This website uses cookies as well as similar tools and technologies to understand visitors’ experiences. By continuing to use this website, you consent to Columbia University’s usage of cookies and similar technologies, in accordance with the Columbia University Website Cookie Notice.

Energy Explained

Insights from the Center on Global Energy Policy

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece may be subject to further revision. Contributions to SIPA for the benefit of CGEP are general use gifts, which gives the Center discretion in how it allocates these funds. Rare cases of sponsored projects are clearly indicated.

For a full list of financial supporters of the Center on Global Energy Policy at Columbia University SIPA, please visit our website at Our Partners. See below a list of members that are currently in CGEP’s Visionary Circle. This list is updated periodically.

Last week, the authors discussed the significance of new rules[1] from the Federal Energy Regulatory Commission (FERC) to address the crunch of new generators, primarily renewables, looking to connect to the electric grid. Customer demand for clean generation is skyrocketing, but the queue just keeps getting longer and longer.

While FERC’s Order No. 2023 starts the important process of shrinking the queue, more fundamental reforms will be needed to process the hundreds of gigawatts of new generation seeking to interconnect every year.[2] Indeed, roughly two-thirds of customers in the United States live in utility service territories covered by regional market operators, which still face long wait times, despite already implementing many of the “first-ready, first-served” cluster study reforms that FERC’s new rule includes.

So what additional reforms should policymakers consider to remove interconnection backlog as a major barrier to the clean energy transition? Options being implemented internationally may provide some lessons and additional pathways for FERC to examine as it considers the next step in fighting interconnection queue creep.

Connect and Manage

Under the “connect and manage” model, the grid operator narrows the scope of the interconnection study process to look at the grid enhancements necessary to allow the generator to physically interconnect to the grid. Questions around deliverability[3] of the power are deferred to subsequent studies. This reduces the complexity of the interconnection process, resulting in faster studies and increased ability to process interconnection requests. [4] In exchange, interconnecting generators accept higher congestion and curtailment risk until deliverability studies and necessary upgrades are completed. Moreover, this approach does not necessarily entail changing the underlying cost allocation[5] or transmission planning[6] processes—thus making it a potentially politically feasible step for FERC to consider.

The UK implemented a connect and manage model in 2011 and reported that it shaved interconnection timelines by approximately 17 percent[7] (although the UK still has some of the longest wait times among European countries, showing the limits of connect and manage[8]). In 2023, the UK’s Office of Gas and Electricity Markets stated that connect and manage “enabled the rapid connection of significant amounts of renewables to the grid, accelerating generation connections which would otherwise have had to wait for transmission network upgrades.”[9]

Germany, which likewise utilizes connect and manage, has some of the lowest queue waiting times in Europe, ranging between one and two years.[10] While Germany is clearly an interconnection success story, it can be difficult to untangle the effects of connect and manage from the impact of other requirements, such as the one to obtain all local planning and siting approvals before entering the queue, which sharply cuts down on speculative projects—a reform that no market in the US has seriously contemplated. While the generator still has to pay for getting to the grid, Germany requires that “grid operators must connect installations ‘without delay’ to the shortest linear distance to the new power plant.”[11] German law even goes so far as to provide renewable energy sources “priority of connection.”[12] Lastly, the German electric grid is a denser system compared to the US, with lots of existing transmission infrastructure, which makes upgrading the existing grid quicker.

In the US, ruby-red Texas utilizes a connect and manage type system. Generators pay for the facilities necessary to connect to the grid, but the costs of grid upgrades are passed on to all ratepayers. Additionally, the Texas grid operator, the Electric Reliability Council of Texas (ERCOT), invested $6.9 billion in the mid-2000s to connect wind-rich areas in West Texas to load centers.[13] The resulting upgrades are one of the major reasons the grid has been able to interconnect disproportionately more renewable generation, and in a quicker timeframe, than many states with more ambitious clean energy goals.

The Mid-Continent Independent System Operator (MISO)[14] employs a hybrid of connect and manage and FERC’s traditional interconnection pricing policy, which assigns costs to the entity causing the upgrades. MISO developed a suite of transmission expansions to increase the transmission capacity in renewable-rich regions in its footprint.[15] The cost of these centrally planned upgrades was shared across states, and the additional transmission capacity was immediately incorporated into the interconnection study process, smoothing the way for new generators. Not only do these transmission buildouts speed the interconnection process, they are also expected to save consumers tens of billions over the coming decades (savings that far exceed the costs of building the transmission).[16]

Data Transparency and New Grid Evaluation Tools

Potentially the most impactful reforms in Order No. 2023 are the suite of data transparency requirements for utilities, including producing “heat maps” and publishing available “headroom” on the grid on a location-by-location basis. Providing a better understanding of grid conditions helps reduce the number of speculative interconnection requests and drive quicker and better interconnection outcomes.

Currently, no utility in the US provides the level of insight into the health of the transmission grid as required by FERC, and a critical touchpoint will be how independent system operators (ISOs) and regional transmission organizations (RTOs), which serve two-thirds of American customers, propose to comply with the new transparency requirements later this year.

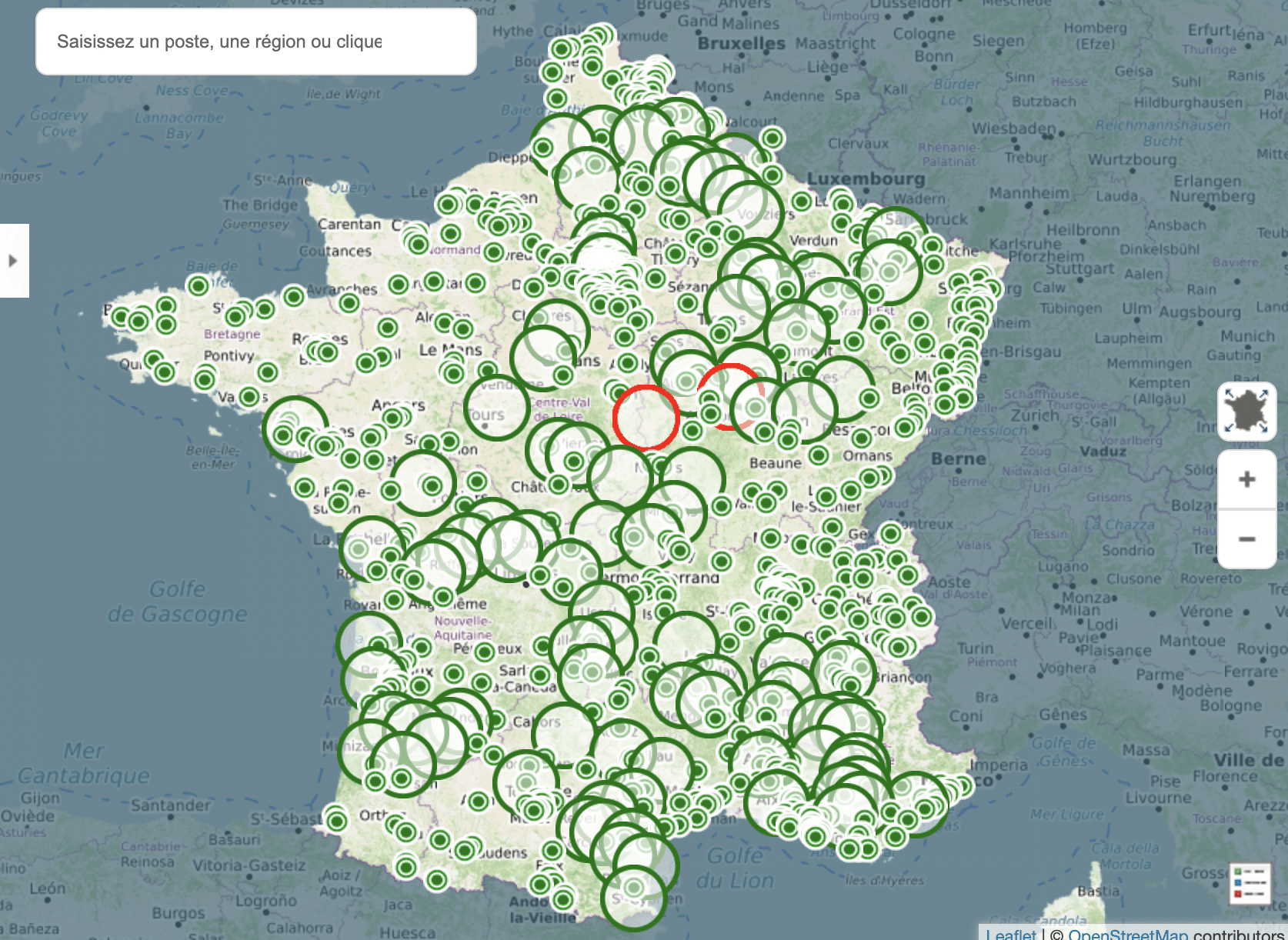

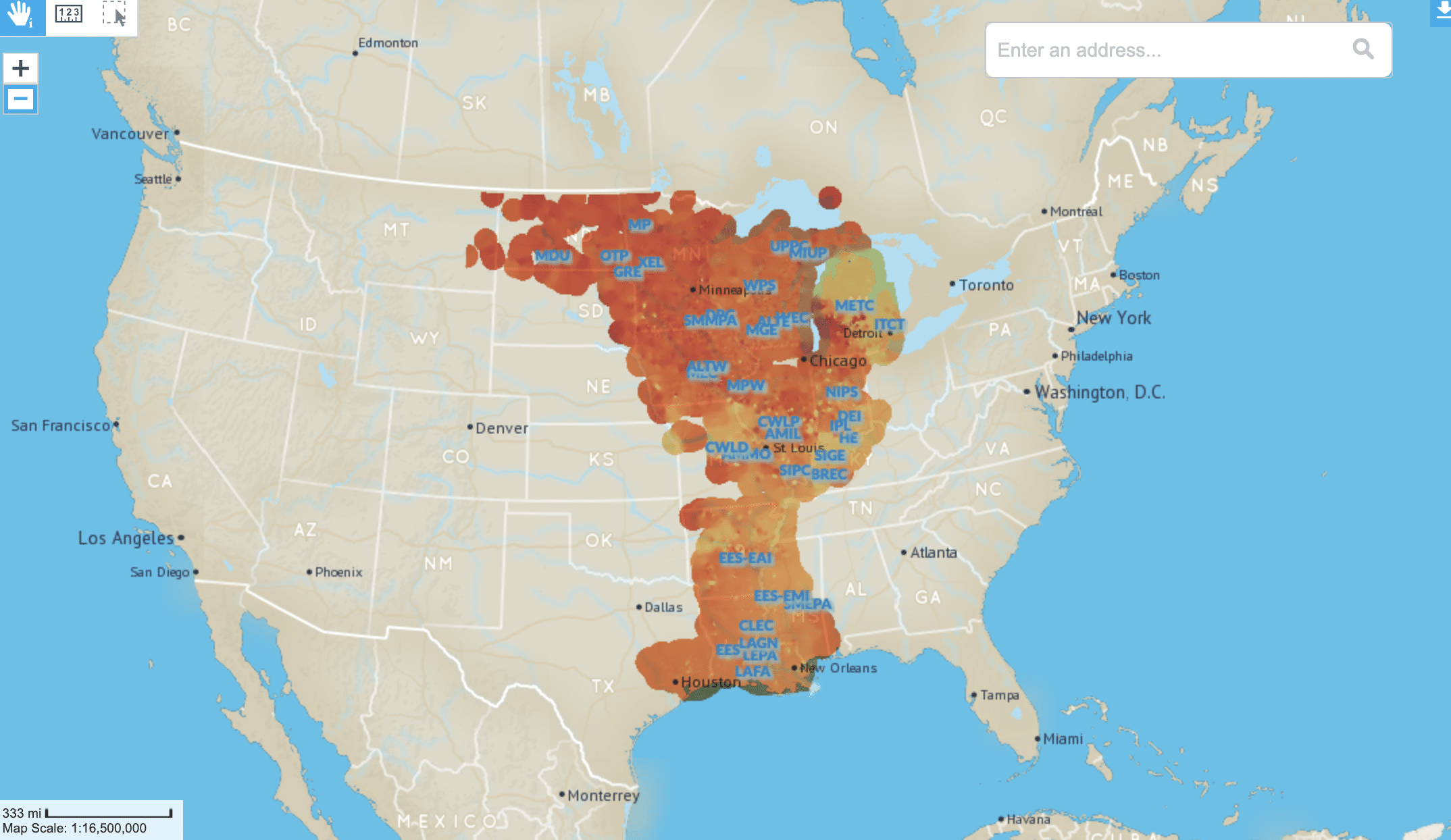

Experience suggests that FERC’s requirements are feasible. French and Danish grid operators offer heat maps (Figure 1) that provide interconnection headroom at every point of the grid and include a host of data points.[17] MISO already provides a heat map, although it gives less information than required under Order No. 2023 (Figure 2).[18]

Figure 1: Sample heat map from French grid operator RTE France (green indicates available headroom; red indicates closed circuits)

Source: RTE France, https://www.capareseau.fr/.

Figure 2: Heat map of MISO points of interconnection (green indicates available headroom; brown indicates closed circuits)

Source: MISO, https://giqueue.misoenergy.org/PoiAnalysis/index.html.

Australia’s Energy Market Operator (AEMO) has taken this concept a step further, creating an openly available “Connections Simulation Tool” (CST) that allows stakeholders to run simulations against the Australian grid’s models.[19] The tool is currently in the trial phase, but promises to let developers run their own interconnection simulations before formally submitting a request. While the CST doesn’t obviate the need for formal grid studies, it is anticipated that “fewer [study] iterations may be required to gain approval.”[20] The AEMO tool was explicitly designed to ensure that data security, confidentiality, and intellectual property needs are met, while still providing a comprehensive siting tool.

Terna, the Italian transmission system operator, is also developing its “Econnextion Tool,” which tracks proposed renewable energy projects and allows users to see trends and identify areas of high grid density and growth, equipping stakeholders to better coordinate future planning of energy infrastructure development and avoid expensive upgrades.[21] Updated every three months, users can see how saturated a given portion of the transmission system is and track the approval status of all new renewable projects in Italy.[22]

Grid Enhancing Technologies and Advanced Transmission Technologies

Another promising solution to the interconnection dilemma is the use of Grid Enhancing Technologies and Advanced Transmission Technologies, together referred to as ATTs, although the terms are largely synonymous.[23] Because ATTs can increase transmission grid capacity, they can ease the interconnection crunch and may be especially effective at creating new grid capacity when paired with a transition to connect and manage.

Order No. 2023 recognizes the benefits of ATTs[24] but stops short of requiring their widespread adoption in interconnection studies. Instead, while utilities must evaluate certain types of advanced transmission technologies, the decision of whether to deploy these technologies is ultimately left to the utilities.[25] Additionally, dynamic line ratings, one of the most widely deployed and successful technologies, was stripped from the list of mandatory technologies that a utility is required to evaluate (although FERC makes clear that utilities are still free to consider these technologies if they wish).[26]

The Belgium grid operator began implementing dynamic line ratings over a decade ago.[27] Like many US utilities, Belgium was reportedly initially skeptical of alternative transmission technologies,[28] but has now identified investments in high-performance conductors, phase-shifting transformers, and other ATTs as one of five main principles in its 2024–30 Federal Development Plan.[29] Denmark similarly reports combining dynamic line ratings with artificial intelligence technologies to achieve marked improvements in transmission capacity in 90 percent of all hours.[30] These types of technological advances are significant since one of the FERC’s main concerns with ordering the evaluation of dynamic line ratings was their unpredictability.[31]

While FERC didn’t go as far as other nations in promoting ATTs, there are two bright spots. First, FERC leaves the door open for utilities to utilize ATTs if they wish.[32] Second, the “good utility practice” standard applied by FERC in Order No. 2023 looks at what “a significant portion of the electric industry” does and considers “applicable regulatory requirements.”[33] This means that both state regulators or progressive ISOs, RTOs (and other progressive utilities) can help accelerate the adoption of these beneficial technologies by mandating their use today, since regulator mandates and utility usage can drive the evolution what constitutes “good utility practice.” And because ISOs and RTOs will have to file formal compliance plans[34] with FERC by the end of the year, it will soon be clear how they propose to incorporate consideration of ATTs into their practical day-to-day interconnection processes.

Conclusion

While it’s tempting to slow down after implementing a 1,500-page rule, fixing the interconnection crisis will likely demand additional reforms. The US could take stock of how pieces of global strategies to accelerate renewable energy deployment can be used to improve its interconnection processes. A combination—moving to connect and manage, full implementation of grid enhancing technologies and alternative transmission technologies, and reform to the nation’s transmission planning and cost allocation strategies (where politically feasible)—could potentially represent the most important opportunity for the United States to remove the interconnection process as a major non-technical barrier to the clean energy transition.

CGEP’s Visionary Circle

Corporate Partnerships

Occidental Petroleum Corporation

Tellurian Inc

Foundations and Individual Donors

Anonymous

Anonymous

the bedari collective

Jay Bernstein

Breakthrough Energy LLC

Children’s Investment Fund Foundation (CIFF)

Arjun Murti

Ray Rothrock

Kimberly and Scott Sheffield

Notes

[1] Abraham Silverman, Gautam Jain, Dafni Papapolyzou, Kavyaa Rizal, Devan Samant, and Josh Williard, “FERC’s Interconnection Reform: Why It Matters for the Clean Energy Transition,” Center on Global Energy Policy, Columbia University, August 7, 2023, https://www.energypolicy.columbia.edu/fercs-interconnection-reform-why-it-matters-for-the-clean-energy-transition/.

[2] Nationally, 497 gigawatts (GW) of new generation (all figures in nameplate capacity) applied to interconnect in 2022, 435 GW in 2021, 286 GW in 2020, and 283 GW in 2019, according to Lawrence Berkeley National Laboratory data.

[3] “Deliverability” refers to the ability for the power produced by the generator to reach the backbone of the transmission system, effectively ensuring that, under normal operating conditions, the generator will not be asked to reduce (or “curtail”) its generation. Ensuring deliverability involves complex studies that result in slower interconnection studies and increase interdependencies between various proposed projects.

[4] For a good review on the technical changes necessary to implement a connect and manage model, see “Plugging In: A Roadmap for Modernizing & Integrating Interconnection and Transmission Planning,” Enel Green Power, https://www.enelgreenpower.com/content/dam/enel-egp/documenti/share/working-paper.pdf.

[5] Who pays for upgrades to the transmission system associated with interconnecting new generators can be a controversial topic. FERC’s long-standing interconnection pricing policy is that the “beneficiary” or “causer” of a transmission system is required to pay. While this ensures that upgrade costs are paid for by the generator in question (and the entities purchasing power at presumably higher rates), opponents point to the fact that it can slow down the process and result in higher overall costs.

[6] A recent strategy document from the Heritage Foundation highlights how planning the transmission grid around clean energy needs has become politicized. It urges the next administration to “[e]nd grid planning and focus on reliability” and that “much of the transmission buildout (including its attendant costs) is being driven by renewable developers seeking market share. These projects are causing rates for customers to go up and hurting reliability[.]” Heritage Foundation, 2025 Mandate for Leadership: Department of Energy and Related Commissions, by Bernard McNamee.

[7] Office of Gas and Electricity Markets (OFGEM), “Monitoring the ‘Connect and Manage’ Electricity Grid Access Regime,” December 5, 2013, https://www.ofgem.gov.uk/sites/default/files/docs/2013/12/connect_and_manage_ar_2013_final_051213.pdf.

[8] Jillian Ambrose, “British Energy Developers to Be Told: Speed Up Projects or Leave Queue for Grid,” Guardian, June 2, 2023, https://www.theguardian.com/business/2023/jun/02/britibritish-energy-developers-projects-national-grid-solar-power.

[9] OFGEM, “Open Letter on Future Reform to the Electricity Connections Process,” May 16, 2023, https://www.ofgem.gov.uk/publications/open-letter-future-reform-electricity-connections-process.

[10] Lara Hayim, “Germany’s Grid Holds Up Against Renewables Influx So Far,” BloombergNEF, March 8, 2023.

[11] A. Wainer, D. Petrovics, and N. van der Grijp, “The Grid Access of Energy Communities: A Comparison of Power Grid Governance in France and Germany,” Energy Policy 170, February 13, 2022, https://www.sciencedirect.com/science/article/pii/S0301421522003846.

[12] Ibid.

[13] Texas eventually funded the construction of 3,600 miles of new transmission lines and facilitated the construction of over 20 GW of onshore generation. See https://www.bakerinstitute.org/research/texas-crez-lines-how-stakeholders-shape-major-energy-infrastructure-projects.

[14] The Mid-Continent Independent System Operator (MISO) covers all or part of 15 states and stretches from North Dakota to Louisiana.

[15] See “Reliability Imperative: Long Range Transmission Planning,” presentation to the Board of Directors, July 25, 2022, https://cdn.misoenergy.org/20220725%20Board%20of%20Directors%20Item%2002a%20Reliability%20Imperative%20LRTP625714.pdf.

[16] Ibid, at p. 8. MISO estimates $23–$52 billion in benefits—even after accounting for the roughly $14–$17 billion cost of the upgrades.

[17] See, e.g., RTE France, https://www.capareseau.fr/.

[18] See MISO website, https://giqueue.misoenergy.org/PoiAnalysis/index.html.

[19] See https://aemo.com.au/energy-systems/electricity/national-electricity-market-nem/participate-in-the-market/network-connections/connections-simulation-tool; see also Merryn York, “AEMO’s Connection Simulation Tool,” AEMO, Energy Systems Integration Group, March 2023, https://www.esig.energy/event/webinar-aemos-connection-simulation-tool/.

[20] See https://aemo.com.au/energy-systems/electricity/national-electricity-market-nem/participate-in-the-market/network-connections/connections-simulation-tool/faqs.

[21] Terna, “Terna: The First Digital Platform for Requests to Connect Renewable Energy Plants to the Electricity Grid in Italy,” press release, February 27, 2023, https://www.terna.it/en/media/press-releases/detail/econnextion-dashboard-online.

[22] Terna, “Econnextion: Map of Renewable Connections,” 2022, https://www.terna.it/en/electric-system/grid/econnextion.

[23] See, e.g., US Department of Energy, “Grid-Enhancing Technologies: A Case Study on Ratepayer Impact,” 2022, https://www.energy.gov/sites/default/files/2022-04/Grid%20Enhancing%20Technologies%20-%20A%20Case%20Study%20on%20Ratepayer%20Impact%20-%20February%202022%20CLEAN%20as%20of%20032322.pdf.

[24] Order No. 2023 at pg. 1583 (“Based on the record, we affirm the Commission’s preliminary finding in theNOPR that alternative transmission technologies have the potential to provide benefits to optimize the transmission system in specific scenarios”) (Citations omitted).

[25] As FERC puts it, Order No. 2023 “mandates a process of evaluation of alternative transmission technologies, not outcomes in specific cases, and does not create a presumption in favor of using an alternative transmission technology as a substitute for a traditional network upgrade deemed necessary in a specific case.” Order No. 2023, at P 1584.

[26] Order No. 2023, at PP 1598 and 1599.

[27] See https://www.elia.be/en/infrastructure-and-projects/our-infrastructure/dynamic-line-rating#:~:text=By%20taking%20into%20account%20local,capacity%20of%20the%20equipped%20lines.

[28] Bruce Tsuchida, Linquan Bai, and Jadon Grove, “Building a Better Grid: How Grid Enhancing Technologies Complement Transmission Buildouts,” Watt Coalition, Brattle, 2023, https://www.brattle.com/wp-content/uploads/2023/04/Building-a-Better-Grid-How-Grid-Enhancing-Technologies-Complement-Transmission-Buildouts.pdf (quoting Victor LeMaire, Operational Planning, Elia, during the 2021 FERC technical conference “Workshop to Discuss Certain Performance-based Ratemaking Approaches”: “….from a Belgium perspective what I can say 10 years ago for dynamic line rating I mean we’re talking about this internally, the system engineers are just looking at us like crazy guys, what are you speaking about. This is a gadget you want to install on the transmission line? It’s just crazy, we’re really against it, totally against these, the usual. And now 10 years later they’re just asking for more.”)

[29] See https://www.elia.be/en/infrastructure-and-projects/investment-plan/federal-development-plan-2024-2034.

[30] Jonathan Spencer Jones, “Energinet’s Dynamic Line Rating Improves Capacity up to 30%,” Energy and Grid Management, Smart Energy International, June 1, 2023, https://www.smart-energy.com/industry-sectors/energy-grid-management/energinets-dynamic-line-rating-improves-overhead-capacity-by-up-to-30/.

[31] See Order No. 2023 at P 1598 (“…while dynamic line ratings may relieve congestion to increase available interconnection service temporarily or in the short-term, they may not be an adequate substitute for building interconnection facilities and/or traditional network upgrades identified through the interconnection study process that are needed to reliably interconnect a generating facility to the transmission system during all hours.”)

[32] Order No. 2023 at pg. 1600 (“…we are not precluding a transmission provider from studying or evaluating any other technology, including those such as dynamic line ratings that we have determined not to add to the list of technologies enumerated in this final rule.”)

[33] FERC’s full definition of “good utility practice” is “any of the practices, methods and acts engaged in or approved by a significant portion of the electric industry during the relevant time period, or any of the practices, methods and acts which, in the exercise of reasonable judgment in light of the facts known at the time the decision was made, could have been expected to accomplish the desired result at a reasonable cost consistent with good business practices, reliability, safety and expedition.” See Order No. 2023 at n. 599.

[34] Order No. 2023 directs each utility to comply 90 days after publication of the order in the Federal Register. Order No. 2023 at P 1762.

More on Energy Explained Energy Explained

Q&A: Trump’s Executive Order on US Domestic Mineral Production

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

Energy and Climate Issues During the Trump Administration’s First 100 Days

President Donald Trump has made energy a clear focus for his second term in the White House. Having campaigned on an “America First” platform that highlighted domestic fossil-fuel growth, the reversal of climate policies and clean energy incentives advanced by the Biden administration, and substantial tariffs on key US trading partners, he declared an “energy emergency” on his first day in office.

Can AI Transform the Power Sector?

This Energy Explained post represents the research and views of the author. It does not necessarily represent the views of the Center on Global Energy Policy. The piece...

Insights from the US and India for Electricity Open Access in Kenya and South Africa

Kenya and South Africa have recently started moving toward an open access regime in their electricity sectors, while the US and India have been on this path for over two decades.

Relevant

Publications

The Potential Contribution of Enhanced Geothermal Systems to Future Power Supply: Roundtable Summary

Addressing Energy Insecurity via Utility Ratemaking

About one in four American households experience some form of energy insecurity. Within this group, Black, Indigenous, Latine, low- and moderate-income (LMI), and other disadvantaged communities face a disproportionately higher burden.