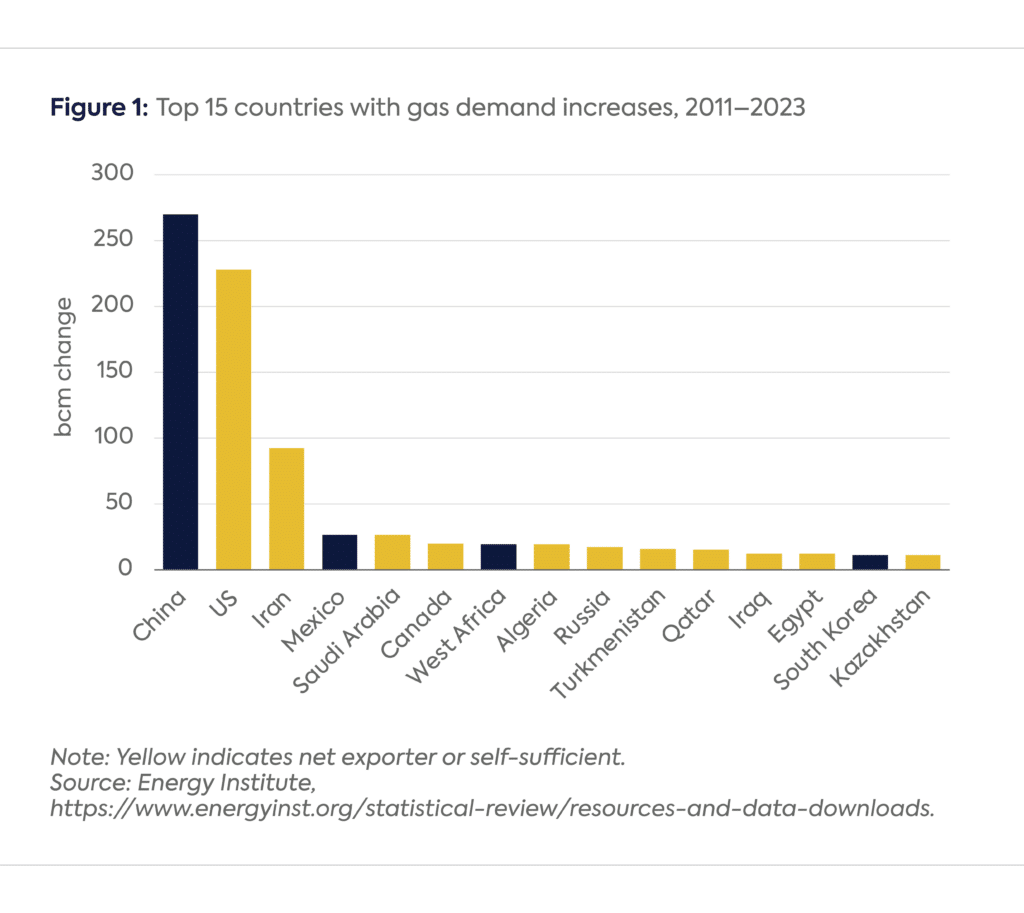

Globally, the golden age of gas has evolved unevenly. Growth has primarily occurred in countries that are net exporters or self-sufficient in gas (see Figure 1), such as the US, Russia, and Qatar. Technological advancements in shale extraction have further bolstered US production, unlocking not just natural gas but also crude oil and natural gas liquids.

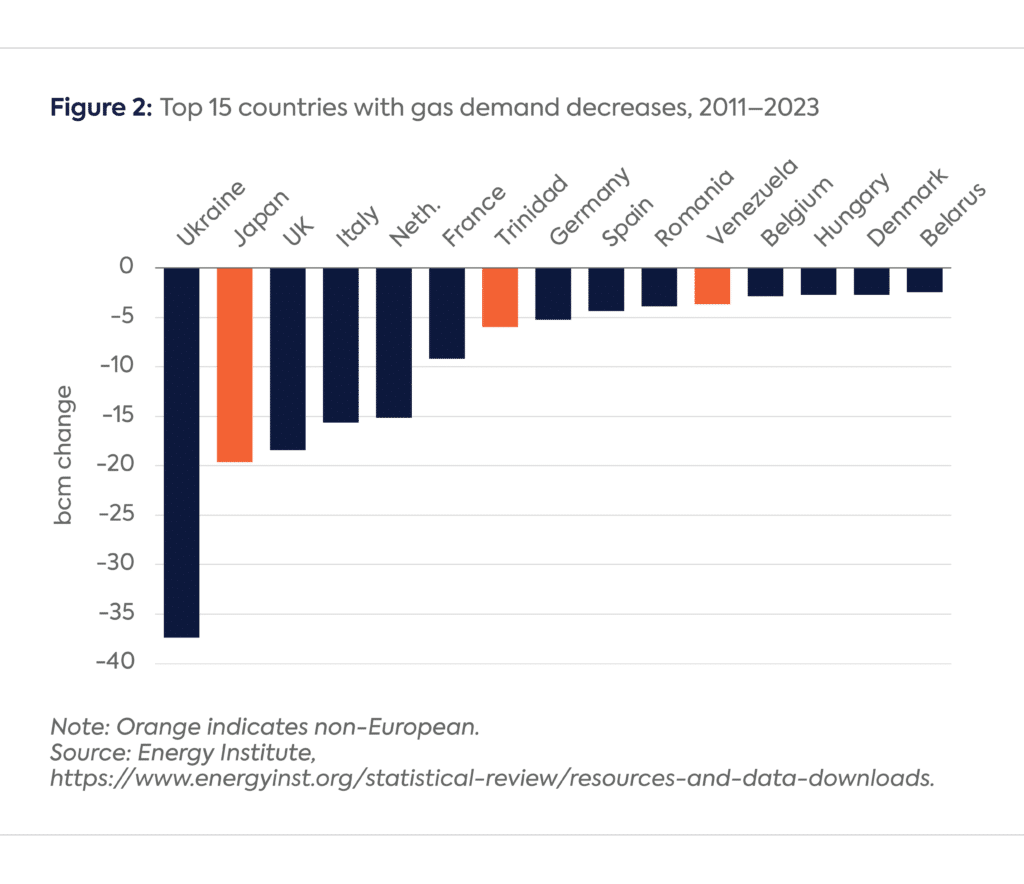

Meanwhile, in large markets that require net imports, such as Europe, gas demand has continued to trend lower since peaking in 2004. Higher prices tied to the Russian invasion of Ukraine have accelerated this downward trend. Most of the top 15 countries shown in Figure 2 are European. In Asia, Japan has seen gas demand drop by 20 billion cubic meters (bcm) from 2011–2023, despite the loss of most of its nuclear fleet for most of this period. Two years ago, China surpassed Japan as the largest LNG buyer in the world—a distinction Japan had held since the beginning of the LNG business in the 1960s.

During the 13 years of the golden age, global gas demand has grown an average of 27 bcm/yr, or 4%. In the 13 years prior to 2011, gas demand grew by 6%, or 24 bcm/yr.

Gas and Emissions: A Mixed Bag

In many countries, switching from coal to gas has significantly reduced carbon emissions. Natural gas emits roughly 50% less carbon dioxide (CO₂) than coal when burned for power generation, and it also reduces air pollutants. However, methane leakage—a potent greenhouse gas with a warming potential 25 times greater than CO₂ over 100 years—remains a major challenge. Despite the benefits, gas’s environmental credentials are increasingly overshadowed by the rapid rise of renewables.

China: The Exception and a Key Player

China stands out as the largest contributor to gas demand growth during the golden age. Its unique circumstances have driven this trend:

- Pollution control: Rapid urbanization led to severe air quality issues, prompting a shift from coal and biomass to gas for residential heating, industry, and power generation.

- Energy diversification: Gas became integral to reducing China’s reliance on coal and imported oil, supported by domestic production, pipeline imports, and LNG.

- Government support: Massive investments in infrastructure, including pipelines, LNG terminals, and storage, alongside subsidies, fueled the growth of gas consumption in residential and industrial sectors.

Additional Challenges to Gas Growth: Renewables and Coal Resurgence

The golden age of gas faces two major challenges:

- Renewables’ rise: The cost of renewables has plummeted, making them a more attractive option for many countries. China, in particular, has invested heavily in renewables, both to secure its energy future and to assert global leadership in the energy transition.

- Coal’s persistence: High gas prices in some places, exacerbated by the Russian invasion of Ukraine, have prompted some countries to revert to coal for economic reasons. The invasion removed approximately 150 bcm of annual gas supply from the global market, driving imported gas and LNG prices to record highs. This price surge diminished the appeal of gas compared to renewables and coal.

The Future of Gas

Gas will likely remain important in regions where it is abundant and cost-competitive, such as North America. It continues to play a role in displacing coal-fired power plants. Emerging technologies, like AI, could further influence gas demand to the upside; however, as the recent news of Chinese firm DeepSeek emerged, AI might also drive efficiency gains in energy consumption, potentially altering the dynamics of gas usage.

Globally, gas must contend with the rapid expansion of renewables and the economic pull of coal. The construction of new LNG facilities face higher costs due to inflation and the limited number of engineering firms with the ability to build them, which limit long-term competitiveness. Buyers are hesitant to sign long-term contracts as renewable energy and coal offer more affordable alternatives in the interim. This ongoing “champagne problem” for LNG pricing (that it is so costly to produce and transport), underscores the growing ability of renewables to undercut gas. Outside of Qatar, most LNG projects require sponsors to cover long-run marginal costs before making a final investment decision. Covering these costs is typically done through signing long-term contracts. If buyers continue reducing their willingness to sign long-term contracts, LNG production will struggle to grow after the next wave of new supply hits between 2025 and 2030.

As a premium fuel, imported LNG may soon face its sunset, while domestic gas growth still has a future in countries with stranded gas. While gas will retain a niche role in certain markets, the golden age of gas is dimming in most markets where gas needs to be imported, overshadowed by a shifting energy landscape toward greater renewables use and the lingering appeal of coal as a cheaper alternative.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum

Tellurian

Foundations and Individual Donors

Anonymous

Anonymous

Aphorism Foundation

the bedari collective

Children’s Investment Fund Foundation

David Leuschen

Mike and Soa Segal

Kimberly and Scott Sheffield

Bernard and Anne Spitzer Charitable Trust

Ray Rothrock

More on Energy Explained Energy Explained

Iran’s Natural Gas Paradox: Vast Resources, Limited Export Capacity

Iran appears to be a natural gas giant, due to its large proved gas reserves and significant gas production and consumption.

More Efficient Use of Venezuela’s Natural Gas Could Strengthen the Region’s Energy Security and the Country’s Electricity Sector

Venezuela holds 70% of Latin America's natural gas reserves, which it could export to Colombia and Trinidad to increase revenues.

Geopolitical Uncertainty Still Creates Wide Range of Potential Russian Gas Export Volumes

Geopolitical uncertainty associated with Russian gas exports could swing the range of those exports by an estimated 150 bcm per year.

Six Key Issues That Defined Climate Week 2025

CGEP scholars reflect on some of the standout issues of the day during this year's Climate Week

Relevant

Publications